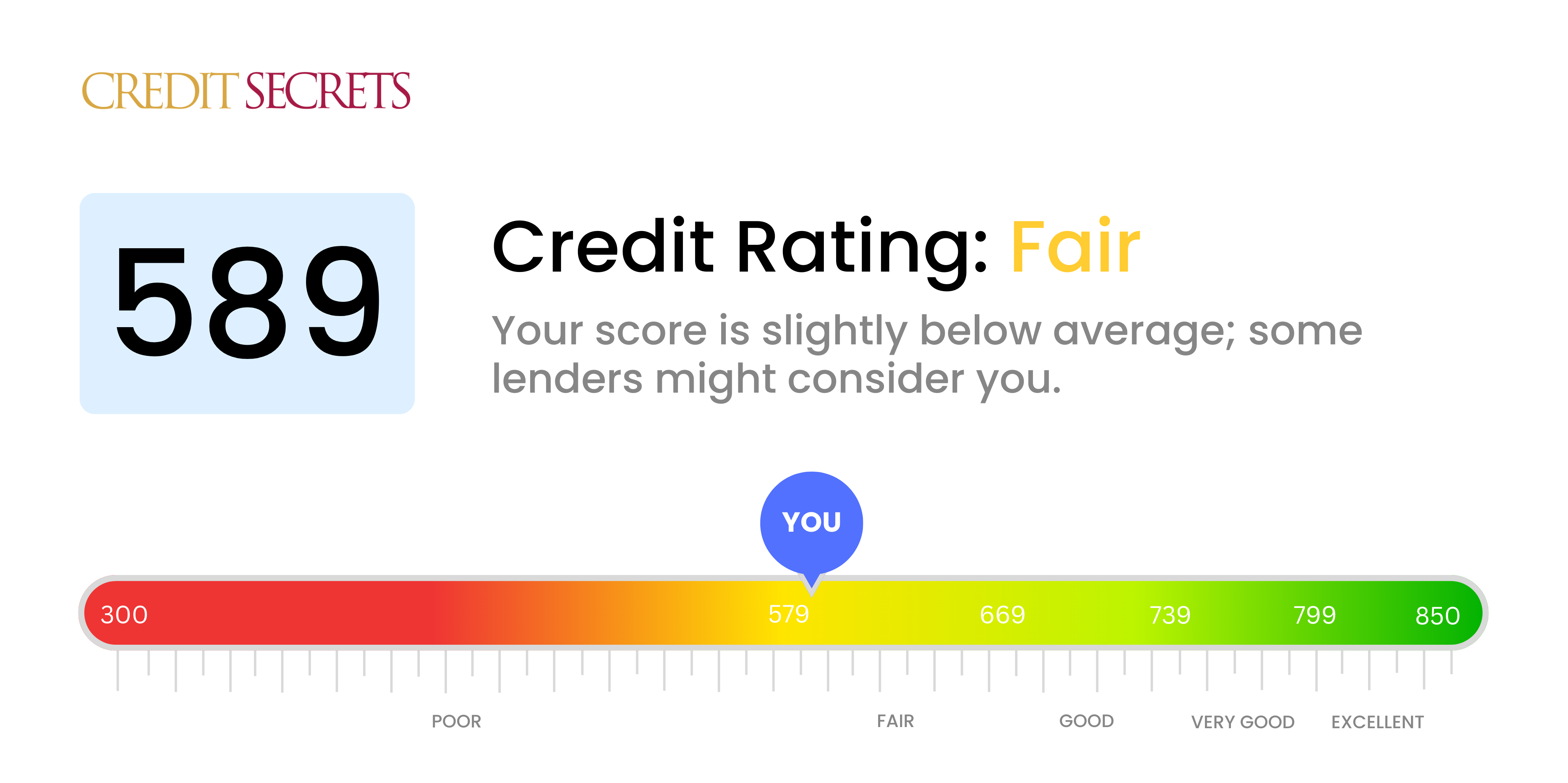

Is 589 a good credit score?

A credit score of 589 is deemed as fair, according to standard credit score ranges. This score is not ideal and it's just above the threshold for having a poor credit score, but there is room for improvement and potential for securing credit or loans, though likely with higher interest rates compared to those with good or excellent scores.

However, don't be discouraged; many have improved their fair credit scores to good or even excellent scores with focused effort, discipline, and utilization of the right resources. Remember, improving your credit is a journey, not a sprint, and every step in the right direction is worth celebrating. Your future, improved credit score is within reach.

Can I Get a Mortgage with a 589 Credit Score?

With a credit score of 589, the chances of approval for a mortgage are unfortunately slim. This score is considerably below the average that mortgage lenders often look for. A credit score within this range often implies a history of difficulties in managing debts, such as missed payments or defaults.

However, don't feel disheartened. There are potential alternatives available. Saving for a larger down payment could improve your prospects for mortgage approval, as it reduces the loan amount needed. Alternatively, considering a co-signer who has a significantly higher credit score could increase your chances of approval. While a score of 589 does present some challenges, it's not an insurmountable situation. It will just require some patience, planning, and proactive steps to enhance your financial health.

