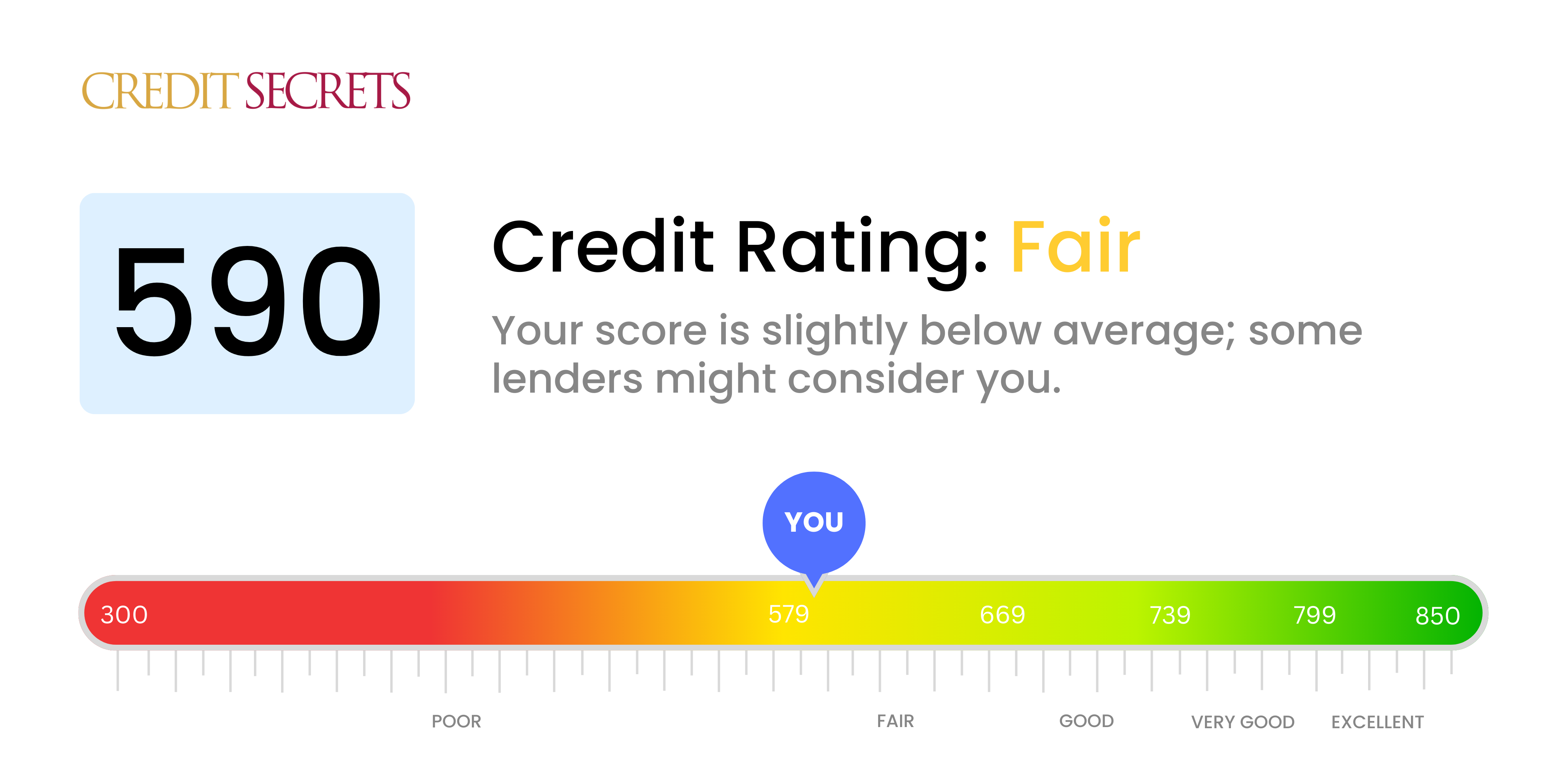

Is 590 a good credit score?

Based on credit scoring standards, a score of 590 is classified as fair. Acknowledge that this may not be where you want to be, but don't worry, this is not a hopeless place to be in. Some lenders may have concerns about your ability to repay loans on time, which might make finding affordable credit or qualifying for loans slightly more challenging.

However, remember that credit scores are not fixed. With the right tools and habits, they can change over time. Look at this as an opportunity to learn and grow, taking small steps to establish better credit habits and improve your score. At Credit Secrets, we believe in your ability to take charge and move toward a better financial future.

Can I Get a Mortgage with a 590 Credit Score?

With a credit score of 590, we regret to tell you that getting approved for a mortgage may be a struggle. This score sits below the typical minimum threshold that most lenders prefer, which could make it difficult for you to obtain the financial support needed for purchasing a home. This score often reflects a past of missed payments or other credit challenges.

While this may feel disheartening, it's important to remain hopeful. There are pathways you can follow that could lead to a stronger credit score. Firstly, consider addressing any unpaid debts or financial missteps contributing to your score's current status. Make a plan to consistently meet future payment deadlines and use your available credit responsibly. Although this is an uphill journey, your consistent effort will eventually yield a better credit score. As you work on this, you could look into alternatives such as government-backed loans which are known to accept lower credit scores. Remember, every financial challenge comes with its own set of solutions. Your path towards a healthier credit score begins today.

