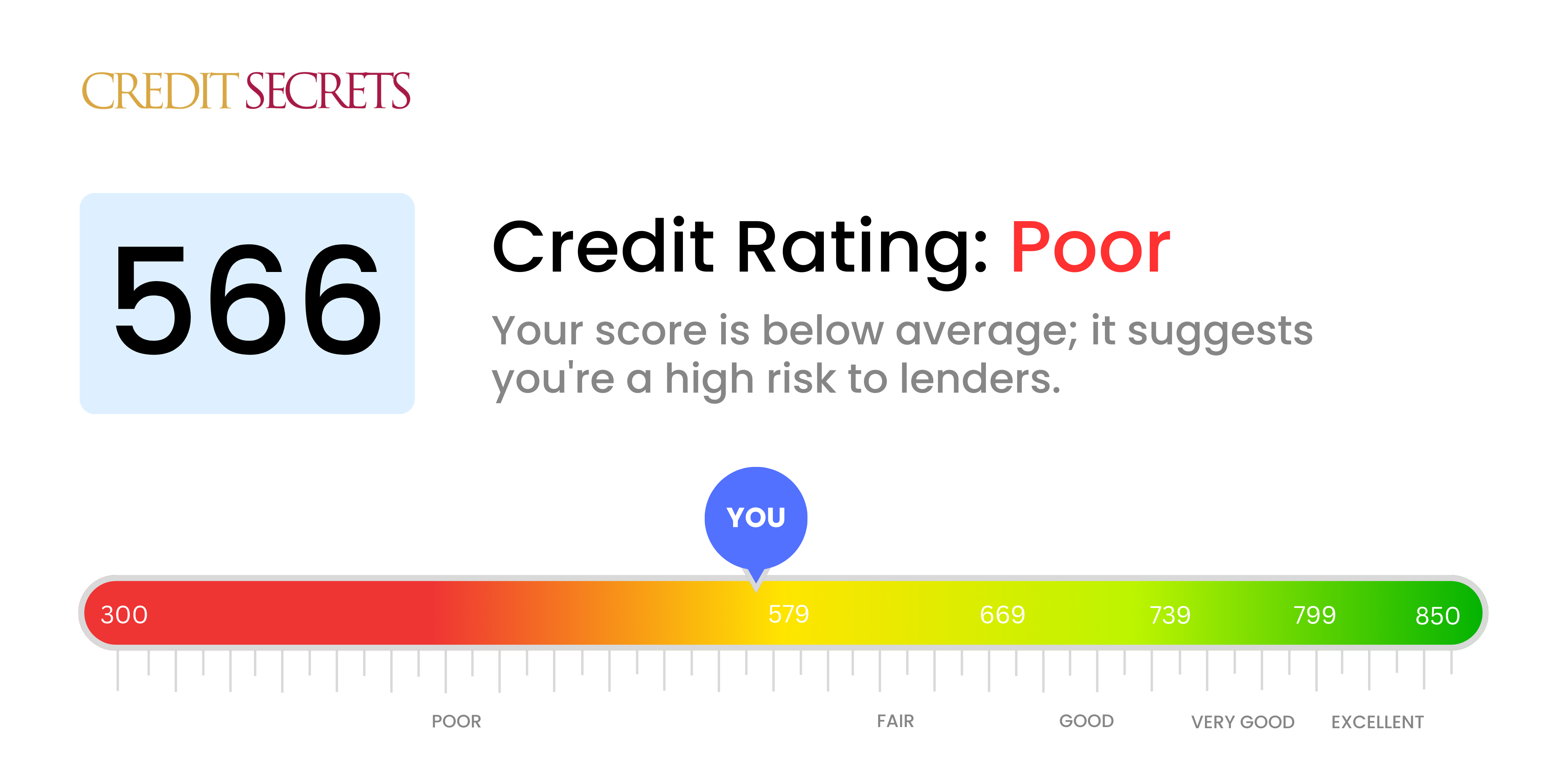

Is 566 a good credit score?

With a credit score of 566, you're currently placed within the "poor" credit score range. This is not an ideal position, and it might cause challenges in achieving your financial goals such as facing higher interest rates or having difficulty securing loans.

However, do bear in mind that this is not a permanent situation and there are ways to work towards improving your credit score. By consistently paying your bills on time, lowering your debt, and working on maintaining good habits, it's completely possible to elevate your score over time. Stay positive, remember that small, consistent actions can lead to big changes in your financial health.

Can I Get a Mortgage with a 566 Credit Score?

With a credit score of 566, your chances of obtaining a mortgage are rather low. Credit scores are a key aspect lenders consider when making decisions. A score like yours is typically viewed as 'poor', which suggests a history of financial struggles such as late payments or high debt balances.

Don't lose hope. There are other options you can consider. Certain programs and lenders are designed to cater to those with lower credit scores. Looking into FHA loans, which are insured by the Federal Housing Administration, or exploring non-traditional lenders might be beneficial. Don't forget: while these alternatives might be available, oftentimes they come with higher interest rates to account for the perceived risk. For a healthier financial future, it's best to start working on improving your score, by addressing the factors that have contributed to its current state. It's a journey, but with each step, you're moving towards a more secure financial future.

