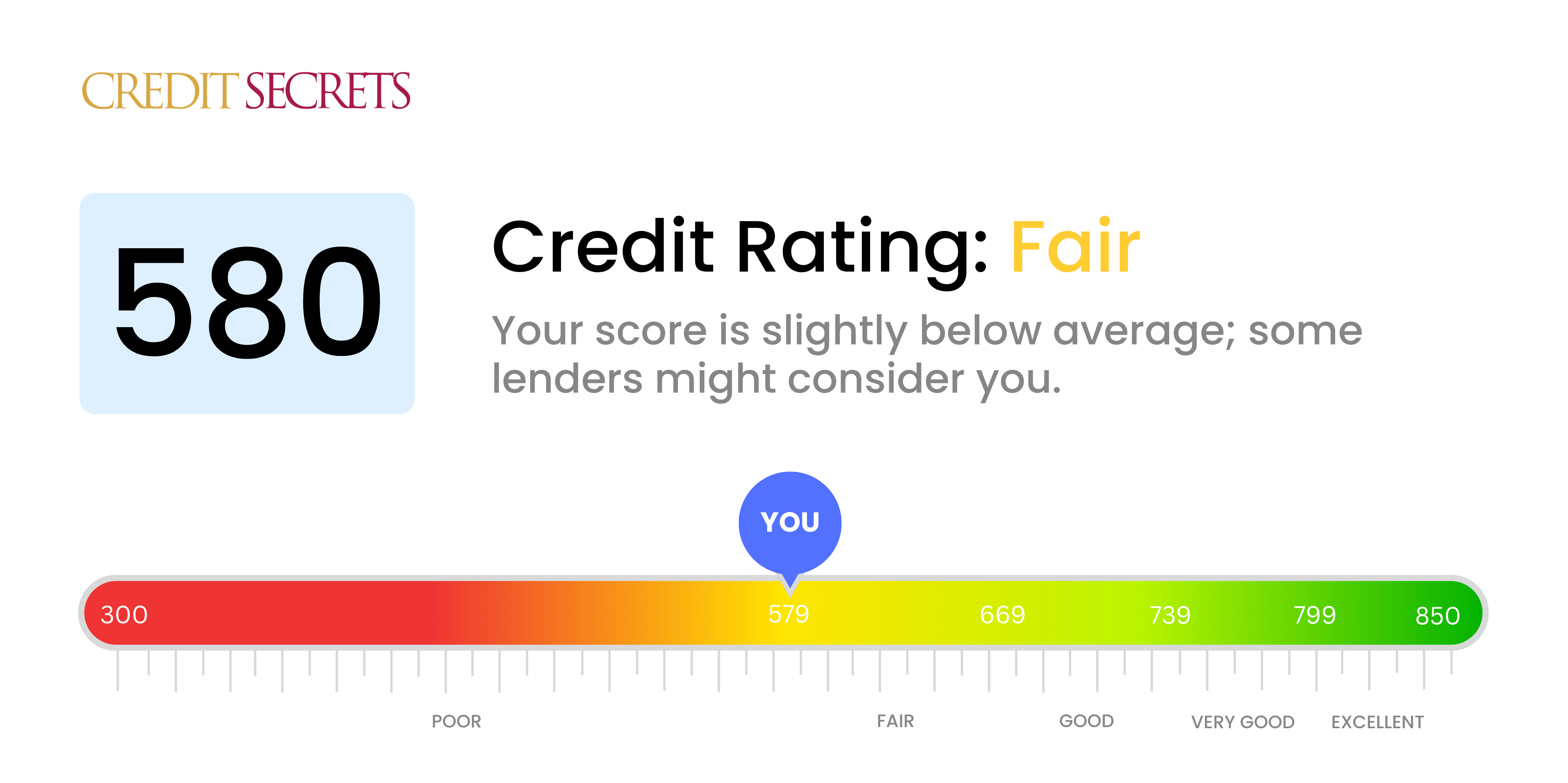

Is 580 a good credit score?

Your credit score of 580 falls into the 'fair' range, which isn't necessarily ideal, but there's room for improvement! With this score, you may experience some difficulty getting approved for lines of credit, low-interest rates, or favorable loan terms, but it doesn't mean these are completely out of reach.

Please keep in mind improving your credit score is absolutely achievable and the journey towards a healthier credit standing can start today. With the right strategies and financial habits, you can work towards a better credit profile, ultimately increasing your score and opening up new financial opportunities for your future.

Can I Get a Mortgage with a 580 Credit Score?

Unfortunately, a score of 580 might not be sufficient for a mortgage approval. Most lenders typically require a higher credit score, reflecting a positive financial history along with low default risks. A score of 580 could suggest a track record of financial inconsistencies, such as missed payments or overextended credit. This makes lenders cautious as they assess you as a potential risk to lend money to.

Despite your current situation, there's room for improvement. Identifying and addressing any existing liabilities that are negatively affecting your score is vital. You may also consider alternatives such as Federal Housing Administration (FHA) loans, which are government-insured and require a minimum credit score of only 500 if you can make a 10% down payment. Or, perhaps explore the possibility of using a creditworthy co-signer for your mortgage, which could give lenders more confidence to approve your loan. While these routes may carry higher interest rates due to the perceived risk, they can be an effective stepping stone towards your homeownership journey with more favorable conditions in the future.

