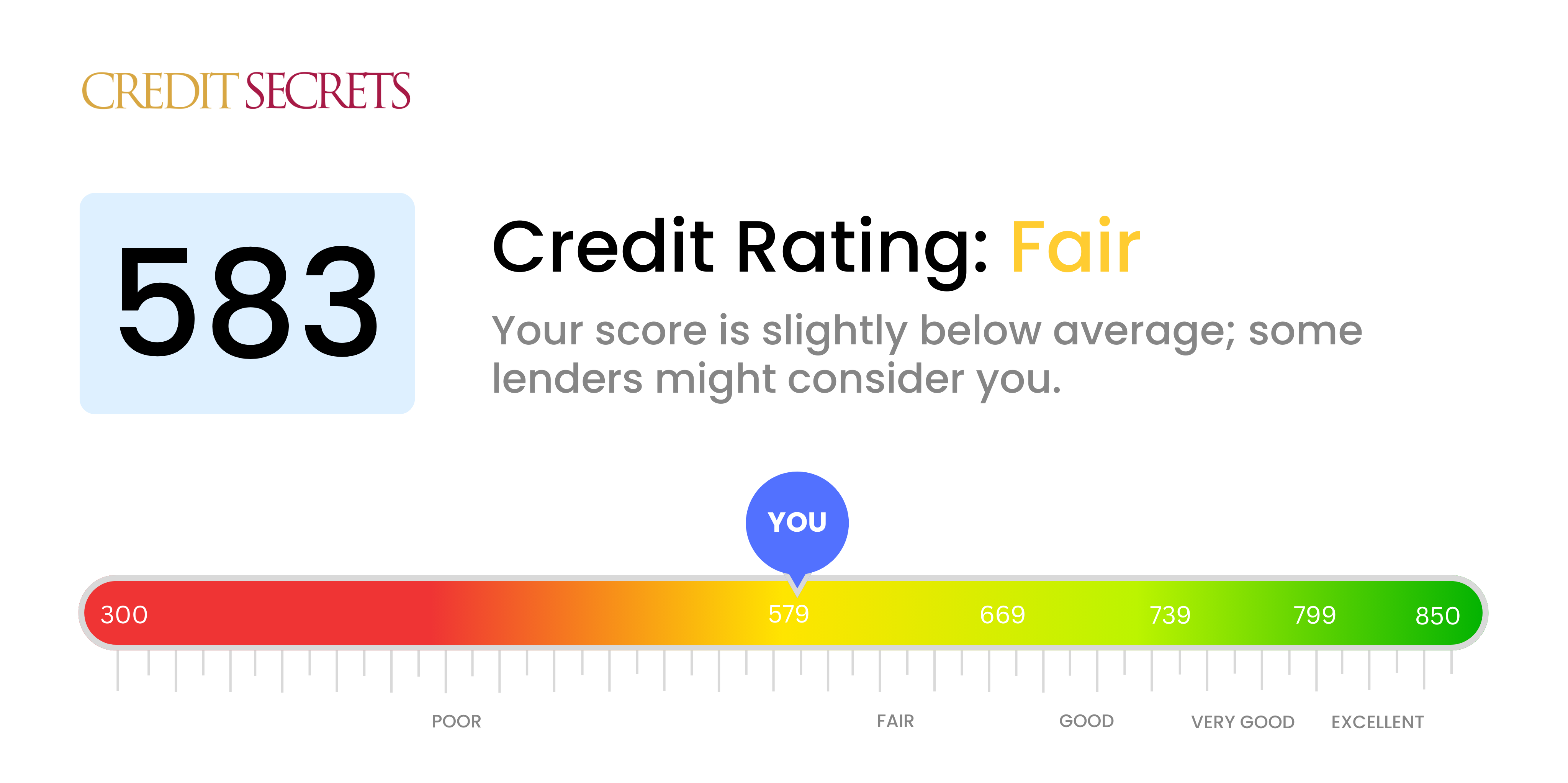

Is 583 a good credit score?

A credit score of 583 falls into the 'Fair' category. While it might not be the best, it's not the worst either; it does, however, may limit choices when it comes to securing credit or loan options. Financial institutions might view you as a potentially risky borrower, which can result in higher interest rates or stricter lending terms.

Improving this score could open up new opportunities to create financial stability. It is possible to take steps to improve your score - paying bills on time, keeping credit balances low, and carefully managing new credit could all contribute towards a better score in the future. Remember, change is a gradual process but each step forward can make a significant difference to your financial future.

Can I Get a Mortgage with a 583 Credit Score?

A credit score of 583 signifies a significant financial challenge when it comes to seeking a mortgage. Most lenders tend to look for a minimum score of at least 620. This places your score below the average threshold, indicating a high credit risk which can make obtaining a loan or mortgage quite difficult.

Keep in mind that while this situation is not ideal, there are options available. Certain programs like FHA loans offer lenient credit requirements and may consider scores as low as 500. However, a higher down payment is usually required for these types of loans, and interest rates may be higher than standard home loans. Even with these constraints, this option might work for you. Remaining optimistic and proactive in managing your credit is key to putting yourself in a better financial position in the future.

