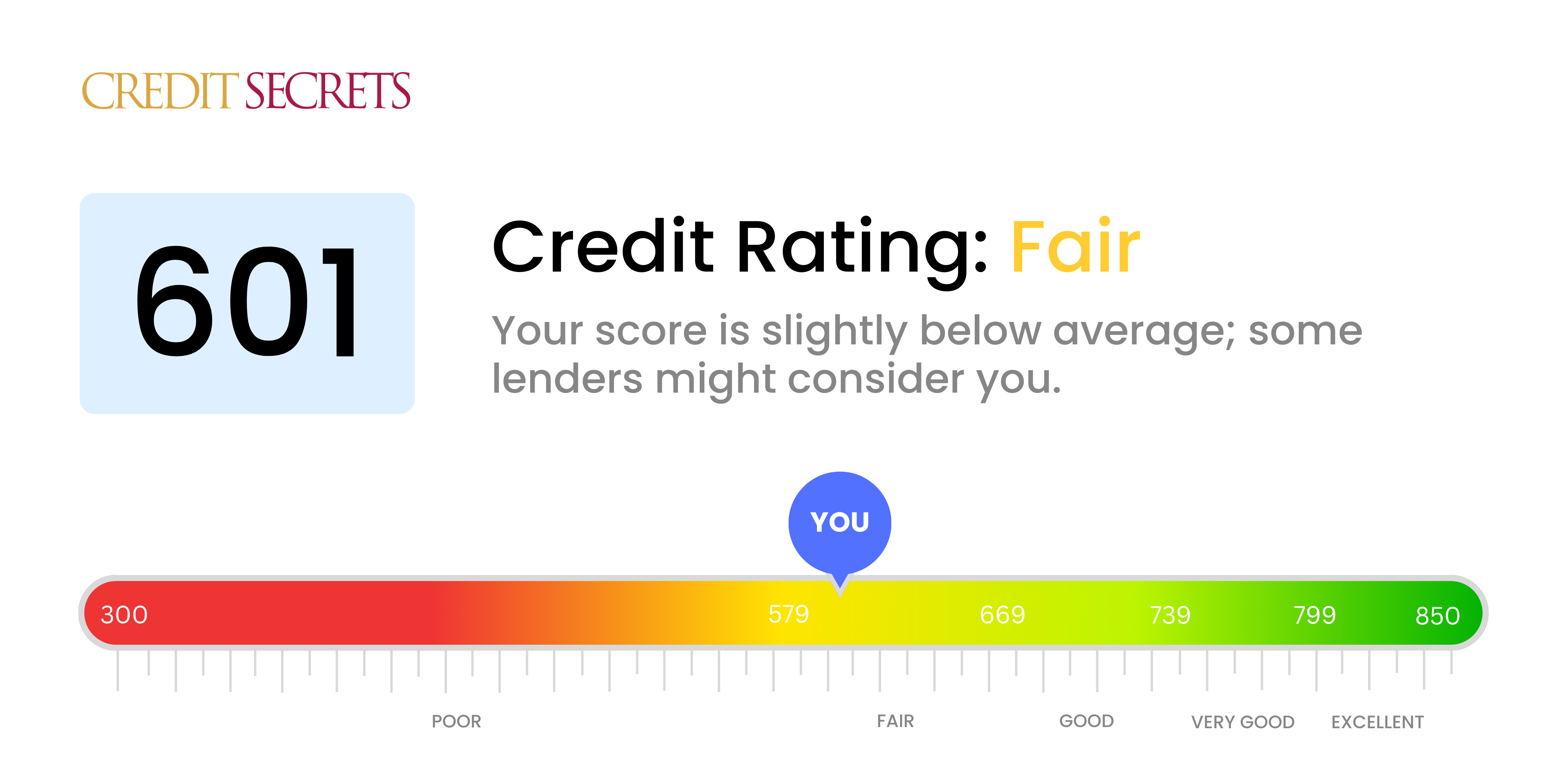

Is 601 a good credit score?

Having a credit score of 601 falls into the 'Fair' category. This isn't the ideal score you would want, but it's not the absolute worst either.

With this score, you may find yourself facing slightly higher interest rates, and your credit applications may not always be approved on your first attempt. However, don't lose hope; this score still offers opportunities for improvement and with consistent, responsible credit behavior, you can increase your score over time.

Can I Get a Mortgage with a 601 Credit Score?

With a credit score of 601, attaining a mortgage can be quite tricky as it falls on the lower-end spectrum of the 'fair' category. Most lenders prefer borrowers with scores in the 'good' to 'excellent' range. A score of 601 suggests past financial missteps, such as late payments, collection accounts, or high revolving balances. Consequently, it will likely be challenging to secure a mortgage approval with competitive interest rates.

However, do not be disheartened as there are other alternatives available. Certain loan programs, like FHA loans, target individuals in your credit score range. Federal Housing Administration (FHA) loans are government-insured mortgages with more lenient qualification requirements. Moreover, improving your credit situation is achievable with patience and persistence. Pay attention to your payment history, try to pay off outstanding debts and minimize new ones, and aim to keep your credit utilization rate below 30%. With these actions, you have the opportunity to positively influence your creditworthiness over time.

