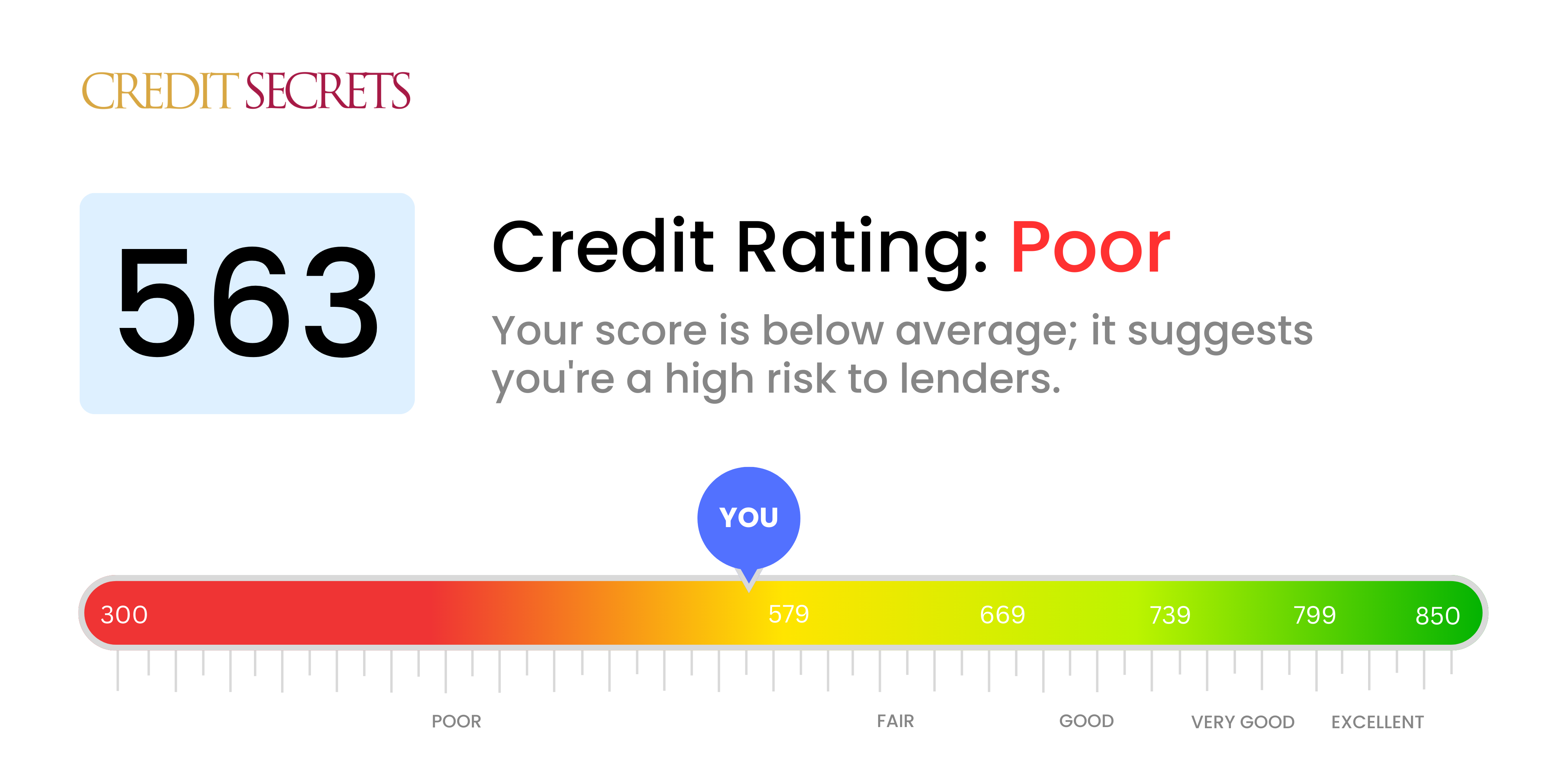

Is 563 a good credit score?

With a score of 563, your credit health falls into the 'Poor' range according to standard classifications. However, it's important not to dismay, there are steps you can take to improve your position over time.

At this level, it might be more challenging to secure lines of credit such as loans and credit cards. Limited borrowing options and potentially high interest rates are likely scenarios. Despite these challenges, remember, you can take proactive steps towards enhancing your score. It's a journey, yet with discipline, time and commitment, you can progress towards better financial health.

Can I Get a Mortgage with a 563 Credit Score?

If your credit score currently sits at 563, getting approved for a mortgage might be quite challenging. This score is below the threshold that many lenders typically require. It suggests a past history of late payments or potential defaults, raising red flags for potential mortgage lenders who fear that you may not keep up with mortgage payments.

While this isn't an ideal situation, it's important to understand this isn't an end-all scenario. There are steps you can take to improve your credit score before applying for a mortgage. Try tackling any negative items on your credit report, like delinquent accounts or collections, to start rebuilding your credit from the ground up. Remember, raising your credit score is a gradual process, and it requires a consistent commitment to better financial practices. You might consider other alternatives in the meantime, such as saving for a larger deposit, finding a cosigner, or seeking out lenders who cater to lower credit score borrowers. These options might help you secure a mortgage while you work on improving your credit score. Interest rates, however, are likely to be high due to your lower credit score.

