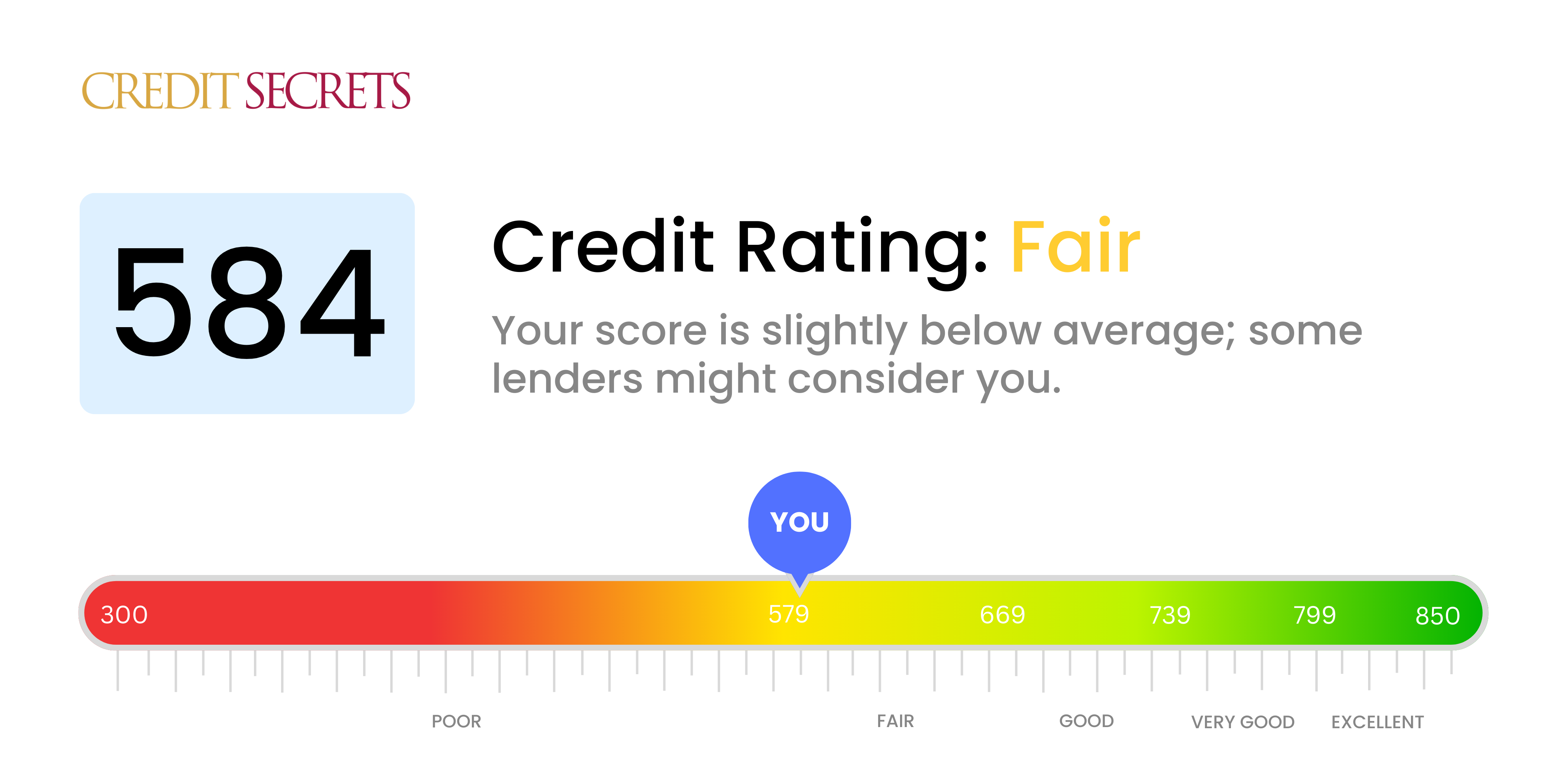

Is 584 a good credit score?

Your credit score of 584 falls into the category of 'Fair,' according to standard metrics. It's not an excellent score, but it's not too far from becoming 'Good,' and there's room to improve.

A score of 584 may limit some of your financial options. For example, you might face higher interest rates on loans and credit cards, and you might not be approved for certain types of financial products. However, there are also opportunities to rebuild and improve your credit standing. Mindful money management, such as paying your bills on time and maintaining a low credit card balance, can help raise your score. Ongoing effort and diligence can transform your 'Fair' score to a 'Good' standing, bringing with it more financial freedoms. With determination and patience, you can significantly improve your financial situation.

Can I Get a Mortgage with a 584 Credit Score?

With a credit score of 584, your chances of being approved for a mortgage may be quite slim. This score is below the threshold that most lenders typically consider safe, demonstrating a serious concern for your ability to repay in a timely and consistent manner. This could be due to various reasons like late payments, debt overloads, or other financial issues.

While this might seem disheartening, there are still other possibilities to explore. For example, certain Federal Housing Administration (FHA) loans are designed for those with lower scores. Or, you might be able to secure a mortgage with a higher interest rate, although this can make your monthly payments significantly larger and the overall loan more expensive. Do know that these alternatives could still be challenging to obtain. However, they reflect a sincere understanding of the hardships you are going through and offer a glimmer of hope for securing a mortgage loan despite a lower credit score.

