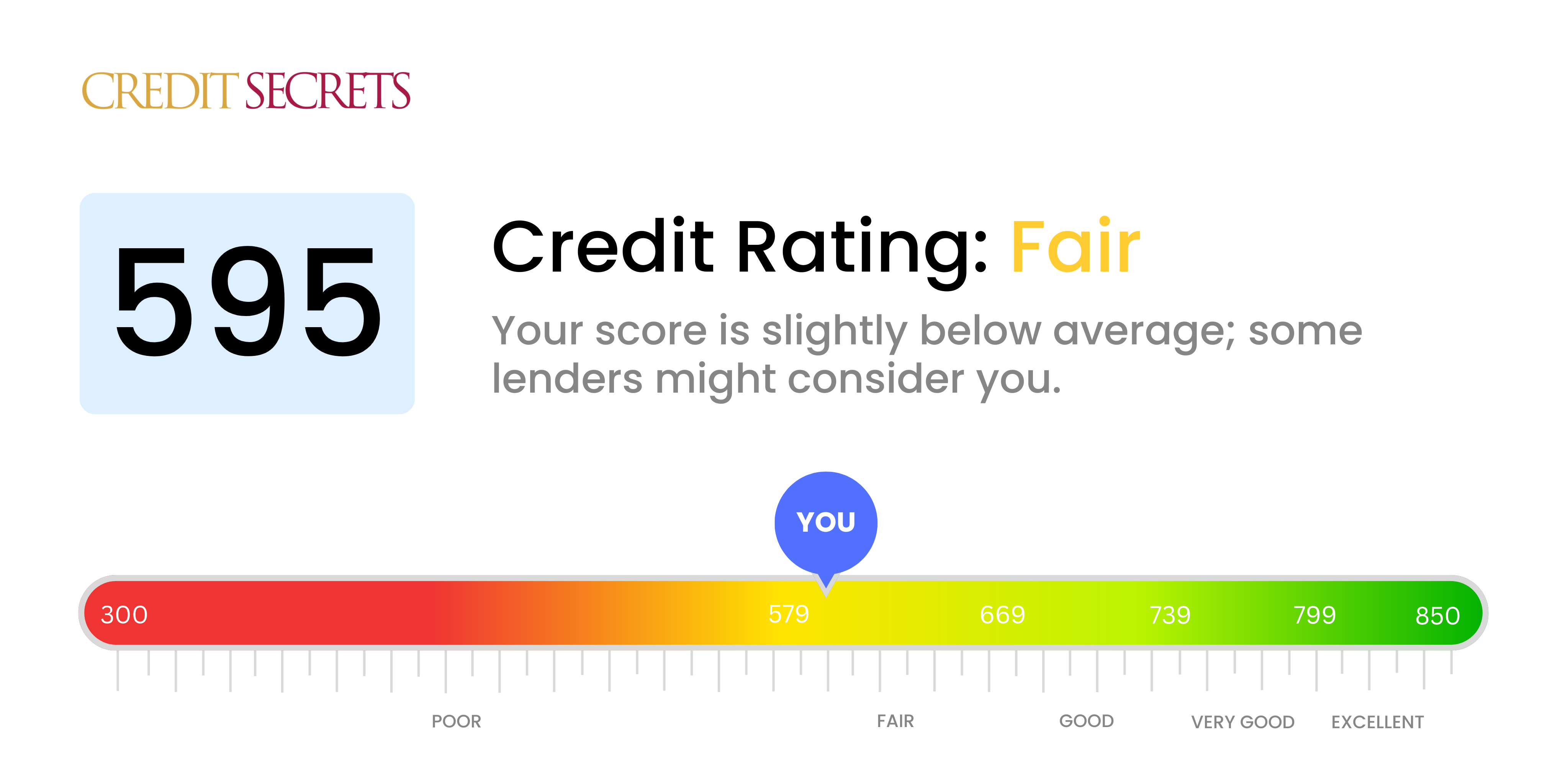

Is 595 a good credit score?

A credit score of 595 falls within the 'Fair' range, meaning it's not in the poor category, but is still a distance away from a good or excellent score. Though you'd likely face higher interest rates or stricter credit conditions, many lenders would still consider you for credit, but it would be more beneficial to aim towards improving this to access better financial terms.

While a 595 score might make things challenging, it's not completely negative and should be perceived as an opportunity to bolster your financial health. Through consistent, positive payment habits and responsible debt management, raising your score is very achievable; accessing a broader range of lending options and lower interest rates can be your reality.

Can I Get a Mortgage with a 595 Credit Score?

If your credit score is sitting at 595, you might find it challenging to be approved for a mortgage. This score is considered by potential lenders to be on the lower end of the scale, and it unfortunately signals to them that there may exist some risk in lending to you. This does not signify it is impossible, but it could be harder to secure a mortgage at a favorable interest rate.

It's important to know that a lower-end credit score isn't a life sentence, but rather a starting point for improvement. Working steadily to pay down existing debt, keeping credit balances low, and making all your payments on time can gradually raise your credit score. Alternative options could include Federal Housing Administration (FHA) loans which often accept applicants with lower credit scores. It also might be a good idea to hold off on applying for a mortgage until your credit score has improved to secure better rates. Remember, with commitment and patience, you can work towards a better financial future.