Can I Get a Credit Card with a 566 Credit Score?

With a credit score of 566, securing a traditional credit card can pose challenges. This score often gives lenders reason to be cautious since it indicates financial instability or possibly past financial missteps. It might be unsettling to face this reality, but it's crucial to do so with patience and balanced judgment. Recognizing your credit standing is a positive first step in enhancing your financial health.

As an alternative, considering options such as a secured credit card would be useful. This type of card necessitates a deposit equalling your credit limit and can be a practical means to slowly rebuild credit. Examining the possibility of a co-signer or opting for pre-paid debit cards could also serve as plausible substitutes. Bear in mind, these pathways don't offer a quick fix, but they could lay the groundwork for future financial progress. Keep in mind that for any available credit options, individuals with such scores will typically face higher interest rates, due to the greater supposed risk for lenders.

If you currently have a credit score of 566, it's going to be challenging to get approval for a personal loan from most traditional lenders. This score is viewed as a high-risk indicator, suggesting that you might have difficulties in repaying the loan. It's a tough situation to be in, no doubt, yet it's important to grasp the truth of what this low credit score may mean for your financial options.

On a brighter note, there are alternatives to traditional loans that you might want to explore. You might consider a secured loan which requires you to provide something valuable as collateral, or maybe a co-signed loan where another person, typically with a better credit history, guarantees your loan. Additionally, peer-to-peer lending platforms might be a viable option, given that they often have a bit more flexibility with credit score requirements. Keep in mind, however, that because of the higher perceived risk, these alternatives typically come with higher interest rates and less flexible terms.

Can I Get a Car Loan with a 566 Credit Score?

Navigating the journey of securing a car loan with a credit score of 566 can be difficult. Most lenders prefer credit scores above 660 and anything below 600 is seen as subprime. Your score of 566 unfortunately fits into this subprime classification. This could result in higher interest rates or even denial of the loan. The reason for this is simple - a lower credit score suggests a greater risk to lenders based on the past repayment pattern.

But, it's important to remember that a lower credit score doesn't bar you from realizing your dream of owning a car. You'll find lenders that work with individuals with lower credit scores. Be mindful, as these loans typically come with significantly higher interest rates. These higher rates are a reflection of the increased risk that the lender is underwriting. But don't be disheartened, with careful planning and thorough understanding of the terms, it's still feasible to secure a car loan. Keep your optimism high. Your journey might be tougher, but it's not impossible.

What Factors Most Impact a 566 Credit Score?

Understanding the details behind a score of 566 is the first step towards a brighter financial future. Let's explore the most impactful factors that could be affecting this score.

Payment History

One of the most crucial elements that affect your score is your payment history. Late payments or defaults could be a key reason to why your score is at its current level.

Verify this: Access your credit report and examine it for any late or missed payments. Reflecting on your past payment behaviour might just highlight the reasons behind your score.

Credit Card Utilisation

How you utilise your credit card greatly affects your score. If you're consistently hitting the limit, this could be lowering your score.

Verify this: Check your credit card statements. If your balances are frequently near their limit, try to keep balances low moving forward to improve your score.

Length of Credit History

The duration of your credit history might be keeping your score low. A short credit history can negatively impact your score.

Verify this: Go through your credit report to identify the age of your credit accounts. If they are relatively new, this could be a contributing factor.

New Credit and Credit Mix

Applying for a variety of credit types responsibly and judicious timing in opening new credit accounts contributes to a better score.

Verify this: Examine your variety of accounts types, their age and whether you've recently applied for new credit.

Public Records

Public records such as bankruptcies or tax liens can negatively impact your score.

Verify this: Check your credit report for any public records. Ensure no past issues are mistaken to be unresolved.

How Do I Improve my 566 Credit Score?

A credit score of 566 lands in the “poor” range, but don’t be disheartened. There are numerous efficient strategies you can apply to pull your score up.

1. Identify and Dispute Errors

Errors on your credit report might be causing your score to plummet. Thoroughly look through your report for any inconsistencies and dispute them immediately. Correcting these errors can help in improving your score.

2. Pay More than the Minimum Due

Simply paying the minimum amount due on your credit cards isn’t enough. Aim for more than the minimum to reduce your outstanding debt faster. This will eventually lower your credit utilization ratio, boosting your credit score.

3. Consider a Secured Loan

Secured loans can be a viable option if you’re struggling to get credit. These loans use assets as collateral and may help build your credit when handled responsibly. Making timely payments on a secured loan can reflect positively on your credit report.

4. Limit Credit Inquiries

Multiple hard inquiries can bring your credit score down. Avoid applying for new credit that you don’t urgently need to minimize hard inquiries on your credit report.

5. Automate Payments

Timely payments are paramount for improving your credit score. Setting up automatic payments can ensure that you never incur late fees and keep a clean payment record – a huge determinant of your credit score.