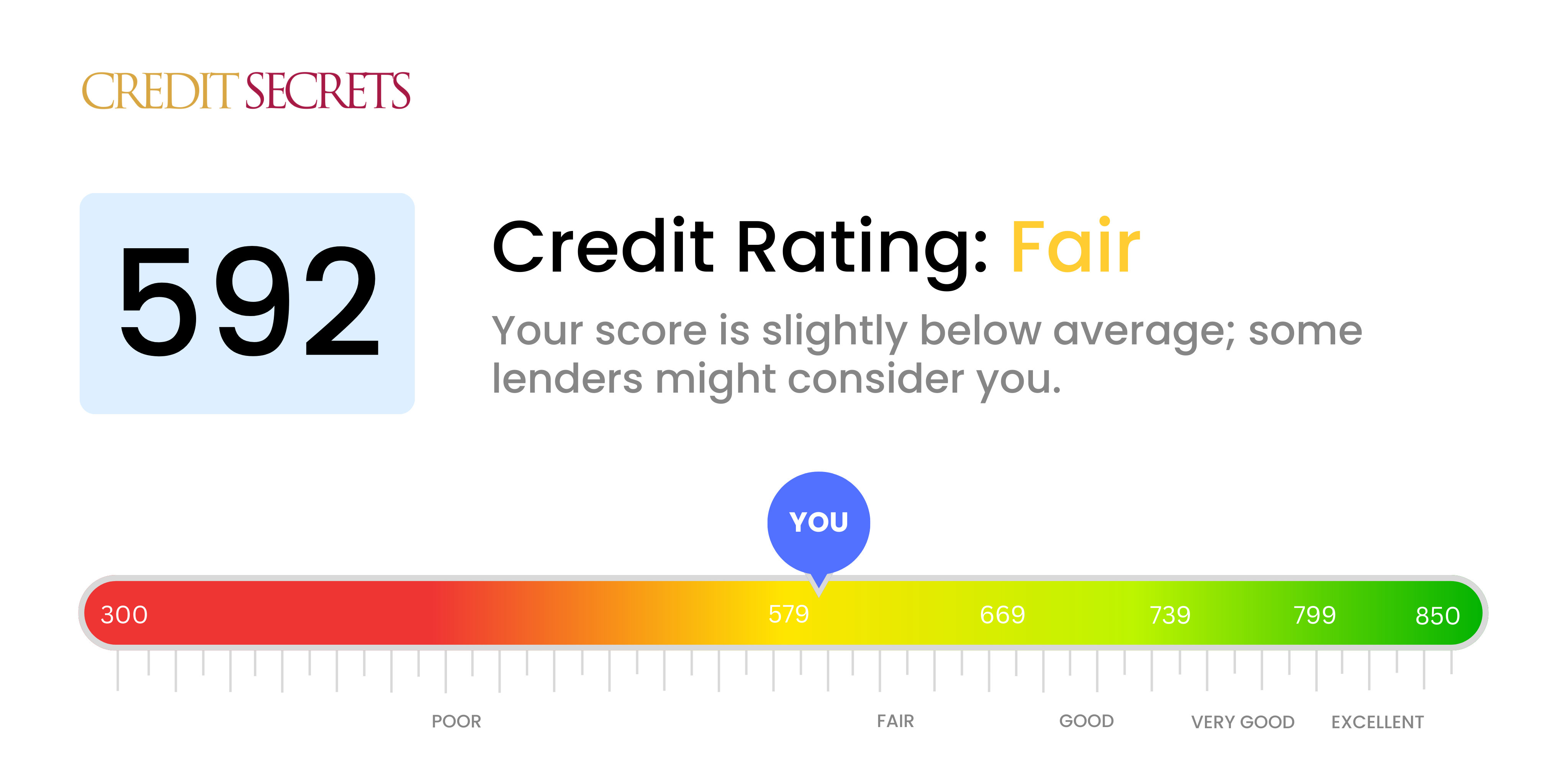

Is 592 a good credit score?

With a credit score of 592, you're in the "fair" category – not ideal, but don't worry, it's not the worst either. Being in this bracket means you might face difficulties in getting loans or credit cards approved or may end up paying high-interest rates, so starting your journey towards better credit is still a smart move.

Remember, improving a credit score is a process, but every step forward, no matter how small, brings you closer to securing a more stable financial future. It might require building some new habits like paying all your bills on time, reducing your debts, and maintaining a low credit card balance. But hang in there, you'll get there before you know it!

Can I Get a Mortgage with a 592 Credit Score?

With a credit score of 592, it is on the lower end of the spectrum and may make it challenging to secure a mortgage. Lenders often require a minimum score that numbers significantly higher. This score can indicate a past of late payments or other financial mishaps.

An unfavorable credit score doesn't mean it's the end of the road. There are alternative options that may be available. One possibility is seeking a mortgage from a lender who specializes in low credit scores. Another option could be Federal Housing Administration (FHA) loans, which have more accommodating credit requirements compared to conventional mortgages. You may be eligible for an FHA loan with a credit score as low as 500, depending on the specifics of your financial situation. Be mindful, however, that these options often come at the cost of higher interest rates.