Can I Get a Credit Card with a 580 Credit Score?

Having a credit score of 580 puts you in a precarious situation when it comes to getting a traditional credit card. Lenders may see a score like this as carrying potential risks, such as a less steady financial past or issues managing debt. It's tough to hear, yet it's better to face the truth with a level head. Knowing where your credit stands is crucial before you can begin to fortify your financial wellbeing.

With a score of 580, you might want to consider other options such as a secured credit card. With these, a deposit is required which becomes your credit limit. This type of card can successfully aid in progressively rebuilding your credit history. Another alternative is considering a co-signer or delving into pre-paid debit cards. It's important to remember that while these options may not provide an instant improvement to your financial status, they are steps towards a sturdier financial future. However, take note that interest rates offered to individuals with this score can be markedly elevated, as it represents a higher risk to lenders.

If your credit score is 580, securing a traditional personal loan may be quite difficult. This score falls below what many lenders consider to be an acceptable limit, signifying a high risk to potential lenders. This score may present obstacles, but it's crucial to understand what this means for your borrowing options.

While it might be more challenging to attain a traditional loan, you still have options for borrowing with a credit score of 580. You could explore secured loans, which are backed by collateral, or co-signed loans, where someone with a higher credit score co-signs your loan. Another option may be peer-to-peer lending platforms which might have more lenient credit requirements. However, it's important to note that these alternatives often come with higher interest rates and may have less favorable terms due to the greater perceived risk by the lender.

Can I Get a Car Loan with a 580 Credit Score?

With a credit score of 580, getting approval for a car loan might be tough. Most lenders prefer credit scores above 660, as they are considered more reliable. Unfortunately, a score under 600, like yours, is often viewed as subprime. This means it may result in higher interest rates or even a denial of the loan request. This is because a lower score presents a higher risk to the lender, suggesting potential repayment issues based on past experiences.

Yet, don't lose hope. A less-than-ideal credit score doesn't necessarily mean a car purchase is out of reach. There are lenders who are willing to work with those who have lower credit scores, but be mindful. These loans usually have much higher interest rates. This is a measure lenders take to protect their investment against the higher perceived risk. With thorough research and understanding of the terms, you can still navigate the path to acquiring a car loan, despite the challenges you face due to your credit score.

What Factors Most Impact a 580 Credit Score?

Interpreting a score of 580 is the initial step of your financial advancement journey. Understanding and addressing the elements that are affecting your score can steer you towards a better financial future. Kindly note that each financial journey is exclusive and filled with possibilities for growth and education.

Past due Accounts

Payment delinquencies greatly influence your credit score. It's likely that past due accounts may be a contributing factor to your current score.

How to Check: Scan your credit report for any instances of default, late, or missed payments. Reflect on how consistent payment patterns may have affected your score.

Credit High Utilization Ratio

Excessive usage of the available credit limit can negatively impact your score. If you frequently max out your credit cards, this could be a significant factor.

How to Check: Inspect your credit card statements closely. Consider reducing account balances, especially if they are near credit limits.

Short Credit History

Having a limited credit history can be unfavorable for your credit score.

How to Check: Scan your credit report to evaluate the age of your accounts. A lack of old, active accounts could be hindering your score.

Lack of Credit Diversity

Maintaining a variety of different types of credit responsibly can positively affect your score.

How to Check: Review your mix of credit accounts. If your credit portfolio lacks diversity, this could be a potential area for improvement.

Derogatory Marks

Derogatory marks like bankruptcies or collections can significantly harm your score.

How to Check: Scan your credit report for any derogatory marks. Paying these off or disputing any errors could help boost your score.

How Do I Improve my 580 Credit Score?

With a credit score of 580, you’re in the ‘fair’ credit range. But don’t be disheartened. You can revamp your financial situation by focusing on specific and achievable steps designed for your current scenario.

1. Rectify Late Payments

Act promptly on any missed or late payments. These tarnish your credit score. Reach an understanding with your creditors for extended payment deadlines or consider setting up automatic payments to avoid future lapses.

2. Curb Credit Card Usage

Your credit utilization ratio is a key factor in credit score calculations. Try not to exceed 30% of your available credit card limit. Maintaining a low balance can have a positive influence on your credit score.

3. Opt For a Secured Credit Card

Applying for a secured credit card is a practical decision given your current credit score. Remember to make regular and full payments every month to showcase responsible credit behavior and improve your credit history.

4. Seek to Be an Authorized User

Becoming an authorized user on someone else’s credit card – a responsible user, preferably – can fast-track your credit score improvement. Ensure that their credit card company reports your activity to credit bureaus for this strategy to be fruitful.

5. Expand Your Credit Portfolio

A varied credit profile denotes financial stability. Look into different credit categories such as installment loans or retail credit cards. Always maintain regular and timely payments to capitalize on this strategy.

Remember to persevere through this financial journey. Progress may seem slow, but each right step takes you closer to a solid credit score.