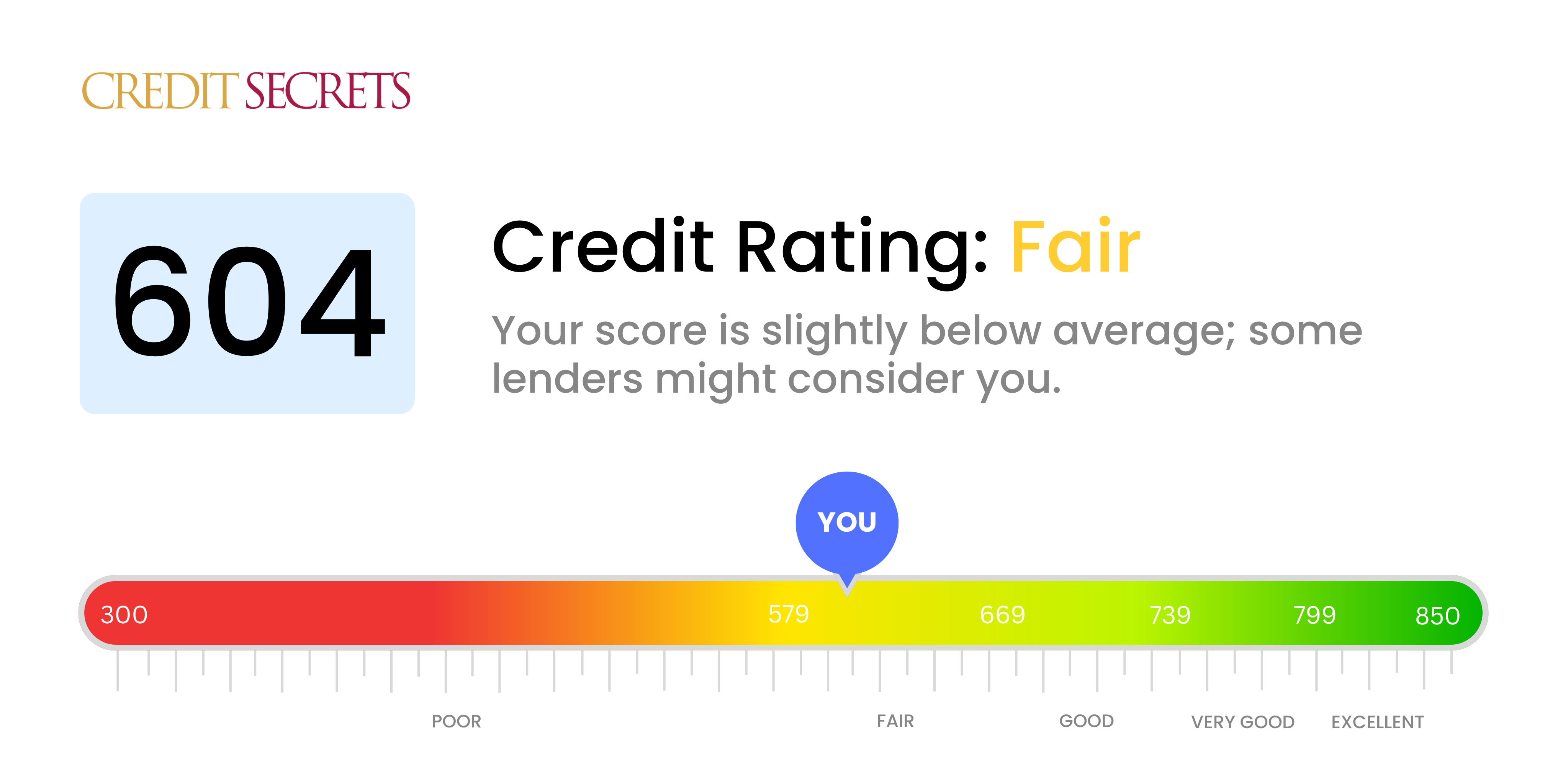

Is 604 a good credit score?

With a credit score of 604, you're in the 'fair' category. This isn't ideal, but remember, this score isn't permanent and there are definitely methods to improve it.

Being in the 'fair' credit range might nean facing some obstacles, like being charged higher interest rates or not being approved for loans and credit cards as easily. But don't lose hope, there's always a path towards improvement and a higher credit score is achievable with the right strategies. You're not alone in this.

Can I Get a Mortgage with a 604 Credit Score?

With a credit score of 604, your chances of being approved for a mortgage may be limited. However, every lending institution has different requirements and thresholds, so it's not outright impossible. Often, a credit score in the 600-649 range, like yours, is seen as 'fair' by lenders. Although it is not in the 'bad' range, it may suggest some financial missteps in the past which could make some lenders wary.

While approval may be more challenging with this score, if you are approved it is likely you may face higher interest rates compared to those with higher scores. This is because lenders may perceive a greater risk in lending to individuals with lower credit scores. One alternative could be considering an FHA loan, as these can be approved with credit scores as low as 500. Another could be using a co-signer with a higher credit score to bolster your application. Above all, continue to work on improving your score for the best potential outcomes in the future.

