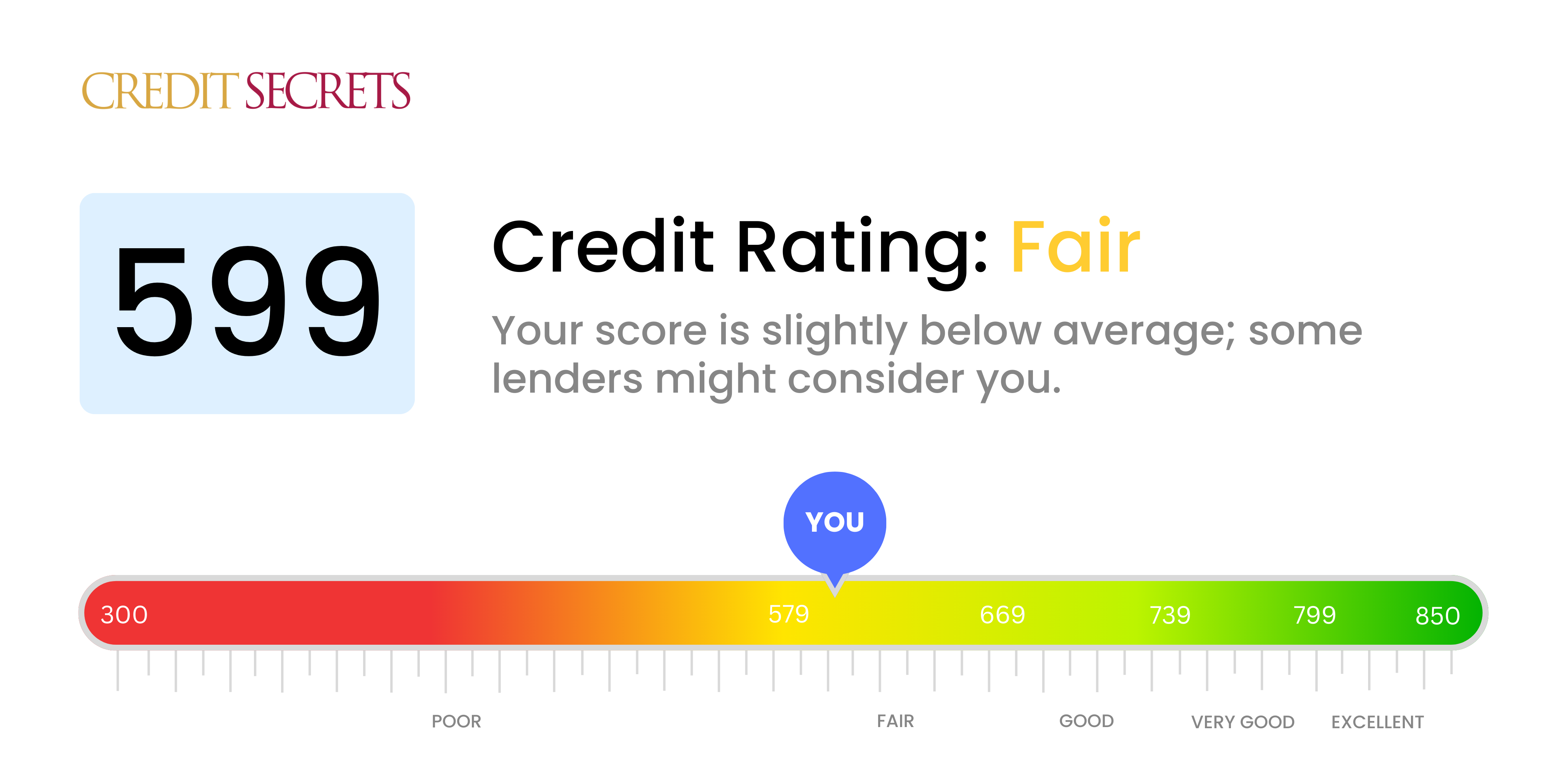

Is 599 a good credit score?

A credit score of 599 is categorized as 'fair', which means it's not exactly a positive or ideal score, but not entirely negative either. Gaining credit approval might be a somewhat challenging task for you, but it's not impossible—there could be some lenders who are willing to extend credit, although possibly at higher interest rates.

This score indicates that there may be a few dings or negative items on your credit history. However, there is room for optimism. With strategic choices and consistent efforts, you could potentially increase your credit score. Using resources like Credit Secrets can empower you to understand your credit more deeply and take charge of your financial future.

Can I Get a Mortgage with a 599 Credit Score?

With a credit score of 599, it may be challenging to get approval for a mortgage. Most mortgage lenders typically seek scores of 620 or above. A score of 599 indicates some financial troubles in the past, such as missed payments or high credit utilization. It's a tough position to be in, yet know that it's not a permanent situation and it can be improved.

If you can delay buying a home, taking time to rebuild your credit can be a smart move. It might be worth considering alternatives like a Federal Housing Administration (FHA) loan, which is more lenient with lower scores. However, a lower credit score may come with higher interest rates, which could result in higher monthly payments. Even so, paying all of your bills on time, reducing your credit card balances, and avoiding opening new credit accounts can start to increase your score. Patience is key here - improving a credit score is not an overnight process, but with steady, responsible behavior, your financial perspective can certainly brighten.

