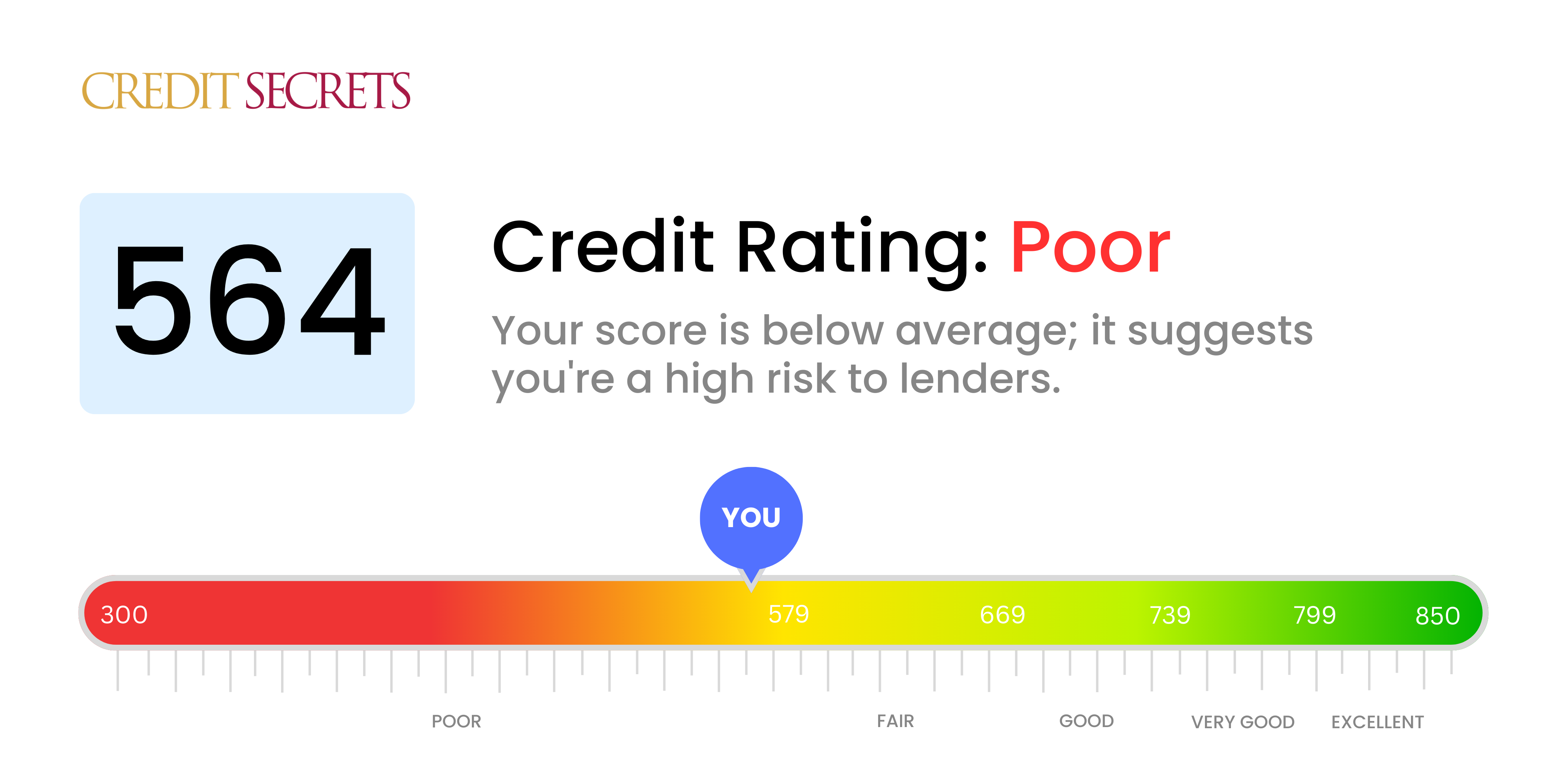

Is 564 a good credit score?

With a score of 564, your credit falls into the 'Poor' category. It's important not to feel discouraged, as this is just a starting point and there is potential for improvement.

This credit score may make it challenging to get credit cards, auto loans, and mortgages, or they may come with very high interest rates. However, making consistent, on-time payments and reducing your debts can certainly boost your score over time, opening up more financial opportunities for you.

Can I Get a Mortgage with a 564 Credit Score?

With a credit score of 564, your chances of approval for a mortgage may be challenging. A score in this range is deemed as a 'poor' credit score by most lenders, and it may indicate some financial difficulties you've faced, like late payments. This may make lenders hesitant to approve a mortgage as they might perceive you as a high-risk borrower.

The reality is not all hope is lost, and there are alternatives available. Certain non-conventional loans such as Federal Housing Administration (FHA) loans cater to people with lower credit scores. Do research and find out if these might fit your situation. Also, remember that interest rates might be higher for those with lower credit scores, and this may increase your monthly mortgage payment. The journey towards a better credit score is a process and commences with disciplined financial management.

Can I Get a Credit Card with a 564 Credit Score?

