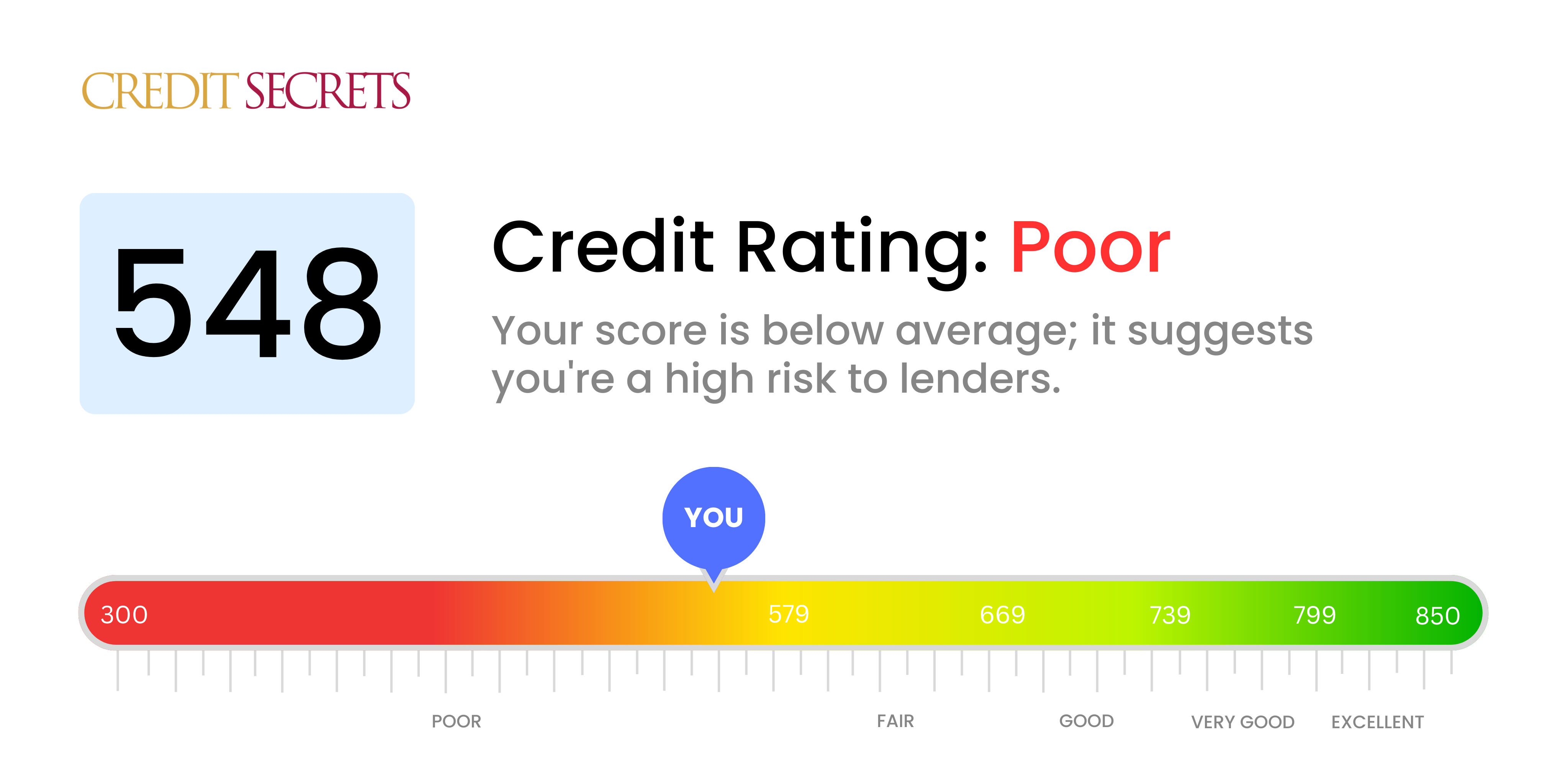

Is 548 a good credit score?

A credit score of 548 is considered as poor. It's understood that some financial hurdles may have brought you to this point, but don't lose hope; it's not a permanent situation.

With a score of 548, you can expect to face challenges like higher interest rates and less favorable loan terms, making it more costly when borrowing money. Building your credit history through responsible fiscal behavior will be key to improving your score. Remember, every step taken towards better financial health counts, so start today.

Can I Get a Mortgage with a 548 Credit Score?

If your credit score stands at 548, it is below the typical benchmark for obtaining a mortgage approval. Lenders associate this score range with a higher financial risk, making it challenging for you to secure a loan for your dream home. This score could indicate struggles with timely debt repayment, financial instability, or past defaults.

While this situation might seem daunting, it's not the end of the road. Just as credit scores can drop, they can also rise. Concentrate on improving your credit score by managing your finances more efficiently, paying your debts on time and minimizing unnecessary credit usage. Also, don't shy away from exploring alternative housing finance options that could fit your current situation. Some federal-backed programs cater to those with lower credit scores. This could mean higher interest rates, but it's a feasible course until you can elevate your credit score to a more favorable range.

Can I Get a Credit Card with a 548 Credit Score?

