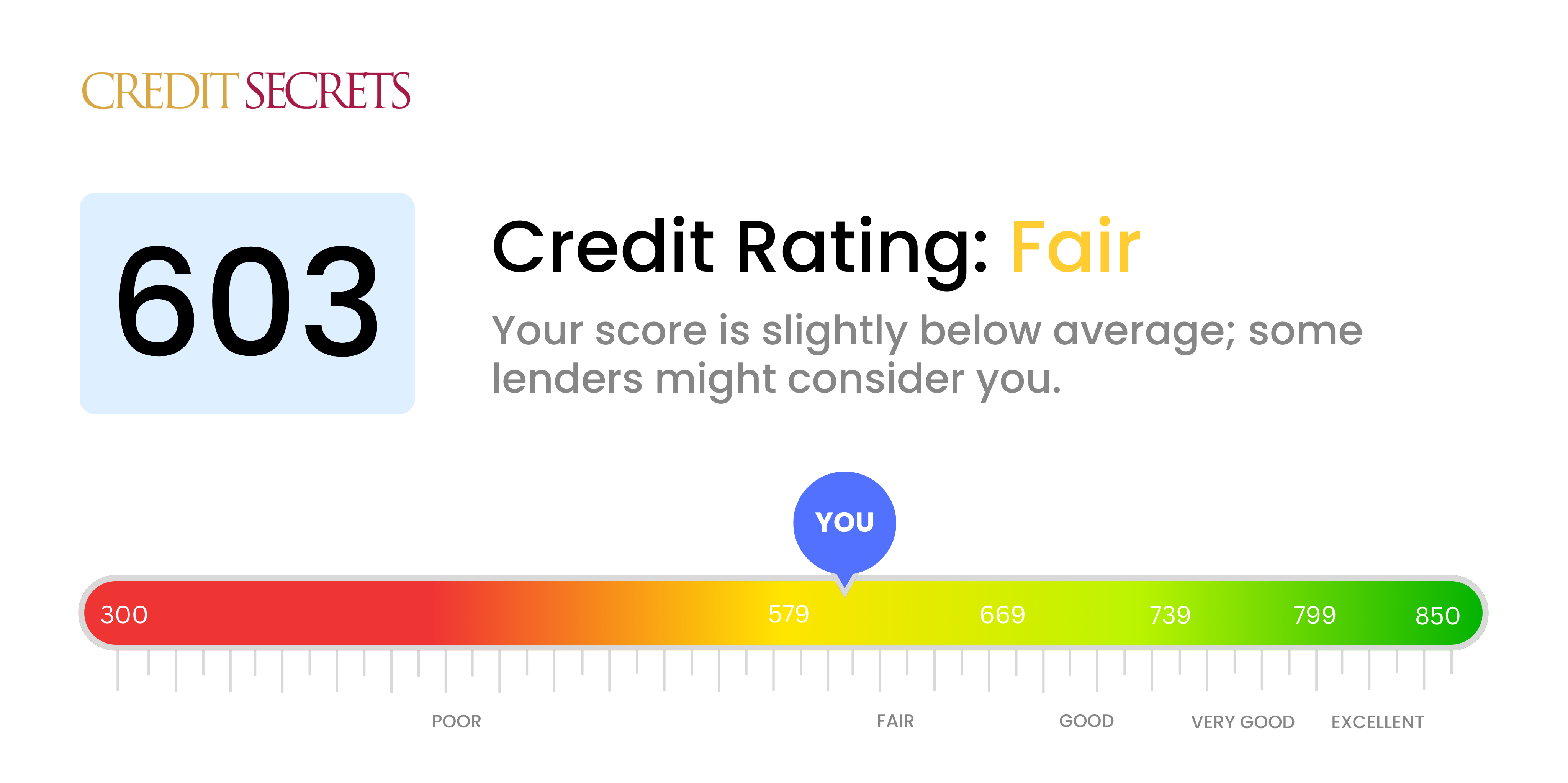

Is 603 a good credit score?

With a credit score of 603, you're currently in what's considered the 'Fair' range. This isn't the worst score you could have, but it's not near the top either, which implies there's plenty of room for improvement.

In practical terms, a score of 603 might make it more challenging to secure loans at favorable interest rates, or it could make certain lenders hesitant to grant you credit at all. Don't lose heart, though! There are steps you can take to raise your score and better your financial standing. Remember, credit score improvement is a journey, and you've already made the first step by checking your score. Keep making timely payments, reduce your debts and make sure to maintain a low credit utilization ratio. Together, these efforts can nudge your score in a positive direction.

Can I Get a Mortgage with a 603 Credit Score?

Holding a credit score of 603, it's essential to be aware that your chances of being approved for a mortgage are somewhat uncertain. This score is slightly lower than what many lenders typically look for, which may signal a history of occasional missed payments or other minor credit usage mishaps. This can make lenders more hesitant to approve a mortgage application.

