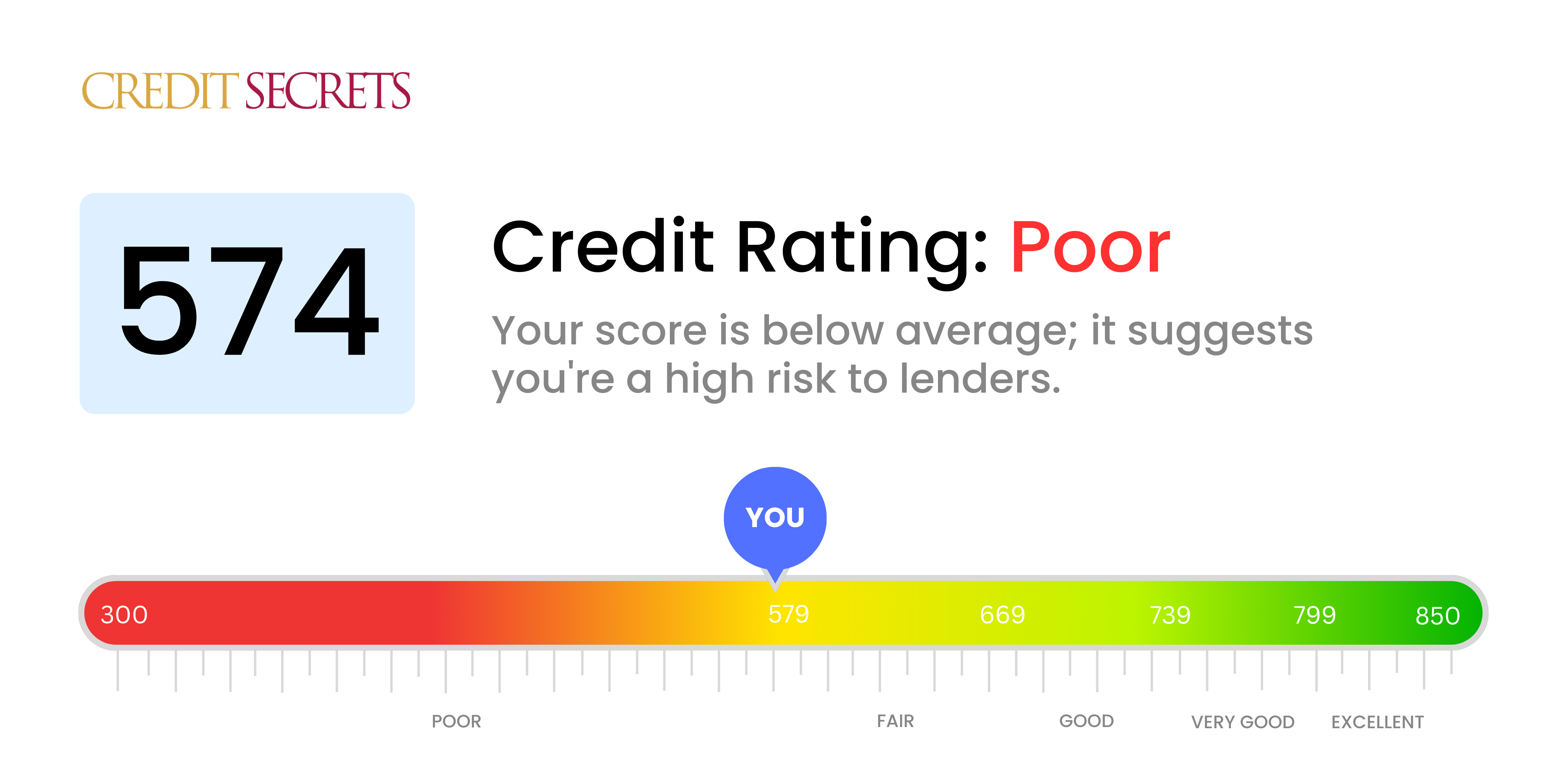

Is 574 a good credit score?

Having a credit score of 574 tends to fall into the 'poor' category. However, please don't lose hope - this isn't an irreversible situation and there are definitely ways to improve your score.

With a score of 574, you may find certain financial challenges. This could include higher interest rates and premiums, difficulty getting approved for credit cards or loans, and a possible requirement for security deposits on utilities. But remember, everyone has the opportunity to shift their financial situation. Your journey towards a higher credit score and financial stability is absolutely possible.

Can I Get a Mortgage with a 574 Credit Score?

Statused at a credit score of 574, your chances of being approved for a mortgage are unfortunately quite slim. This score is notably below the minimum requirement most lenders have set. A score like this is indicative of past financial struggles, which may include defaults or periodic late payments.

Feeling stuck in such a situation might be disheartening. However, it's important to know that there are still options. One path could be applying for FHA loans, as they typically have more lenient credit requirements in comparison to conventional mortgages. Alternatively, you might qualify for VA loans, given you have the service history or are the spouse of some who has. However, these loans will likely come with higher interest rates given the risk associated with a lower credit score. Thus, it's worth starting to take measures to improve your credit score sooner rather than later. Better scores can provide a wider range of loan options and more favorable interest rates.

