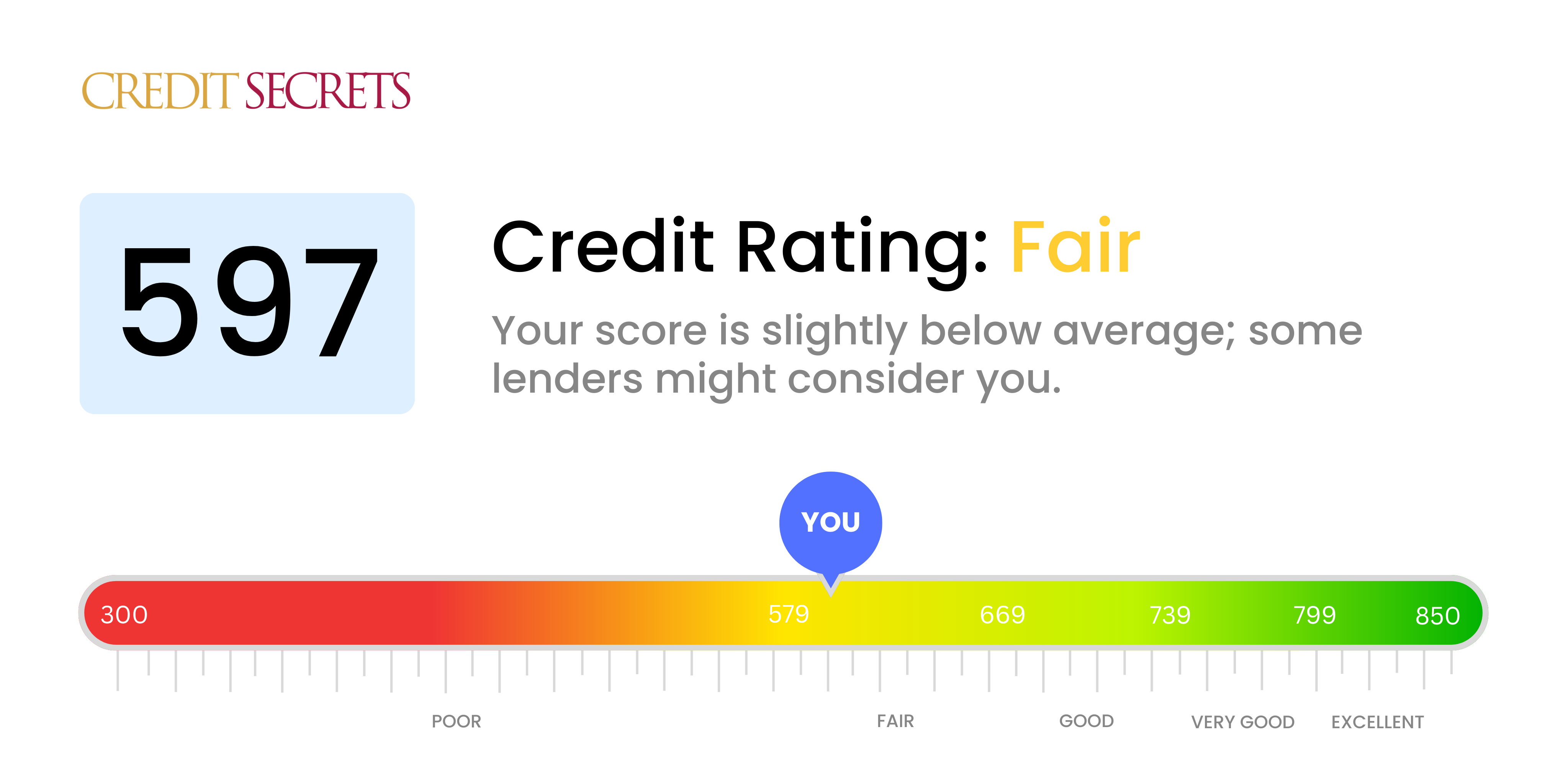

Is 597 a good credit score?

With a credit score of 597, your credit is considered to be fair - it's not the worst, but also not the best. This means that while you might find it more challenging to qualify for credit and loans, there's room for improvement and you're not too far from the 'good' credit range.

A credit score like yours might lead to higher interest rates and less favorable terms when applying for credit cards or loans. But don't worry, with strategic planning and disciplined habits, you can work towards boosting your score. Remember, improving your credit score takes time and persistence, but the rewards are worth it.

Can I Get a Mortgage with a 597 Credit Score?

Unfortunatly, with a credit score of 597, it is unlikely that mortgage approval will be granted. This score is considered below the typical threshold that most lenders require. With this score, it is implied that you may have faced some financial hurdles in the past, such as late payments or loan defaults.

Nevertheless, there are measures you can take to increase the likelihood of approval in the future. Focusing on the repayment of existing debts or delinquencies that are currently affecting your score may be a good place to start. It's also worth considering developing a history of prompt payments and responsible credit usage. Bear in mind, this process may take some time, but with steady effort, achieving a healthier credit score is certainly within reach. It's important to remember that mortgage lenders will also consider other factors like income and job stability. Alternative paths such as working with a co-signer or seeking out lenders willing to work with lower credit score borrowers might also be worth considering.

