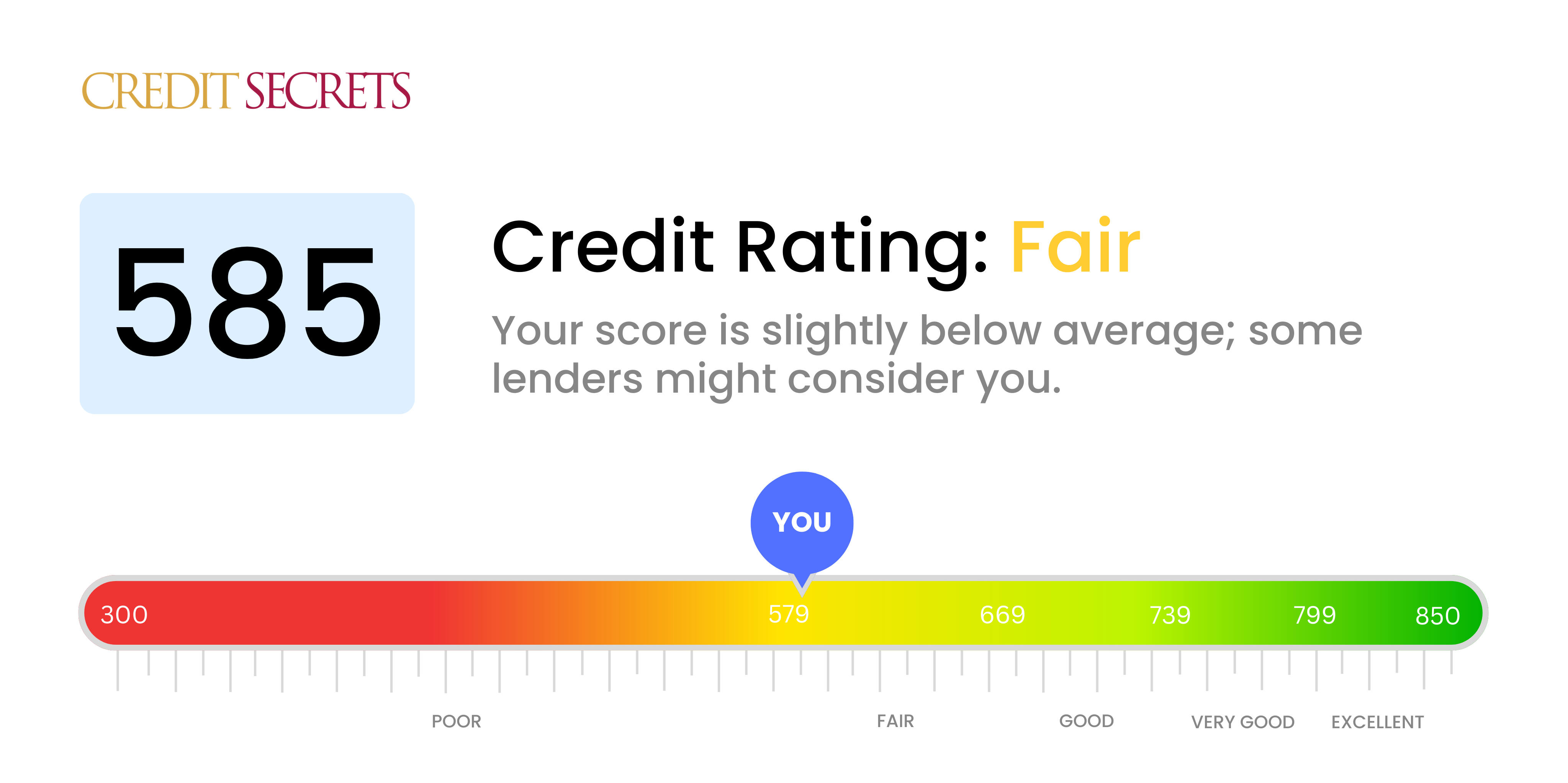

Is 585 a good credit score?

A credit score of 585 falls into the 'fair' category. This score is not considered high enough to receive the most optimal interest rates and loan conditions that lenders have to offer, but it doesn't mean you can't access credit services at all.

You might face slightly higher interest rates making loans and credit cards more costly, and you may not qualify for certain financial products. But don't be disheartened, as this doesn't mean you're stuck here. With consistent effort, patience and smart financial management, it's entirely possible to improve your credit rating and move into the 'good' or even 'excellent' category over time.

Can I Get a Mortgage with a 585 Credit Score?

With a credit score of 585, it's unlikely you'll be approved for a mortgage. This score is below the threshold most lenders consider minimal for approval. It signals to lenders that you've possibly dealt with financial setbacks such as late payments or defaults. It can be a difficult pill to swallow, but it's important to know where you stand.

Given this situation, it's crucial to be aware of alternative options. One option might be looking at FHA loans; these usually accept lower credit scores than traditional mortgages. However, remember that lower scores can sometimes lead to higher interest rates. You could also consider saving for a larger down payment to reduce the lender's risk. While these alternatives might not be ideal, they can provide a stepping stone towards homeownership and better credit. It's a gradual journey, but, step by step, you can make strides towards your financial goals.

