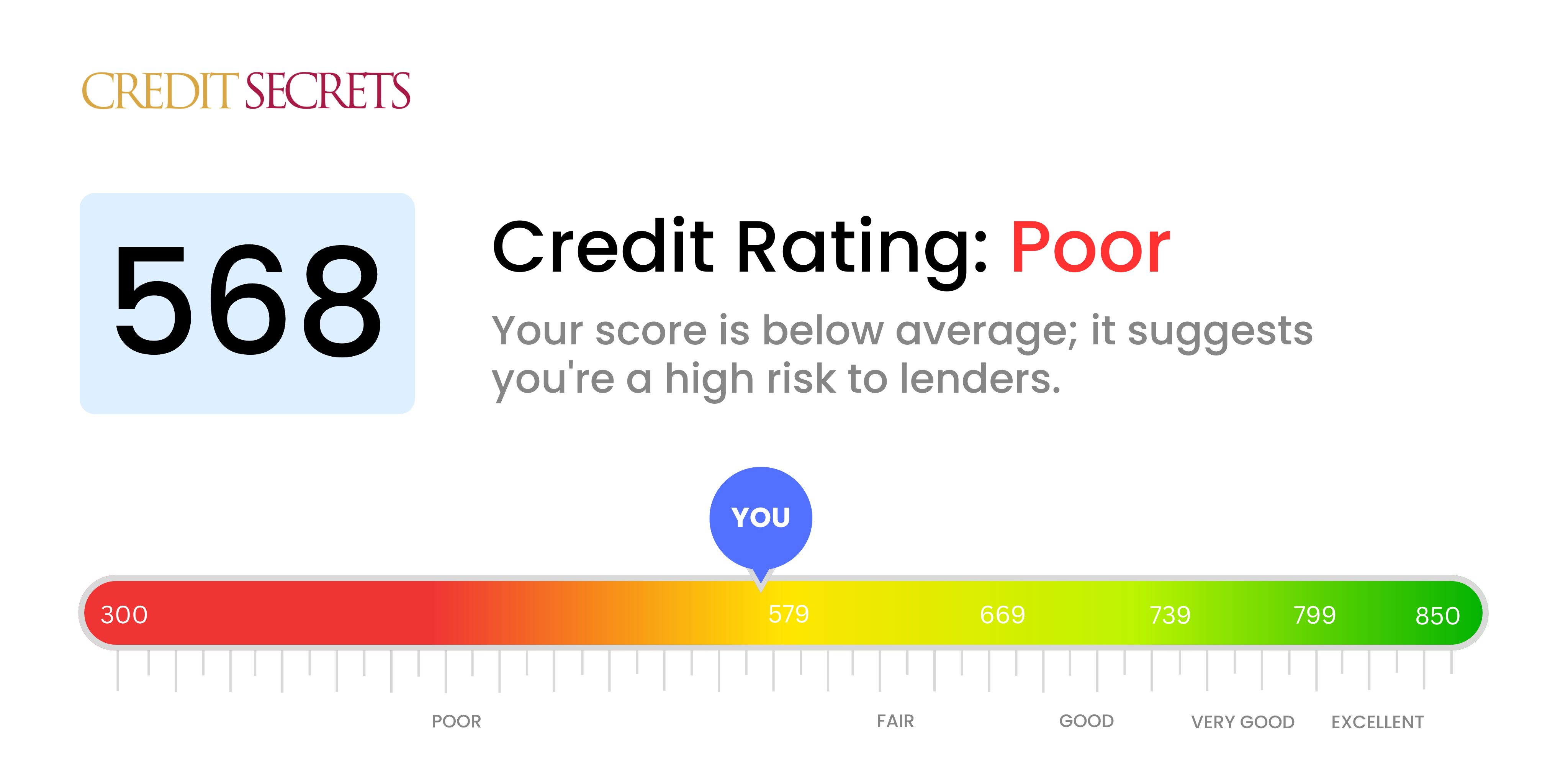

Is 568 a good credit score?

With a credit score of 568, the conclusion is that this score falls into the 'Poor' category. However, this isn't a life sentence and it's totally possible to improve!

A low score like this can make it a little more difficult for you to secure loans or credit, and you may be given higher interest rates. But remember, your credit score is only a snapshot of your financial health at a specific point in time. Starting now, you can take steps to gradually increase your score, opening the door to more financial opportunities down the line. Stay positive, take small steps everyday, and watch your score rise over time.

Can I Get a Mortgage with a 568 Credit Score?

With a credit score of 568, securing a mortgage approval can be quite an uphill task. Most lenders typically look for scores in the mid-600s or higher, meaning a score of 568 falls below these expectations. This score might suggest to potential lenders a history of delays or missed payments.

Don't be discouraged, though. There are other ways to reach your homeownership dream. Some lenders offer programs tailored for individuals with lower credit scores but bear in mind they may come with higher interest rates. FHA-backed loans are also an alternative, as they require lower minimum credit scores, but this option still requires an evaluation of your entire financial profile, not just your credit score. Remember that improving your credit score is a journey, hence patience and consistency is key.

Can I Get a Credit Card with a 568 Credit Score?

