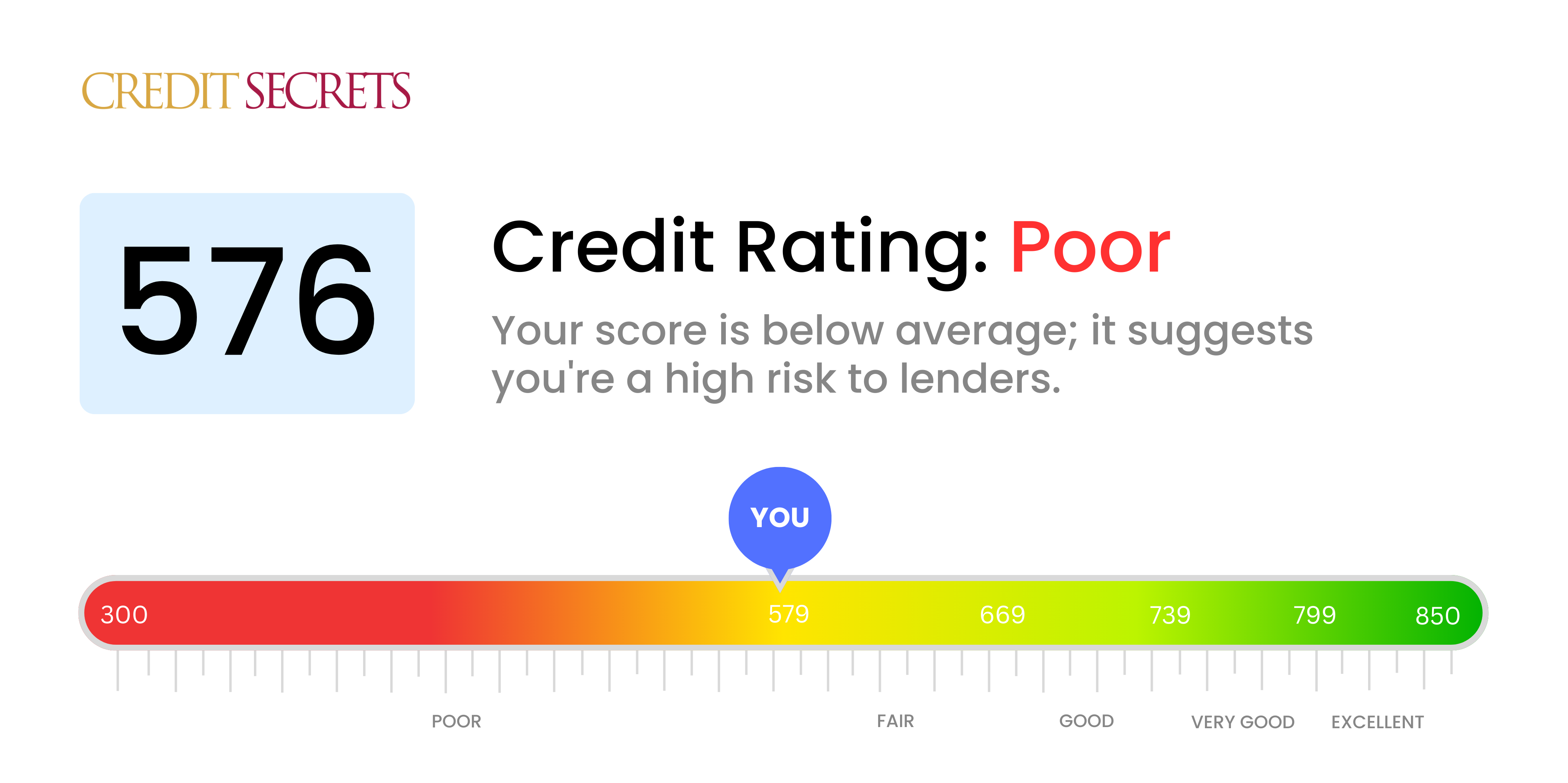

Is 576 a good credit score?

With a credit score of 576, your score falls into the poor range. This isn't ideal, but don't lose heart - there are plenty of steps you can take towards improving it. People with a score in this range may face difficulties when attempting to secure loans or credit, and may be offered higher interest rates. However, though it might seem daunting, boosting your score back up to a more favourable standing is not impossible. By starting now, you can gradually build up your score and unlock all the advantages that come with a better credit standing.

Can I Get a Mortgage with a 576 Credit Score?

With a credit score of 576, the likelihood of being approved for a mortgage is unfortunately not high. Scores in this range are typically considered poor, depicting a past of potential financial missteps or difficulties. Lenders often perceive these scores as risky and are hesitant to facilitate a mortgage.

During this challenging phase, acknowledging and addressing the factors contributing to your low credit score becomes vital. It could include unresolved debts or rarity of on-time payments, among others. It's beneficial to start building a strong payment history and use credit responsibly. A steady endeavor can help bridge the gap between where your score currently lies and where you'd like to be.

Moreover, bear in mind that when you are approved for a mortgage in the future, lower credit scores often mean higher interest rates. This is because lenders might see you as a bigger risk. But don't lose hope. By continuously working towards better financial habits, you can still pave a path towards mortgage approval in the future.