Can I Get a Credit Card with a 597 Credit Score?

With a credit score of 597, you may find it somewhat tricky to be approved for a standard credit card. Credit scores in this range are often associated with past financial struggles, which may make lenders hesitant. This news can be tough to hear, but it's key to take it in stride and understand the reality of your financial standing. Knowledge of your credit score is a crucial first step towards financial improvement, even if it involves confronting some tough realities.

Given the challenges that come with a credit score of 597, alternative paths like secured credit cards might be worth consideration. Secured cards involve a deposit that also serves as your credit limit, making them generally easier to obtain and beneficial for credit rebuilding. There's also the potential option of becoming an authorized user on someone else's card or investigating prepaid debit cards. Remember, these methods aren't immediate fixes, but can be beneficial tools on your way towards financial health. Be prepared, though; interest rates on any sort of credit accessible to individuals with scores in this range usually face higher interest rates given the increased risk perceived by lenders.

With a credit score of 597, it may be challenging to get approved for a personal loan through a traditional lender. This score is below what many lenders typically consider 'creditworthy,' making you appear as a riskier borrower. We understand that this can feel discouraging, but it's crucial to understand the truth about what this credit score means for your personal loan possibilities.

While a traditional loan might not currently be an option, there are alternatives you can explore. These may include secured loans, where you provide an asset as collateral, or a co-signed loan with the help of somebody with a stronger credit. There's also the opportunity of seeking out peer-to-peer lending platforms that may have more relaxed credit score requirements. It's essential to note that these other lending paths often consist of higher interest rates and may not have the most favorable terms due to the perceived risk associated with lower credit scores.

Can I Get a Car Loan with a 597 Credit Score?

Carrying a credit score of 597 may put you in a tough spot for securing a car loan. Financial institutions usually favor applicants with ratings above 660. This means that having a score under 600 places you within the realm of what's often termed 'subprime'. It's unfortunate, but this score of 597 is within that category. Lenders might see this as heightened risk, due to the possibility of having issues with loan repayment in the past.

Yet, it's also crucial to remember that your credit score doesn't entirely halt the prospect of purchasing a car. Several lenders specialize in working with individuals that have less-than-stellar credit. But be alert, these loans might come with increased interest rates. These heightened rates are a direct result of lenders safeguarding themselves from the risk they're assuming. Although the path may have a few hitches, with diligent research and attention to loan details, attaining a car loan isn't out of the question.

What Factors Most Impact a 597 Credit Score?

Understanding a score of 597 plays an essential role in the quest for improved financial standing. Your score may be influenced by certain credit factors, so it's important to investigate and address these to provide a strong foundation for financial progress. Remember, each financial journey provides unique opportunities for growth and learning.

Outstanding Debts

With a score of 597, outstanding debts could be dragging your score down. Debts that go unpaid can significantly impact your credit score.

How to Check: Evaluate your credit report for any outstanding debts that you haven't addressed yet.

Amount of Credit Inquiries

Multiple credit inquiries in a short period can harm your score. If you've been applying for numerous new lines of credit recently, this could explain your score.

How to Check: Scrutinize your credit report to see how many inquiries have been made recently.

High Credit Utilization

A high credit utilization ratio could have a negative impact on your score. If you're using a large portion of your available credit, this could be a contributing factor.

How to Check: Review your credit card statements. If you're using a lot of your available credit, you should aim to bring down those balances for a healthier utilization ratio.

Length of Credit History

Short credit history might be affecting your score. This is an important factor, especially if your newest account is considerably new.

How to Check: Review your credit report to check the age of your oldest and newest credit accounts as well as the average age of all your accounts.

Payment History

If your payment history includes late payments, this could be affecting your score significantly. Making payments on time is a vital aspect of maintaining a good credit score.

How to Check: Review your credit report for late payments. If you find any, consider ways to ensure on-time payments in the future.

How Do I Improve my 597 Credit Score?

Being at a credit score of 597 would place you in the subprime range—but don’t worry, opportunities for improvement are plentiful. Let’s explore your best strategies:

1. Correcting Credit Report Errors

Unnoticed errors on your credit report can drastically weaken your credit score. Regularly obtain and thoroughly scrutinize your credit reports from each of the three major credit bureaus for inaccuracies. If you find any, be sure to dispute them promptly.

2. Prioritize Delinquencies

Delinquent accounts hit your credit score hard. If there are any overdue accounts in your name, quickly bringing them up to date should be your primary concern. Immediate action will halt any further negative reporting to credit bureaus.

3. Opt for a Secured credit Card

Securing a new credit card may seem daunting with a score of 597, but a secured credit card is designed for this situation. By depositing cash that serves as your credit limit, you can gradually rebuild your credit by responsibly making purchases and paying the card balance regularly.

4. Lower Credit Usage

Maintaining high balances on your credit cards can lead to a lower credit score. Aim to keep your credit usage under 30% of your credit limit. If your cards are over this margin, plan to start reducing those balances swiftly.

5. Leverage a Co-signer

If possible, secure a co-signer with a firm credit standing for a new loan or credit card. Their good credit can project positively on your score, but remember, if you falter on payments, their credit will be adversely affected as well.