Can I Get a Credit Card with a 599 Credit Score?

A credit score of 599 can present challenges when attempting to secure a traditional credit card. Lenders may view this score as risky due to potential past financial troubles or mismanagement. This isn't an easy predicament, but acknowledging your credit situation is a powerful first step towards financial health. Though this may be a difficult pill to swallow, facing your financial reality is essential for progress.

Given the hardships that can occur with a score of 599, looking into alternatives such as secured credit cards, which call for a deposit that equals your credit limit, might be beneficial. These kinds of cards can often be easier to acquire and can substantially contribute to mending your credit over time. Additionally, considering pre-paid debit cards or finding a co-signer could also be practical alternatives. Although these options won’t provide overnight success, they can undoubtedly assist you on your path to financial stability. It's also worth noting that interest rates on any credit options available to those with lower scores are usually on the higher end due to the perceived risk by lenders.

Having a credit score of 599 may present some difficulties when trying to secure a personal loan. This score is below what most traditional lenders consider a favorable credit profile, making it challenging to gain approval. While this might feel daunting, it's essential to understand the implications this score holds for your lending possibilities.

It's not impossible to secure a loan, but it might not be through conventional means. You might want to explore avenues such as collateral-backed loans, wherein you pledge personal assets, or co-signed loans, where someone with a high credit score backs you up. Peer-to-peer lending platforms could also provide an alternative, offering leniency on credit requirements. Keep in mind, however, that these options may have higher interest rates and less advantageous terms, as the risk to the lender is more substantial due to your lower credit score.

Can I Get a Car Loan with a 599 Credit Score?

With a credit score of 599, securing a car loan may pose some difficulties. Lenders usually seek scores of 660 or higher for the best terms, and a score below 600, like yours, is often seen as subprime. This indicates that getting a loan may come with higher interest rates or even risk rejection.

This is because your credit score plays a significant role in how lenders gauge risk. A lower score suggests to them a possibility of future repayment troubles. But remember, a lower credit score isn't necessarily a dead-end. There are lenders who are willing to accommodate lower credit scores. However, be aware, these loans tend to come with notably steeper interest rates to offset the lender's added risk.

Continue to tread with caution, and ensure you look thoroughly into the loan's terms before committing. While it may not be an ideal scenario, obtaining a car loan with a credit score of 599 is not impossible.

What Factors Most Impact a 599 Credit Score?

Comprehending a 599 credit score is key to setting the right course for financial enhancement. Let's look at the potential factors that might have contributed to this score and see how addressing them can help improve your financial outlook.

Payment History

One of the key factors contributing to your credit score is payment history. Late or missed payments leave a negative mark on your credit report.

How to Check: Go through your credit report and check for any missed payments or defaults. These are usually a significant factor in lower scores.

Credit Usage

Your credit utilization ratio – how much of your available credit you're using – plays a vital role. A high percentage can negatively impact your score, indicating overdependence on credit.

How to Check: Scrutinize your credit card statements for credit utilization. Reduce the balance-to-limit ratio on individual cards and overall for a better score.

Duration of Credit History

A limited credit history may drag your score down, as it gives lenders less data to evaluate your ability to manage credit.

How to Check: Evaluate your credit report to determine the age of your credit accounts – newer accounts can decrease your average credit age.

Credit Mix and New Credit

A diverse mix of credit types and careful management of new credit can contribute positively to your credit health.

How to Check: Check your types of credit accounts. It's beneficial to maintain a blend of credit card accounts, retail accounts, installment loans, and more.

Derogatory Marks

Public records such as foreclosures or bankruptcies have significantly negative impacts on your score.

How to Check: Scan your credit report for any derogatory marks or public records to address and resolve.

How Do I Improve my 599 Credit Score?

A credit score of 599 definitely requires improvement. Don’t worry, we have some practical steps you can take to elevate this score effectively:

1. Tackle Late Payments

A critical step at this stage is managing late payments. Ensure that any currently overdue payments are made, as these have the greatest negative effect on your credit score. Communication is key; get in touch with your creditors and negotiate a manageable payment plan.

2. Keep Credit Card Balances Low

High credit card balances are a major factor in your credit score. Keep your credit card balances under 30% of your limit. Ultimately aim for below 10%, paying more attention to the card(s) with the highest utilization rates.

3. Opt for a Secured Credit Card

Considering your current score, getting a regular credit card may be a challenge. Think about a secured credit card. This card requires a deposit that becomes your credit limit. Use it wisely and pay off the balance consistently each month. This could aid in establishing a more positive payment history.

4. Explore Authorization on Someone Else’s Card

Consider asking someone trusted with good credit history if you can be an authorized user on their card. This can boost your credit score by reflecting their solid payment pattern onto your credit report, provided the card issuer reports authorized user actions to the credit bureaus.

5. Diversify your Credit

Having various types of credit can positively influence your score. Begin to venture into other forms of credit like retail cards or credit builder loans once you have a satisfactory payment record with your secured card. Remember, responsible management is key.