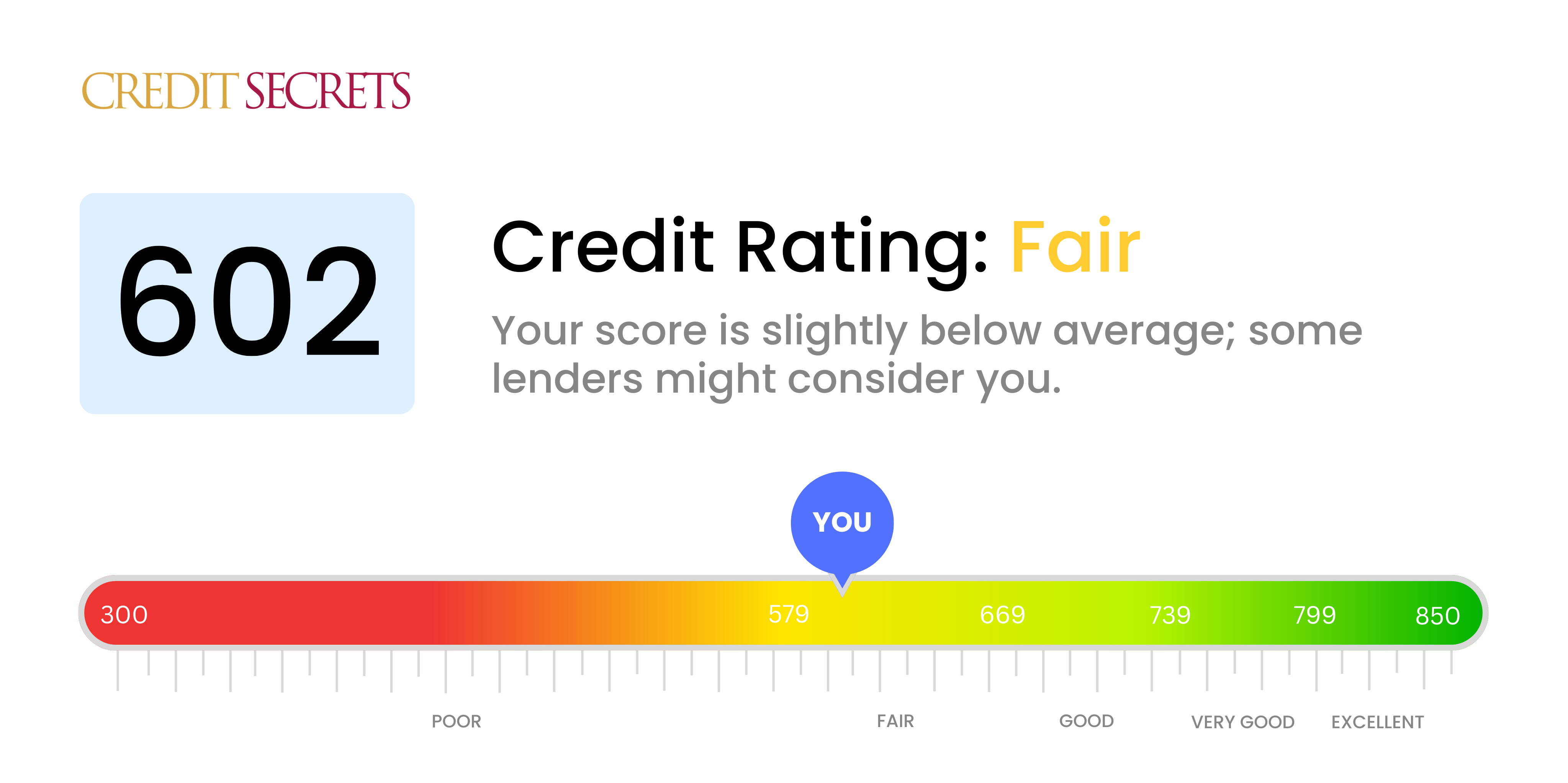

Is 602 a good credit score?

With a credit score of 602, your credit rating falls into the 'Fair' category. This means that while you are not in the poor credit range, there is certainly room for improvement to increase your chances of getting approved for loans or securing lower interest rates.

Your score might be the result of past financial missteps, but remember, it's not a life sentence. By understanding how credit scores work and taking steps to improve yours, like consistently paying your bills on time and maintaining a low credit utilization rate, you've got the power to push that number up. It may take some time, but it is definitely worth the effort. Remember, a healthy credit score is a key component of your overall financial health.

Can I Get a Mortgage with a 602 Credit Score?

With a credit score of 602, obtaining mortgage approval may be a bit challenging, as this score is slightly lower than the minimum most lenders are comfortable with. A credit score in this range may signal past struggles with managing finances, such as late payments or overstretched credit.

In light of this, it's important to understand the alternatives available to you. Some lenders are willing to consider more than just credit score, and may also evaluate your employment history, income stability and overall financial situation. Additionally, Federal Housing Administration (FHA) loans are an option for borrowers with lower credit scores. While you may face higher interest rates due to your lower score, these options could provide a viable path to homeownership until your credit score improves. Patience and diligent efforts to make positive changes can eventually pave the way to a brighter financial future.

