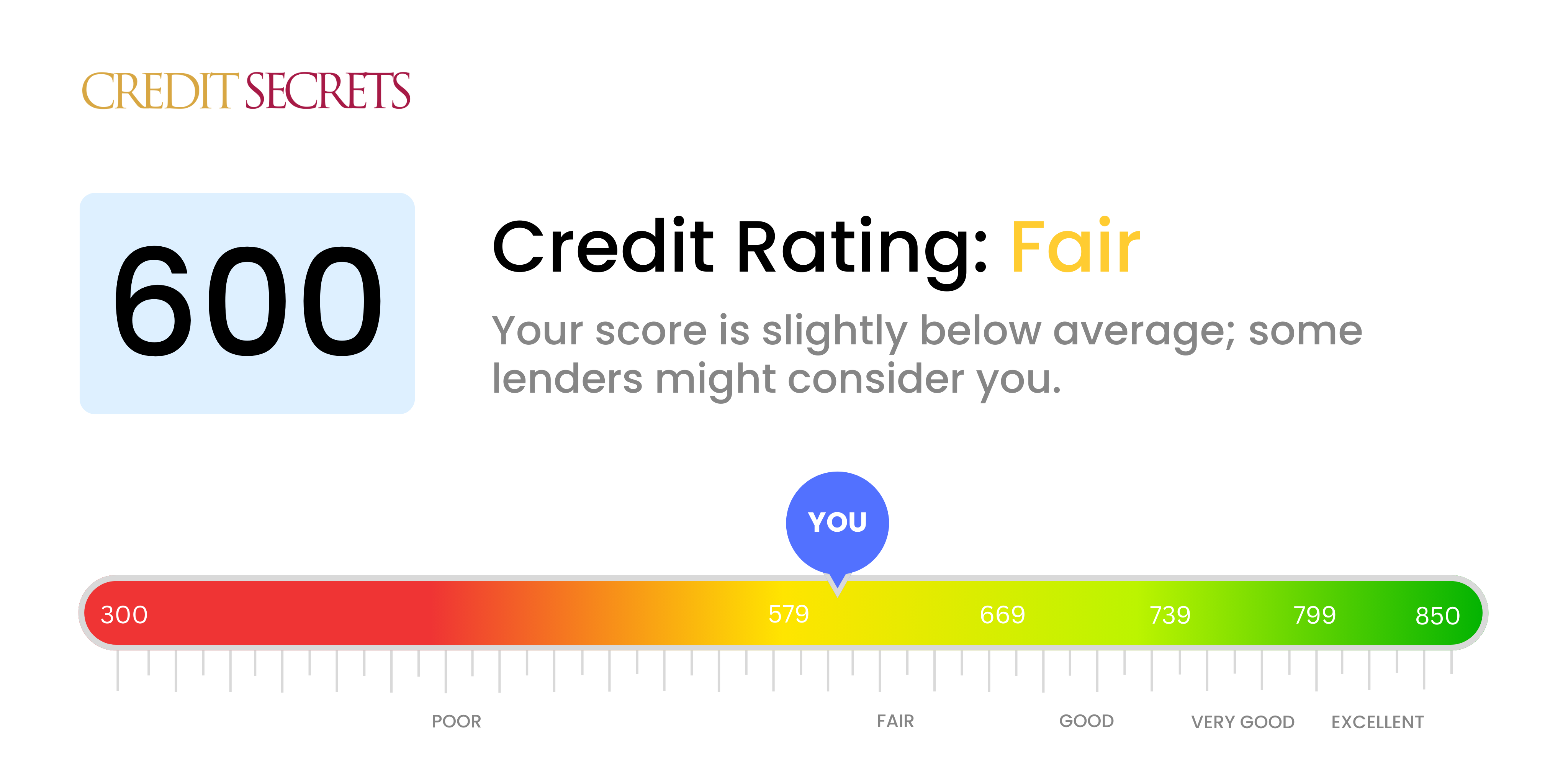

Is 600 a good credit score?

With a credit score of 600, you fall into the 'Fair' category. While this isn't an optimal score, it shouldn't stop you from being hopeful as there are options for improvement.

Obtaining credit could be a bit challenging, but not impossible, with opportunities to secure different types of loans being infrequent and usually accompanied by higher interest rates. Keep in mind, while a lower score limits your options, it's not a lifetime sentence. By maintaining good credit practices, you have the opportunity to gradually climb to better credit brackets. Remember, taking control of your credit future is possible and Credit Secrets is here to facilitate the journey.

Can I Get a Mortgage with a 600 Credit Score?

With a credit score of 600, your chances of being approved for a mortgage may pose a challenge. Typically, mortgage lenders prefer scores above 620, indicating a more solid credit history. A 600 score suggests hiccups in your financial history, like late payments or overused credit lines. It is indeed a tough spot but take heart that it's not insurmountable.

