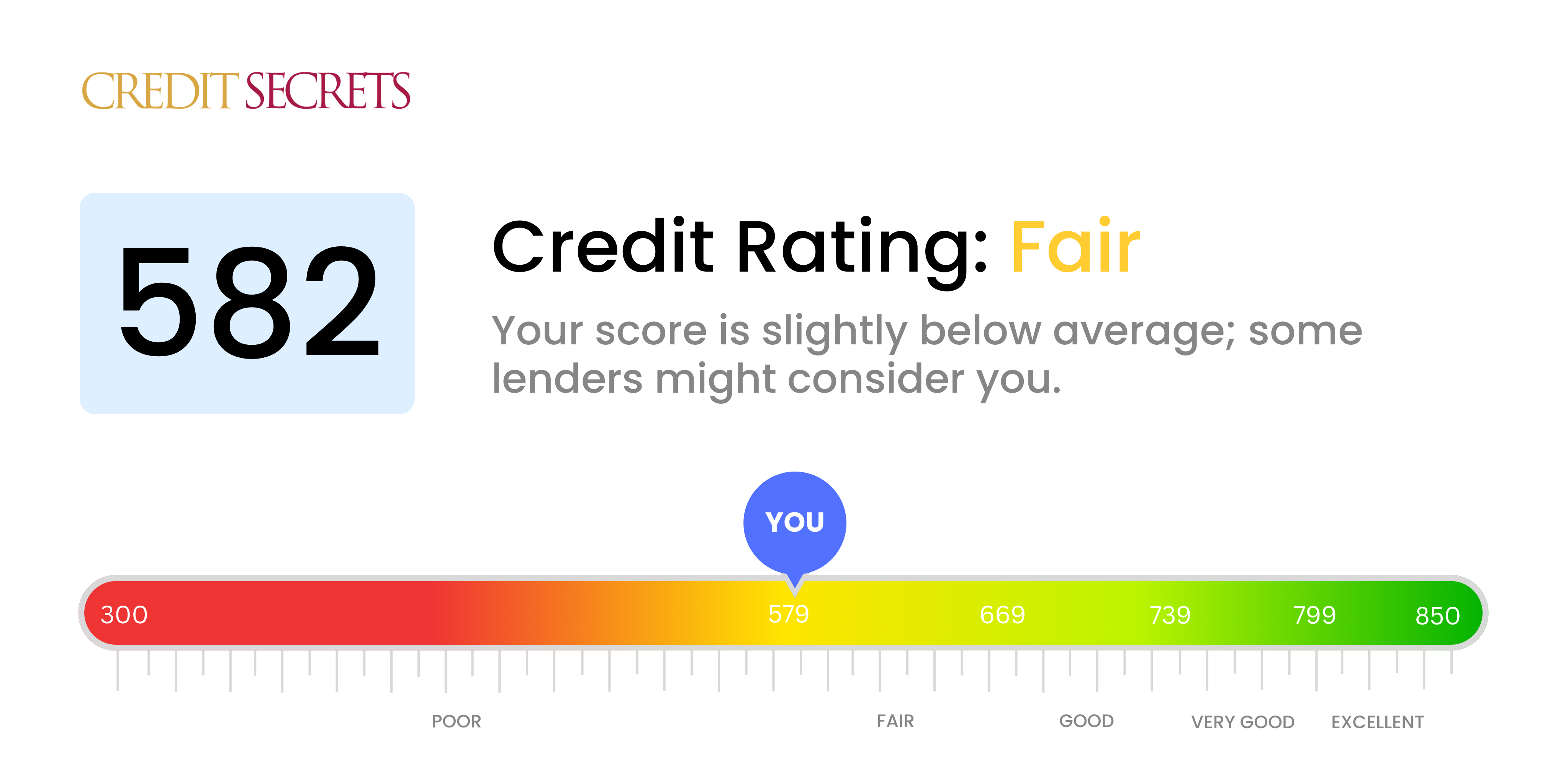

Is 582 a good credit score?

With a credit score of 582, you're currently in the 'fair' range on the credit spectrum. This signifies that while your credit is not in poor shape, there is still significant room for improvement to gain access to better loan rates and financial opportunities.

Being in the 'fair' category, you might face challenges with securing loans or credit and could be subject to higher interest rates. Nevertheless, you're just on the border of stepping into the 'good' credit range. By making regular, timely payments, reducing your outstanding debts, and keeping a close eye on your credit activities, your score could improve, opening the door to better financial outcomes for you. The journey to a better credit score is a process, but remember, the effort you put in towards financial responsibility can reap significant returns in the future.

Can I Get a Mortgage with a 582 Credit Score?

A credit score of 582 suggests that you may face challenges when seeking approval for a mortgage. This score is considered 'fair' by some scoring models, but many lenders would regard it as subpar, minimizing your chances of loan approval. Unfortunately, a score in this range seems to indicate a history of late or missed payments, overextended credit lines, or other credit missteps.

Nevertheless, it is essential not to lose heart. Despite the grim outlook, there are still options available to you. Certain lenders specialize in offering loans to individuals with lower credit scores. These loans, however, often come with higher interest rates due to the increased risk to lenders. Alternatively, government-backed options such as Federal Housing Administration (FHA) loans could be available to you. Though securing a mortgage with a 582 credit score may be difficult, it is not entirely impossible. Gaining a clear understanding of your credit history and the available loan options is a crucial first step toward reaching your homeownership dream.

