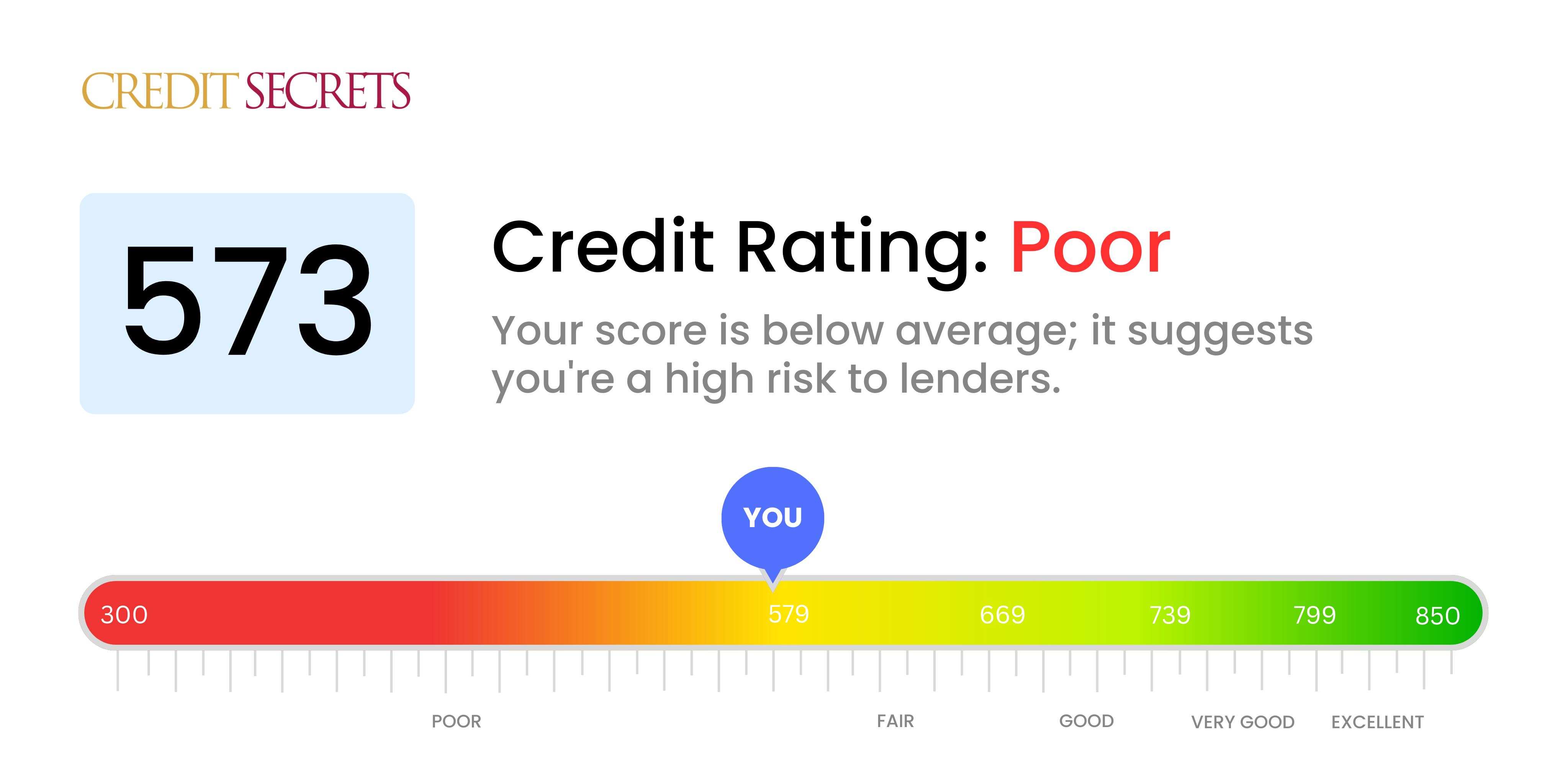

Is 573 a good credit score?

Your 573 credit score sits within the 'Poor' range. This means lenders may perceive you as a higher risk, making it potentially more challenging to secure credit cards, loans, or mortgages. However, it isn't all doom and gloom; with commitment and the right strategy, you can take steps towards improving this score and moving towards your financial goals.

Having a credit score of 573 isn't optimal, but remember, it doesn't define you or your future ability to manage your finances. Everyone starts somewhere and it's possible to turn things around. At Credit Secrets, we're here to guide you through that process, providing advice and support to help you boost that number and achieve financial stability.

Can I Get a Mortgage with a 573 Credit Score?

Having a credit score of 573 puts you in a difficult position when seeking approval for a mortgage. This score is below the range most lenders prefer, implying possible credit hurdles in your past such as late payments or defaults.

