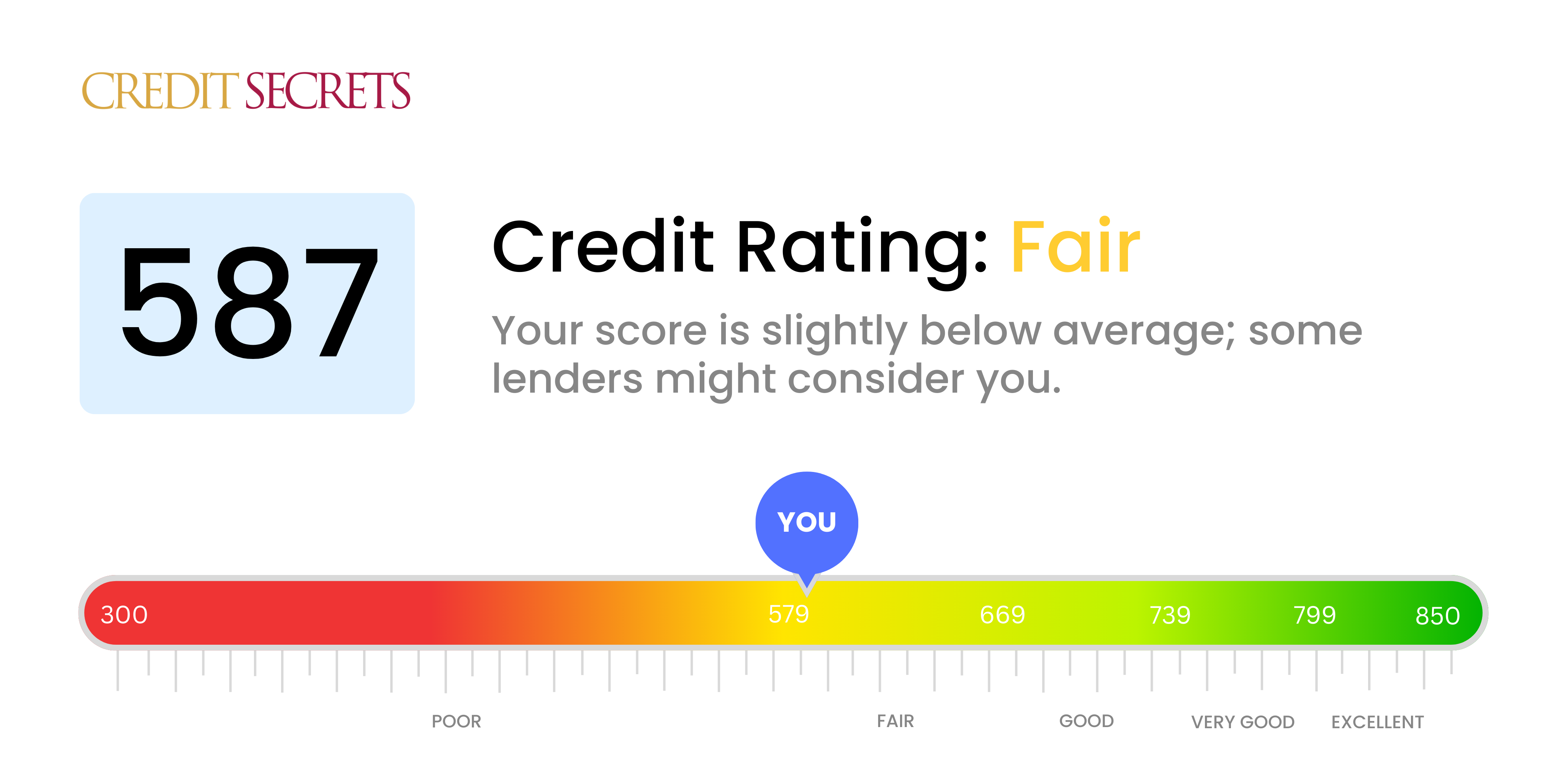

Is 587 a good credit score?

A credit score of 587 falls into the 'fair' category. Slightly above the 'poor' range, it is not considered a good credit score, implying that you may have had credit issues in the past, yet there are opportunities for improvement.

With a score of 587, you can expect higher interest rates and difficulties being approved for premium credit offers. It's not all gloom, though. With focused effort, you can uplift your score to a level that opens the doors to better financial opportunities. Many following our Credit Secrets program manage to significantly increase their scores, step by step.

Can I Get a Mortgage with a 587 Credit Score?

A credit score of 587 is considered to be in the fair range. It is often difficult to get approval for a mortgage with such a score. This because a score at this level suggests you may have had some financial difficulties in the past, which makes mortgage lenders wary. They might question your ability to maintain regular payments on a home loan.

It's important to remember that this isn't a permanent state and there are alternatives available to you. For instance, you could look into Federal Housing Administration (FHA) loans, which are government-insured loans that accommodate borrowers with lower credit scores. But bear in mind, these loans usually come with higher interest rates. Yet, even with this alternative, it might be more beneficial, over the long term, to work on repairing your credit to achieve better loan terms and interest rates. While this process may take time, it's the surest step towards a brighter financial future. By making prompt payments and maintaining responsible credit use, your score can gradually improve, opening better opportunities for you, including mortgage approval.