Can I Get a Credit Card with a 584 Credit Score?

With a credit score of 584, it may be tough to be approved for a traditional credit card. Lenders often see this score as somewhat risky, indicating possible past financial struggles. While this might be a hard pill to swallow, acknowledging your credit status is a crucial stepping stone towards rebuilding your financial health. Accepting the reality of your situation, though it may appear daunting, is necessary.

Given the potential difficulties tied to a lower score, you might want to consider alternatives such as secured credit cards. These cards require a deposit that becomes your credit limit, making them a more attainable option. They can, over time, assist in the recovery of your credit score. Other potential alternatives include seeking a co-signer or exploring pre-paid debit cards. Even though these options might not provide an immediate solution, they offer a solid path on your journey to financial stability. However, remember that the interest rates on any available credit forms to individuals with such scores are usually higher, as lenders see it as a high-risk proposition.

With a credit score of 584, securing approval for a personal loan might prove challenging. This score is below what most traditional lenders typically consider as reliable in financial practice. They see this score as an indication of elevated risk, which could make it unlikely that you would qualify for a conventional loan. It's essential to acknowledge the implications this credit score carries, but it's equally important to remember there are other ways forward.

One avenue you could explore are secured loans that require collateral, co-signed loans, where someone with a higher credit score can back your application, or peer-to-peer lending platforms which may have more flexible credit score requirements. However, please be aware that these alternatives often bring higher interest rates and less appealing loan terms due to the perceived elevated risk. While they might not be the most favorable options, they provide a route to consider as you work on improving your credit score.

Can I Get a Car Loan with a 584 Credit Score?

With a credit score of 584, getting a car loan may prove to be a tough task. Financial institutions are generally looking for credit scores above 660 to consider offering favorable loan conditions. Unfortunately, a credit score below 600 is usually viewed as subprime. This category includes your score of 584, and it could result in higher interest rates when applying for a loan, or even a loan rejection.

This is due to the simple fact that a lower credit score represents a higher risk to these institutions. It's a reflection of your past financial behavior and is used to predict possible difficulties in repaying loans in the future.

But don't lose hope. Even with a lower credit score, opportunities to secure a car loan still exist. Some lenders cater to borrowers with lower credit scores. Just bear in mind, these kinds of loans can carry notably higher interest rates. This is a result of the increased risk these lenders are taking on. However, with careful planning and thorough understanding of your loan conditions, driving off in your new car is still a possibility.

What Factors Most Impact a 584 Credit Score?

Having a 584 credit score provides a key opportunity to kick-start your journey towards financial betterment. By understanding the elements affecting your score, you can create a personalized plan to enhance it. Remember, your financial path is unique and presents dynamic learning opportunities.

Payment History

Payment consistency significantly affects your credit score. If you've missed or delayed payments, it's likely contributing to your score of 584.

How to Check: Review your credit report for missed or late payments. Recollect any instances of delayed payments, as they could be impacting your score.

Credit Usage

Excessive credit utilization can lower your score. If you often max out your credit cards, it's probably impacting your score.

How to Check: Inspect your credit card statements. Are your balances often at, or close to, their limits? Strive to keep your balances low.

History of Credit

A short credit history may be negatively affecting your score.

How to Check: Check your credit report to determine the age of your oldest, newest, and average age of all your accounts. Carefully consider the timing of any recently opened accounts.

Type and Amount of Credit

It's integral to have a balanced mix of credit, from credit cards to installment loans, and handling new credit responsibly.

How to Check: Review your types of credit accounts and note if you’ve recently applied for new credit.

Public Records

The presence of public records like tax liens or bankruptcies can significantly decrease your score.

How to Check: Analyze your credit report for any public records. Address any listed points needing resolution.

How Do I Improve my 584 Credit Score?

With a credit score of 584, there’s room for improvement, but it’s entirely possible to raise your credit score using these focused steps:

1. Rectify Accounts in Collections

If you have accounts in collections, addressing these should be your immediate focus. Paying off or settling these accounts can have a significant, quick impact on your credit score. Always remember to request a deletion agreement when settling an account in collections.

2. Manage Credit Utilization

Your balance-to-limit ratio, or credit utilization, plays a vital role in your credit score. Aim to keep your balance under 30% of your overall credit limit to improve your score.

3. Apply For a secured credit card

Given your current score, a secured credit card could be a viable option. This requires you to make a deposit as collateral, then you can make small purchases and pay them off promptly, boosting your credit history in the process.

4. Solicit Credit Card Add-On Status

You can request a trustworthy friend or family member with a good credit history to add you as an authorized user on their credit card. This can help demonstrate responsible credit use and boost your credit score. However, ensure their card issuer reports authorized users to credit bureaus.

5. Explore Different Types of Credit

Once your score improves, look to diversify your credit portfolio. Consider a credit builder loan or a department store credit card. Demonstrating responsible management of different types of credit can positively impact your score.

Focus on these strategies, and with diligent work, you will see improvements in your credit score.