Can I Get a Credit Card with a 604 Credit Score?

Having a credit score of 604 might make getting approved for a typical credit card challenging. It's nothing personal, but lenders often view this score as a risk. It might indicate a past with financial hiccups. It's hard to hear, but understanding credit realities is a critical part of financial recovery, even when those realities are tough to deal with.

Given the potential hurdles with a score of 604, it might be beneficial to consider other avenues such as secured credit cards. These require a deposit equal to your credit limit and they are typically friendlier towards lower credit scores. They can also help you rebuild credit bit by bit. Options like having a co-signer or utilizing pre-paid debit cards might be worthwhile as well. Don't forget, these pathways aren't an overnight fix, but they're all important parts of your journey towards financial fortitude. Bear in mind, any credit that comes your way might carry higher interest rates due to the perceived risk creditors associate with this score.

With a credit score of 604, it could be challenging, but not impossible, to be approved for a personal loan. Lenders may view this score as risky, making the process of getting approval more difficult. This score certainly does not disqualify you and every lender has their own criteria, but it's crucial to understand the impact it carries on your borrowing potential.

While it might be harder to receive approval, there are alternatives to consider. Secured loans or co-signed loans could be available options for you. These can sometimes come with higher interest rates due to the perceived risk the lender is taking on. Another route to consider is peer-to-peer lending. These platforms often have more relaxed qualifications, but bear in mind they could also come with less favorable terms. It's important to weigh your options carefully and make financial choices that will best suit your circumstances.

Can I Get a Car Loan with a 604 Credit Score?

Having a credit score of 604 brings you into a category that might complicate your process of getting approved for a car loan. Generally, lenders prefer credit scores above 660 for agreeable terms. A credit score lower than 600 is usually deemed as subprime, translating to higher risk for lenders. With your credit score being 604, you hover slightly above this mark, but your risk profile may still be considered elevated, potentially resulting in less favorable conditions, such as increased interest rates, or even application denial. This is due to your credit score suggesting potential difficulties with managing repayments in the past.

Don't lose hope. This situation does not mean your car owning dream is not possible. There are lenders out there who are willing to work with people with less-than-perfect credit scores. However, tread carefully as these loans often carry higher interest rates, reflecting the increased risk perceived by lenders. By carefully examining all terms and conditions, and understanding the implications, obtaining a car loan can still be within your reach. Stay optimistic, but guard your finances wisely.

What Factors Most Impact a 604 Credit Score?

Grasping the implications of a 604 credit score is a vital step towards enhancing your financial health. Let's uncover the key elements which might have led to this score.

Payment Diligence

Your credit score can be heavily influenced by your payment history. If your payments are not on time or you have missed payments in the past, this could potentially lower your credit score.

How to Check: Analyze your credit report carefully for any late payments or missed ones. Think over any incidents of overlooked or delayed payments as they might have affected your credit score.

Debt Utilization

If your credit cards are maxed out or close to their limits, your credit score may decrease. This is referred to as high credit utilization and is an indication of high potential risk to lenders.

How to Check: Take a close look at your credit card statements. Is the utilization high? Aim to keep card balances low relative to the limit as this can boost your credit score.

Credit History Span

A relatively short credit history may lower your credit score. It can be harder for creditors to assess your risk level without enough credit information.

How to Check: Check your credit report thoroughly. Consider the age of your oldest and newest accounts and the average age of all your accounts. Determine if new accounts have recently been opened.

Credit Diversity and Fresh Credit

Having a range of credit types and properly managing new credit can elevate your credit score. However, frequently applying for new credit may lower it.

How to Check: Examine your mix of credit accounts. Look at the balance between credit cards, retail accounts, installment loans, and mortgage loans. Assess whether you've been seeking new credit cautiously.

Legal Filings

Legal actions such as bankruptcies or tax liens, can severely impact your credit score negatively.

How to Check: Go over your credit report for any judicial records or rulings. Attend to any listed items that need addressing.

How Do I Improve my 604 Credit Score?

A credit score of 604 isn’t high, but there’s room for considerable improvement. Here’s a tailored step-by-step action plan:

1. Make Timely Payments

With a credit score of 604, it’s critical that you maintain current accounts and avoid late or missed payments. This can contribute positively to your payment history which is pivotal for credit score improvement.

2. Handle Outstanding Debts

Outstanding debts can greatly impact your score. Focus on settling any unpaid collections and delinquent accounts. Try to negotiate for a payment plan that suits your current financial capability with your creditors.

3. Keep Credit Utilization Low

High credit utilization can negatively affect your score. Aim to spend less than 30% of your credit limit and consistently pay off balances, this helps to improve your credit score over time.

4. Consider a Credit Builder Loan

You may find getting conventional loans challenging with your current score. A credit-builder loan might be a practical option. These loans are typically provided by smaller financial institutions and designed to help individuals improve their credit scores.

5. Dispute Inaccuracies in Your Credit Report

Check your credit reports for any inaccuracies. If you spot errors, disputing them can lead to their removal, significantly improving your credit score.

Your journey to improved credit health starts with these steps. Remember, progress might be slow, but consistent positive actions would surely yield results over time.