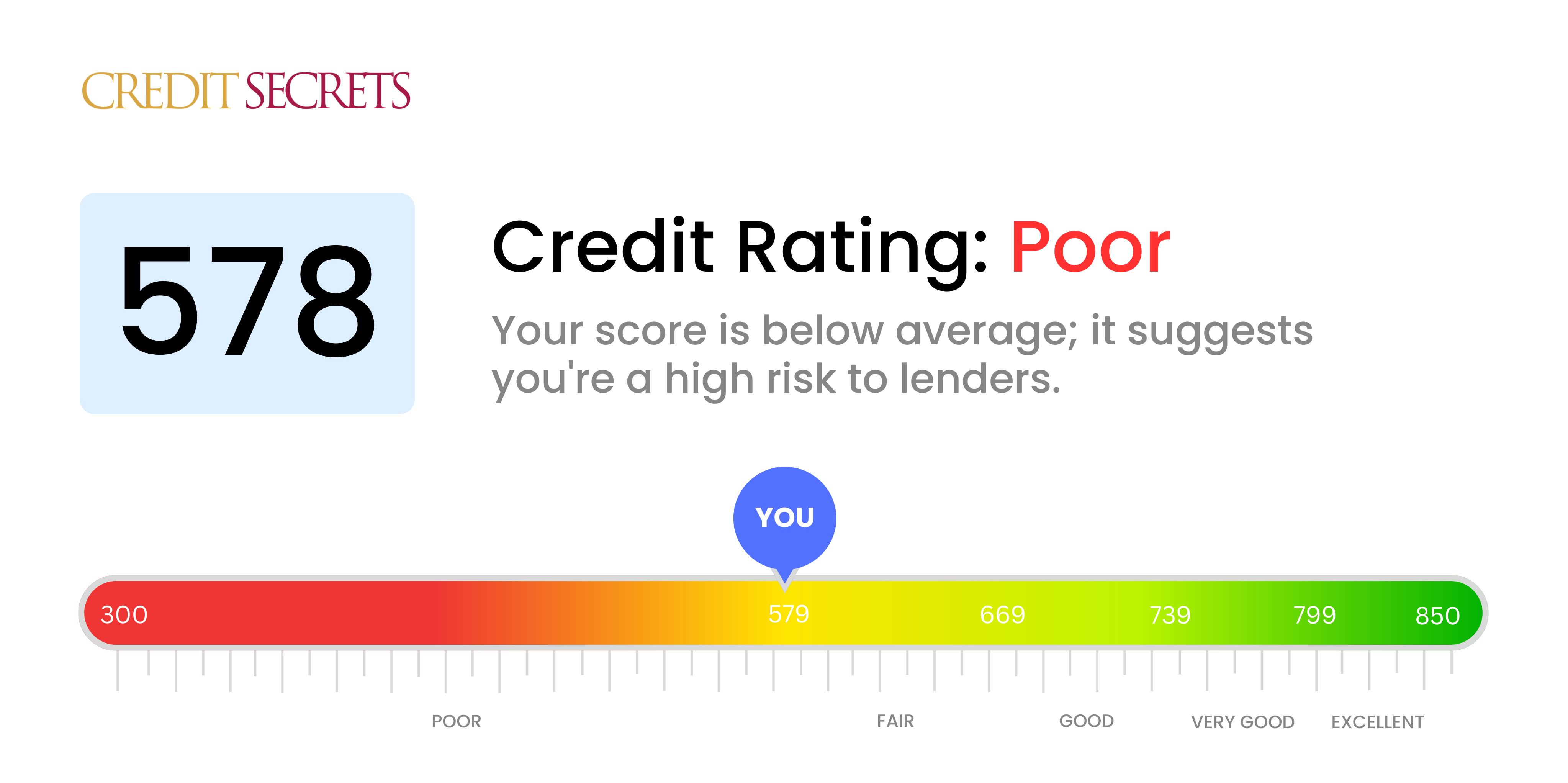

Is 578 a good credit score?

With a credit score of 578, you are currently situated in the 'Poor' category as per standard score ranges. Don't lose hope, though, your financial situation is not set in stone and with targeted efforts, you can certainly improve your score.

Being in the 'Poor' range could make obtaining new credit a bit challenging. You may find that lenders are less willing to extend loans or credit cards to you, and those that do may charge higher interest rates due to the increased perceived risk. It could also affect your ability to rent a desirable home or secure certain employment opportunities. However, remember that there are always ways to improve. By managing your finances responsibly and paying your bills on time, you can and will boost your credit score.

Can I Get a Mortgage with a 578 Credit Score?

Having a credit score of 578 might make qualifying for a mortgage a struggle. This score is below what many lenders usually consider satisfactory, which signifies potential past financial predicaments like late payments or outstanding debts. It's certainly not an easy situation, but it's an important reality to face.

