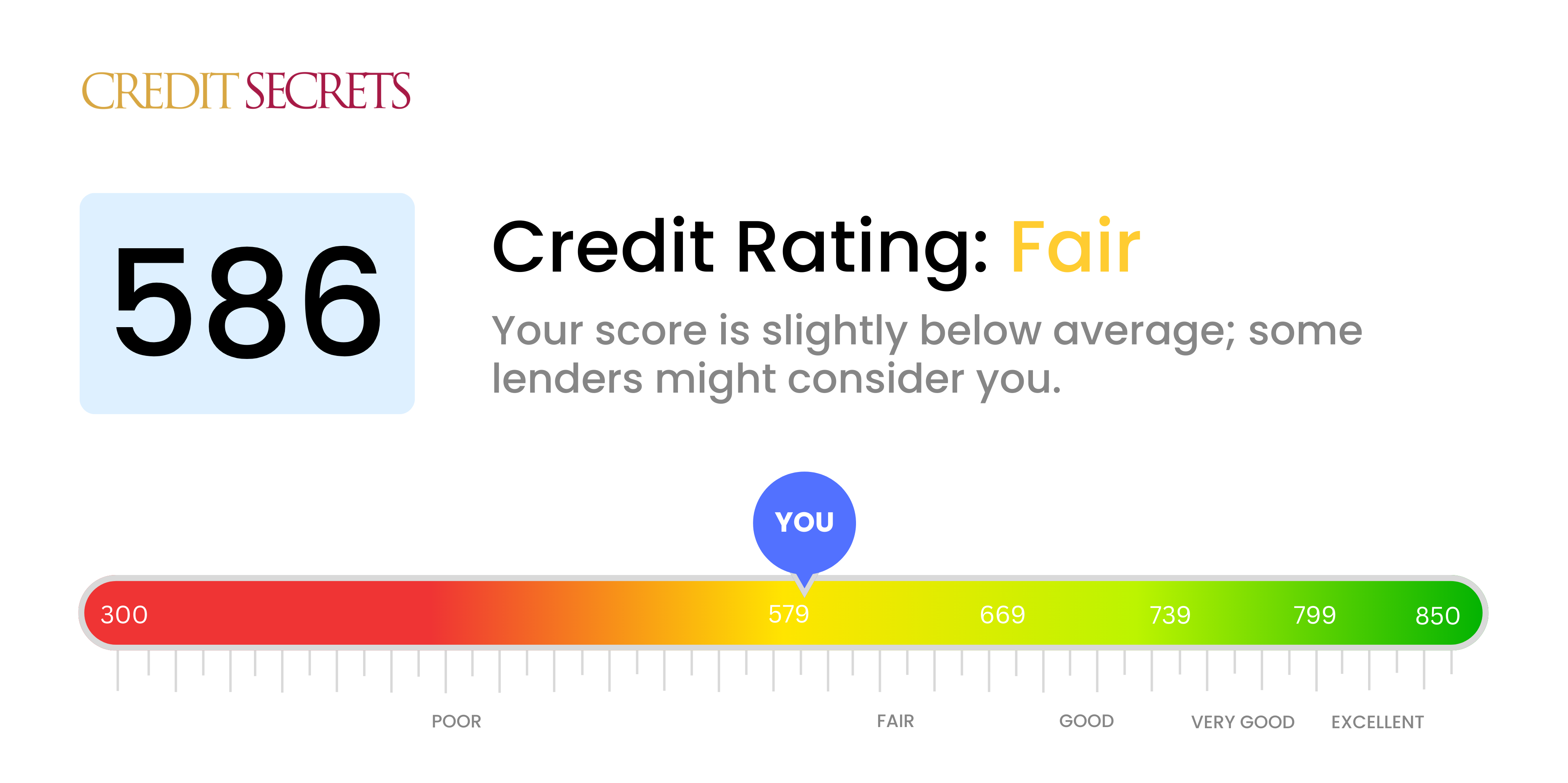

Is 586 a good credit score?

A credit score of 586 falls into the 'fair' category. This isn't considered a strong score, but it's far from the worst and you already have a foundation to build upon. Typically, with a score in this range, you can expect to face slightly higher interest rates on loans and may have limited options for credit cards. However, it's entirely possible to improve this score with some focused financial management.

People with scores similar to yours have made significant improvements, often stepping up to the next tier of credit classified as 'Good'. The tools and strategies offered by Credit Secrets can help guide your journey towards a higher credit score. Remember, improving your credit score is a process, not an overnight fix, but you're already on the path to financial stability.

Can I Get a Mortgage with a 586 Credit Score?

With a credit score of 586, it's quite challenging to secure mortgage approval. Most loan officers see this score as an indication you've faced some credit difficulties, potentially including late payments or defaults. This understandably causes apprehension about lending, as they might anticipate issues regarding prompt payments.

By no means does this mean you're permanently out of options. Some lenders may still consider candidates with lower scores, but you're likely to encounter higher interest rates and more rigid terms. Alternatively, you might investigate mechanisms like Federal Housing Administration (FHA) loans, which can be available even with suboptimal credit scores. Exploring such alternatives, while concurrently focusing on enhancing your credit score, may increase your chances. Remember: the path to a better credit score isn't a sprint, but a marathon. Patiently working on it will eventually yield fruitful results.