With a credit score of 564, finding approval for a standard credit card might be tricky. Lenders may see this score as a signal of potential risk, perhaps indicating past financial challenges or mishandling of credit. This may sound disheartening, but don't be discouraged - acknowledging and understanding your credit situation is the initial stride towards your financial wellbeing, even though it might involve facing some tough realities.

Reflecting on potential alternatives in light of these challenges, one could contemplate secured credit cards. These cards necessitate a deposit that serves as your credit limit and could be obtained with less difficulty. Utilizing these cards wisely could play a role in enhancing your credit over time. Exploring options like having a co-signer or opting for pre-paid debit cards could be a possible path forward as well. These tools won't solve the situation overnight, but could provide a stepping stone towards improving your credit situation. Nevertheless, anticipate higher interest rates for any credit form available due to the higher risk perceived by lenders for lower credit scores.

With a credit score of 564, obtaining approval for a personal loan from traditional lenders may prove challenging. Unfortunately, from a lender's perspective, a credit score this low suggests a higher risk of potential default or late payments. But remember, confronting and understanding your current credit situation is the first step towards improving it.

Alternative loan options could be a pathway for you at this juncture. Secured loans, which require collateral, or co-signed loans with the help of a trusted individual possessing a higher credit score, might be a viable option. You could also explore peer-to-peer lending platforms, known for their flexible credit requirements. It's important to keep in mind, however, that these alternative loans typically come with higher interest rates and less favorable conditions due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 564 Credit Score?

With a credit score of 564, getting approved for a car loan may not be a straightforward process. This is because lenders generally prefer scores above 660, classifying scores below 600 as subprime. Your 564 score falls into the latter category, which could mean higher interest rates or potential denial of your loan application. This is based on the assumption that a lower credit score may indicate a higher risk factor for the lender, suggesting potential struggles with loan repayment based on past behavior.

Nonetheless, having a 564 credit score doesn't mean you should bid farewell to your car ownership ambitions. Certain lenders cater to individuals with lower credit scores. But remember, deals from these lenders may come with considerably high-interest rates. This is a protective measure on the lenders' part due to the elevated risks they're taking. So, while obtaining a car loan may seem challenging, it's not entirely impossible. Careful analysis and a good understanding of the loan terms may still lead you to the key of your dream car. Just remember, it’s about finding the right balance between your ambition and capability, and always make sure to fully understand the terms of the agreement.

What Factors Most Impact a 564 Credit Score?

Recognizing the factors that have led to your current credit score of 564 is an essential step towards stronger financial health. This understanding can help you take the right measures and decisions to raise your credit score.

Diverse Credit Accounts

Operating a variety of credit types can play a role in defining your current score. Perhaps your credit portfolio lacks diversity?

How to Check: Scrutinize your credit mix. If it includes only one type like credit cards only, diversifying it with different types like mortgages, or installment loans can help improve your score.

Credit Card Balances

Maintaining high balances on your credit cards could be a factor influencing your score. Are your credit cards maxed out?

How to Check: Browse through your credit card statements. Make a habit of keeping your balances as low as possible relative to your credit limits.

Credit Inquiries

Excessive inquiries for new credit can negatively reflect on your score.

How to Check: Check your credit report for recent inquiries. Remember, applying for new credit should be done sparingly.

Credit Usage

Having a high credit utilization ratio, meaning using a large portion of your available credit, can harm your credit score.

How to Check: Evaluate your credit utilization ratio by dividing your total credit card balances by your total credit limits.

Collections or Defaults

Accounts in collections or defaulted loans could be significantly impacting your score.

How to Check: Go through your credit report for any accounts in collections or defaults. Address any errors and take the necessary steps to improve your payment habits.

How Do I Improve my 564 Credit Score?

A credit score of 564 falls into the ‘poor’ category, but don’t worry, there are specific measures you can take to improve your situation. Below, you’ll find impactful and feasible tactics tailored to your score range:

1. Rectify Late Payments

If there are late payment records, it’s time to fix them. Focus on the accounts where payments are most delayed as those have the greatest negative effect on your score. You may need to connect with your creditors and discuss a possible repayment strategy, if required.

2. Tackle High Balances on Credit Cards

Balances that are high in relation to your credit limit substantially drop your score. Strive to lower your balances to under 30% of your limit, and in the long run, aim for under 10%. Focus first on the cards where the proportion of balance to limit is highest.

3. Opt for a Secured Credit Card

At your score level, you might find it hard to get a regular credit card. A secured credit card, which requires a cash deposit that acts as your credit limit, can be a good choice. Use this card responsibly, pay off your balance each month, and slowly build up a good payment record.

4. Seek Authorized User Status

Can a friend or family member with high credit add you as an authorized user on their card? This can enhance your score by including their positive payment history into your report. Whether the card issuer reports authorized user activity to credit bureaus is something you’ll need to check.

5. Expand Your Credit Portfolio

A wide variety of credit types can have a positive impact on your score. Once you have a solid payment history with a secured card, consider other types of credit, like retail credit cards or credit builder loans, and handle these responsibly.