Can I Get a Credit Card with a 589 Credit Score?

A credit score of 589 is considered low, making it difficult to be approved for a conventional credit card. Bear in mind that lenders often use credit scores to evaluate the potential risk posed by lending money. Though it may seem disheartening, it's essential to acknowledge this reality as it is the path to improving your financial standing. Knowing the state of your credit score is an integral first step towards financial recovery and stability.

Seeing the challenge in getting a traditional credit card, there are other viable options to consider. Secured credit cards, for example, can be a practical solution. They need a deposit that will then become your credit limit. Aiming for this type of card could be feasible and beneficial as they can assist in gradually rebuilding your credit. Interested rates with these cards may be higher due in part to the lower credit score associated with higher risks. Other options include exploring a co-signer or perhaps opting for prepaid debit cards. These alternatives might not offer an immediate fix, but they can pave the way to a healthier financial future.

A credit score of 589 presents a bit of a hurdle when it comes to traditional loan approval. This score falls into a lower bracket, often seen as potentially risky from a lender's perspective. It may lead to challenges on your path to obtain conventional personal loans. This reality might be tough to accept, but it's vital to recognize its implications for your borrowing capacity.

Nonetheless, there are alternative options you can consider; one of them being secured loans. These loans involve attaching an asset as collateral, providing more assurance to the lender. Another route could be co-signed loans, which require someone with high creditworthiness to guarantee your loan repayment. Peer-to-peer lending platforms might also be worth exploring, as they tend to be more relaxed about credit scores. Keep in mind, however, due to the perceived risk, these options may come with higher interest rates and may not have the most favorable terms. Stay hopeful and determined; with careful decision-making, you will find an option suited to your situation.

Can I Get a Car Loan with a 589 Credit Score?

A credit score of 589 isn't the most favorable when it comes to car loan approvals. Understandably, this might feel like a roadblock. Typical lenders tend to look for scores above 660 for attractive loan terms. Being under 600, the given 589 score is seen as subprime. There's a notable risk for lenders here - a subprime score suggests that there might be some bumps in repayment.

Despite this, it's important to remember that the score doesn't entirely put a halt on your car ownership aspirations. There are certain lenders who are proficient in handling cases with lower credit scores. Be aware, though, that these loans generally come with substantially higher interest rates. This increase is mainly because these lenders are taking on more risk, and they need to secure their investment. While the journey may feel rough at times, through careful review and understanding of loan terms, acquiring a car loan isn't out of reach.

What Factors Most Impact a 589 Credit Score?

Understanding your credit score of 589 is a significant first step toward financial recovery. By pinpointing and addressing the factors most likely affecting your score, you can start paving the path toward financial health. Remember, every financial journey is unique, with its own set of challenges and lessons learned.

Credit Payment History

Your payment history plays a substantial role in your credit score. Late payments or outstanding debts could be key contributors to your current score.

How to Check: Go through your credit report for any late payments or unpaid debts. Reflect on times when payments were not made on time as this could be affecting your score.

Credit Utilization Ratio

A high credit utilization ratio - which shows how much of your available credit you're using - may negatively influence your credit score. If your credit card balances are near their limits, this could be impacting your score.

How to Check: Assess your credit card statements. Are the balances nearing the limits? Striving to maintain lower balances compared to your credit limits can help to improve your score.

Credit History Length

A relatively short credit history could adversely impact your credit score.

How to Check: Look at your credit report to gauge the age of your oldest and newest accounts and the average duration of all your accounts. Think about whether you've opened any new accounts recently.

Public Records

Public records, like legal judgments or collections, could significantly lower your score.

How to Check: Look at your credit report for any public records. Deal with any items that may need resolution.

Demographics

Even though credit scores don't directly consider age, marital status, income, or employment, these elements could indirectly affect the score. For example, a low income could affect your ability to pay your debts on time.

How Do I Improve my 589 Credit Score?

With a credit score of 589, there is room for significant improvement. The following steps offer immediate, achievable actions tailored for your situation:

1. Prioritize Existing Debts

Managing any existing debts should be your top priority. Start by crafting a plan to pay down the highest-interest debts first, this will lessen your overall interest payments over time. Keep up with minimum payments on all other loans and credit cards to avoid penalties.

2. Implement Budget Control

Control your spending with a budget plan. Prioritize needs over wants, and try to save wherever possible. Utilise an automatic savings plan to keep track and control your spending habits. This can help you accumulate savings and lessen the need for future borrowing.

3. Consider A Secured Credit Card

Your current score may limit your credit card options. Applying for a secured credit card could be a sound decision. Secure it with a cash deposit to match the credit limit and make punctual payments in full to boost your credit history positively.

4. Take Advantage Of A Co-signer

If feasible, ask someone you trust with good credit to co-sign a loan with you. This can potentially increase your credit limit and improve your credit score by leveraging their positive credit status. Take caution, however, as any default on payment will affect both credit scores negatively.

5. Diversify Credit Types

Once you’ve established reliable payment methods, consider broadening your credit types. Small consumer loans or retail credit cards, carefully managed, can further improve your credit reputation.