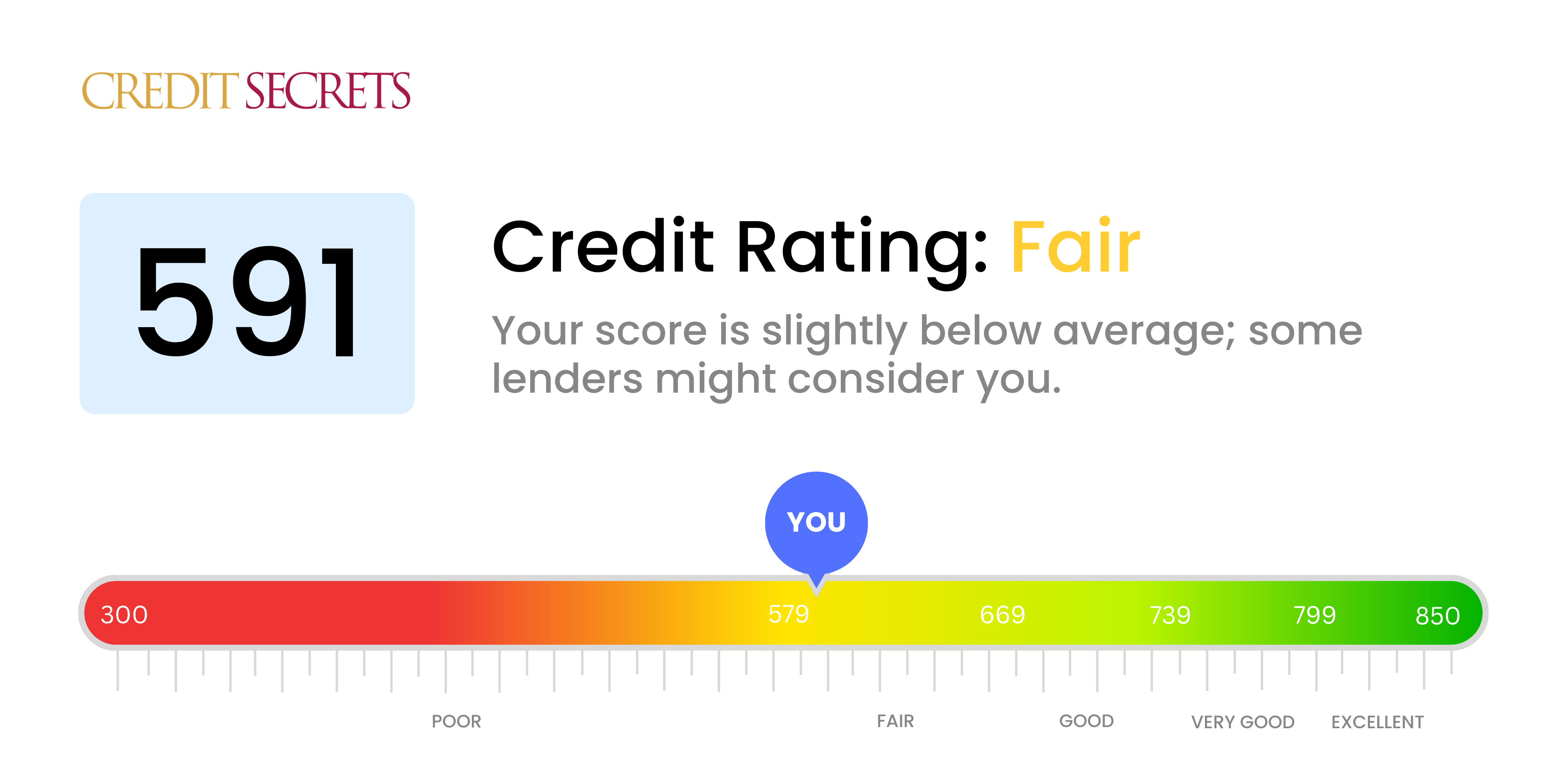

Is 591 a good credit score?

A credit score of 591 falls into the 'fair' category. It's not the highest score you could have, but it also doesn't put you in the 'poor' range either. Fortunately, there's always room for improvement and you could start working on boosting your score.

With a score like this, you could potentially experience challenges in obtaining new credit or loans, and when you do, the interest rates might be higher than if you had a better score. On the positive side, it's not an impossible situation and you can take steps to improve your score over time.

Can I Get a Mortgage with a 591 Credit Score?

With a credit score of 591, getting approved for a mortgage can be tough. This score is below the typical minimum requirement by most mortgage lenders, which means your credit history may show delayed payments or a history of borrowing too much. It's crucial to remember that this isn't a permanent situation and there are paths forward.

One alternative could be Federal Housing Administration (FHA) loans. These loans are targeted specifically at those with lower credit scores. Another option is to look at 'bad credit' mortgage lenders, who specialize in helping those with lower scores secure a mortgage. However, it's worth noting these paths often come with higher interest rates due to the perceived risk.

While it may seem disheartening now, this doesn't mean homeownership is out of your reach. With effort, time and strategic financial decisions, it won't always be this way.