Your credit score directly impacts the interest rates for which you'll qualify. A lower score like 600 may lead to higher rates which means higher monthly mortgage payments. While this might seem bleak, you do have options. Consider exploring alternative lending programs that cater to those with lower credit scores. It's also possible to have a cosigner with a better credit score to strengthen your application. While approval isn't guaranteed, remember, your current score isn't the final word on your financial health. Improving your credit is a journey, and you've already taken the first step by seeking information.

Can I Get a Credit Card with a 600 Credit Score?

If your credit score is around 600, securing a traditional credit card could be a bit tough. This level of score might indicate some financial missteps in the past which makes lenders see you as a potential risk. While disappointing, understanding and accepting your credit situation is a vital part of moving towards a healthier financial future.

However, a score of 600 doesn't mean you cannot have a credit card at all. Consider options like secured credit cards, where a deposit is required, that amount then becomes your credit limit. This kind of card can be a bit easier to get and contributes to improving your credit over time. Another alternative is seeking out cards that are specifically marketed towards those with 'fair' or 'average' credit. Remember, the interest rates may be higher due to the higher perceived risk. While these alternatives may not be the perfect solution, they can equip you with valuable tools on your journey towards better financial stability.

With a credit score of 600, securing a personal loan may prove challenging as lenders often seek a higher score reflecting a safer risk. It's unfortunate, but it's crucial to understand what a score at this level means for your financing opportunities.

Recognizing this, you may need to explore alternative loan options. Secured loans, which require an asset for collateral, could be an option. There are also co-signed loans, where another individual with stronger credit acts as a guarantor for the loan. Peer-to-peer lending platforms may also offer loans with softer credit requirements. It's important to note, these alternative loans typically carry higher interest rates and strict terms due to the increased risk involved for the lender.

Can I Get a Car Loan with a 600 Credit Score?

With a credit score of 600, obtaining a car loan might seem tricky. Credit scores above 660 are usually preferred by lenders, and a score of 600 is often considered to be in the subprime range. This category gives lenders a sense of increased risk, which can lead to higher interest rates or even a denial of the loan application. That's because your credit score is seen as a reflection of your history with borrowed money, and lenders might have concerns about your ability to repay the loan on time.

But don't lose hope. Although a score of 600 might present some challenges, it doesn't completely close off the opportunity of buying a car. There are lenders who specifically work with individuals with lower credit scores. However, it's important to tread carefully. These kinds of loans often come with steeper interest rates as a way for lenders to protect their investment against the perceived added risk. The path to securing a car loan with this score might have a bump or two, but with attention to detail and a comprehensive examination of the terms, it's certainly possible.

What Factors Most Impact a 600 Credit Score?

If you've got a credit score of 600, it's alright. Just know every financial challenge is a chance to improve. Let's look into probable factors affecting this score.

Payment History

Your payment history has a profound influence. If there are records of late or missed payments, they could be driving your score down.

Checking Tip: Look over your credit report for signs of late payments or missed ones. Mull over times when payments were not on time.

Level of Debt

Your debt levels might have an impact on your credit score. If your debts exceed your credit limits, it could be influencing your score negatively.

Checking Tip: Inspect your loan statements and credit card bills. High balances compared to your limit might be hurting your score.

Length of Credit History

Short duration of your credit history might bring down your credit score.

Checking Tip: Evaluate your credit report to review the age of your oldest and newest credit lines and the mean age of all your accounts. Reflect on the frequency of opening new lines of credit.

Types of Credit and Recent Inquiries

Lack of a mix of credit types or multiple recent credit inquiries are factors likely affecting your score.

Checking Tip: Review your credit report to see the variety of credit accounts. Keep in mind, responsible handling of various types of credit can help build a healthy score.

Public Records

Public records such as bankruptcies or tax liens significantly impact your score.

Checking Tip: Scrutinize your credit report for public records. Resolving any such issues can help improve your credit health.

How Do I Improve my 600 Credit Score?

Your credit score of 600 is in the fair range. Don’t worry, there are a few achievable steps you can take to start improving this score:

1. Review Your Credit Report

First, scrutinize your credit report for any errors or discrepancies. Sometimes, they can slip into your report and affect your score negatively. If you locate any, report them to the credit bureau promptly to get them rectified.

2. Clear Your Outstanding Debts

A notable debt can bring your score down. Make a plan to start repaying any outstanding debt. Prioritize these payments by focusing on the accounts that are overdue or with high interest rates. If it’s possible, create a payment schedule to avoid further delays.

3. Maintain Low Credit Utilization

Keep your credit card balances as low as possible. To maintain a low credit utilization ratio, aim to utilize less than 30% of your available credit on each credit card you own. This can significantly improve your credit score.

4. On-Time Payments

Your payment history accounts for a substantial part of your credit score. Following a regular schedule for managing and clearing your bills on time can make a substantial contribution towards score improvement. Setting up automatic payments can help ensure you never miss a due date.

5. Limit New Credit Inquiries

Each time a potential creditor checks your credit, it can slightly lower your credit score. Therefore, limiting new credit applications can help keep your score from getting worse. Keep in mind that this doesn’t mean you should avoid new credit altogether, especially if it helps diversifying your credit mix.