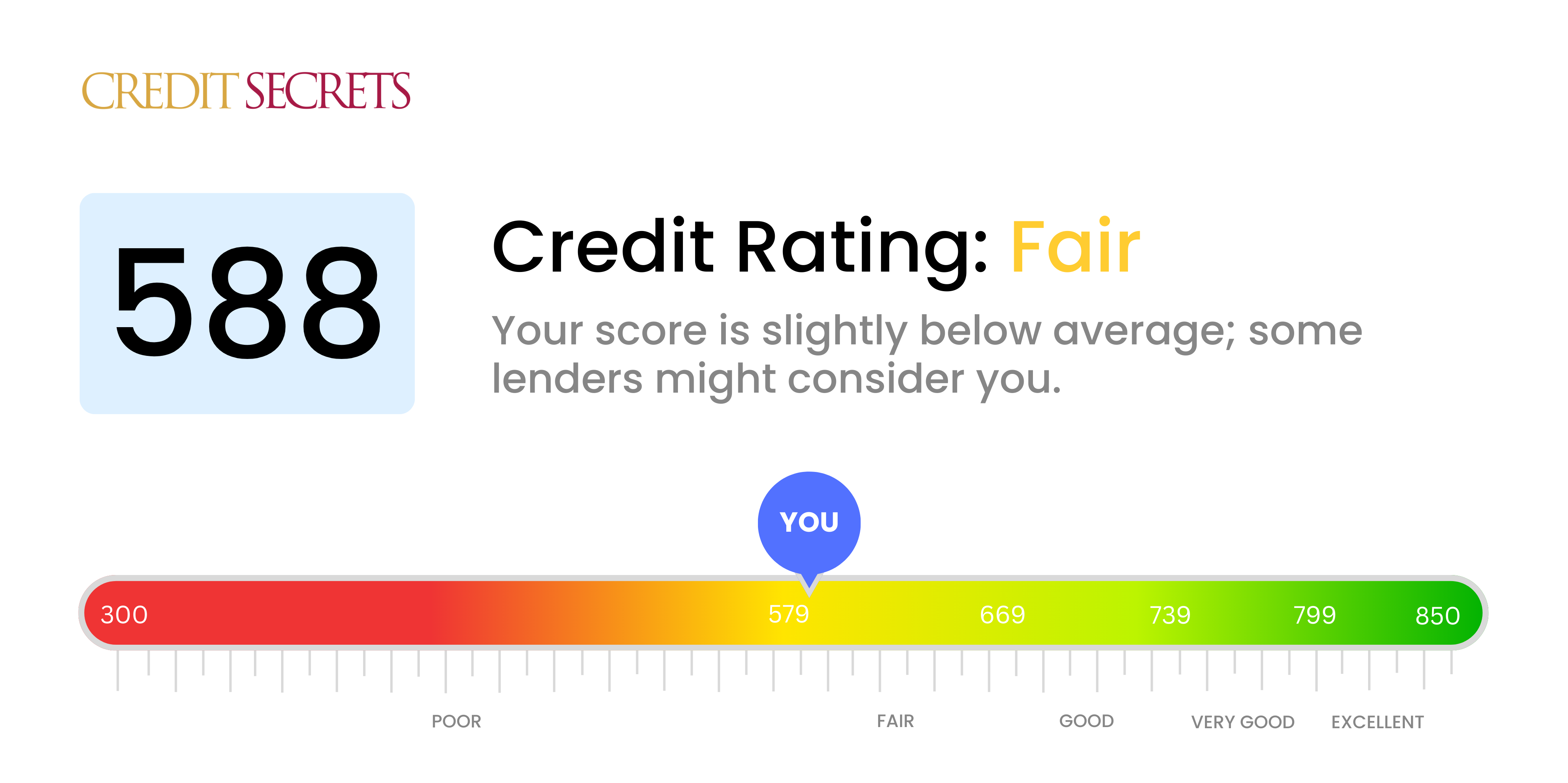

Is 588 a good credit score?

A credit score of 588 falls within the 'Fair' category. While this isn’t the lowest rating possible, this score indicates potential financial risk to lenders and could result in difficulty obtaining new lines of credit or securing favorable interest rates.

Despite the challenges associated with a 588 credit score, there are still opportunities for improvement. Responsible financial practices such as maintaining positive payment history, managing debt, and correcting any inaccuracies on your credit report are steps towards score improvement. Remember, the journey to a good credit score is a marathon, not a sprint. Keep moving forward and stay focused on your financial goals.

Can I Get a Mortgage with a 588 Credit Score?

With a score of 588, securing a mortgage approval may prove challenging as this falls into the 'fair' credit category. Lenders see a score in this range as an indication of potential credit risk which might hinder your ability to secure a loan certification.

However, don't lose hope. Despite a low score, there are alternatives like government-backed Federal Housing Administration (FHA) loans. These loans may have more accommodating credit requirements. You could also explore the possibility of receiving lender exceptions. With a larger down payment or proof of a strong income, some lenders may be flexible. But be mindful, even if a mortgage is attainable, interest rates might be higher due to your lower score. Use this as motivation to prioritize your financial health, maintain regular on-time payments, and methodically reduce your debt to improve your credit score and prospects.

Can I Get a Credit Card with a 588 Credit Score?

