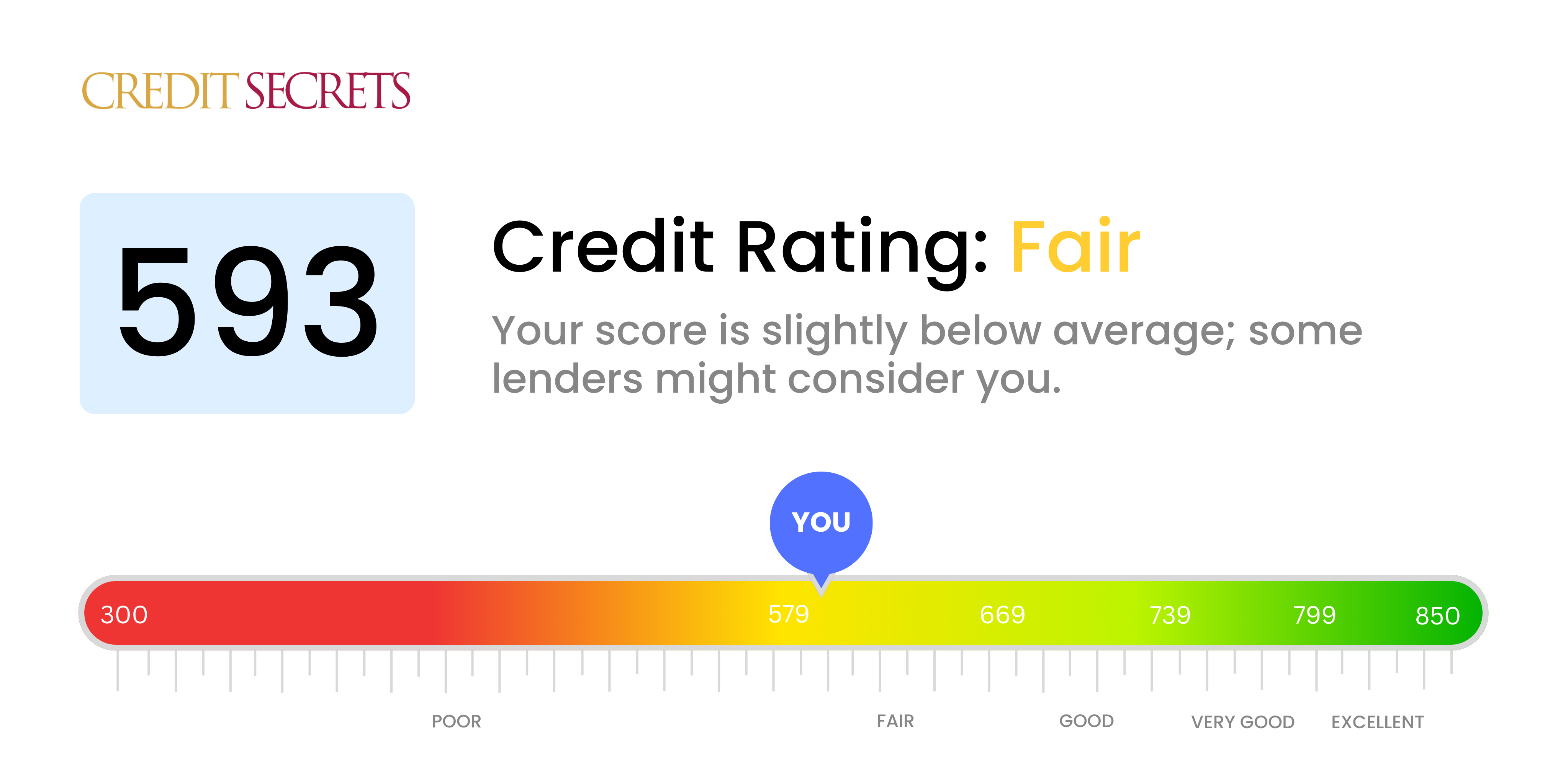

Is 593 a good credit score?

With a credit score of 593, you're in the 'Fair' range. This isn't necessarily a bad state, but there's room for improvement to enhance your financial opportunities. You might face higher interest rates or stringent conditions while applying for credit cards or loans, but the right kind of efforts can help you boost your score and overall financial health.

It's crucial to remember that financial progress isn't immediate, but consistent and responsible behaviors like making payments on time, maintaining a lower credit utilization ratio, and having a diverse mix of credit types can move your score into the 'Good' range or even better over time. Begin making strides toward a healthier financial future right now. You're capable of turning your financial situation around – remember, a credit score is not fixed, it's a fluid measure of your credit risk.

Can I Get a Mortgage with a 593 Credit Score?

With a credit score of 593, it's important to acknowledge the challenges you may face when applying for a mortgage. This score is significantly below the standard minimum required by most lenders. Scores in this region typically indicate a history of late payments, defaults, or other negative financial occurrences, making approval for a mortgage more difficult.