Can I Get a Credit Card with a 601 Credit Score?

With a credit score of 601, you might find it somewhat challenging to get approved for a majority of credit cards. This score, classified as 'fair' by many lenders, could signify past financial missteps or late payments. Even though this is a slightly discouraging situation, it's vital to approach it with clarity and a touch of positivity. Acknowledging your credit score is the initial step in bettering your financial stance.

Fortunately, there are certain options available. You might wish to consider secured credit cards, which require you to make a deposit that becomes your credit limit. These cards are typically more accessible to people with lower credit scores and can even help improve your score over time if used responsibly. Alternatively, a starter credit card could be a viable option. However, it's crucial to note that interest rates on these types of cards tend to be on the higher side, as lenders see a greater risk in lending to individuals with lower credit scores. Despite these challenges, remember that these are just stepping stones on your journey to financial stability and a healthier credit score.

With a credit score of 601, your prospects for obtaining a personal loan may be quite limited. This score is seen as below average in the eyes of many traditional lenders, presenting a higher risk. You may find it challenging to get loan approval from conventional lenders. But remember, your situation, though difficult, is not hopeless, and there are strategies to maneuver within this context.

Alternative lending solutions might be a better choice at your current credit score. Considering options such as co-signed loans, secured loans that require collateral, or looking into peer-to-peer lending platforms can be beneficial. Please bear in mind that these alternatives can come with their own drawbacks, such as higher interest rates due to the perceived increased risk. So, please carefully evaluate all conditions before choosing the best fit for your financial needs.

Can I Get a Car Loan with a 601 Credit Score?

Embarking on a journey to purchase a car with a credit score of 601 can seem intimidating. This score is considered "fair" in the eyes of the lenders, but getting approved for a car loan might present some hurdles. The reason being, lenders generally prefer scores above 660 as they reflect a lower risk. A score of 601, although slightly above 600, could result in less favorable terms and possibly higher interest rates due to the perceived financial risk.

On the brighter side, obstacles don't necessarily mean defeat. While a car loan approval might be tougher, it's not impossible. Some lenders may still consider your application, but bear in mind that this could come with higher interest rates. The increased rates act as a safety net for these lenders; a way to offset the potential risk. Proceed with caution, understand the terms thoroughly, and remember, your drive for a new car might still become a reality.

What Factors Most Impact a 601 Credit Score?

Grasping a credit score of 601 is vital in your financial progress. Tackling the reasons behind this score can build a strong foundation for your financial health. Remember: your financial journey is a personal one, filled with growth and insightful lessons.

Blemished Payment History

Payment history bears a substantial weight on your credit score. Late payments or defaults could be the primary reason behind your current score.

How to Check: Look over your credit report for any lagging payments or defaults. Reflect on the reasons behind these late payments as they could have impacted your score.

Elevated Credit Utilization

High credit utilization can bring down your credit score. If your credit card balances are near their maximum limit, this could be a deciding factor.

How to Check: Inspect your credit card statements. Are the balances near to the limit? Endeavor to maintain balance levels below the limit.

Short Credit History

The duration of your credit history can influence your credit score. A relatively short credit history might be negatively impacting your score.

How to Check: Scan your credit report to gauge the age of your oldest and youngest accounts. Reflect on whether you have opened new credit accounts recently.

Diversity in Credit Type and Fresh Credit

Possessing diverse types of credit and managing new credit responsibly contribute to a healthier score.

How to Check: Assess your combination of credit accounts - credit cards, retail accounts, installment loans, mortgage loans etc., and keep a check on your recent applications for new credit.

Public Record Presence

Public records such as bankruptcies or tax liens can heavily influence your credit score.

How to Check: Look at your credit report for any public records. Resolve the items listed that require attention.

How Do I Improve my 601 Credit Score?

With a score of 601, your credit health is in the “fair” range. It’s not ideal, but you can still take several strategic steps to improve your position significantly.

1. Review Credit Reports

First things first, obtain a free copy of your credit report and review it carefully. Look for inaccuracies or outdated information and dispute them if necessary. Any mistake can pull your score down.

2. Set Up Automatic Payments

The easiest way to ensure you’re making payments on time is to automate them. Having a consistent track record of on-time payments can significantly boost your score.

3. Work on High-Balance Accounts

High balances are the arch-enemy of a solid credit score. Try to lower your balances, particularly on revolving accounts like credit cards. This will decrease your utilization rate—a key factor in your credit score.

4. Consider a Credit-Builder Loan

You might be eligible for a credit-builder loan, which allows you to improve your credit score by effectively paying back yourself. It’s a secure and predictable way to build positive credit activity.

5. Explore Debt Consolidation

If you have multiple debts with high interest rates, consider consolidation. This can simplify payments and potentially reduce interest, helping you pay down balances faster.

6. Keep Old Accounts Open

Avoid closing old credit accounts unless necessary. Age of credit history makes up a significant portion of your credit score. Keeping accounts open can aid in maintaining a higher score.