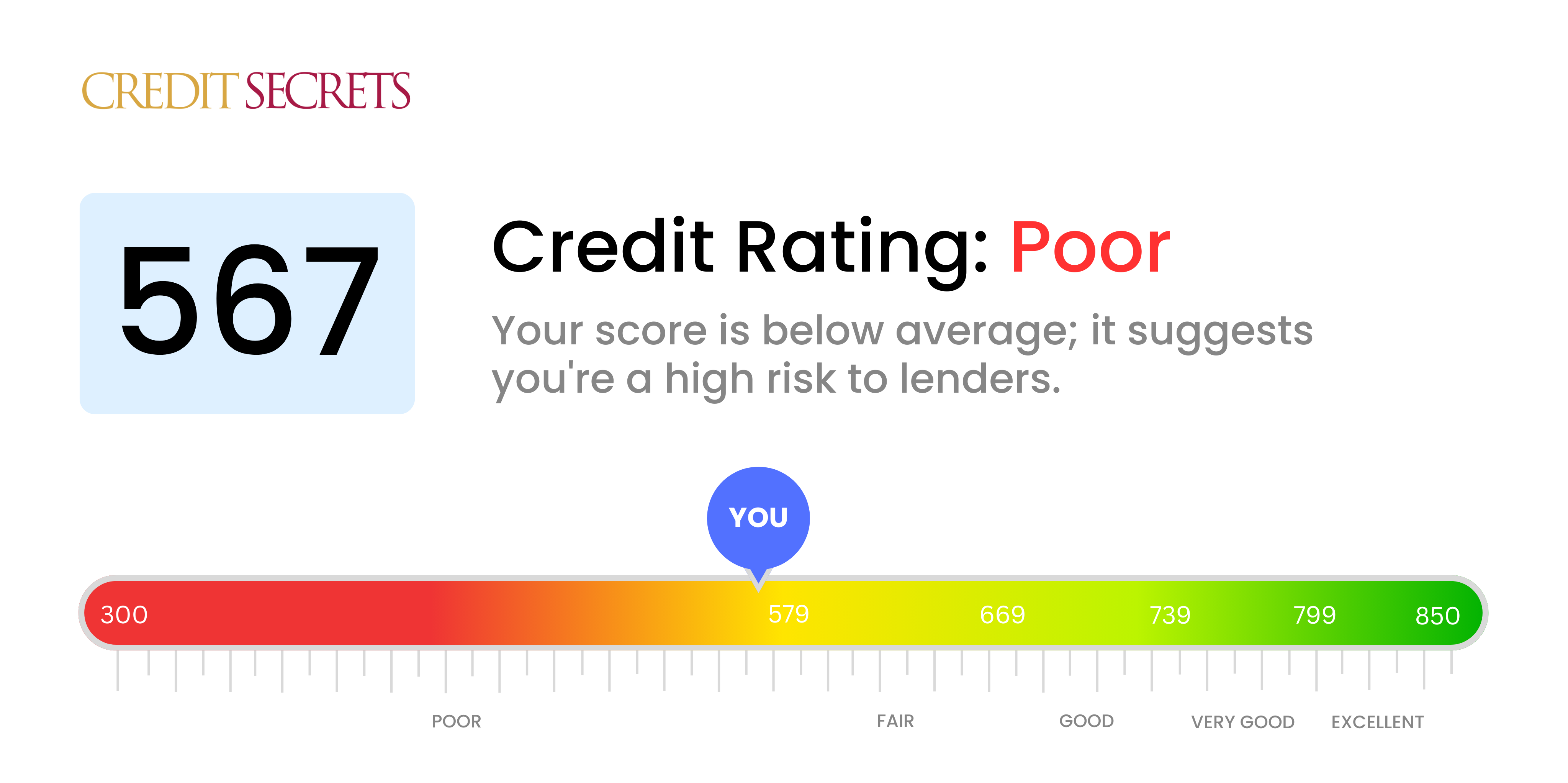

Is 567 a good credit score?

With a score of 567, you're currently positioned in the 'poor' credit range. This may present some challenges when it comes to acquiring loans or credit cards, finding favorable interest rates, or being approved for various forms of financing. However, don't be discouraged - many have lifted their scores from this range by learning more about the nuances of credit and applying some strategic methods.

Understand that there are ways to steadily improve your score. With diligent effort, a slight adjustment in financial habits, and a proper understanding of how credit works, there is definitely room for upward movement. It's important to remember that credit repair is a journey that requires patience and persistence. You can increase your credit score and work towards a more robust financial future.

Can I Get a Mortgage with a 567 Credit Score?

If your credit score stands at 567, you may find it challenging to get approved for a mortgage. This score tends to fall on the lower side of the credit spectrum, which might signal potential risks such as late payments or credit defaults to mortgage lenders. It's important to note that while this situation may be disheartening, don't lose hope just yet.

The bright side is that there are other alternatives to consider if a traditional mortgage is currently out of reach due to your credit score. For instance, you might want to explore government-insured mortgages, like Federal Housing Administration (FHA) loans, which tend to have lower credit requirements. In the meantime, focus on improving your credit score with consistent, on-time payments, and keep your credit utilization low. Each step you take brings you closer to achieving your financial goals.