Can I Get a Credit Card with a 583 Credit Score?

Having a 583 credit score can be a bit of a hurdle when trying to get approved for a standard credit card. Companies often perceive this score as potentially risky, suggesting some past struggles with your financial obligations. While this reality may be tough to face, it's crucial to confront it honestly and head-on. Recognizing where your credit stands is a pivotal first step in your journey towards better financial health.

However, this doesn't mean you're without options. Secured credit cards, which involve making a deposit that becomes your credit limit, are one possible route. These cards can be less challenging to secure and serve as useful tools for bolstering your credit over the long term. You might also contemplate getting a co-signer or investigating pre-paid debit cards. Keep in mind; these strategies are stepping stones, not immediate solution. Furthermore, the interest rates provided to persons with this credit score are usually elevated, reflecting the higher perceived risk to issuers.

With a credit score of 453, it's likely that you may encounter some challenges getting approved for a traditional personal loan. This score is significantly below what many lenders typically consider acceptable, as it presents a high level of risk. But, understanding the implications of a low credit score like this is a crucial step towards making informed financial decisions.

While the path may be a bit tougher, there are still options available. Consider secured loans which require collateral, or co-signed loans where another person with better credit guarantees your loan. Similarly, peer-to-peer lending platforms could be a potential avenue as they sometimes have relaxed credit considerations. But remember, these alternatives might come with higher interest rates and less amicable terms. This is due to the increased risk lenders take when considering lower credit scores. So, it's important to keep this in mind as you explore the lending landscape.

Can I Get a Car Loan with a 583 Credit Score?

Having a credit score of 583 can make securing a car loan a difficult task. Many lenders prefer credit scores above 660, considering scores under 600 as subprime. Unfortunately, your score of 583 falls into this less desirable bracket. This can result in higher interest rates or even denial of loan because to lenders, a lower score signifies a heightened risk of not getting repaid.

However, don't lose heart! Possessing a lower credit score doesn't mean you absolutely can't get a car loan. You've got some lenders who concentrate on assisting folks with lower scores. But bear in mind, such loans often come with steep interest rates. High interest rates equate to lenders offsetting the risk they're taking on. Carving your path may seem rough right now, but with a clear understanding of the loan terms and prudent decision-making, a car loan isn't out of the equation.

What Factors Most Impact a 583 Credit Score?

Knowledge is pivotal on your journey towards financial betterment. A credit score of 583 indicates some financial challenges, but understanding the influential factors can create a roadmap towards an elevated credit score.

Importance of Timely Payments

One of the most determining factors of your credit score is your payment history. Late or missed payments could be the reason your score is at 583.

What to Do: Scrutinize your credit report for late payments or missed payments. Use this analysis to strategize on maintaining consistent and on-time payments moving forward.

Credit Utilization Ratio

Having high credit utilization can also contribute to a lower credit score. If you're consistently reaching or exceeding your credit limit, that could impact your score negatively.

What to Do: Check your credit card statements. Are you regularly close to your credit limit? As a guideline, aim to keep your total utilization under 30% to help improve your score.

Length and Variety of Credit

A short credit history or a lack of diverse credit can impact your score. Having various types of credit like credit cards, personal loans, and auto loans contributes positively to your score.

What to Do: Evaluate your credit report for diversity and length of credit history. Consider how you can create a healthier mix and lengthier credit history.

Derogatory Marks

If you have derogatory marks such as bankruptcies, foreclosures, or tax liens, they can significantly lower your credit score.

What to Do: Look through your credit report. Address any derogatory marks and consider how to handle them moving forward.

How Do I Improve my 583 Credit Score?

With a credit score of 583, it’s clear that room for improvement exists. Here’s how you can elevate your score with accessible, effective steps:

1. Prioritize Outstanding Balances

To make a notable boost to your score, focus on your outstanding balances. If you have defaulted loans or bills that haven’t been paid, start by clearing those. The longer a debt is outstanding, the heavier its impact on your credit score, so tackle the oldest debts first. You might find you can work out a manageable plan with your creditors.

2. Aim for Lower Credit Utilization

Maintaining high balances on your credit cards can negatively affect your credit score. Strive to bring your credit card balances down to 30% or less of your credit limit, though if you can get and keep it below 10%, that’s even better. Start with the cards with the highest utilization rates.

3. Consider a Secured Credit Card

Securing a regular credit card with a score of 583 might be tough. Think about a secured credit card instead. This requires a cash deposit equivalent to your line of credit. By using it responsibly, you can demonstrate a positive payment pattern and boost your score.

4. Use a Co-Signer

If you know a person with a healthy credit history who is willing to co-sign a loan or credit card, this can help elevate your score. This allows their good credit to offset yours, but remember, any negative activity impacts both of you.

5. Explore Various Credit Types

Diversifying your credit can improve your score. Once a positive history with a secured card is established, look into other credit types like retail credit cards or credit builder loans. Remember, managing these responsibly is key to improving your score.