Can I Get a Credit Card with a 563 Credit Score?

Unfortunately, with a credit score of 563, the chances of being approved for a standard credit card are less likely. Credit card companies often associate this score with risk, suggesting past financial troubles. Such a reality may be tough to accept, but honesty about your credit health is crucial. Recognizing your current financial situation is an essential first step towards reclaiming your financial health.

While it might be more challenging to secure traditional credit cards at this score, there are other opportunities. You might consider secured credit cards, which require a deposit that becomes your credit limit. These types of cards are typically more accessible and help rebuild your credit over time. Considering a co-signer could also be a meaningful choice, as can the utilization of pre-paid debit cards. And although these alternatives don't instantly rectify the situation, they can be valuable elements in reestablishing financial stability. Remember, interest rates on any credit offered to individuals with a lower score like yours are likely to be higher due to the increased risk for lenders.

With a credit score of 563, obtaining a personal loan from traditional lenders is likely to be a considerable challenge. This score is significantly below what most lenders typically find desirable. For lenders, this score suggests a higher risk level, which likely impacts their willingness to approve a loan. It's understandably a difficult situation, but it's crucial to be aware of what this credit score means for your possibilities in the lending market.

While typical personal loans might not be possible at this time, there are some alternative options you can consider. Secured loans, which involve providing collateral, or co-signed loans, where someone with stronger credit co-signs your loan, are two potential routes. Additionally, digital platforms like peer-to-peer lenders can sometimes be more accommodating about credit scores. Remember, these alternatives may come with higher interest rates and more stringent conditions due to the increased lender's risk. Maintaining an optimistic perspective, it's reassuring to know that there are still avenues open to explore, even with a score as low as 563.

Can I Get a Car Loan with a 563 Credit Score?

With a credit score of 563, you might find it tough to get approved for a car loan. Most lenders prefer scores over 660. Anything less than 600 is typically categorized as subprime, this includes your score of 563. Your low score implies a higher risk to lenders, which can lead to increased interest rates or possibly no loan at all.

Despite a lower credit score, don't lose hope in your ability to secure a car loan. There are certain lenders who may consider working with you, even with a lower score. However, it's important to remember these offers often come with steep interest rates as lenders try to protect themselves. So while it might be slightly more difficult, and possibly more expensive, owning a car isn't out of reach. Be sure to check the terms of any loan thoroughly before making a decision.

What Factors Most Impact a 563 Credit Score?

Discovering the reasons behind a credit score of 563 is crucial for mapping out your path towards improved financial health. By understanding and addressing the causal factors, you can start to rebuild your credit.

Paying Bills on Time

Paying your bills in a timely manner forms a significant part of your credit score. If you have a history of late payments, it could have weighed down your score.

How to Check: Request a copy of your credit report. Check for any late payments which may have caused your score to dip.

Credit Usage

Maxing out your credit cards can negatively impact your score. If you're using a high proportion of your available credit, it could be contributing to your current credit rating.

How to Check: Review your card statements. Do your balances seem high compared to your total credit line? Reducing your credit utilization rate can be helpful.

Duration of Credit History

A shorter credit history can lower your score. The age of your oldest account, your newest account, and the average age of all your accounts are crucial factors.

How to Check: Assess the age of your credit accounts through your credit report. Consider if you have recently established new accounts that may be affecting your score.

Type of Credit

Managing a mix of credit types responsibly can boost your score. If you have only one type of credit, it might be impacting your score negatively.

How to Check: Evaluate your credit accounts. Is there a good mix of credit like credit cards, mortgage loans, and retail accounts? Giving thought to diversifying your credit can be beneficial.

Public Records

Public records such as bankruptcies or tax liens can significantly impact your score.

How to Check: Scrutinize your credit report for any public records. Addressing these issues can play an important part in improving your score.

How Do I Improve my 563 Credit Score?

A 563 credit score places you in the “poor” category, yet don’t lose hope, it can be improved with the right steps. Concentrate on these specific strategies tailored to your score range:

1. Clear Past-Due Debts

Prioritize clearing any accounts that are past due as they drastically affect your credit score. Initiate communications with your creditors to arrange a manageable payment agreement if required.

2. Lower Your Credit Utilization

Keeping your credit card balances in check is crucial. Strive to keep the balance below 30% of your credit limit, eventually aiming for less than 10%. Pay off the cards with the highest balances first.

3. Secured Credit Card Consideration

Given your 563 score, a standard credit card might be tough to obtain. A secured credit card, backed with a cash deposit serving as the credit line, could be an alternative. Use this card wisely to develop a record of timely payments.

4. Seek Authorized User Status

Appeal to a relative or friend with sound credit to include you as an authorized user on their card. This lets you benefit from their good credit track record. Verify that the card company reports to the credit bureaus.

5. Broaden Your Credit Portfolio

Establishing a mix of credit types can bolster your credit score. Once you’ve shown responsible payment behavior with a secured card, look into different credit options like retail credit cards or credit builder loans, and handle them with care.