With a credit score of 568, the chances of being approved for a typical credit card may be quite low. Creditors usually associate this score with some financial risk due to past troubles. This situation might appear upsetting, but it's crucial to face it with open-mindedness and acceptance. Acknowledging your credit position is the first stride towards financial recovery, even when it includes confronting some inconvenient realizations.

Considering the hurdles that come with a relatively low score, you might consider alternatives like secured credit cards. Such cards need a deposit that doubles as your credit limit; they're generally less demanding to secure and can help rebuild your credit standing over time. Exploring the possibility of a co-signer or considering prepaid debit cards might also be viable options to think about. Bear in mind that these options don’t immediately rectify the situation, but they can be instrumental in paving the way towards financial stability. However, the interest rates on any form of available credit tend to be higher, mirroring the heightened risk perceived by lenders.

A credit score of 568 may indeed make securing a personal loan more challenging than if your score was higher. Traditional lenders generally seek scores above 700 to mitigate their risk. With a score of 568, lenders may view you as a high-risk borrow, which could lead to loan disapproval. It's essential to recognize what such a credit score conveys about your borrowing options.

However, not all hope is lost. There are alternatives available. Secured loans, where you provide an asset as collateral, could be a feasible option. Co-signing a loan with someone possessing a higher credit score may also be a consideration. Peer-to-peer lending platforms are another route to consider as they may have more lenient credit requirements. Nevertheless, bear in mind that these alternative options often come with higher interest rates and less favourable terms, a reflection of the increased hazard presented to the lender.

Can I Get a Car Loan with a 568 Credit Score?

Having a credit score of 568 can make it somewhat difficult to secure approval for a car loan. Lenders often favor those with scores above 660 when offering favorable loan terms. Unfortunately, a score below 600, like yours at 568, is often referred to as being in the subprime range. This means you may face higher interest rates, or possibly be denied a loan altogether. A lower score indicates to lenders that there's a higher risk involved, as it may suggest past difficulties in managing financial obligations.

Though this may sound discouraging, it's not the end of the road for your car financing aspirations. There are lenders who understand and cater to individuals with lower credit scores. But remember to tread lightly. These special loans often come with significantly steeper interest rates, intended as a safety net for lenders in response to the risk associated with lower credit scores. Despite this hurdle, a car loan is certainly not off the table. By paying closer attention to loan terms and considering the implications of higher interest rates, you can make a sound and informed financial decision.

What Factors Most Impact a 568 Credit Score?

A credit score of 568 is considered subprime which can limit your financial opportunities. Understanding the contributing factors can be the first step towards improving it.

Payment History

Your payment history is a fundamental component of your credit score. Late or missed payments are a likely reason for your score of 568.

How to Check: Scrutinize your credit report for missed payments, defaults or any collections. Examine your past financial habits to identify any late payments that may have led to a low score.

Credit Utilization

Using a high rate of your available credit can negatively impact your score. If your credit balances are high, it can contribute to a lower score.

How to Check: Look at your credit card statements. If your card balances are near or exceed their limits, it is important to work on reducing them.

Length of Credit History

A short credit history could also be a factor impacting your score.

How to Check: Scroll through your credit report to determine the length of your credit history and how many new accounts you've opened recently.

Type of Credit in use

If your credit mix is limited, it could be affecting your score. Diverse credit types like credit cards, car loans, and a mortgage can contribute to a healthier score.

How to Check: Go through your credit report and see the kinds of credit accounts you currently have. An assorted mix can eventually improve your score.

Public Records

Public records such as bankruptcies or judgments can also significantly drive down your credit score.

How to Check: Review your credit report for any public records. It's important to address and resolve these where possible.

Remember, your journey to a better credit score starts with understanding these factors and making necessary adjustments.

How Do I Improve my 568 Credit Score?

A credit score of 568 often refers to a suboptimal credit situation, but with specific action steps, it’s possible to elevate your score. Here are several attainable strategies to help raise your credit score from this level:

1. Clear Outstanding Debts

If any debt on your accounts is in arrears, focus on resolving these first. Overdue accounts can drive down your score significantly. Engage your creditors in discussions to establish feasible payment arrangements if necessary.

2. Decrease Credit Card Usage

Carrying high balances on your credit cards compared to your available credit can negatively impact your score. Strive to bring your credit card usage below 30% of your total credit limit, with an eventual goal to maintain it under 10%. Pay off the cards with the highest utilization first.

3. Obtain a Secured Credit Card

With your current credit score, it might be a challenge to get a conventional credit card. Think about getting a secured credit card, which needs a cash deposit that doubles as the credit limit for the account. Use it prudently, make smaller purchases, and always pay off the balance each month to establish a good payment history.

4. Seek Authorized User Status

You can try asking a relative or friend with a favorable credit background to add you as an authorized user on their credit card. It can provide a boost to your credit score as it adds their good payment habits to your credit report. Ensure that the card company reports activity of authorized users to credit bureaus.

5. Vary Your Credit Portfolio

Having a variety of credit accounts can enhance your credit score. Once you’ve shown a positive payment pattern with a secured card, consider opening other credit types such as a credit-builder loan or a store-based credit card, but always manage these responsibly.