Though it may not entirely block your path to homeownership, a credit score in this range can affect your interest rates. In a typical scenario, higher credit scores equate to lower interest rates, and inversely, lower scores often result in higher rates. This could mean you end up paying more money over the life of your loan. Alternatives might include seeking a loan that accepts lower credit scores or exploring options like Federal Housing Administration (FHA) loans that have more flexible credit requirements. Standing firm in this situation and recognizing that improvements can and will be made is a viable step towards your financial goals.

Can I Get a Credit Card with a 603 Credit Score?

Having a credit score of 603 might lead to some challenges when applying for traditional credit cards. This isn't an ideal score, and lenders could see it as a risk. While this scenario might not be what you're hoping for, it's key to be honest with yourself about your credit standing. It's an essential part of starting the journey towards better financial health, even if it means facing up to some less than ideal realities.

There is, however, some hope. You might want to look into getting secured credit cards. These require a security deposit, which then becomes your credit limit. Secured cards can be easier to qualify for, and over time, can help reestablish healthier credit. Another option could be utilizing a reliable co-signer or looking into prepaid debit cards. Lastly, keep in mind, interest rates for available credit are likely to be higher due to the elevated risk to lenders. But remember, these steps don't offer overnight solutions but serve as stepping stones towards better financial health.

A credit score of 603, while not the lowest, typically falls below the threshold that many traditional lenders consider acceptable. Although difficult to acknowledge, it's essential to understand that this score may present obstacles when applying for a personal loan, as lenders often view a score in this bracket as carrying a higher risk.

In these circumstances, other types of loans might be a possibility, like secured or co-signed loans, which require collateral or a second party with a better credit score to vouch for you. Peer-to-peer lending platforms can sometimes offer more flexible credit score requirements as well. Bear in mind though, these alternatives can bring higher interest rates and stricter terms, due to the perceived increased risk to the lender. Attaining a loan is possible, but it's key to be aware of these potential differences and consider what arrangement would be best for your personal situation.

Can I Get a Car Loan with a 603 Credit Score?

With a credit score of 603, obtaining a car loan may be quite difficult. It's important to know that lenders generally look for credit scores above 660 for car loan approvals. Having anything under 600, much like your score of 603, leans towards the subprime threshold. A subprime score may lead lenders to impose higher interest rates or refuse the loan application altogether. This is because a lower score can suggest a higher risk and make lenders wary of potential difficulties in the repayment of the loan.

While this seems grim, don't lose hope. Some alternatives do exist for people with lower credit scores. Some lenders specialize in car loans specifically designed for people with credit scores like yours. It's crucial to remember though, these loans usually have a significantly higher interest rate, as higher rates generally reflect perceived risks by lenders. With careful planning and a clear understanding of the terms, it's still entirely possible to secure a car loan. Remember, this isn't easy, but a determined effort towards understanding your options can make it achievable.

What Factors Most Impact a 603 Credit Score?

Understanding Your 603 Credit Score

With a credit score of 603, it's essential to pinpoint the components affecting your score to support your financial advancement. Remember, financial growth is unique to every individual and is a continuous learning process.

Payment History

Your payment history has a pronounced influence on your credit score. Frequent late payments or a history of default may be negatively affecting your score.

How to Check: Evaluate your credit report for any late or missed payments. Consider your payment habits and the impact they may be having on your score.

Credit Utilization Ratio

If you are consistently using a substantial portion of your available credit, this could be lowering your score.

How to Check: Study your credit card statements. If your credit absorptions are high, aim to reduce your balances to increase your score.

Length of Credit History

A limited credit history may be pulling your score down.

How to Check: Scrutinize your credit report for the tenure of your oldest and most recent accounts, and the overall average length of your credit history.

Type of Credit and New Applications

Accumulating various credit types and applying for new credit discriminately can positively affect your credit score.

How to Check: Observe the variety of your credit types like credit cards, retail accounts, and different types of loans on your credit report. Count the number of recent credit applications you’ve made.

Public Records

Public records such as bankruptcies or tax liens can significantly lower your credit score.

How to Check: Check your credit report for any public records. Initiate resolutions for any listed items.

How Do I Improve my 603 Credit Score?

Through targeted action steps, you can improve a credit score of 603, which is currently situated in the ‘fair’ range. Here are some immediate and effective strategies tailored to your current score:

1. Revisit Your Payment History

Your payment history has a significant influence on your credit score. Diligently make all your payments on time. If there are any missed or late payments on your credit report, bring these accounts up to date at the earliest.

2. Minimize Credit Utilization

Keep your credit utilization, or the ratio of your credit card balances to their limits, as low as possible. Prioritize paying off those cards that are closest to their credit limit first, as high utilization rates can negatively impact your score.

3. Consider a Secured Credit Card

If getting a traditional credit card is challenging due to your current score, consider taking a secured credit card. A cash deposit serves as your credit line, enabling you to build a positive credit history with responsible use.

4. Seek Authorized User Status

Approach a close acquaintance with good credit to add you as an authorized user on one of their well-maintained credit lines. This can not only assist in bettering your credit score but also help generate a healthier credit history.

5. Explore Different Credit Types

Broadening your spectrum of credit—like retail or installment accounts—once you’ve established a solid payment record can assist in unfolding a well-rounded credit profile, thereby steadily improving your score.