With a credit score of 588, it may be somewhat challenging to secure approval for a traditional credit card. This score is often viewed by lenders as a bit risky, which could hint at past financial bumps in the road. Acknowledging this is a tough pill to swallow, but owning up to the situation is a necessary part of moving forward financially. Remember, there's no shame in confronting financial setbacks. They're a part of life.

Given the potential obstacles with a 588 credit score, it might be worthwhile to look into alternative credit card options. Secured credit cards, for instance, may be a good start. These cards require a deposit that partially or fully covers your credit limit, making them easier to get. Alternatively, you might consider asking a trusted individual to become a co-signer on your card, or even use a pre-paid debit card as a stop-gap measure. Bear in mind, while these might not be the ideal long-term solutions, they can be beneficial stepping stones towards better credit health. Lastly, be aware that any credit cards you do qualify for might likely come with higher interest rates due to your credit score and hence the higher risk involved for lenders.

With a credit score of 588, it may be challenging to receive approval for a personal loan from traditional lenders. Many institutions view this score as high risk, indicating a likelihood of difficulty in keeping up with payments. It's a tough realization, but understanding the implications of your credit score regarding borrowing options is a crucial first step to tackling your financial situation.

If the route of traditional personal loans seems closed, alternative paths might be worth considering. Secured loans, which involve you offering collateral, or co-signed loans, in which a person with stronger credit endorses the loan, are possibilities. Additionally, platforms dedicated to peer-to-peer lending could have more flexible credit norms. Nevertheless, be aware that these alternatives could bear higher interest rates and less favorable conditions, due to elevated lender risk. Although the path may seem tricky, remain optimistic. Your financial journey is unique, and exploring all possible avenues will lead you towards the best decision for you.

Can I Get a Car Loan with a 588 Credit Score?

Having a credit score of 588 may pose some roadblocks if you're hoping to secure a car loan. Generally, lenders look for scores above 660 to offer desirable terms. A score under 600, like yours, is often viewed as subprime. This means you're more likely to face higher interest rates or even be declined for a loan. Why? Because a lower credit score like 588 suggests to lenders that there could be a higher risk in lending money.

Yet, don't let this information cause any distress. Not all hope is lost. There are lenders who work explicitly with people carrying lower credit scores. However, proceed with caution. These car loans often carry heftier interest rates as a nod to the increased risk those lenders are taking to offer the loan. Therefore, be vigilant and take the time to understand all the terms before you proceed. So while the journey may seem challenging, don't lose sight of your goal. Obtaining a car loan is still within reach, just with some extra hurdles to clear. Remember, every challenge is an opportunity in disguise.

What Factors Most Impact a 588 Credit Score?

Nurturing a credit score of 588 back to health is a journey unique to your financial history. Recognizing the factors affecting your score will prepare you for healthier credit. Remember, overcoming financial challenges is a learning experience.

Delinquent Accounts

Unpaid or overdue accounts could be pulling your score down. Creditors report these late payments, which won't paint a good picture on your credit report.

How to Check: Review your credit report and identify any delinquent accounts. Make suitable arrangements to catch up on these payments, where possible.

High Credit Utilisation

Maxing out your credit limit presents you as a high-risk borrower, which could explain your current score.

How to Check: Take a look at your credit card statements. Paying down those high balances can be beneficial to your credit score.

Short Credit History

A relatively immature credit history could also be a factor influencing your score.

How to Check: Evaluate your credit report noting the age of your oldest account, your newest one, and the average age of all your accounts. Consider if there were any recent accounts opened.

Credit Inquiries

Multiple recent hard inquiries can damage your score portraying you as desperate for credit.

How to Check: On your credit report, find out how frequently you have applied for credit. Try to keep hard inquiries to a minimum.

Collections and Public Records

Accounts sent to collections or any public records like bankruptcies could be significant factors affecting your score.

How to Check: Check your credit report for any collections or public records. Address any outstanding issues promptly.

How Do I Improve my 588 Credit Score?

With a credit score of 588, you’re not far from the range to start seeing real improvement. It may seem like a difficult journey, but with concrete steps you can make vast improvements. Below are some specifically tailored actions to help raise your score:

1. Settle Outstanding Debt

Creditors take note of unpaid dues. First, let’s focus on clearing up any unsettled debt that you may have. Talk to your creditors about setting up a feasible payment plan and stick to it. This will help in improving your credit score.

2. Monitor Credit Card Utilization

Keeping your credit utilization low is essential. Try to keep your revolving credit balances under 30% of your credit limit. This shows your ability to manage credit responsibly and eventually helps in improving your score.

3. Consider a Secured Credit Card

Secured credit cards are a good way of building credit history. As they require a security deposit, almost anyone can get approved. Ensure you manage this card well, demonstrating that you can handle credit responsibly. This is a good step towards higher credit scores.

4. Request to be an Authorized User

Having a trusted individual add you as an authorized user on their credit card can help boost your credit score, as long as they maintain a good pay-off history. Check with the credit card issuer to ensure they report authorized user activity to the credit bureaus.

5. Diversify Credit Portfolio

Once you’ve shown responsible management with a secured card, consider adding a mix of credit such as retail cards or installment loans. This adds diversity to your portfolio, which reflects favorably on your credit score.

Remember, credit improvement is a marathon, not a sprint. Have patience and stay consistent in your efforts.