Can I Get a Credit Card with a 586 Credit Score?

A credit score of 586 makes getting approved for a typical credit card a challenging task. Most lenders see this score as a red flag, indicating that there have been past financial issues or impaired management of your credit. It's a tough spot to be in, but taking it in stride and understanding your situation is crucial. Looking at your score honestly is the first step towards your financial improvement.

Considering your credit score, options like secured credit cards could be a route worth exploring. Secured cards work through a deposit that establishes your credit limit, making them easier to qualify for and a helpful tool in rebuilding credit gradually. Additionally, you might want to consider finding a co-signer or looking at pre-paid debit cards. These are not quick-fix solutions, but stable stepping stones towards a better financial future. It's important to note that for those with a 586 credit score, interest rates on any credit you may be eligible for are likely to be considerably high, which reflects the higher risk for lenders.

Having a credit score of 586 can feel discouraging when trying to secure a personal loan. This number falls short of the conventional credit score range that lenders typically look for, strongly suggesting a high risk profile. Being faced with this fact can be tough, but understanding the implications this brings to your lending opportunities is vital.

Since typical personal loans may be out of reach, exploring options like secured loans could be a fruitful route. By offering collateral for the loan, access to capital from certain lenders may be possible. Another potential route is co-signed loans, where another person with a more favorable credit score commits to the loan agreement alongside you. Another alternative is to explore peer-to-peer lending platforms, which occasionally possess more lenient credit accommodation. Keep in mind though, these alternatives generally come with higher interest rates or less favorable terms due to the increased risk perceived by lenders.

Can I Get a Car Loan with a 586 Credit Score?

Having a credit score of 586 may make it difficult to gain approval for a car loan. The majority of lenders like to see credit scores over 660 to offer favorable terms. Your credit score falls below this range, into what's often considered as the 'subprime' category. This could mean facing higher interest rates or even having the loan application denied. This outcome is due to the higher risk your lower credit score represents to the lenders - they may worry about potential problems with repaying the borrowed money.

Yet don't lose hope - a car loan isn't entirely out of your reach. There are certain lenders who work especially with individuals presenting lower credit scores. Just remember to be careful. Loans from these providers tend to have significantly higher interest rates. These rates reflect the increased risk that lenders bear. The way forward may not be smooth, but with astute judgement and comprehensive examination of loan terms, obtaining a car loan can still be achievable.

What Factors Most Impact a 586 Credit Score?

Deciphering a credit score of 586 can feel daunting, but by recognizing and addressing key factors affecting this score, you're taking a pivotal step towards better financial health.

Past-Due Payments

Persistent tardy or omitted payments may be a major reason behind a 586 score. These can considerably impact your credit score.

How to Check: Closely read your credit report for past-due payments or non-payments. Reflect on times when you failed to pay on time, as these can drastically hurt your score.

High Credit Utilization

Racking up high balances on your credit cards can be detrimental to your score. If you're maxing out your cards often, this could be dragging down your score.

How to Check: Look at your credit card statements. Are your balances frequently hitting their limits? It's best to keep balances low in relation to your credit card limits.

Short Credit History

A less mature credit history can be a factor to your score of 586. Recently opened accounts can affect your score negatively.

How to Check: Take a look at your credit report to see your oldest, newest, and the average age of your credit accounts. If you've recently opened several new accounts, this could be affecting your score.

Lack of Credit Diversity

Having a balanced mix of credit types (like credit cards, retail accounts, installment loans) and maintaining them responsibly can boost your score.

How to Check: Review your credit report for the types of credit you hold. If you only have one type of credit, diversifying may serve your score well.

Derogatory Marks

Negative records, such as bankruptcies or collections, can drastically lower your score.

How to Check: Examine your credit report for any derogatory marks. It's essential to address any listed that need resolving.

How Do I Improve my 586 Credit Score?

With a credit score of 586, you are within the fair credit range. However, hope is not lost. Let’s outline the most beneficial and actionable steps to boost that score:

1. Rectify Unsettled Debts

Existing debts that haven’t been addressed can greatly pull down your credit score. Begin by settling these debts promptly. If you have any difficulties, don’t hesitate to communicate with your creditors to hash out a feasible payment schedule.

2. Lower Your Credit Card Balances

Strive to lower your credit card balances to at least 30% of your overall credit limit. This, in the long run, has a positive effect on your credit score. Prioritize the cards with the highest balances.

3. Take Advantage of a Secured Credit Card

With a score of 586, acquiring an ordinary credit card might be daunting. A secured credit card, which involves a refundable deposit that equals your credit line, is your best bet. Ensure regular and full payments to enhance your credit history.

4. A Trusted Authorized User Role

Request a trusted person with a good credit score to add you as an authorized user on their credit card. This act can improve your credit score through their positive credit history. Make sure the card provider reports authorized user activities to the credit bureaus.

5. Diversify Your Credit Types

Having a variety of credit account types can play a role in raising your credit score. Once your secured card shows a good track record, consider other types of credit like retail credit cards or credit builder loans and always remember to use responsible management.