Can I Get a Credit Card with a 602 Credit Score?

Having a credit score of 602 may appear worrying, but it's key to remember that each lender has different measures for what they consider an acceptable credit risk. This score is typically seen as fair to poor, meaning you might face some difficulties when applying for a traditional credit card. Lenders could see this score as somewhat high-risk, potentially indicating past financial struggles. However, acknowledging your credit score honestly is the first step on the road to improving it.

Given the hurdles that come with a 602 credit score, exploring alternative credit options could be a smart move. Secured credit cards, for example, require a deposit that serves as your credit limit. These cards are usually simpler to get approved for and offer a practical way to rebuild your credit gradually. You might also look into options like seeking a card with a co-signer or utilizing pre-paid debit cards. While these alternatives don't fix your credit score immediately, they are effective tools in enhancing financial stability over time. It's crucial to note, however, that any credit offered to someone with a score of 602 will likely come with higher interest rates, due to the greater risk perceived by lenders.

Having a credit score of 602 can make securing a personal loan a bit of a hurdle. Traditional lenders might hesitate to approve your loan application, viewing a score in this range as somewhat risky. It's not the news you may have hoped for, but it's important to understand how lenders interpret this credit score and how it may impact your borrowing possibilities.

However, there are still options to consider. Secured loans, which require collateral, or co-signed loans, where someone with a higher credit score guarantees your loan, could be potential alternatives. You might also consider exploring peer-to-peer lending platforms, which can sometimes be more forgiving with credit standards. Please bear in mind, these loan alternatives are likely to come with higher interest rates and less advantageous terms due to the increased risk assumed by the lender. While it might be a tougher path, a personal loan is not entirely out of reach.

Can I Get a Car Loan with a 602 Credit Score?

Having a credit score of 602 might make it a bit tricky to secure a car loan. Lenders frequently seek credit scores above 660, and your score of 602, while slightly higher than the often seen 'subprime' tag, is still a bit low. Your score represents a potential risk to lenders due to the possibility of having difficulty repaying the borrowed money, which can lead to less favorable loan conditions or even denial of the loan application.

Despite this, don't lose hope. Some lending institutions offer services for people who have less-than-perfect credit scores like yours. However, these loans tend to come with higher interest rates due to the increased risk presented to the lender. It's crucial to fully understand the terms and conditions before agreeing to any higher interest rates. Despite the challenges, getting a car loan is still a realistic goal, just remember to proceed with caution and study all the terms thoroughly.

What Factors Most Impact a 602 Credit Score?

Achieving a higher score than 602 can be your financial goal, and understanding factors influencing your credit score can be the first step on that path. The focus would be on the areas that have most likely impacted your current score.

Payment Consistency

Your credit repayment behaviour predominantly dictates your credit score. Delays or missed payments could be one source of your score concerns.

What to Do: Scrutinize your credit report for any inconsistencies in your payment history. Acknowledge any instances of non-timely payments which may have lower your score. Strive for timely repayments.

Debt Ratio

Higher credit usage might be interfering with your credit score growth. Credit providers may perceive you as risk prone leading to a lower score.

What to Do: Sift through your credit card records. If you find balances have reached or are approaching the limits frequently, this could be a point of rectification.

Credit Tenure

A brief credit history could be an issue too. Lenders usually find longer and consistent credit behavior more credible.

What to Do: Explore your credit records, check the age and number of active and old accounts. Recent accounts might be affecting your average credit lifespan adversely.

Credit Account Diversity

Handling various types of credits and opening new ones responsibly is another aspect to consider.

What to Do: Investigate the mix of your credit resources such as credit cards, mortgages, and loans. Apply for new credit with discretion.

Legal Financial Actions

Legal proceedings like bankruptcy or tax liens, if any, can drastically lower credit scores.

What to Do: Look for any such records on your credit report. Resolve any outstanding issues, if any are listed.

How Do I Improve my 602 Credit Score?

A 602 credit score is deemed fair, but don’t worry, a brighter financial future is possible. Below are tailored strategies specifically designed to elevate a credit score in this range:

1. Promptly Deal with Collections

Facing collections can be conjuring up stress, but handling them promptly will lessen their impact on your credit score. If a debt has landed in collections, start a dialogue with the collector and arrange a repayment plan.

2. Optimize Credit Utilization

Strive to use less of your overall credit. Your credit utilization, which is the percentage of credit you use compared to your credit limit, should ideally be below 30%. Aim to pay down the debt on the credit cards reaching their limits first.

3. Apply for a Credit Builder Loan

Become eligible for a Credit Builder Loan. This loan helps you boost your credit score by immediately setting aside your loan funds and releasing them once you’ve fulfilled your payment agreement. Each timely payment gets reported to the credit bureaus, improving your payment history.

4. Request Credit Limit Increases

Rather than opening a new card, request a credit limit increase on current cards, this can lower your overall credit utilization. However, be careful not to take this as an invitation to spend more.

5. Explore Different Credit Types

Once you’ve built a strong payment history through the above steps, consider testing other credit types like personal loans or retail cards. Remember, managing them responsibly is vital, as diversity in your credit mix can positively affect your score.