Can I Get a Credit Card with a 590 Credit Score?

With a credit score of 590, it's not generally easy to get approval for a regular credit card. Financial institutions may see this score as risky, indicating previous money issues or a lack of good credit management. No doubt, this is not the news you hoped for, but facing it with realism and understanding is essential. Knowing the truth about your financial health is a crucial step forward, although it can be slightly uncomfortable.

Due to the hurdles that come with a score like 590, you could look into some other options. One such option could be a secured credit card which requires a deposit that serves as the credit limit. These cards can be somewhat easier to get and could help in gradually improving your credit score. It's also an option to consider getting a co-signer or using a prepaid debit card. These alternatives may not instantly solve the problem, but they certainly provide useful means on your path to financial stability. Be aware, though, that any kind of credit accessible to those with scores like yours would likely have somewhat higher interest rates, mirroring the greater risk perceived by the lenders.

A credit score of 590 might appear discouraging, and it's true that this score is below what many lenders typically look for when considering personal loan applications. This lower score might be interpreted as a potential risk, which can make being approved for traditional personal loans challenging. However, understanding the implications of this credit score can help in navigating your financial path.

While conventional loans might be difficult to secure, remember that you still have other options. You might want to explore secured loans, which require providing assets as collateral, or even co-signed loans, where another person with a better credit score can vouch for you. Additionally, peer-to-peer lending platforms may sometimes have less stringent credit requirements. Keep in mind, though, that these alternatives may come with their own challenges, such as higher interest rates or less favorable repayment terms, due to the elevated risk posed to the lender.

Can I Get a Car Loan with a 590 Credit Score?

Having a credit score of 590 might present some obstacles when trying to secure a car loan. This is because lenders often seek scores higher than 660 for optimal terms. Anything below 600 is generally considered subprime, and 590 unfortunately falls into this particular category. This implies that the interest rates on your loan may be higher, or a loan may not be granted at all. This is largely due to the perceived level of risk associated with lower credit scores, as it might suggest a history of difficulties in repaying loans.

Don't feel defeated if your credit score is less than ideal. There still may be some car financing possibilities open for you. Some lenders specialize in working with borrowers like you who have lower credit scores. However, exercise diligence as such loans often carry higher interest rates. This reflects the increased risk lenders assume when issuing these loans. Navigating the path to car ownership with a lower credit score may seem daunting, but with careful planning and judicious exploration of all loan terms, getting that car loan is not beyond your reach.

What Factors Most Impact a 590 Credit Score?

A 590 credit score hovers around the lower end of the 'fair' category. Here are the most probable factors affecting such a score and how you can investigate and address them:

Payment History

The most influential credit score component is your history of payments. Missing or delaying payments is a potential reason for a 590 credit score.

How to Check: Go over your credit report for any delinquencies. Late payments can considerably lower your score.

Credit Utilization

Your score can be affected by your credit utilization, which is the balance of your credit compared to your credit limit. If this ratio is high, this could be why you have a 590 score.

How to Check: Scrutinize your credit card statements. If your balances are getting close to the limits, you'll want to work on reducing them.

Length of Credit History

If you've recently started building your credit history, its short length can affect your score negatively.

How to Check: Look at your credit report to find out the age of your oldest and newest credit accounts, and the average age of all accounts.

Credit Type Variety

Your credit mix, or the variety of your credit types, can influence your credit score. If you lack a mixture of revolving and installment credit, this could be a factor.

How to Check: Evaluate your credit report to see the variety of your credit accounts, like mortgages, credit cards, and loans.

Public Records

Public records like tax liens or bankruptcies can noticeably lower your score.

How to Check: Review your credit report for any public records. Make sure to address them ASAP as they can significantly impact your score.

How Do I Improve my 590 Credit Score?

With a credit score of 590, you find yourself in a challenging spot, but it’s not a dead end. You can take a few crucial steps tailored to your unique situation to ascend from here:

1. Clear Overdue Debts

Make sure to bring any past-due accounts to current status. Paying these off, particularly the ones that are overdue the longest, will give your credit score an immediate boost. Feel free to talk to your lenders about possible payment arrangements.

2. Lower Outstanding Credit Card Balances

Keep an eye on your credit card balances, as they play a significant role in your credit score. Strive to slash your card balances to below 30% of your limit. It’s smarter in the long run to maintain them below 10%. But for now, focus on the cards with the highest utilization.

3. Consider a Secured Credit Card

An ordinary credit card may be out of reach with your current score. Think about a secured credit card, where you make a cash deposit that defines your credit line. Use it wisely by making small purchases and paying the full balance each month. This can build a strong payment reputation.

4. Broach Authorized User Discussion

Engage a trustworthy person with solid credit about being added as an authorized user on their card. It can elevate your credit score through their good payment history. Confirm with the card issuer that they report authorized user activities to credit bureaus.

5. Expand the Types of Credit on Your Report

Diversifying your credit types can assist in increasing your score. After establishing a good history with a secured card, try exploring other credit forms, like a credit builder loan or retail card. Be sure to handle them responsibly.