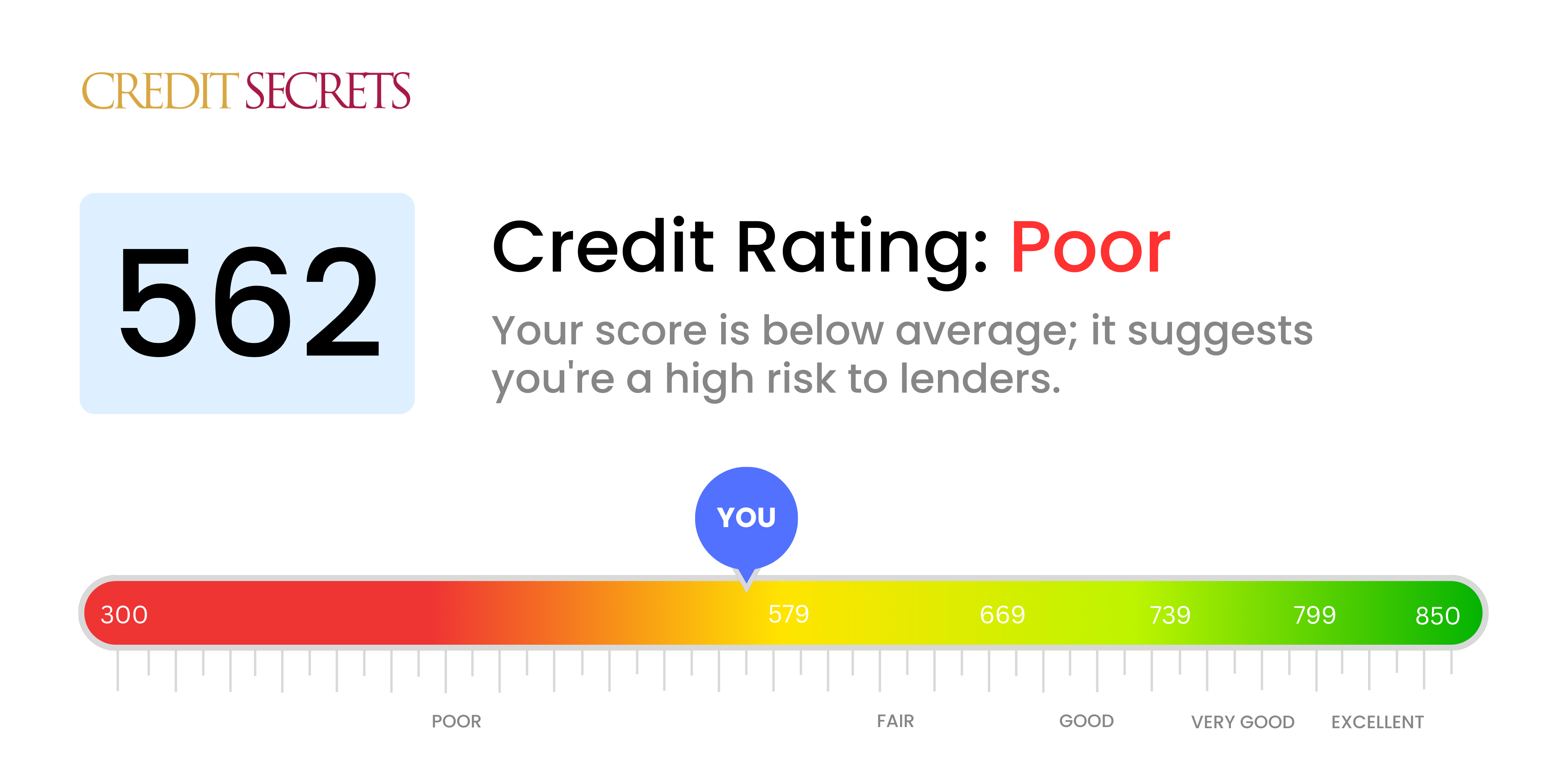

Is 562 a good credit score?

A credit score of 562 is categorically a poor credit score. Although this may limit your access to certain financial products and higher interest rates, please remember improvement is always possible and there are various things you can do to raise your score over time.

Being in the 'Poor' credit range typically means you'll face more obstacles when attempting to obtain credit - whether it's a new credit card, mortgage, or car loan - compared to those in higher score ranges. However, it's crucial to understand that your credit score is something you can influence with consistent effort and sound credit habits.

Can I Get a Mortgage with a 562 Credit Score?

Regrettably, with a credit score of 562, obtaining approval for a mortgage can be quite challenging. This score is significantly lower than the minimum usually needed by many lenders. Having a credit score in this range often suggests some past financial difficulties such as late payments, defaults, or other discrepancies in managing debt.

However, don't lose hope. This isn't the end of your homeownership dreams, but it does mean that some alternative paths may be necessary. One option might be considering a Federal Housing Administration (FHA) loan which has somewhat more lenient credit score requirements. Another could be finding a cosigner with a better score.

