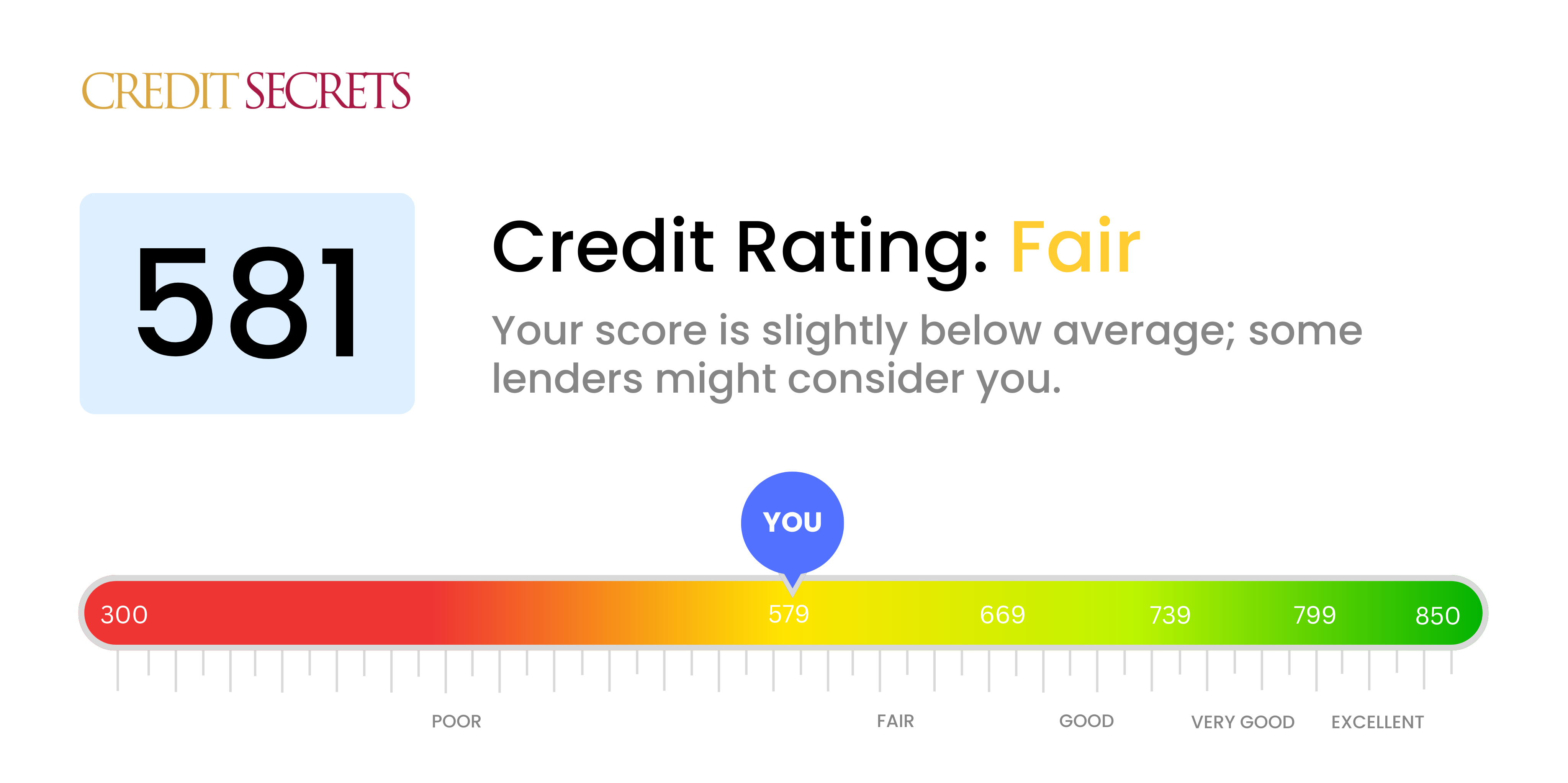

Is 581 a good credit score?

A credit score of 581 falls into the 'Fair' category. This score may not necessarily disqualify you from being approved for credit, but it could make approval harder or result in higher interest rates. However, improving it certainly is within your reach.

With a score of 581, it's likely you've had some issues with maintaining credit health in the past, like late payments or defaults. But don't worry, the journey towards a healthier credit score is completely possible. You may want to consider strategies like reducing credit card balances, making payments on time, and avoiding new debt. Consistent effort can lead to significant improvement over time.

Can I Get a Mortgage with a 581 Credit Score?

With a credit score of 581, it's unlikely that you will receive approval for a mortgage. Most lenders require a higher score since this range shows a history of potential financial challenges including possible late payments, exceeded credit limits, or defaults. This may be a tough condition to be in, but it is not impossible to improve from here.

Your current score may not be enough for traditional lenders, but some alternatives are possible. A Federal Housing Administration (FHA) loan might be an option for you as they typically have lower credit score requirements. Another route could be seeking a co-signer with a stronger credit score. Nevertheless, even with these alternatives, interest rates may be relatively high due to potential risk lenders would be taking on. The optimal solution is to take steps toward boosting your credit score. This involves clearing any outstanding debts, ensuring timely bill payments, and maintaining low credit card balances. By making these changes, your credit score can increase gradually, making it easier for you to qualify for better mortgage rates in the future.