With a credit score of 548, it's tough to get approval for a conventional credit card. This score signals potential risk to lenders, likely because of past financial hardships or struggles with money management. Even though these realities can be hard to face, knowing your credit status is the first step towards financial empowerment.

However, it's not an end, but a chance to explore other avenues like secured credit cards which are sometimes easier to obtain with a lower score. These cards require a deposit that sets your credit limit. Pre-paid debit cards or having a co-signer on a card could also be practical alternatives. While these options do not immediately solve the problem, they are helpful tools on the path to financial betterment. It's also important to note that any credit form available at this score likely will have a higher interest rate, due to the higher risk seen by lenders, so plan accordingly.

Understanding that a credit score of 548 places you in a challenging position is the first step towards improvement. With this score, traditional lenders are likely to view you as a high-risk borrower, and chances of obtaining a personal loan are slim. The score signifies a high-risk category, making most lenders cautious about extending credit. It's not the best news, but it's better to be aware and prepared of what this means for your loan options.

Yet, you still have alternatives that might work for you. Think about secured loans, where you need to provide collateral as a guarantee, or the option of a co-signed loan, which requires someone with a better credit score to step in on your behalf. Platforms offering peer-to-peer lending could be another accessible avenue, as they might have more relaxed credit policies. However, be mindful that these substitute options might have higher interest rates and rigid terms. These unpleasant conditions signify the elevated risk the lender takes given your credit score.

Can I Get a Car Loan with a 548 Credit Score?

With a credit score of 548, securing a car loan may appear challenging. Lenders usually prefer to deal with scores that are above 660, and any score less than 600 is typically seen as subprime. In this case, your score of 548 is considered subprime, creating a likely possibility for increased interest rates or perhaps, loan rejection. This perception is fostered by the belief that a lower credit score portrays a candidate who could find repaying the loan difficult, hence posing a higher risk to lenders.

That said, a below-average credit score doesn't necessarily seal your fate. There are lenders out there who work specifically with those having lower credit scores. It's important to tread carefully here though, as loans from such sources often come attached with significantly higher interest rates. These higher rates provide a cushion to the lender against any perceived risk. Planning wisely and understanding the terms in depth are key to securing a car loan under such circumstances. Even with a rocky start, the chance to own your dream car still exists.

What Factors Most Impact a 548 Credit Score?

A score of 548 presents opportunities to positively impact your financial health. By focusing on the most relevant factors contributing to this score, you can strategically navigate towards a more promising credit status. The road to improvement is unique for each person, full of lessons and possibilities.

Payment History

With a score of 548, late payments or unpaid bills can be a critical contributor. If you have neglected a loan or credit card bill, it usually has a severe impact on your score.

How to Check:

Scrutinize your credit report for overdue or defaulted accounts. Any recent missed payments could be the cause of your current score.Credit Utilization

Excessive credit utilization can dampen your score. If you're using a high percentage of your available credit limit, it can pose a risk to your score.

How to Check:</strong

Review your credit card accounts. If your balances are near their maximum, it might be negatively affecting your score.Length of Credit History

The length of your credit history can affect your score, especially if it's relatively short. Starting to build credit recently could lead to your current 548 score.

How to Check:

Check your credit report for the age of your oldest and latest accounts. Consider if opening new accounts has influenced your score.Credit Diversity and Recent Applications

Holding a diverse range of credit and managing new credit responsibly can boost your score. However, opening up too many new accounts or types of credit could have led to your current score.

How to Check:

Evaluate your collection of credit accounts. If you have applied for a lot of new credit recently, this could be a contributing factor.Derogatory Markings

One or more derogatory markings like bankruptcy, foreclosure, or tax liens on your credit report can significantly lower your score.

How to Check: Investigate your credit report for any such derogatory marks. If any are found, it will be essential to resolve these situations.

How Do I Improve my 548 Credit Score?

With a credit score of 548, you’re in the range of poor credit, but don’t worry. There are steps that you can take to start raising your score effectively from where you stand right now.

1. Rectify Delinquent Accounts

Your first course of action should be to address any delinquent accounts on your credit report. Delinquencies have a major bearing on your credit score. If you have any, make immediate arrangements to make these accounts current. Renegotiate payment plans with lenders if required.

2. Limit Your Credit Utilization

Keeping your credit card balances low is of prime importance. Strive to keep your balances below 30% of your credit limit. In the long run, aim to maintain them under 10%. Focus on credit cards bearing the highest balances first.

3. Opt for a Secured Credit Card

Getting a regular credit card may be tough with a 548 credit score. In this situation, a secured credit card is an excellent alternative. This card will require a cash deposit which acts as your credit limit. Wisely manage this card to steadily build a positive credit history.

4. Request to Be an Authorized User

If you have a trusted person willing to add you as an authorized user to their credit card, this could provide a boost to your credit profile. Make sure that the cardholder maintains a healthy credit behavior and that the card issuer reports authorized user transactions to the credit bureaus.

5. Broaden Your Credit Portfolio

Managing a mix of different types of credit contributes to a robust credit profile. Once you’ve successfully managed a secured card, look into adding other types of credit like retail cards or credit-builder loans and manage them sensibly.