Can I Get a Credit Card with a 585 Credit Score?

With a credit score of 585, it might be substantially tricky to get approval for a regular credit card. Lenders could perceive this as a riskier score, which may reflect a history of financial complexities or mishandling. It's disheartening indeed, but it's equally vital to be realistic and knowledgeable about your credit circumstances. Recognizing conditions of your credit is the fundamental move towards fiscal recuperation, though it might mean confronting unwelcome facts.

Considering the hurdles linked with such a score, it might be wise to deliberate on alternatives like secured credit cards. These cards demand a deposit that becomes your credit cap and can be relatively easy to obtain, aiding in the process of restoring your credit gradually. Other possibilities include seeking a co-signer or opting for pre-paid debit cards. Though these options don't imply an immediate solution, they help in navigating your journey towards stable financial footing. It's crucial to note that, the interest rates on any credit made available to you would likely be higher, encapsulating the increased risk lenders perceive.

A credit score of 585 is likely going to pose challenges when applying for a personal loan through traditional lenders. Given this score falls lower on the credit scale, it's often seen by lenders as an indication of higher risk, making loan approval challenging. We understand that this is not an easy position to be in, but it's necessary to understand the gravity of what this credit score means for your loan options.

With conventional loans possibly being an uphill battle, consider exploring alternatives such as secured loans or co-signed loans. These can sometimes be more achievable, as they involve collateral or a co-signer with better credit. Another potential avenue might be peer-to-peer lending platforms, which can sometimes have more relaxed credit expectations. However, remember that these alternatives might come with higher interest rates and tougher terms due to the increased risk for the lender. The journey towards financial balance can be tough, but exploring various options can be beneficial in finding a path that works for you.

Can I Get a Car Loan with a 585 Credit Score?

Obtaining a car loan with a credit score of 585 can be complicated. A good rule of thumb is that lenders prefer credit scores above 660 for optimal terms. Meanwhile, a score below 600 like yours is often labeled as subprime. This could lead to more costly interest rates or even rejection because lenders consider low credit scores as high risk. This assessment is based on your credit history reflecting potential challenges in repaying the loan.

But don't worry, your hopes of purchasing a car are far from hopeless. Though it may be trickier, there are lenders who cater to people with lower credit scores. However, it's crucial to tread cautiously since these loans frequently carry higher interest rates. This is how lenders shield themselves when taking on more risk. You're advised to understand the terms thoroughly before making any decision. The road to securing a car loan could be rough, but by being wise in your choices, your dream car still stays within your reach.

What Factors Most Impact a 585 Credit Score?

Grasping the nuances of a 585 credit score is the first step toward your financial progress. Discovering the elements impacting your score can lay the foundation for a strong financial trajectory. Keep in mind, each person's journey towards better credit is personal and filled with learning experiences.

Timeliness of Payments

Paying your bills on time has a significant effect on your credit score. Any past instances of delayed payments could be the reason behind your current score.

How to Inspect: Analyze your credit report carefully for any late payments. Any history of missed or late payments could be influencing your score.

Credit Card Balance

If your credit card balance is high, this could also be influencing your credit score. Your credit balance utilization rate i.e., how much of your available credit you're using, plays a crucial role.

How to Inspect: Check your credit card statements. Are you using a large portion of your available balance? If so, aim to reduce your balance.

Duration and Nature of Credit

Short credit history or having limited types of credit (like only credit cards) may also impact your score negatively.

How to Inspect: Go through your credit report to understand the duration and variety of your credit accounts. Think about the recent credit accounts you may have opened.

Public and Collection Records

Public records such as bankruptcies and collection accounts could dangerously bring down your score.

How to Inspect: Look into your credit report for any such records. Tackle any issues that you find to start improving your score.

How Do I Improve my 585 Credit Score?

With a credit score of 585, you’re presently in the ‘fair’ category, but don’t fret – scores can always be improved! Here are some of the most viable and effective steps you can take:

1. Settle Outstanding Debts

Outstanding debts can be a major weight on your score. Prioritize paying off these debts as promptly as you can. If needed, communicate with the agencies concerned to set up a reasonable payment plan.

2. Monitor Your Credit Utilization Ratio

Keep a close watch on the balance available vs. consumed on your credit cards. Reduce the usage to below 30% of your available limit. It’s still even better if you can maintain it below 10% steadily.

3. Consider a Secured Credit Card

Securing a regular credit card might be an uphill task with your current credit status. A money-backed, secured credit card becomes a feasible option. Handle it wisely, use it for small purchases, and clear the balance monthly to record a good payment history.

4. Seek to be an Authorized User

Explore becoming an authorized user on a credit card belonging to a friend or family member with a commendable track record. It could boost your credit score as their good credit habits reflect on your report. Make sure the credit card company records authorized users’ activity.

5. Broaden Your Credit Portfolio

Diverse credit such as retail cards or credit builder loans can help to lift up your score. Start off establishing a secured card’s sound payment history, then gradually step into various credit types.