Can I Get a Credit Card with a 595 Credit Score?

Having a 595 credit score may give you a tough time when applying for standard credit cards. Lenders might perceive you as a risk since this score is an indication of past financial missteps or difficulties. It's disheartening to find out you have a less-than-perfect credit score, but remember, empathy and realism can be your guides towards improving your financial situation. Understanding your credit status is undoubtedly a powerful first step.

Given the challenges that come with having a 595 credit score, you may want to consider alternative options, such as secured credit cards. These types of cards require a deposit which then becomes your credit limit, and they can also help you in rebuilding your credit gradually. Co-signing a card or opting for pre-paid debit cards might also be worth exploring as potential options. While these steps don't immediately fix your credit situation, they serve as stepping stones to regain financial stability. Notably, it's important to bear in mind that any form of credit accessible at this score level is likely to have significantly higher interest rates due to the higher risk factor associated with lending.

Having a credit score of 595 can create significant barriers when applying for a personal loan. Traditional lenders tend to regard such a score as high risk, which limits your chances of being approved for a loan under standard criteria. It's a tough situation to be in, but it's important to know where you stand so that you can consider your next steps.

Even though traditional loans might not be feasible, there are alternative options that could be worth considering. One such alternative is a secured loan where you provide collateral to the lender. Another is a co-signed loan, where a person with a higher credit score co-signs for you. Platforms offering peer-to-peer lending can also be explored as they may have more forgiving credit score expectations. However, please know that these alternatives often come with higher interest rates and less desirable terms, reflecting the increased risk to the lender.

Can I Get a Car Loan with a 595 Credit Score?

Having a credit score of 595 might make obtaining a car loan a bit challenging. Lenders often prefer to provide loans to those who have credit scores above 660. Unfortunately, your score of 595 falls in the subprime credit category, which lenders might see as a risk. This could lead to higher interest rates, or possibly, your loan application being denied. The reason is simple: a lower credit score equates to a high risk for lenders because it implies potential difficulties in paying back the loan in a timely manner.

However, don't get discouraged yet! There are lenders out there who specifically cater to individuals with lower credit scores. Please remember, these types of loans generally have markedly higher interest rates, due to the additional risk perceived by the lenders. It might be a rough path, but with due diligence while understanding the loan terms, the possibility of getting a car loan hasn't evaporated. Remember, with careful planning and thoughtful decisions, your car owning dream can still come true.

What Factors Most Impact a 595 Credit Score?

Achieving a healthier financial status and working toward an improved credit score of 595 requires a keen understanding of your unique financial patterns and behaviors. The elements that tally up to this credit score are likely related to a variety of contributory factors.

Payment Consistency

One major factor invariably affecting your score is your payment consistency. Missed or late payments can be a prominent reason for this credit score.

Checking Method: Scrutinize your credit report. If you identify missed or delayed payments, these instances could have lowered your score.

Credit Card Balances

High balances on your credit cards can be detrimental to your credit score. If your balances are exceeding or reaching your card limits, this could significantly impact your credit score.

Checking Method: Analyze your credit card statements. If you have high card utilization, try to reduce your spending or pay down the balances.

Account Age

A limited credit history can also influence your score. Younger accounts can decrease your credit score.

Checking Method: Investigate your credit report and consider the ages of all your accounts, including the oldest and newest ones. A long-standing history of credit is beneficial for your score.

Credit Inquiries

Multiple credit applications within a short timeframe might be lowering your score. Each application can result in a hard inquiry, which reduces your score.

Checking Method: Review your report and consider recent applications for new credit. Aim to limit new credit applications.

Legal Judgments

Legal judgments or public records like bankruptcies can notably tarnish your credit score.

Checking Method: Scrutinize your credit report for any public records or legal judgments. Prompt resolution of these items can positively impact your score.

How Do I Improve my 595 Credit Score?

A credit score of 595 is not optimal, but remember, you have the power to transform your financial health. To enhance your credit score from this level, consider the following strategic steps:

1. Rectify Late Payments

When dealing with a credit score of 595, your immediate attention should be on any late payments. Clearing these can substantially improve your credit standing. Communication with your creditors is key, discuss the possibility of agreeing upon a new payment plan to get back on track.

2. Decrease Debt-to-Credit Ratio

The ratio of your existing debt to your available credit limits can significantly impact your score. Initiate a plan to decrease your debt, ideally to beneath 30% of your available credit limit. Pay attention to accounts with higher utilization rates initially.

3. Acquire a Secured Credit Card

Gaining approval for a conventional credit card can be tough at this score. Consider a secured credit card, which requires a cash deposit that represents your credit line. Use it responsibly to create a trail of positive payment behavior.

4. Seek to be an Authorized User

Explore the option of becoming an authorized user on a credit card owned by someone you trust who maintains good credit. This can help boost your credit score as you will reap the benefits of their positive payment history. Double-check that the creditor reports authorized user activity to the credit bureaus.

5. Broaden Your Credit Portfolio

Having a range of credit accounts, like loans and credit cards, is beneficial to your credit score. Once you’ve established responsible usage with a secured card, investigate other forms of credit and manage them wisely.