Can I Get a Credit Card with a 576 Credit Score?

With a credit score of 576, it's an uphill battle to get approved for a standard credit card. This score is commonly seen by lenders as higher risk. It's a tough pill to swallow, but it's crucial to embrace the reality of your financial situation. Being upfront about your credit score is a significant stride towards financial well-being. It might be uncomfortable to deal with these facts, but it's part of the journey.

Given the challenges a score of 576 can present, you might want to consider other options such as a secured credit card, which involves a deposit that serves as your credit limit. This type of card can be an easier path and can help improve your credit score in the future. Other alternatives could include getting a co-signer or exploring prepaid debit cards. These might not be ideal, but they stand as potential stepping stones towards financial recovery. Do bear in mind that the interest rates can be higher for individuals with such scores due to the heightened risk seen by lenders.

A credit score of 576 is viewed as subpar by most traditional lending institutions. This credit score might convey a higher degree of risk to lenders, potentially making it difficult for you to secure approval for a personal loan. It's a tough spot to be in, but understanding what this credit score means for your borrowing possibilities is the first step in determining your options.

While obtaining a conventional loan might be difficult, other routes are available. Secured loans, which involve providing collateral, or co-signed loans, where a person with a higher credit score backs you, might be options. You could also consider peer-to-peer lending platforms, as some may have less stringent credit requirements. Be aware, however, that these options often carry higher interest rates and less favorable terms, reflecting the increased risk the lender is taking on.

Can I Get a Car Loan with a 576 Credit Score?

With your credit score standing at 576, it's going to be a bit tough to obtain approval for a car loan. Generally, lenders consider scores above 660 as the safe zone for offering loans. Any score that falls below 600 is seen as subprime, which unfortunately includes your score of 576. This categorization towards higher risk means you might face greater interest rates or in some cases, a denial of the loan. This is due to the fact that to lenders, a score in the subprime range signifies a higher chance of repayment issues.

Despite this, don't lose hope in your car ownership dreams. Opportunities still exist with certain lenders who are equipped to work with people who have lower credit scores. However, be aware that these loans can come with a steep price in the form of high interest rates. This is a safeguard measure taken by lenders due to the additional risk associated with lower credit scores. This may mean a slightly tougher journey, but with mindful decisions and full understanding of the loan details, it's certainly still possible to secure a car loan.

What Factors Most Impact a 576 Credit Score?

Consistency in Payments

A significant factor influencing your credit score is your payment history. Presence of late payments or defaults might be a primary reason for your score.

How to Verify: Scrutinize your credit report for any late payments or instances of defaults. Ponder over occasions of deferred payments – such episodes might have had an impact on your score.

Rate of Credit Usage

Your score can be negatively affected by excessive credit utilization. High balances maxing out your credit cards could be a contributing factor.

How to Verify: Go over your credit card statements. Are the balances stretching to their upper limits? As a tip, keeping balances lower relative to your credit limits can aid score improvement.

Credit Tenure

A short credit history might be lowering your score.

How to Verify: Peruse your credit report and gauge the lifespan of your oldest and newest accounts along with the average age across all accounts. Reflect if you might have recently set up new accounts.

Diversity of Credit and New Credit Handling

Owning a mix of credit types and effectively managing new credit lines is vital for a better score.

How to Verify: Check your array of credit accounts; credit cards, retail accounts, installment loans, and home loans. Think over if you've been judiciously applying for new credit.

Public Record

Public records such as bankruptcies or tax liens can markedly drag your score down.

How to Verify: Look through your credit report for any public records. Make sure to attend any listed items that require handling.

How Do I Improve my 576 Credit Score?

With a credit score of 576, you’re in the poor range. But don’t fret, this number can rise with some focused and disciplined steps. Let’s dive into the most effective and attainable strategies to boost your current score:

1. Tackle Outstanding Debts

Start by addressing any outstanding debts you may have. Accounts in collections pose a substantial threat to your credit score. Reach out to your debt collectors, discuss your situation, and arrange a feasible payment plan.

2. Curb Credit Card Spending

Your credit utilization rate might be inflated, dragging down your score. Work on reducing your credit card balances to less than 30% of your available credit limit, ultimately aiming at keeping them below 10%. Focus on lowering the balances for the cards with the highest utilization first.

3. Apply for a Secured Credit Card

Regular credit cards might be difficult to obtain at your current score level. Think about a secured credit card that requires a security deposit equaling your credit line. By making regular, manageable purchases and paying the balance fully each month, you can cultivate a positive payment track record.

4. Authorized User Strategy

If a trusted friend or relative with strong credit agrees, becoming an authorized user on their credit card can push your credit score up. Their positive payment habits would reflect positively on your record, but make sure their card issuer reports user activity to credit bureaus.

5. Vary Your Types of Credit

Holding a variety of credit types can positively impact your credit score. Once you’ve shown responsible usage with a secured card, consider exploring other credit avenues like retail credit cards or credit builder loans. Managing these effectively can contribute towards increased creditworthiness.