Can I Get a Credit Card with a 587 Credit Score?

With a credit score of 587, obtaining a traditional credit card can be tough. Lenders typically regard this score as high-risk, suggesting past financial missteps or hardships. This realization can be hard to swallow, but it's crucial to remain realistic and informed about your credit status. Recognizing your current credit situation is a big stride towards better financial health, even if that means dealing with some unpleasant truths.

Despite the challenges a credit score of 587 may pose, there are still alternatives that can help improve your financial standing. A secured credit card is one option to consider. Secured cards necessitate a deposit which is equivalent to your credit limit, making them a feasible option for those confronting credit difficulties. They can help pave the way towards improved credit over time. Another option might be using a co-signer or opting for a prepaid debit card. While these alternatives may not rectify your credit situation instantly, they could act as stepping stones towards financial steadiness. Just keep in mind, interest rates available for individuals with such scores are usually higher, as the risk to lenders is perceived to be greater.

With a credit score of 587, chances are more likely that a traditional lender might hesitate to approve a personal loan application. It's a tough situation to be in. This score is considered below average and might be seen as a greater risk by lenders. This isn't what you wanted to hear, but it's important to have a clear understanding of your credit situation.

Although regular personal loans might be hard to get, don't lose heart. There are still options to explore. Perhaps consider applying for a secured loan, for which you will have to put up a collateral. Also, loans co-signed by someone with a higher credit score are a possibility. Peer-to-peer lending might also be a suitable choice with their possibly more flexible lending conditions. Be aware, however, that these alternatives usually come with higher interest rates and not-so-friendly terms. This reflects the increased risk the lender is taking by approving a loan with a lower credit score. While it's hard, remember there are always possibilities and solutions out there. Stay positive and keep exploring.

Can I Get a Car Loan with a 587 Credit Score?

With a credit score of 587, it can be difficult to receive approval for a car loan. It's important to understand that lenders typically seek credit scores above 660, and anything below 600 is often labeled as subprime. Unfortunately, your score of 587 falls into this subprime bracket, leading possibly to higher interest rates or even application denial. The reason for this is that lenders see a lower credit score as a higher risk, as it indicates potential challenges in managing debt and making repayments.

Despite this hurdle, it doesn't mean a car loan is completely out of reach. You will find lenders who are willing to work with those suffering from lower credit scores. Keep in mind, though, that these loans might come with much higher interest rates, as a safety measure for the lenders. While this is not an ideal situation, by carefully considering the terms, there is still a chance to secure the loan you need for your new car.

What Factors Most Impact a 587 Credit Score?

Understanding your 587 credit score can be a critical step towards financial progress. Areas worth examining due to their impact on your score may include:

Payment Footprints

Your payment history is a strong factor for your credit score. Late or missed payments might play a part in your current score situation.

Checking guide: Scan your credit report for traces of late or defaulted payments. Reflect on your payment promptness in the past.

Credit Utilization Ratio

Your credit score can take a hit with a high credit utilization ratio. If you're frequently near your credit limits, it might weigh down your score.

Checking guide: Analyze your credit card balances in comparison to their limits. Endeavor to maintain balances that are far from your limits.

Credit History Duration

A brief credit history may exert a negative effect on your score.

Checking guide: Examine your credit report for insights on the ages of your oldest, newest, and all accounts averaged. Recent account openings could be an influencing factor.

Diversity and Fresh Credit

Maintaining a mix of credit types and handling new credit judiciously are crucial for an improved credit score.

Checking guide: Assess your mix of credit accounts, e.g., credit cards, retail accounts, installment loans. Reflect on your recent credit applications.

Public Records

Public records such as bankruptcies or tax liens can have a major impact on your credit score.

Checking guide: Scrutinize your credit report for any public records. Any items listed should be addressed promptly.

How Do I Improve my 587 Credit Score?

With a credit score of 587, you’re in a challenging yet surmountable position. By focusing on the following steps, you can see significant improvements to your score:

1. Directly Address Late Payments

Overdue payments tend to leave a negative impact on your credit score. Start rectifying this by addressing the most overdue accounts and paying them off. Negotiating a reasonable payment plan with your creditors can be helpful if you’re struggling with repayments.

2. Manage High-Interest Debt First

Credit card balances carrying high interest rates can hurt your credit score. Prioritize repayment of these balances to lower the overall debt burden. Endeavour to maintain your credit usage under 30% of your total credit limit for optimal results.

3. Rely on Secured Credit Cards

A secured credit card could be beneficial for you at this stage as it requires a cash deposit, doubling as your credit line. Using this type of card responsibly saves you from falling into further debt and gradually helps build your credit history.

4. Leverage Authorized User Status

Consider becoming an authorized user on a trusted person’s credit card. Ensure that the card owner maintains a good credit habit, as this can reflect positively on your credit score.

5. Mix It Up with Different Credit Options

Remember that a variety of credit types can enhance your credit score. Once you’ve established a consistent payment pattern with a secured card, consider expanding your credit portfolio, including retail credit cards or credit builder loans – and make sure to manage them properly.