Can I Get a Credit Card with a 582 Credit Score?

With a credit score of 582, you might find securing a typical credit card somewhat difficult. This score is seen by lenders as being in the "fair" range, implicating some past struggles with financial management. It's not a pleasant reality, but it's important to face the situation with honesty and clarity. Understanding your credit status is a crucial part of improving your financial outlook and stability.

Given the hurdles that come with this score, considering other options like a secured credit card may be beneficial. Secured cards require a deposit that serves as your credit limit, and they can be easier to obtain. Moreover, they can contribute to the rebuilding of your credit over time. Other alternatives could be finding a co-signer, or possibly opting for pre-paid debit cards. These are not quick fixes but valuable tools that could aid in the journey to better financial standing. Importantly though, remember that interest rates on any credit option available for a 582 credit score might be higher due to the lender's perceived risk.

A credit score of 582 may be a challenging number when pursuing a personal loan from traditional lenders. These institutions typically look for scores in the mid-600s and above, associating lower values with increased lending risk. No doubt, this puts you in a challenging spot, but it helps to know exactly where you stand.

You may want to explore alternative loan options. Secured loans can hinge on you offering collateral, while co-signed loans can depend on someone else with stronger credit advocating on your behalf. Additionally, peer-to-peer lending networks could provide more accommodating credit norms. Bear in mind, these alternatives can commonly carry higher interest rates and more stringent terms, mirroring the increased risk perceived by the lender. Dealing with credit scores can feel overwhelming, but knowing what to anticipate is often the first step towards brighter financial possibilities.

Can I Get a Car Loan with a 582 Credit Score?

Having a credit score of 582 means you might find it tougher to get approved for a car loan, but it's not impossible. Why? Because lenders usually favor scores above 660. Being under 600 places your score in the subprime range, so you may face higher interest rates or, in some cases, loan denial. The lower your credit score, the greater the risk you appear to lenders, and this could signify potential repayment issues in your past.

But don't give up! There are lenders who cater specifically to individuals with less-than-stellar credit scores. But proceed with caution, as these loans can come with steep interest rates. The increased cost is their way of mitigating the risk they're taking on your loan. Though it might be a rough ride, by carefully reviewing all terms and thinking things through, getting a car loan with your current credit score is absolutely doable. Just remember, a low score today doesn't mean it'll stay low forever. With patience and dedication, your credit score can improve with time.

What Factors Most Impact a 582 Credit Score?

Analyzing a score of 582 is an essential first step toward improving your financial health. By pinpointing the factors that could be affecting your score, this understanding will aid in formulating an actionable plan for progress. It's important to remember that everyone's financial journey is different and is always an opportunity for growth and understanding.

Payment History

Payment history is a critical factor that might be affecting your score. The presence of late or missed payments on your report could be a primary reason for a score of 582.

How to Check: Scour your credit report for any instances of missed or late payments, these could have led to a decrease in your score.

Credit Utilization

A high credit utilization rate can also contribute towards a lower score. This might be a case if your credit card balances are close to their respective limit.

How to Check: Look at your credit card balances. Are they nearing the maximum limit? Strive to keep these balances lower than the limit to aid in lifting your score.

Credit Age

A shorter credit history might be influencing your score negatively.

How to Check: Examine your credit report to determine the age of your oldest and newest account and the average age of all your accounts. Keep in mind that opening new accounts can impact your score.

Type of Credit and Recent Credit Applications

Having a limited variety of credit types or frequent new credit applications could be impacting your score.

How to Check: Analyze your combination of credit accounts. Have you been frequently applying for new credit recently? Responsible management of different credit types is beneficial for good credit health.

Public Records

Public records such as bankruptcies or unpaid taxes can greatly affect your score.

How to Check: Check your credit report for any public records. Addressing these promptly will help in enhancing your score.

How Do I Improve my 582 Credit Score?

With a credit score of 582, you fall into a lower category, but don’t worry, improvement is within reach. The following are some concrete and effective steps you can take to boost your score from its current state:

1. Prioritize Delinquent Accounts

Accounts that have fallen behind on payments have a significant impact on your score. Focus on getting these accounts up to date. If needed, consult with your lenders to arrange a feasible payment plan.

2. Lower Your Credit Utilization

Your credit card balances play a large role in your credit score. Aspire to get your balances below 30% of your total credit limit, and, in the long run, aim for under 10%. Begin with the cards that are closest to their limits.

3. Consider a Secured Credit Card

At this level, you might find it difficult to get a standard credit card. Consider securing a credit card that requires a cash deposit, which will serve as your credit limit. Use this card wisely, make regular purchases, and pay your balance each month to establish a good payment history.

4. Join a Reliable Credit User

If possible, find a friend or family member with solid credit who would add you as an authorized user on their credit card account. This can enhance your score by incorporating their positive payment history into your credit report. Ensure the card company reports authorized users to the credit bureaus.

5. Expand Your Credit Types

A variety of credit lines can increase your credit score. After building a good record with a secured card, think about adding another type of credit, such as a credit-builder loan or a department store credit card. Make certain to manage these accounts responsibly.