On a brighter note, this isn't the end of your homeownership dreams. Some alternative possibilities exist such as considering a Federal Housing Administration (FHA) loan. These loans are designed for low-to-moderate income earners who can't make a sizable down payment or have a lower credit score. However, remember that although a lower credit score might not bar you from achieving a mortgage, a higher score will often afford you better terms and lower interest rates. Take this as a starting point to strive for a healthier financial future and improved credit score.

Can I Get a Credit Card with a 578 Credit Score?

If your credit score is 578, unfortunately, it's less likely that you'll be able to get approval for a regular credit card. This score generally implies a history of financial challenges. This is not an easy reality to face, but acknowledging where you stand is crucial. It's key to stay realistic, yet positive, and understand that there are ways forward.

There are a couple of alternatives you could consider. Look into secured credit cards, where a deposit will set your credit limit. Being on time with payments can help improve your credit score over time. Another option is to find a cosigner or explore prepaid debit cards. While these aren't immediate solutions, they serve as workable steps towards better financial footing. However, be advised that the interest rates on these options might be rather high, reflecting the added risk that lenders face with such credit scores.

With a credit score of 578, securing a traditional personal loan might present some challenges. Lenders may perceive this score as a representation of higher risk, which can cause them to hesitate on loan approval. This is an undeniably tough spot to be in, but it's crucial to understand what this credit score signifies for your borrowing options.

When the standard pathway to a loan seems uncertain, alternatives exist. One might be a secured loan, which involves offering something valuable, like your car or home, as a guarantee. Co-signed loans, where you have another individual with a stronger credit score stand with you as a security, can also be explored. Peer-to-peer lending platforms may offer another viable option as they sometimes have more accommodating credit requirements. However, these alternatives can carry higher interest rates and less favorable terms, mirroring the increased risk to the lender. It's important to weigh these factors carefully when considering these alternatives.

Can I Get a Car Loan with a 578 Credit Score?

With a credit score of 578, getting a green light for a car loan may prove to be difficult. A score of 660 or more is often what lenders like to see for approving loans with favorable terms. A score below 600, such as yours at 578, falls into what's known as the 'subprime' category. This label may lead to higher interest rates or even declined loan applications. The reason being that lower credit scores are seen as a higher risk to lenders. The score suggests to them that there may be a higher chance of repayment issues.

Yet, this doesn't mean the prospect of owning a car is off the table. There are lenders who cater to those with lower credit scores, but it's important to be wary, as these loans often carry significantly higher interest rates to counterbalance the lender's perceived risk. Acquiring a car loan can still be achievable, but this path requires careful thought and a full understanding of the terms. A bit challenging, yes, but certainly not impossible. Despite the apprehensions, owning a car can still be within reach.

What Factors Most Impact a 578 Credit Score?

Understanding your credit score of 578 is vital to improving your finances. Let's analyze the likely factors affecting your particular score so you may effectively strategize your way around them.

Credit Utilization

Your 578 credit score might be the result of high credit utilization. Being close to or over your credit limit can harm your credit score.

How to Check: Go over your credit card balances on your statement. If you're near or exceeding your limit, it could be detrimental to your score. Strive to keep balances at 30% or less of your total limit.

Past and Current Dwelling-Related Debts

Unsettled or delayed payments on mortgages, rentals, or utilities can negatively affect your credit score.

How to Check: Review your credit report for any such liabilities. Settlement or prompt payment of these can help improve your credit score.

Credit History Age

A relatively young credit history could be influencing your credit score downwards.

How to Check: Scrutinize your credit report for the longevity of your oldest and newest accounts. Keeping older accounts open can potentially increase the average age of your credit history, thus improving your score.

Derogatory Marks

Your 578 score could be affected by derogatory marks such as collections, tax liens, or bankruptcies. These have a considerable negative impact on your credit score.

How to Check: Check your credit report for such marks. If found, resolving these can significantly improve your credit score.

How Do I Improve my 578 Credit Score?

With a credit score of 578, you may face some challenges securing certain lines of credit. However, achievable methods to uplift your credit status are available. Keep reading to discover pertinent action steps:

1. Promptly Attend to Collections Accounts

Collections accounts greatly impact your credit score negatively. If you have any such accounts, swiftly act to settle them. You could potentially negotiate a ‘pay for delete’ arrangement with the collection agency. This means, upon payment, the collection account is removed from your credit report.

2. Plan a Budget Strategically

Unplanned and excessive spending, often leading to high credit card balances, can deteriorate your credit score. Draft a realistic budget that caps your monthly expenditures. Reducing your credit card usage, aiming to use less than 30% of your credit limit, can help improve your score.

3. Consider a Secured Loan

Given your current score, obtaining a traditional unsecured loan could be challenging. Secured loans, where some assets are provided as collateral, could be a feasible option. Consistently making full payments on-time can influence your credit score positively.

4. Inspect Your Credit Reports

Meticulously scrutinize your credit reports for inaccuracies or fraudulent activity. File disputes for any you find; their removal can aid in enhancing your score.

5. Maintain Varied Types of Credit

Having a diverse credit portfolio can contribute positively to your credit score. Once you’ve improved your payment behaviors, consider limited utilization of different credit types.