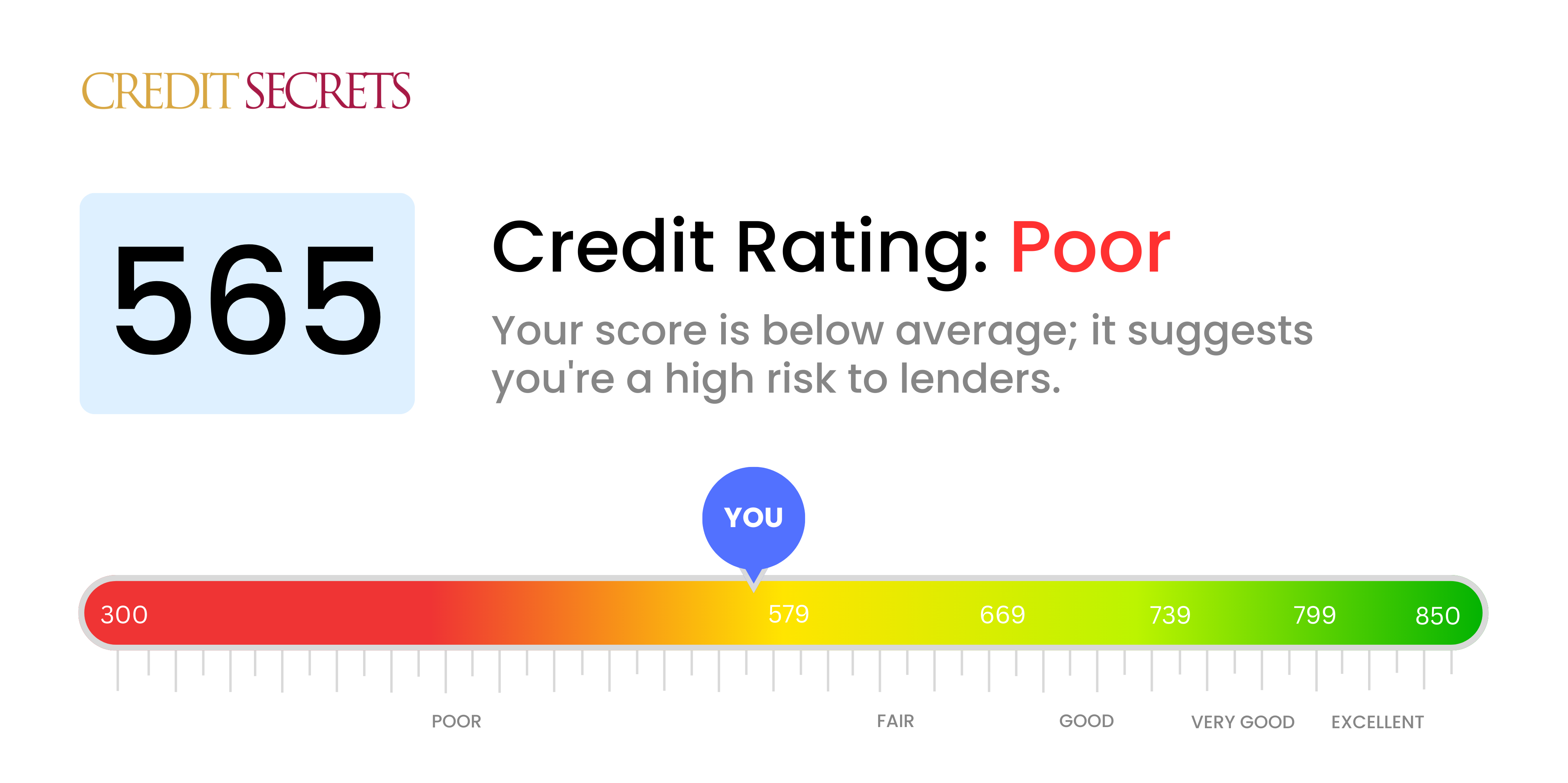

Is 565 a good credit score?

Unfortunately, having a credit score of 565 is considered to be in the 'poor' range. While you may face hurdles in qualifying for certain loans or credit cards, remember that this is just a temporary state, and there are always strategies to improve your credit standing.

With a 565 credit score, you can expect to encounter higher interest rates, stringent credit terms, or even outright denials. However, rather than feeling disheartened, take this as an opportunity to establish better financial habits. By regularly monitoring your credit, making payments on time, reducing your debt, and being careful with taking on new credit, you can make significant strides toward improving your credit score.

Can I Get a Mortgage with a 565 Credit Score?

With a credit score of 565, securing a mortgage approval can be quite difficult as this score is substantially below the required minimum for most lenders. A credit score in this range usually suggests a past record of financial challenges, including late payments or defaults. Hence, lenders may perceive this as a potential risk.

Acknowledging that this isn't an ideal situation to be in, the focus should now be on amending the aspects that have contributed to this credit score. Aim to settle any outstanding debts or delinquencies that have played a role in diminishing your score. Establish a thorough plan that promotes a consistent pattern of on-time payments and reasonable credit use. Although improving your credit score isn't an overnight process, with a dedicated effort and strategic approach, you can slowly but surely enhance your financial status. Higher credit scores often result in lower interest rates on loans, so this work will pay off in the future.

