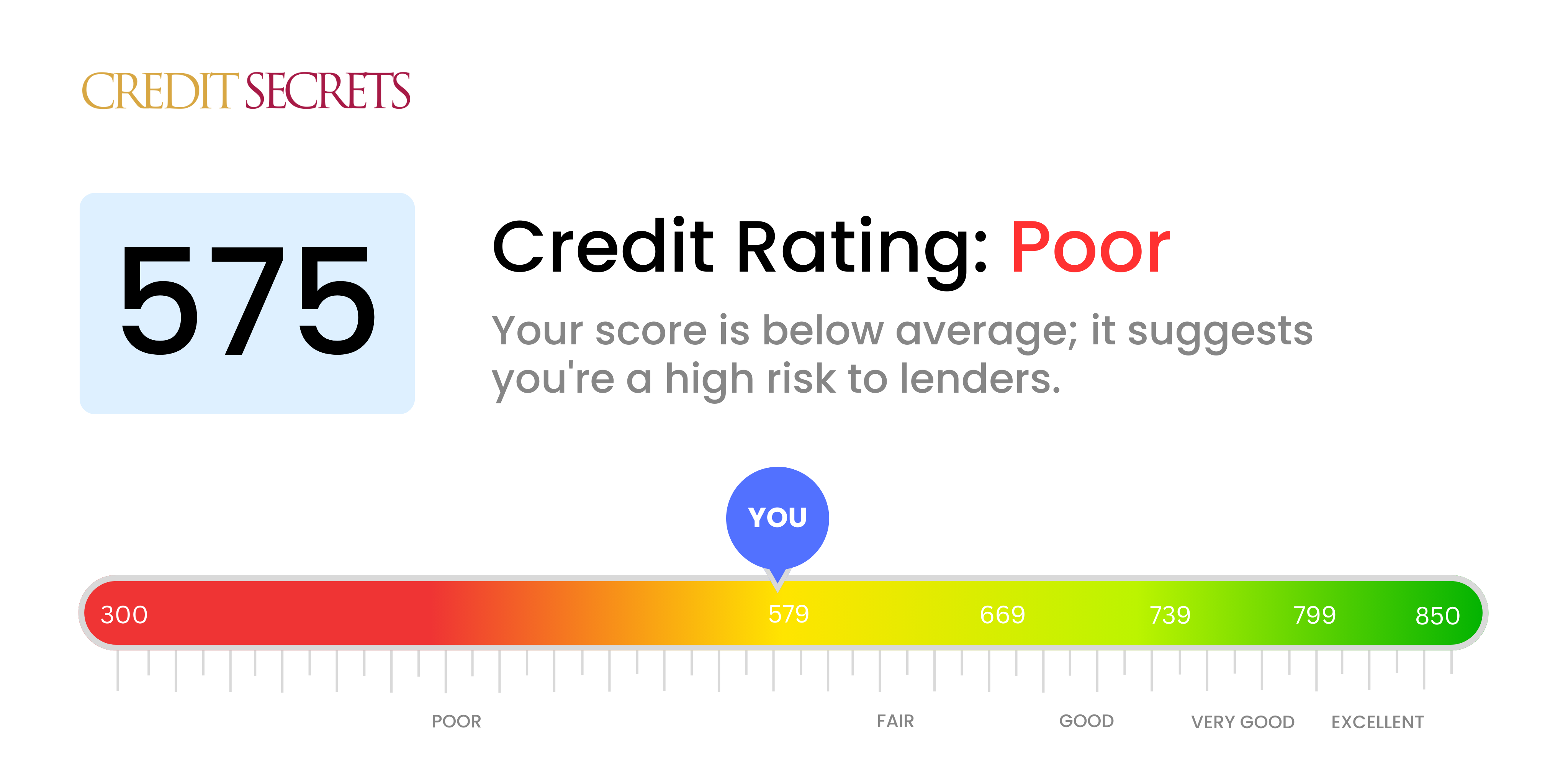

Is 575 a good credit score?

A credit score of 575 falls within the 'poor' range, according to standard credit score categories. Although it's not the score you'd prefer to have, it's crucial to remember that it does not define your worth but rather provides opportunities for growth and improvement in your financial journey.

Let's examine what a credit score of 575 typically denotes. Generally, you may find it more challenging to secure loans or credit at favorable interest rates. You could encounter higher premiums on contracts, such as insurance, and it may impact your ability to rent or even secure some types of employment. But, remember this is just a phase and doesn't have to be your financial future.

Your financial outlook can improve, and one can learn to use this situation as a stepping stone towards cultivating better financial habits. By consistently making timely payments, reducing the amount you owe, and being mindful of your financial decisions, you can start the journey towards improving your credit score.

The road to better credit might feel long and challenging, but each step in the right direction brings you closer to your financial dreams. Remember, slow and steady wins the race in the world of credit scores.

Can I Get a Mortgage with a 575 Credit Score?

Living with a credit score of 575 can be challenging, particularly when it comes to borrowing for major expenses such as a home purchase. A credit score in this range signifies financial struggles and is generally considered poor. In context to mortgage approval, lenders often see this score as risky, making it difficult to secure the loan that's required.