Can I Get a Credit Card with a 591 Credit Score?

With a credit score of 591, it is unfortunately somewhat challenging to secure approval for a conventional credit card. Lenders often perceive this score as indicating a moderate to high risk, suggesting past financial struggles or mismanagement. Unquestionably, this is a hard pill to swallow. However, being forthright about your current credit standing is a vital step toward better financial health.

Because approval for traditional credit cards can be challenging with a score at this level, you might want to consider options such as secured credit cards. These require a deposit which serves as your credit limit and are generally easier to obtain. They also offer a pathway to gradually rebuild your credit score over time. Alternatively, you might consider seeking a co-signer or using pre-paid debit cards. Although not instant solutions, these options are practical steps on the road to financial stability. It's worth noting that interest rates on any form of credit accessible to someone with a credit score of 591 are likely to be higher, reflecting the increased risk to lenders.

With a credit score of 591, securing a personal loan from traditional lenders might be a stretch. This score is below the preferred range for many lenders and may be seen as a sign of financial risk. It's a tough position to be in, but understanding your credit score's significance is crucial when exploring your loan options.

If you're finding doors closed due to your credit score, alternative lending options may be worth considering. Secured loans, where you offer an asset as collateral, or co-signed loans, where someone with a stronger credit score supports your application, can be viable pathways. Platforms offering peer-to-peer lending could also be an option, as they sometimes consider applicants with lower credit scores. However, please be aware that these options may attract higher interest rates and might offer less beneficial terms due to the higher perceived lending risk.

Can I Get a Car Loan with a 591 Credit Score?

Having a credit score of 591 might make getting approved for a car loan a bit tricky. Most lenders typically prefer to work with people who have a credit score above 660 since this is seen as less of a financial risk. Unfortunately, if your score is below 600, it falls into what is known as the subprime category. This categorization often leads lenders to charge higher interest rates or even decline the loan application. This is due to the financial risk your credit history represents.

Don't lose hope, though. A lower credit score does not completely close off the path to owning a car. There are certain lenders who are comfortable with working with people with lesser credit scores. However, please note - these car loans quite often come attached with higher interest rates. This extra cost is perceived as the lender's way of protecting their investment in case of any issues. There might be a few additional bumps in this journey, but with some patience, diligent research, and understanding of the terms, getting that car loan could still be a reality.

What Factors Most Impact a 591 Credit Score?

Past Payment Behavior

Past payment behavior can significantly impact a credit score. If your payment history involves any missed or delayed payments, it may have contributed to your current score.

How to check: Go over your credit report for any instances of missed or delayed payments. Identifying these instances can lead to better payment practices in future.

Remember Utilization Rates

Utilization rates play a crucial role. If your borrowed amounts are nearing the credit limits, this might be negatively influencing your score.

How to Check: Look at your credit card statements closely. Are your borrowed amounts nearing the credit limit? Lowering these amounts could positively impact your score.

Duration of Credit History

A shorter credit history might be a factor contributing to your 591 score. Longstanding, well-managed accounts are more favorable for credit score calculations.

How to Check: Check your credit report to gauge the age of your oldest and newest credit accounts and the total duration of your credit history.

Assortment of Credit Types and Recent Credit Inquiries

Managing different types of credit responsibly and minimizing new credit inquiries can improve your score.

How to Check: Look into your credit report to identify your mix of credit types and also whether you've been applying for credit frequently in the recent past.

Public or Legal Records

Legal complications such as bankruptcy or tax liens can severely affect your score.

How to Check: You can carefully examine your credit report for any public records. Having these issues addressed and resolved if possible can help improve your score.

How Do I Improve my 591 Credit Score?

With a credit score of 591, there’s room for improvement – but don’t worry, boosting your score is entirely doable. Below are some effective, reachable steps you can take to help raise your credit score from its current level:

1. Prioritize Delinquent Payments

If any of your accounts are behind in payments, your focus should be on clearing these backlogs. Paying them off, starting with the most overdue, can help reshape your credit history. It may seem daunting, but communicating with your creditors might make this process easier if you work out a feasible payment plan.

2. Pay Down High-Interest Debt

Debt, especially when it carries high interest, weighs heavily on your credit score. Chop down these debts as quickly as you can, starting with those that come with the highest interest rates. This approach will help you save on interest charges and create a positive impact on your credit score in less time.

3. Consider a Secured Credit Card

Your current score might restrict you from obtaining a regular credit card, but a secured credit card is an alternative that can work to your advantage. This requires a deposit which sets your credit limit, then proper usage and diligent payments each billing cycle can build stronger credit rapport.

4. Seek to Be an Authorized User

Enquire from a close relative or friend with healthy credit if they could add you as an authorized user on one of their credit cards. This can allow their healthy credit behaviors to reflect on your credit score, but ensure that the credit card company reports these activities.

5. Explore Various Types of Credit

Fostering a diverse mix of credit can aid in boosting your score. After establishing a steady payment routine with your secured card, consider credit builder loans or department store credit cards to diversify your credit portfolio. Use these opportunities responsibly to further improve your credit stature.