Despite this hurdle, remember that your current financial standing is not permanent. Your credit score is a reflection of past behaviours and can be improved with consistent, responsible financial habits. Keep in mind that while a higher credit score will open more doors, it is only one part of a larger financial picture when considering you for a mortgage.

Can I Get a Credit Card with a 592 Credit Score?

It's important to be honest first and foremost, neither ignoring the situation nor dwelling too much on the negative. A credit score of 592 is below average in the eyes of many lenders, and it might pose some hurdles while applying for a traditional credit card. This score isn't necessarily indicative of your financial talents or future, but it does suggest some past credit challenges or struggles.

Nevertheless, there are other available alternatives to help you. Consider researching about secured credit cards. These cards function by requiring a deposit which serves as your credit limit. Although this may sound unconventional, these cards can serve as an instrumental gateway towards reconstruction of your credit over time. Another helpful alternative could be seeking a trustworthy co-signer or exploring prepaid debit cards. Even though these strategies may not immediately improve your credit situation, they are steps in the direction of financial recovery. Remember, credit options available for individuals at this score range generally come with higher interest rates due to the increased risk perception by lenders.

With a credit score of 592, applying for a traditional personal loan may be a tough challenge. Most lenders would view a score in this range as high-risk, which could mean your application will not be successful. This is understandably a disheartening position to be in, but remember, it is necessary to confront the truth about how your credit score can affect your borrowing options.

Despite the hurdles, there might be other ways for you to obtain a loan. Options such as a secured loan, where you offer an asset as collateral, or a co-signed loan, where an individual with a better credit score vouches for you, could be worth considering. Peer-to-peer lending platforms may also be more accepting of lower credit scores. Remember, though, that these alternative loans often carry higher interest rates and less agreeable terms due to the increased risk to the lender.

Can I Get a Car Loan with a 592 Credit Score?

Getting approved for a car loan with a credit score of 592 might be a tough road ahead. Auto lenders generally prefer scores that are above 660 and anything below 600 falls into the subprime category - which is where your score sits. This means you are considered a high risk to most lenders, as this score is often associated with a history of repayment difficulties.

However, don't be discouraged. There are still options available to you. Certain lenders specialize in working with people who have lower credit scores. One word of caution though - these car loans can sometimes carry higher interest rates. This is the lenders' way of mitigating risk in case of default. Although it may seem like a daunting task, securing a car loan is not impossible for you. Just remember to thoroughly read all terms and be mindful of higher interest rates that could be attached to your loan. The journey might be challenging, but the door to car ownership is definitely not closed.

What Factors Most Impact a 592 Credit Score?

A credit score of 592 means you may have faced some financial bumps on the road, and this could be due to various factors. It's essential to understand these as they provide a crucial roadmap for improving your score.

Past Payment Patterns

Your repayment journey significantly affects your credit score. Missed or late payments on bills could be a major reason behind this score.

How to Check: Scan your credit report for patterns of delayed or missed payments. Reflecting on your past payment behavior can help identify any issues.

Amount of Debt

Carrying a substantial debt load can negatively impact your score. The total amount of money you owe may be affecting your score if it's relatively high compared to your income.

How to Check: Verify your statements and add up how much debt you owe. If this number is high relative to your income, this might be the issue.

Short Credit History

A shorter credit history can impact your score. If you're new to credit or lack a long history of responsible borrowing, this can affect your score.

How to Check: Look at your credit report. If your credit history is short, this could be the reason behind your score.

Types of Credit Used

Lacking variety in your credit can influence your score. Your credit mix - or the types of credit you utilize like cards, installment loans, and so on - can affect your score if not varied enough.

How to Check: Evaluate your credit report. If your types of credit don't vary enough, this could be weighing down your score.

Public Records

Public records including bankruptcies or tax liens can heavily affect your score.

How to Check: Inspect your credit report. If it contains public records, resolution of these items could significantly improve your score.

How Do I Improve my 592 Credit Score?

A credit score of 592 falls under the ‘fair’ category, but a better score is certainly within your reach. You can take several steps right now to build toward that improved score.

1. Settle Collection Accounts

Debts that have gone into collections can have a substantial impact on your credit score. Reach out to the creditors to negotiate a manageable payment plan. Once these accounts are settled, it can help improve your score.

2. Limit Credit Inquiries

Each time you apply for new credit, it results in a hard inquiry on your report, which can lower your score. With your current score, limit additional credit requests and focus on improving your current standing.

3. Employ a Secured Credit Card

Qualifying for a standard credit card may be challenging with a score of 592, so consider a secured credit card instead. Backed by a deposit you provide, a secured card allows you to build credit through responsible use and timely payments.

4. Ask to be an Authorized User

If a trusted person with established credit accepts you as an authorized user on their card, your credit score can benefit. Just be sure the cardholder keeps their account in good standing and that the issuer reports to the credit bureaus.

5. Explore Diverse Credit Options

Having a mix of credit accounts can boost your score. After demonstrating responsible usage of a secured card, look into other manageable forms of credit, like retail credit cards or a credit building loan.