Can I Get a Credit Card with a 565 Credit Score?

Having a credit score of 565 can make it tough to get approval for a standard credit card, and here's why - lenders may see this score as an indication that there's a certain risk involved, possibly due to earlier financial mishaps or issues. It's not an easy situation to confront, but being aware of such obstacles is a crucial first step on the path towards improving your financial future.

Gaining a clear perspective on your situation can help in exploring other alternatives such as secured credit cards. These cards require a deposit which will serve as your credit limit, making them a more achievable goal. Another potential route to consider is getting a co-signer, or looking at prepaid debit cards. Though these solutions will not turn around your predicament instantly, they serve as a starting point on this journey towards bettering your financial status. One thing to keep in mind though, is that interest rates can be slightly higher with these options, due to the higher level of risk perceived by the lenders.

Having a credit score of 565 might be problematic in securing a traditional personal loan. This score is significantly lower than what most lenders typically find acceptable in potential borrowers. This implies that you pose a potential financial risk and hence it becomes less likely for you to get approved for a standard loan. It's a tough spot to be in but it's important to understand the implications of such a score.

However, even with this score, there is still a way forward. Options like secured loans, involving collateral, or co-signed loans, where someone with a higher credit score co-signs for you, might be worth considering. Another viable choice would be peer-to-peer lending networks, which might have more accommodating credit requirements. Please do keep in mind though, that these alternatives are often associated with higher interest rates and less attractive terms due to the higher potential risk posed to the lender.

Can I Get a Car Loan with a 565 Credit Score?

Having a credit score of 565 may make securing a car loan more difficult than if your score was higher. Ideal credit scores for more favorable lending terms usually start around 660. Anything under 600 is considered subprime and could negatively affect the terms of your loan. The lower score of 565 indicates to lenders the potential of increased risk.

Despite this, it's essential to remember not all hope is lost. There are lenders who specialize in working with individuals who have lower credit scores like 565. However, because of the higher risk they take on, these loans usually come with a much steeper interest rate. It's a way for them to protect their investments. Securing a car loan can then, be possible, but may require more scrutiny in terms of the loan conditions. As long as you're prepared for higher interest rates and carefully understand the terms, getting a car loan can happen.

What Factors Most Impact a 565 Credit Score?

Comprehending a credit score of 565 is essential for guiding your path towards financial stability. Recognizing and dealing with contributing factors can promote a brighter financial outlook. Every financial journey is unique and consists of room for significant growth and learning.

Payment Track Record

Payment history significantly impacts your credit score. Missed or late payments could potentially be a major contributing factor to your score.

What to Do: Inspect your credit report for any late or missed payments. Contemplate any circumstances of delayed payments, as these could have brought down your score.

High Credit Utilization

Using a high percentage of your available credit can negatively impact your score. If your credit card balances are near their limits, this might be what's driving your score down.

What to Do: Look over your credit card statements. Are the balances pushing their limits? Striving to keep balances low relative to the limit can help boost your score.

Short Credit History

A brief credit history can impact your score negatively. If you're new to credit, this may explain your score of 565.

What to Do: Examine your credit report to gauge the age of your oldest and most recent accounts, plus the average age of all your accounts. See if you've recently opened multiple new accounts, which can harm your score.

Type of Credit and New Credit

Maintaining a diversified mix of credit types and handling new credit wisely contributes to a healthy credit score.

What to Do: Assess your variety of credit accounts, such as credit or retail cards, loans, and mortgages. Reflect on whether you've been mindful when applying for new credit.

Public Records

Public records like bankruptcies or tax liens can severely affect your score.

What to Do: Review your credit report for any public records. Address any listed items that you can resolve.

How Do I Improve my 565 Credit Score?

A credit score of 565 is often classified as fair, but it’s not far from turning towards the good. Here are the most valuable steps to work on specifically for this situation:

1. Contact Lenders to Discuss Payment Options

Your first move should be speaking with lenders to discuss potential payment arrangements. Some lenders may offer options such as lowering your interest rate or arranging a different payment plan to help you catch up and get your accounts up-to-date. Dealing with past due accounts will have an immediate positive impact on your credit score.

2. Limit New Credit Requests

Too many requests for new credit can adversely affect your score. Therefore, avoid applying for new credit at this time and focus on improving your current available credit.

3. Apply for a Secured Credit Card

With your present score, it might be tough to qualify for an unsecured credit card. A secured credit card, where you make a cash deposit that becomes your credit limit, may be a better option. Make scrupulous efforts to pay off the balance in full each month to demonstrate creditworthiness.

4. Leverage the Credit of Others

It could help to become an authorized user on a credit card belonging to a loved one with solid credit. This could boost your credit score as their positive credit behavior would reflect on your credit report too. Ensure the card provider reports the activity of authorized users so this step can be productive.

5. Explore Various Types of Credit

With a better payment history under your belt, consider expanding your credit types. Look into credit builder loans or store credit cards and manage these responsibly to further enhance your credit score.