Though this can be a tough situation, there are alternatives to consider. Some lenders specialize in offering loans to individuals with lower credit scores. They may approve a mortgage loan but it'll likely come with higher interest rates and more restrictive terms. Whenever possible, try to minimize your overall debt and ensure to make payments on time. Developing good financial habits can gradually increase your credit score, making the path towards getting a mortgage smoother in the future. Despite the challenges, know you have the power to change your financial story with perseverance and patience.

Can I Get a Credit Card with a 593 Credit Score?

With a credit score of 593, getting approved for a conventional credit card can be quite a struggle. This score typically reflects some financial difficulties you may have experienced. Although this is not the ideal situation, understanding your credit score is critical to working towards better financial outcomes.

A score of 593 is considered to indicate a higher risk for lenders, so it may be challenging to secure traditional forms of credit. However, there are alternatives. Secured credit cards, for instance, can be an accessible choice. They require a deposit that serves as your credit limit and provide an opportunity to moderately rebuild your credit over time. Another option could be finding someone willing to co-sign for credit or to consider is a prepaid debit card. These options won't instantly resolve your struggles, but they are helpful steps towards achieving a better credit standing. Bear in mind that any available credit for a score in this range likely comes with higher interest rates, due to increased risk for lenders.

A credit score of 593 is indeed a challenge when it comes to securing a personal loan from traditional lending institutions. A score in this range suggests to lenders that you pose a high level of risk, meaning it's not as likely for you to be approved for a personal loan. Understandably, this might be tough to hear, but it's crucial to recognize the impact this credit score has on your borrowing options.

Despite this setback, alternatives exist. Explore the possibility of secured loans that require collateral, or co-signed loans where someone with a better credit score vouches for your repayments. Additionally, peer-to-peer lending platforms could be viable options; they might be willing to offer loans, despite a lower credit score. Keep in mind, though, these options can come with higher interest rates due to the increased risk to the lender. This doesn't mean your journey to financial stability is unreachable, just that it might take a slightly different route.

Can I Get a Car Loan with a 593 Credit Score?

Securing a car loan with a credit score of 593 may be a bit difficult. Generally, lenders tend to prefer supplying loans to those who have a score above 660. Regrettably, your score of 593 falls below this, into what is typically considered as the 'subprime' category. This could mean high-interest rates or even no approval. Understand that this is because lower credit scores suggest to lenders a higher risk, as it could indicate trouble repaying funds in the past.

Yet, don't lose hope. There are lenders who specialize in supporting those with lower credit scores. It's important to tread with caution though, as these loans often carry significantly elevated interest rates. This might seem harsh, but from the lenders' perspective, they're taking on additional risk, and hence they aim to secure their investment. Despite some bumps, acquiring a car loan with this score is not completely out of the question. All it requires is careful consideration and a keen understanding of the terms.

What Factors Most Impact a 593 Credit Score?

In understanding a credit score of 593, it's important to recognize the factors likely impacting your score. By addressing these, you can begin to strategize how to accelerate your financial growth.

Late Payments

Payment history is a huge element of your credit score. Delayed or missed payments could be why your score is low.

How to Check: Scrutinize your credit report for any late payments and try to identify potential patterns in your payment habits.

High Credit Utilization

Maxing out your credit limits can detrimentally affect your score. If your balances are near their limits, that could be influencing your 593 score.

How to Check: Look at your credit card statements. Is there a high balance? Working towards lower balances can aid your score.

Short Credit History

Shorter credit histories can negatively affect your score. If you're new to credit, this could be a reason for your 593 score.

How to Check: Examine your credit report for your oldest and newest accounts, and estimate the average age of all your accounts.

Lack of Credit Diversity

Not having a mix of credit types (credit cards, loans, mortgage etc.) can affect your score negatively.

How to Check: Review your credit report to determine your credit mix. A balance of various credit types can be favorable for your score.

Negative Public Records

Public records such as bankruptcy or tax liens can negatively affect your credit score.

How to Check: Review your credit report for any records listed. Identifying and resolving any records could boost your score.

How Do I Improve my 593 Credit Score?

While a credit score of 593 is not ideal, it is important to remember that enhancing your score is within your control. Here are some concrete steps you can take to directly impact your current situation:

1. Pay Attention to Collections

Now might be the time to clear any outstanding debt that has moved to collections. It may be hard but directly engaging with collections agencies to create payment plans can greatly aid in boosting your score.

2. Keep Credit Card Utilization Low

When your credit card balance is high compared to your total credit limit, it can hurt your credit score. Keep your balances below 30% of your total limit, and work towards reducing them below 10% over time. Prioritize tackling those with the highest utilization first.

3. Try a Secured Credit Card

With your current credit score, acquiring a regular credit card may be tough. A viable alternative is a secured credit card, backed by a cash deposit, which also acts as your credit line. Use it thoughtfully making few purchases and clearing those promptly to build a healthy payment record.

4. Leverage Being an Authorized User

Joining a responsible family member or friend’s credit card as an authorized user can help enrich your credit score. Their on-time payments will be a part of your credit report, but make sure their credit card issuer reports this activity to the bureaus.

5. Consider Credit Diversity

Once you have a history of responsible usage with a secured card, gradually add other types of credit to your profile. This could include retail credit cards or credit builder loans. Ensure to effectively manage these.