It is also worth noting that a mortgage obtained with a lower credit score will likely come with higher interest rates due to the increased perceived risk for lenders, making the loan more expensive in the long run. Therefore, even though it may take time and patience, steadily working on raising your credit score can pave the way to more appealing terms in the future.

Can I Get a Credit Card with a 562 Credit Score?

With a credit score of 562, it's likely you'll find it difficult to be granted a traditional credit card. This score tends to indicate to lenders there may have been some past problems with managing credit properly. It can be tough to face this reality, but understanding your credit score is a crucial part of gaining control of your financial wellbeing.

Being denied a credit card doesn't mean you're out of options, though. You could find success with secured credit cards, which are set up with a deposit that essentially serves as your credit limit. Additionally, prepaid debit cards might be a good fit for your situation. Bear in mind, however, that the interest rates on these types of credit can be considerably higher as a result of the perceived risk to lenders. Nevertheless, these could serve as stepping stones on your path to repairing your credit and achieving your financial goals.

With a credit score of 562, it can be quite difficult to secure approval for a traditional personal loan. This is because lenders view this score as indicating a substantial amount of risk. Typically, lenders prefer a credit score that's higher, as it signifies a lower chance of missed payments or default. But remember, this isn't a final verdict on your financial abilities - it's simply a snapshot of your creditworthiness at this present moment.

Should the option of standard personal loans be out of reach, there are alternative pathways to explore. You might consider a secured loan, which involves offering up collateral like property or a vehicle. Alternatively, you could consider a co-signed loan, where a trusted individual with a stronger credit history stands as a guarantor for you. Peer-to-peer lending could offer more flexible credit requirements. However, bear in mind that these forms of borrowing could result in higher interest rates or other less favorable terms due to the increased risk perceived by the lender. Remember - it's all about finding the most suitable option that fits your unique financial circumstances.

Can I Get a Car Loan with a 562 Credit Score?

Carrying a credit score of 562 might seem like a roadblock when it comes to getting approved for a car loan. Most lenders want to see scores above 660 and anything lower than 600 is usually considered less than ideal. Your 562 credit score unfortunately places you in this lower range. Lenders may view your score as representing a greater risk, hinting at past repayment issues, which could lead to higher interest rates or even an outright refusal of a loan.

That said, hope is not entirely lost. There are lenders who are accustomed to working with applicants who have lower credit scores. However, remember to tread carefully, as these loans can come with much steeper interest rates. The higher rates are a reflection of the lenders' perspective, their way of managing the risk they are taking on. So while the journey might be somewhat rough, it's important to know that obtaining a car loan is still a viable option, as long as you take the time to fully understand the terms and take the necessary precautions.

What Factors Most Impact a 562 Credit Score?

Unlocking the secrets of a 562 credit score isn't merely about understanding numbers, it's about equipping yourself with knowledge for your financial growth. Discerning the elements that possibly led to your present score will help you to enhance your financial health in a significant way.

Banking and Credit Behavior

Your score could be impacted by a history of overdrawn bank accounts, unpaid or returned checks. These might appear on your credit report and affect your score.

How to Check:

Scan your bank statements and your credit report to comprehend whether any such activities have contributed to your current score of 562.

Maxed-out Credit Cards

Using all or almost all of the credit available to you, also known as maxing out your credit cards, can negatively influence your score.

How to Check:

Analyze your credit card statements. Notice if your balances are at or near their limits. Keeping them as low as possible is usually advisable.

Foreclosures or Repossessions

If your assets have been foreclosed or repossessed in the past, this can take a toll on your credit score.

How to Check:

Inspect your credit report, checking for any references to foreclosures or repossessions. If you find any, create a plan to financially recover from those situations.

Lack of Diverse Credit

Possessing only one type of credit account can limit your score. A mix of both installment (e.g., auto loans) and revolving (like credit cards) can be helpful.

How to Check:

Examine your credit report to determine the type of credit accounts you currently have and consider diversifying if needed.

How Do I Improve my 562 Credit Score?

With a credit score of 562, you’re in a challenging financial position. This is considered to be a poor score, but don’t feel disheartened. Your score may be improved effectively by taking certain critical actions:

1. Stay Current on Bills

Ensure all your bills are paid on time every month. Missed or late payments can significantly lower your credit score. If you’re struggling to keep track, consider setting up automatic payments.

2. Limit Credit Inquiries

Each time you apply for credit, your score takes a minor hit. Limit unnecessary inquiries to avoid further reducing your credit score.

3. Rectify Credit Report Errors

Checking your credit report for errors and rectifying them can help increase your score. You’re entitled to free reports once a year from each of the three credit bureaus—take advantage of this.

4. Utilize A Secured Credit Card

Having a 562 credit score might make getting a regular credit card difficult. Apply for a secured card instead. By ensuring you always clear your balance each month, you demonstrate responsibility with credit, which can boost your score.

5. Consider Credit-Builder Loans

Once you’ve established good credit behavior with a secured card, consider a credit-builder loan. These can further enhance your payment history and raise your credit score.

Remember, improving a credit score is a process, not a quick fix. Be patient, consistent and diligent, and you’ll see improvements in your financial position.