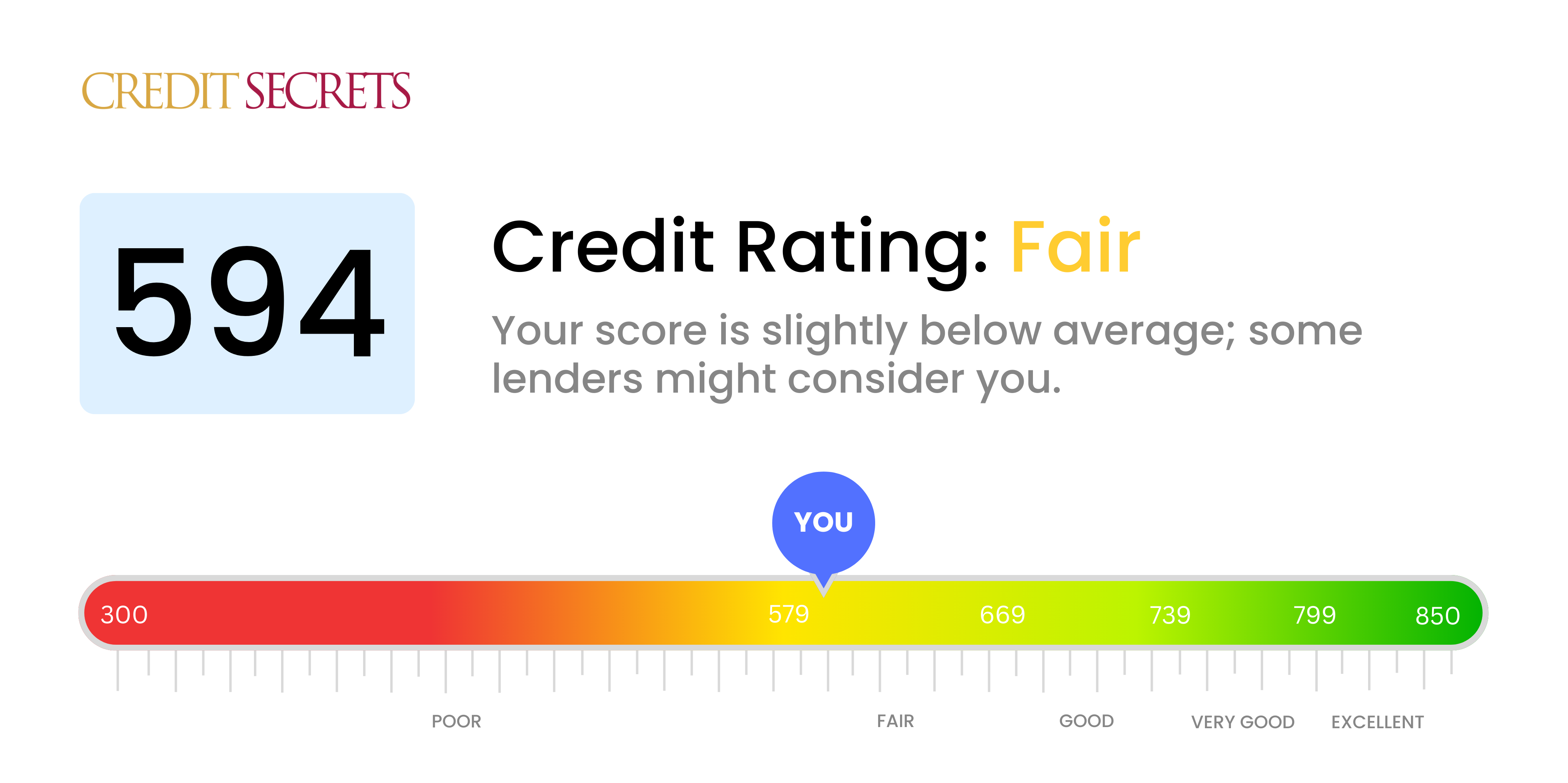

Is 594 a good credit score?

With a credit score of 594, you're in the 'fair' credit range. It's not the best place to be, but keep in mind it's far from the worst and still a position from which you can improve. Having a fair credit score could make it a bit challenging to access certain credit products or get favorable interest rates, but it's not impossible.

It's important not to be disheartened as this score is something you can work on. Improving your credit score might require a bit of effort and discipline but remember, it's not just about getting a higher score, it's also about ensuring overall financial health. Moving towards the 'good' or 'very good' score categories might mean better financial opportunities for you. Stay focused and positive, and consider you have the power to influence your credit score for the better.

Can I Get a Mortgage with a 594 Credit Score?

With a credit score of 594, you may face difficulty in securing a mortgage. This score is categorically below the range usually considered by most lending institutions for loan approval. A score in this range could suggest past financial struggles, including delinquent payments or defaults.

The road ahead might seem daunting, but don't lose hope. There are paths that you can take to improve your chances. Start with addressing the financial decisions that contributed to your current score. Make an effort to meet all upcoming payment deadlines. Responsibly using the credit available to you can positively influence your credit score over time. Since interest rates are typically higher for those with lower credit scores, you'll want to watch them closely. Your primary objective should be to increase your credit score, so that you can access better loan terms in the future. This journey may take some time, but it can potentially place you in a healthier financial position for the long-term.