While this is a difficult situation, there are options available. You can consider alternative paths like getting an FHA loan, which are specifically designed for those with lower credit scores. However, the downside to this is that you might have to deal with higher interest rates and private mortgage insurance costs. Remember, it's not impossible to secure a mortgage with a credit score of 573, but it's certainly challenging. You'll need to navigate the situation cautiously and make improvements moving forward.

Can I Get a Credit Card with a 573 Credit Score?

Navigating your financial future with a credit score of 573 might feel a bit tough. This score often indicates to potential lenders a history of some credit missteps or rough patches. Although this might not be what you want to hear, acknowledging the situation is a crucial first step on your path to better financial health.

With a credit score of 573, it can be quite difficult to be approved for a traditional credit card. Consider other options like secured credit cards. These require an upfront deposit which will serve as your credit limit. Though not an immediate solution, they can help reestablish credit over the long haul. Another potential alternative might be obtaining a cosigner or looking at pre-paid debit cards. Keep in mind that interest rates with these options tend to be higher due to the increased perceived risk to the lender. Please remember, every step you take towards improving your credit health is a step closer to achieving your financial goals.

Having a credit score of 573 indicates a high risk to lenders and it's quite possible that approval for a personal loan, under typical conditions, might be difficult. This score suggests you've encountered financial challenges in the past which negatively impacted your credit. It's a hard reality to face, but understanding your situation is the first step towards improvement.

However, do not lose hope, there are alternatives available. You could look into secured loans which require collateral, or co-signed loans where someone with a higher credit score stands as your guarantor. Another option is peer-to-peer lending platforms, which may have more flexible credit requirements. Please keep in mind, these alternatives usually come with higher interest rates and may not offer the best terms due to the increased risk they present to lenders.

Can I Get a Car Loan with a 573 Credit Score?

With a credit score of 573, finding approval for a car loan might be a bit more difficult for you. Most lenders prefer credit scores over 660 because that's seen as less risky. Being under 600, your score falls within the subprime range. This could mean higher interest rates or even a tough time getting a loan approved since your score suggests a higher risk to lenders.

Even so, there's still hope. Some lenders and special loan programs are specifically designed for people with lower credit scores. These loans might come with higher interest rates due to the additional risk. It's all a way for lenders to protect themselves. So, even though it might feel like a bumpy ride, with careful and cautious navigation, you can still find a way to get that car loan you need.

What Factors Most Impact a 573 Credit Score?

Gaining clarity on a score of 573 is the first step in your journey of financial enhancement. Let's explore pivotal factors that could be influencing this score, enabling you to target your most helpful improvements.

Payment History

Timely payments significantly affect your credit score. Late payments or defaults are potential aspects lowering your score.

How to Check: Scrutinize your credit report to identify any late or missed payments. Think about times when payments fell behind schedule and how these may have been reflected on your credit score.

Credit Utilization

If you’re using too much of your available credit, it may drop your score. This might be a decisive factor if your credit cards are close to their limits.

How to Check: Check your credit card statements. If balances are perilously close to limits, reducing them will help improve your score.

Length of Credit History

A brief credit history might be lowering your score.

How to Check: Look into your credit report for the age of your oldest, newest, and average age of all accounts to understand the overall length of your credit history.

Credit Types and New Credit

A healthy score requires a diverse mix of credit types and wise management of new credit.

How to Check: Consider your variety of credit accounts including credit cards, retail accounts, installment loans, and mortgage loans. Monitor your frequency of new credit applications.

Public Records

Public records such as bankruptcies or tax liens can heavily impact your score.

How to Check: Check your credit report for any public records. If any exist, find steps to resolve these issues.

How Do I Improve my 573 Credit Score?

Having a credit score of 573 classes as the poor range, but viable steps can help raise it. Here’s a tailored guide toward better credit specific to your current situation:

1. Clear Outstanding Debts

Prioritize clearing any outstanding amount remaining on credit lines, particularly those past their due dates. Contact creditors to negotiate feasible repayment methods if needed. Paying off what you owe is the fastest route to credit recovery.

2. Lower Credit Utilization

Credit utilization, especially on credit cards, has a substantial impact on your score. Target getting your outstanding balances below 30% of your overall limit. In the long run, maintaining balances below 10% will lead to improved credit health.

3. Apply for a Secured Credit Card

Qualifying for a standard credit card might be tough with a 573 score. Look into obtaining a secured credit card that necessitates a refundable deposit, acting as your credit line. Using this conscientiously can foster positive payment history.

4. Authorized User Option

Seek a trusted individual with high credit to add you as an authorized user to their credit card. This strategy improves your credit score by adopting their solid payment history. Make sure their issuer reports activity to credit bureaus.

5. Expand Credit Spectrum

Diversifying the types of credit you hold can strengthen your credit score. Upon establishing good stewardship over a secured card, consider venturing into other types of credit like credit builder loans and manage them purposefully.