Do understand, however, that securing a mortgage with a lower credit score could mean higher interest rates. Lenders typically charge higher rates to borrowers with lower scores to compensate for the perceived risk. The interest rate on your mortgage can greatly impact your monthly payments, so it's essential to factor this into your budgeting process.

Can I Get a Credit Card with a 567 Credit Score?

Having a credit score of 567 might make it quite complex for you to secure approval for conventional credit cards. This score generally indicates a history of financial struggles which makes lenders cautious. They see you as a high-risk client. It's critical to address this situation with objectivity and a sense of realism. Accepting the state of your credit is the first stride towards financial recovery, even if the reality can be tough to face.

Considering the challenges that this credit score entails, you could explore solutions such as secured credit cards. These require a deposit which essentially acts as your credit limit. They are typically easier to get even with a lower score and can be beneficial for gradually rebuilding your credit. It's also worth noting, considering a co-signer or even considering a pre-paid debit card might also be reasonable alternatives in this situation. Remember, these options might not offer an instant solution, but they are practical and effective tools in the journey towards achieving financial stability and better credit. Lastly, be mindful that any form of credit available to individuals with this score will likely have significantly higher interest rates, due to the increased risk to lenders.

With a credit score of 567, it may be tough for you to secure a traditional personal loan. Most lenders prefer borrowers with scores in the "good" range, typically starting around 670, to reduce their risk. A score like yours could be interpreted as a sign of previous financial difficulties, causing lenders to worry that you might struggle with repayments. It's a difficult spot to be in, but acknowledging these facts is a vital step towards deciding your next action.

Although traditional loans may seem out of reach, alternative lending options do exist. You could look into secured loans, where you offer up assets like your car or home as collateral, or have someone with a superior credit rating co-sign your loan. Peer-to-peer lending could also be a potential solution, as their credit requirements might be less stringent. However, it's important to remember that these alternatives may carry higher interest rates or stricter conditions due to the increased risk presented to lenders. Even though your journey to financial security might be a bit uneven, keep in mind there are different paths you can take.

Can I Get a Car Loan with a 567 Credit Score?

Having a credit score of 567 can present some hurdles while applying for a car loan. Given that most lenders view scores below 600 as subprime, your current score falls into this category. Lenders usually seek scores above 660 when offering ideal terms. A subprime score, like yours, suggests that you possess potentially higher risk to lenders, who may be concerned about your ability to pay back the loan in the future.

However, it is important not to lose heart. There are lending institutions prepared to provide car loans to individuals even with lower credit scores. The catch here though, is that these loans often carry higher interest rates. Lenders implement these elevated rates as a means of protecting their investment against the perceived risk. Tread carefully and scrutinize loan terms thoroughly. Yes, it might be a bit harder, but with persistence and thoughtful decision-making, obtaining a car loan can still be achievable.

What Factors Most Impact a 567 Credit Score?

Mastering a credit score of 567 is a vital step towards boosting your financial wellness. By pinpointing and managing the elements that factor into this score, a brighter financial future is within reach. Keep in mind that every financial journey is unique and offers many chances for growth and learning.

Payment Consistency

Timely payment of debts weighs heavily on your credit score. If you have missed or defaulted on payments, this could be a factor keeping your score at 567.

What To Do: Scan your credit report for missed or delayed payments. Try to identify any periods of financial strain that may have led to inconsistencies in payment.

Outstanding Debts

Having a large amount of unpaid debt can drastically reduce your credit score. If you owe large sums on credit cards or loans, this could be part of the problem.

What To Do: Check your current credit balances. Aim to reduce any outstanding balances and strive to maintain low overall debt.

Credit History Length

If your credit history hasn’t been established for long, this could be affecting your score negatively.

What To Do: Evaluate your credit report for the lifespan of your credit history. Be cautious about opening new accounts too quickly.

Credit Diversity

A well-rounded mix of credit types can contribute to a better score. If you’re relying too heavily on one form of credit, this might be impacting your score.

What To Do: Review your credit report to determine your credit balance. Endeavor to diversify your credit forms over time.

Public Records

Any negative public records, like bankruptcies or tax liens, can massively impact your score.

What To Do: Inspect your credit report for any such records. Try to resolve anything listed to help improve your score.

How Do I Improve my 567 Credit Score?

With a credit score of 567, you’re in the “poor” category, but don’t worry, there are accessible and effective ways to enhance your score:

1. Tackle Delinquent Accounts

Addressing any delinquent accounts is the first step to improving your credit score. Prioritize accounts that are most overdue and create a plan to pay them off. Consider reaching out to creditors to discuss a manageable payment schedule.

2. Decrease Credit Card Debt

Ensure your credit card balances remain under 30% of your available limit. Strive for an ideal goal of maintaining them below 10%. Paying down the cards with the highest utilization rates should be your first focus.

3. Consider a Secured Credit Card

With your current score, you might face difficulty qualifying for a standard credit card. Applying for a secured credit card, which requires a deposit could be beneficial. This deposit will become your credit limit. Use it wisely to build a positive payment history.

4. Get Added as Authorized User

If you have a trusted family member or friend with a good credit history, you could ask to be added as an authorized user on their credit card. This allows you to share in their good payment history, provided the card issuer reports user activity to credit bureaus.

5. Enhance Your Credit Variety

Maintain a mix of credit types to improve your credit score. Once you’ve established a good payment history with your secured card, you can consider adding a variety of credit forms to your portfolio like credit builder loans or retail credit cards, and manage each wisely.