Can I Get a Credit Card with a 594 Credit Score?

With a credit score of 594, getting approved for a conventional credit card might still appear daunting. This score tends to be considered subprime by lenders, which signifies a level of financial instability or prior difficulties in managing financial obligations. It's challenging, but acknowledging the current state of your financial health is a crucial initial move toward sustainable monetary practices.

Nevertheless, even with a score like 594, diverse alternatives to traditional credit cards are available. Secured credit cards, for example, might be suitable for your circumstance. These cards necessitate a deposit which becomes your credit limit and are typically easier to be approved for. Alternatively, you may explore options such as enlisting a co-signer or using prepaid debit cards. Interest rates, on any form of credit you eventually qualify for, are likely to be elevated due to the increased risk perceived by lenders. It's important to remember that while these options don't immediately alleviate the situation, they could serve as tools to gradually improve your credit.

A 594 credit score is considered to be less than ideal for many traditional loan providers. This score is viewed as higher risk and so it is unlikely you'd be approved for a personal loan through standard channels. This may seem like tough news to hear, but understanding your current standing is a key part of navigating forward.

Since obtaining a traditional loan is less likely with your score, you may need to explore other avenues. Secured loans, where you provide an asset as collateral, or co-signed loans, where someone with stronger credit guarantees your loan, could be potential solutions. Another option could be peer-to-peer lending platforms, which often have lower credit score requirements. However, bear in mind that these alternatives typically feature higher interest rates and less advantageous conditions due to the increased risk to the lender. Despite the challenges, there are still paths forward available for you.

Can I Get a Car Loan with a 594 Credit Score?

Holding a credit score of 594 could present some obstacles when attempting to get approved for a car loan. Lenders often favor scores above 660 and may view a score under 600 as subprime. Falling within this subprime range, a 594 score could lead to higher interest rates or potential loan denial. This is because having a lower credit score may suggest to lenders a higher risk, reflecting potential challenges in repaying borrowed money.

But don't lose hope! A lower credit score doesn't mean car ownership is out of reach. Some lending institutions specialize in working with individuals with less-than-perfect credit scores, but fair warning, these loans typically come at much higher interest rates. These spiked rates stem from the increased risk lenders perceive and serve as a way for them to protect their investment. Even though the journey might seem rough, taking time to understand the terms and conditions could still steer you toward securing a car loan.

What Factors Most Impact a 594 Credit Score?

Deciphering a score of 594 can unravel key areas to focus on for your financial rehabilitative journey. Each credit score paints a unique financial picture, that varies with each individual. It all starts with understanding what might have contributed to your current score.

Payment Punctuality

Your track record of payments influences your credit score majorly. Late or missed payments are likely to impact your score negatively.

How to Verify: Carefully look through your credit reports, noting any late or skipped payments. This might offer you insight into your score.

Credit Use

Your credit utilization rate, or how much of your credit limit you're using, also impacts your score. If your balances are constantly near their maximum, your score might take a hit.

How to Inspect: Review your credit card statements. Are you maintaining balances close to your credit limits? If so, try decreasing your utilization rate for a healthier score.

Financial History Duration

A short credit history may reflect negatively on your score.

How to Ascertain: Scrutinize your credit report marks, especially concentrating on the age of both your oldest and latest accounts, and their average age.

Credit Diversity and Fresh Credit

Maintaining a mix of different credit types and cautiously obtaining new credit is critical for an upgraded score.

How to Assess: Review your mix of credit accounts which includes credit cards, retail accounts, installment loans, and mortgage loans. Ponder over your new credit applications and their periodicity.

Public Records

Public records including any bankruptcies or tax liens could have a significant effect on your score.

How to Investigate: Scan your credit report for any public records. Attend to any adverse entries that need to be resolved.

How Do I Improve my 594 Credit Score?

With a credit score of 594, you’re at the lower end of the fair score range. But not to worry, you can take active actions to improve your score. Here are directed strategies based on your current score.

1. Clear up Errors on Your Credit Report

Start by requesting your credit report from the three major credit bureaus, and scrutinize them for any errors or incorrect information. If you find any, initiate a dispute. This can help improve your score if the disputed items are cleared.

2. Prioritize Delinquent Accounts

Delinquent accounts significantly affect your score. If any exist, first focus on paying them off. Contact your creditor, and work out a payment plan that works for you.

3. Control Your Credit Utilization

A high credit utilization rate can lower your score. Strive to keep your credit card balances far below your credit limit, aiming for a utilization ratio of less than 30%. This reflects positively on your creditworthiness.

4. Regularly Monitor Your Credit

Keep tabs on your credit history by regularly checking your credit score. This will help you stay informed about your financial standing and avoid any surprises.

5. Seek Secured Credit

A secured credit card or loan can help enhance your credit score if managed responsibly. These types of credit require a deposit as security, and can assist in building a stable credit history over time.

With patience and disciplined financial habits, you’re on the path to a better credit score.