Can I Get a Credit Card with a 581 Credit Score?

With a credit score of 581, there might be some struggles getting approved for the standard credit card. This score indicates to lenders a certain degree of risk, suggesting that maybe there have been some past hurdles with managing credit. It's not easy facing this, but realizing where you at this time, without judgement, is key. Grasping the current state of your credit situation is an acknowledgment that propels financial healing forward.

You might want to think about alternatives that could be more easily available to someone with a 581 credit score. Secured credit cards, for instance, which are backed by an upfront deposit, could be an option. This deposit, which typically becomes your credit limit, can provide reassurance to lenders and thus, make approval easier. Remember, secured cards can also help improve your credit with time. Other possibilities include approaching someone, like a close family member, to be a co-signer, or getting a prepaid debit card. But be aware, the interest rates associated with these cards might be significantly higher reflecting your risk factor to lenders. Though these options don't solve everything instantly, they're stepping stones towards a brighter financial landscape.

Having a credit score of 581 indicates that you might face difficulties while applying for a personal loan. Most traditional lenders prefer a score that is substantially higher. This particular score is usually seen by lenders as a sign of financial risk, making the approval of a loan a challenging process. However, this situation is not the end of the road for you. Facing the truth about your credit score is the first step toward finding a solution.

While obtaining a traditional loan may be tough, there are other potential avenues available. Secured loans, which require collateral, or co-signed loans, where another individual with better credit supports your application, are valid alternatives. You could also explore peer-to-peer lending which may have less strict credit guidelines. Be mindful that these choices typically have higher interest rates and sterner terms due to the elevated risk for the lenders. Still, with appropriate planning and responsibility, they can serve as viable routes toward achieving your financial goals.

Can I Get a Car Loan with a 581 Credit Score?

Owning a car can offer so much independence, but with a credit score of 581, getting approval for a car loan could be tough. See, lenders usually want to see scores over 660 for better terms. Sadly, a score below 600 is often thought of as subprime, and your score of 581 falls into this bracket. The harder truth is that lenders may charge higher interest rates or even deny the loan- this is because lower credit scores paint a picture of a higher risk to lenders.

Yet, with all that said, a low credit score doesn't completely close off your hopes of owning a car. There are lenders out there who are ready to work with folks with lower credit scores. But, be careful. These loans usually carry much higher interest rates. The higher rates are seen as a way to offset the perceived risk. Though the journey might seem a little rough right now, with some patience and determination, it is not impossible for you to secure a car loan. Always remember to carefully explore the terms to avoid any unpleasant surprises.

What Factors Most Impact a 581 Credit Score?

Grasping the factors affecting your score of 581 sets a foundation for enhancing your financial health. The journey to improve is unique and full of valuable lessons.

Payment Timeliness

One's payment history can significantly influence a credit score. Late or missed payments might be a considerable factor in a 581 score.

How to Check: Go over your credit report looking for any delayed or missed payments. Reflect on your payment behavior and see how it's impacting your score.

Credit Utilization Rate

High credit utilization, meaning you're using a high proportion of your available credit, could be driving down your score.

How to Check: Look at your total credit card balance and calculate its ratio to your total credit limit. Working towards a lower balance can enhance your score.

Credit Account Longevity

A short credit history could negatively impact your score. A longer credit history typically leads to a higher score as it provides more data about your financial behaviors.

How to Check: Look at your credit report to see the age of your oldest and current credit lines. Recently opened accounts could have dropped your score.

Credit Diversity and Fresh Credit

Maintaining a mix of credit types (such as personal loans, credit cards, auto loans) and responsibly handling new credit could boost your score.

How to Check: Review your report to understand the types of credit you currently have. Frequent applications for new credit can lower your score.

Public Records

Public records, like bankruptcies or judgments, can significantly affect your score.

How to Check: Check your report for any public records. Remember, resolving these can positively impact your score.

How Do I Improve my 581 Credit Score?

With a credit score of 581, you’re in the fair range. Although this isn’t ideal, it’s certainly not the end of the road. A few precise strategic actions can help elevate your score.

1. Identify Late Payments

First, single out any late payments that are affecting your credit score. Each late payment can significantly affect your score, so it’s crucial to resolve these as swiftly as possible. Initiate contact with the lenders to arrange a realistic payment plan.

2. Manage Credit Card Utilization

When your credit card balance is high compared to your credit limit, it adversely impacts your credit score. Pay down your balance, aiming to keep the balance under 30% of your credit limit, or even lower if possible. Start by lowering the balance on cards with high utilization rates.

3. Apply for a Secured Credit Card

At this point, a secured credit card may be your best bet. This will need a refundable cash deposit which then becomes your credit limit. By making small, manageable purchases and paying them off each month, you start to establish a healthy payment history.

4. Request Authorized User Status

Another potential strategy is to ask someone with robust credit if you can be added as an authorized user on their credit card. This can help by mixing their strong payment record with yours, but ensure the card issuer reports authorized user activity to credit bureaus.

5. Explore Varying Credit Types

Lastly, diversifying your credit types can help increase your score. After maintaining a solid payment record with your secured card, consider other types of credit like retail cards or credit-building loans, and manage them responsibly.