Can I Get a Credit Card with a 574 Credit Score?

With a credit score of 574, it might be a steep climb to gain approval for standard credit card offerings. This score is typically seen as a risky indicator by lenders, hinting at past financial missteps or inability to manage credit effectively. As disappointing as this may feel, possessing this knowledge about your credit status is the first step towards a better financial future and, despite the challenges, this situation can be improved over time.

Alternatives, such as a secured credit card, can prove beneficial in these circumstances. Secured cards require a deposit, which becomes your credit limit, and can be relatively easier to obtain. This can be helpful in reconstructing the credit score gradually. You might also consider having a co-signer or using pre-paid debit cards. Although these options are not quick-fix solutions, they are steps in the right direction towards enhancing financial stability. Bear in mind that the interest rates on credit options available to individuals with lower scores are generally higher because lenders perceive a greater risk in lending to them. Maintaining a sense of optimism and purpose during this process can make it more manageable.

With a credit score of 574, it's likely that securing a traditional personal loan becomes a significant challenge. Lenders often see such a score as indicative of higher risk. This typically makes them hesitant to approve personal loans because there's a higher chance of default. It's a tough reality, but knowing your current standing is a crucial step towards finding a suitable solution.

Given the circumstances, you might want to explore other avenues. Secured loans, where you pledge an asset as collateral, can be an option. Another pathway is co-signed loans, where someone with a stronger credit score can co-sign on your behalf. They take on the responsibility to repay if you can't. There's also peer-to-peer lending; these platforms could offer more flexible credit requirements. It's important, however, to understand these alternatives often carry higher interest rates and less favorable conditions due to the increased risk for the lender.

Can I Get a Car Loan with a 574 Credit Score?

A credit score of 574 can present hurdles when seeking approval for a car loan. When evaluating loan applicants, lenders typically favor scores hovering near 660 and higher. Subprime scores, considered to be under 600, can lead to less favorable loan terms or possible denial. With a score of 574, you fall in this subprime group. This means you're seen as a higher risk to lenders because your lower score might suggest potential repayment challenges.

Even though a low score presents difficulties, don't lose hope. There are lenders out there who are willing to take on higher-risk loans, which means a car loan could still be attainable. Be aware, however, that this typically comes with higher interest rates as a way for lenders to shield themselves against potential losses. Navigating this pathway might feel daunting, but by thoroughly understanding your loan terms and comparing different lenders, securing a car loan remains a tangible goal.

What Factors Most Impact a 574 Credit Score?

A credit score of 574 suggests areas that need attention for improving your financial health. Understanding these factors can guide you in your financial upgrading journey. Always remember, improvement is reachable regardless of where you start.

Payment Consistency

Punctual payments significantly reflect on your credit score. Therefore, inconsistent payments or defaulting might be a reason for your current score.

What to Do: Assess your credit report for any indications of late payments or defaults. Timely payments can significantly boost your score.

Credit Utilization Ratio

A high credit utilization ratio can pull down your score. If you're frequently maxing out your credit cards, this could be influencing your score.

What to Do: Peruse your credit card statements. If you're consistently nearing your credit limit, aspire to keep a buffer margin. Having a healthy gap between your balance and the limit can help improve your score.

Credit History Duration

A short credit history might be lowering your score. A longer credit history facilitates a better understanding of your credit habits.

What to Do: Review your credit report for the length of your oldest and newest accounts. Maintaining older accounts and delaying new ones can help enrich your credit history.

Credit Diversity and New Applications

Managing a mix of different credit types and limiting applications for new credit contributes to a positive score.

What to Do: Assess your credit portfolio, consider their diversity and the frequency of new applications. Moderate applications for new credit and manage different types of credit efficiently.

Financial Legalities

Legal financial matters such as bankruptcies or tax liens have a considerable impact on your score.

What to Do: Scrutinize your credit report for legalities and address any issues promptly. Resolving these matters will elevate your credit score.

How Do I Improve my 574 Credit Score?

With a credit score of 574, you’re in the ‘poor’ category, but don’t feel disheartened. By addressing the right areas, you can see considerable progress. Let’s focus on actionable steps designed for your score range:

1. Updated Payment History

Have you neglected to pay some bills on time? If so, strive to start clearing any past due accounts from oldest to newest. Your payment history greatly influences your credit score, so this is a crucial step.

2. Carefully Handle Credit Balances

Maintaining high outstanding balances on your credit cards can negatively impact your credit score. Try to reduce your balance to below 30% of your credit limit, and even aim for less in the long run.

3. Consider a Secured Credit Card

A conventional credit card might not be within reach with your current score. You might want to adpot a secured credit card which is backed by an upfront cash deposit which is typically equivalent to the line of credit. Use the card judiciously to build a strong credit history.

4. Explore the Authorised User Route

Seek a trustworthy individual who could add you as an authorized user on their credit card. This approach could infuse some much-needed positivity into your credit report.

5. Craft a Diverse Credit Portfolio

Variety matters in your credit mix. Once you demonstrate consistent payment history, think about adding different types of credit like a credit builder loan or a store credit card to enhance your credit profile.