However, not all hope is lost as there may be alternative paths worth exploring. One possibility might be through certain government-backed loans, like an FHA loan, which have less strict credit requirements. Another possibility might be trying to save a larger down payment. While it's challenging, every percentage point you can add to your down payment decreases the risk to your lender, increasing your odds of getting the loan. Keep in mind, though, that even if a loan is granted, it's likely to carry higher interest rates due to the level of risk associated with a lower credit score. The journey towards credit improvement may be gradual but hang in there; a more stable financial future awaits.

Can I Get a Credit Card with a 575 Credit Score?

If you have a credit score of 575, getting approved for a traditional credit card may be somewhat difficult. This isn't the best news to hear, but it's critical to face these facts head-on. Keep in mind, this score might be seen as a higher risk by lenders because it may demonstrate past struggles to manage credit effectively.

Don't fret, though. There are still options available to you. One pathway to explore is securing a secured credit card. These cards function by having you deposit a certain amount of cash upfront, which then becomes your credit limit. They can be a good first step in and are often easier to get approved for. Furthermore, they can help in the process of incrementally building up your credit score. Another potential alternative could be finding a reliable co-signer or considering the use of pre-paid debit cards. These methods won't solve everything overnight, but they can be helpful tools on your financial journey. Lastly, it's important to remember that interest rates are typically higher for those with lower credit scores due to the perceived risk by lenders.

If you have a credit score of 575, it may be more challenging to secure a personal loan from traditional lenders. This is because, in their view, a credit score of this amount could indicate a greater level of risk, and they might be hesitant to grant approval. While it's certainly a trying circumstance to navigate, it is essential to honestly confront the implications that a credit score of 575 may have on your loan options.

However, don't lose hope; there are alternative routes to consider. Secured loans, which require collateral for approval, or co-signed loans, with someone else with better credit backing you, could be a viable option. Another alternative would be exploring peer-to-peer lending platforms, as some of these platforms have more lenient credit prerequisites. Bear in mind, though, that these alternatives usually incorporate higher interest rates and less ideal terms, mirroring the greater risk for the lender. Still, these options might provide a pathway towards your financial goals.

Can I Get a Car Loan with a 575 Credit Score?

Navigating the auto loan market with a credit score of 575 can prove difficult, but it's not impossible. Most lenders favor a credit score above 660 and often view anything beneath 600 as a riskier proposition – sadly, your 575 score falls into this category. Because of this categorization, the chances of experiencing high interest rates or even denial of the loan are considerably greater. This default-risk perception from lower credit scores typically represents potential obstacles in paying back borrowed funds.

But there is a light at the end tunnel. While obtaining a car loan may be more complex, there are certain lenders who specialize in assisting those with lower than average credit scores. However, it's important to know these loans generally carry considerably higher interest rates, used as a protective measure for the lender's investment. So, with patience, a keen eye on the terms and a good head for the decisions to be made, it is still feasible to secure a car loan, albeit a challenging endeavor. Stay positive, the road may be rocky, but it doesn't mean it's not passable.

What Factors Most Impact a 575 Credit Score?

Having a credit score of 575 may feel discouraging, but understanding the factors affecting it unlocks the path to improvement. Your journey towards healthier finances is unique and has the potential to become a transformative learning experience.

Credit Payment History

The consistency of your payment history can greatly influence your credit score. Missed or late payments might be causing your current score.

How to Check: Scrutinize your credit report for any instances of late or missed payments. These occurrences could have had a significant impact on your score.

Credit Utilization Rate

A high credit utilization rate can lower your score. If your credit utilization is above 30%, or if your credit cards are maxed out or nearly so, this could also be damaging your credit score.

How to Check: Review your credit card statements. Are your card balances near or at their limits? Keeping balances low relative to your limit is advantageous for your score.

Length and Variety of Credit History

Short credit histories and a lack of credit variety can both negatively affect your score. Not having a mix of different types of credit or recently opening new accounts may have contributed to your score of 575.

How to Check: Examine your credit report to determine the age of your accounts and what types of credit you have. Reflect on whether you have been opening new accounts frequently.

Public Records

Public records like bankruptcies or tax liens can have a significant effect on your credit score.

How to Check: Scan your credit report for any public records. Tackle any listed items that require resolution.

How Do I Improve my 575 Credit Score?

A 575 credit score is categorized as poor, but don’t worry, with the right steps, you can boost it. Let’s look at the most potent, yet achievable strategies suitable for your current score:

1. Clear Late Payments

If there are any late payments on your report, clearing these should be your primary mission. The longer an account has been overdue, the worse its effects are on your score. Reach out to your creditors to set up a manageable plan to deal with these late payments.

2. Cut Down Credit Card Debt

Carrying high balances on your credit cards relative to your limits can notably lower your score. It’s crucial to aim to maintain your balances below 30% of your credit limit, while setting a broader goal of under 10%. Start paying off the cards with the highest utilization rates first.

3. Consider a Secured Credit Card

At your current score, getting a regular credit card could be a hard task. However, a secured credit card, which requires a cash security deposit, can be a practical solution. Use the card wisely by making small purchases and clearing the balance each month to demonstrate good credit behavior.

4. Seek Authorized User Status

Enquire with a friend or relative with sound credit if you could become an authorized user on their credit card. This can gradually raise your credit score by including their good credit standing onto your own. Check first if the card provider reports authorized user activity to the credit bureaus.

5. Broaden Your Credit Portfolio

Diversifying your credit accounts can gradually enhance your score. After building a good credit history with your secured card, explore different types of credit like credit builder loans or retail credit cards, and handle them responsibly.