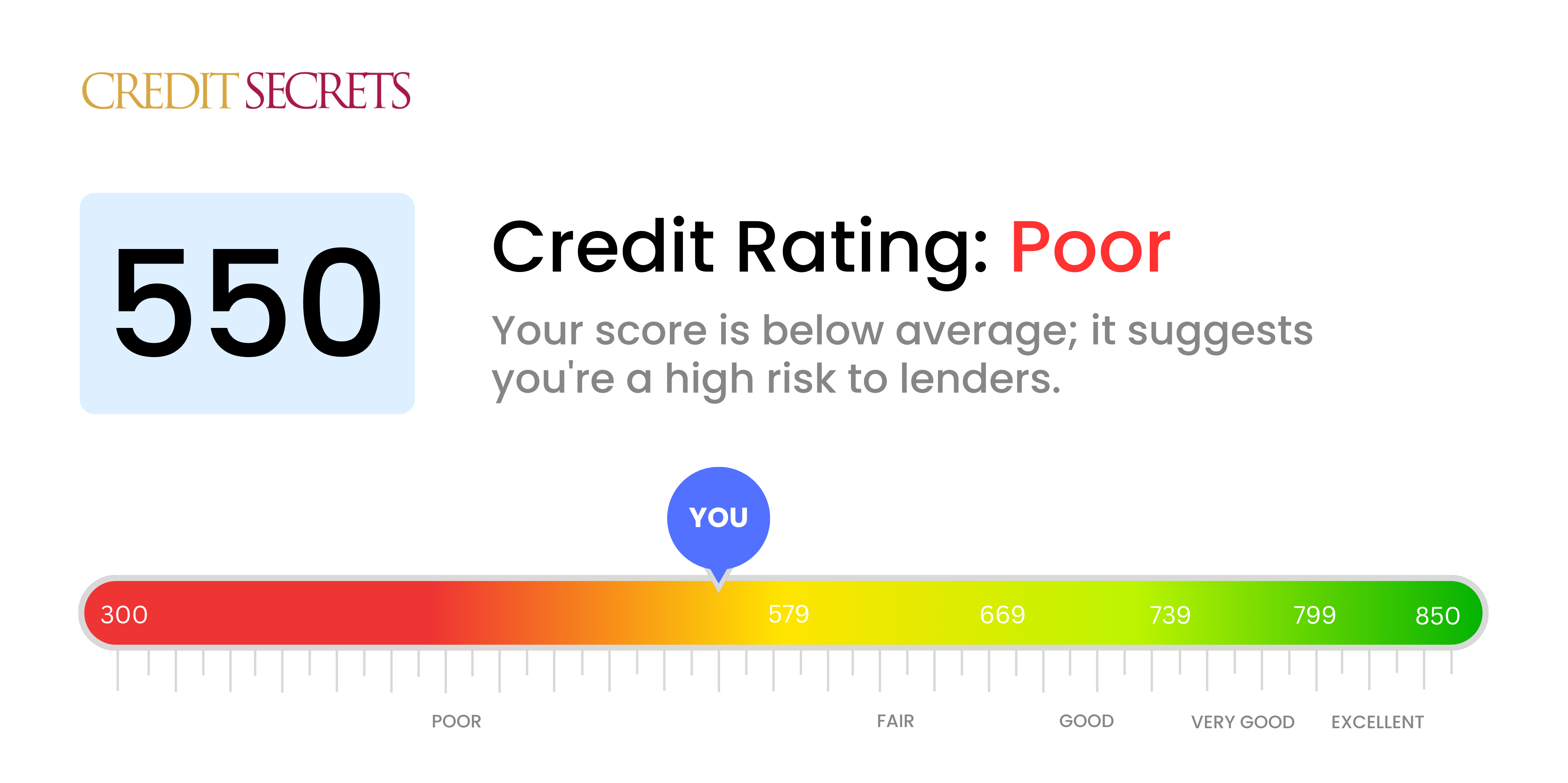

Is 550 a good credit score?

A credit score of 550 falls within the 'Poor' range, implying that it's not a favorable credit score. However, don't get discouraged, remember it's always possible to improve your credit status. With such a score, you may face difficulties in securing loans or credit at desirable interest rates, but action today can lead to improved results.

Often, you could get charged higher interest rates, need to pay extra fees or deposits, or only qualify for lower credit limits. You may also struggle with being approved for new credit or loans. But don't lose hope, even if you're starting from a challenging place, there are proven methods to improve your credit score over time.

Can I Get a Mortgage with a 550 Credit Score?

Can I Get a Credit Card with a 550 Credit Score?

With a credit score of 550, it can be challenging to get approved for a traditional credit card. This score is generally considered to be in the lower range, indicating a history of financial struggles or difficulty managing credit. While it may be disheartening, it's important to face this reality with understanding and determination, as it's the first step towards improving your financial situation.

Given the obstacles associated with a score like yours, exploring alternatives such as secured credit cards might be a helpful option. These cards typically require a deposit that acts as your credit limit, making them more accessible and providing an opportunity to rebuild credit over time. Another possibility could be considering a co-signer or looking into pre-paid debit cards. While these alternatives won't instantly solve your situation, they can serve as valuable tools on your path to financial stability.

It's important to note that if you are approved for a credit card with a score of 550, the interest rates might typically be higher. Lenders view lower scores as having a higher risk, which can result in increased interest rates. It is crucial to understand and carefully consider the terms and conditions of any card offered to you.

A credit score of 550 is below the standard range that most traditional lenders consider acceptable for approving a personal loan. Lenders view a score this low as a sign of significant risk, making it unlikely that you would be approved for a loan under conventional terms. While this may feel discouraging, it's essential to acknowledge the reality of your borrowing options given this credit score.

If traditional loans are not an option, there are alternatives worth considering. Secured loans, where you provide collateral, or co-signed loans, where someone with better credit vouches for you, could be potential alternatives. Another possibility is exploring peer-to-peer lending platforms that sometimes have more lenient credit requirements. However, bear in mind that these alternatives may come with higher interest rates and less favorable terms due to the increased risk for the lender.

Can I Get a Car Loan with a 550 Credit Score?

What Factors Most Impact a 550 Credit Score?

Understanding a credit score of 550 is essential for charting your path towards credit improvement. By identifying the factors responsible for your current score, you can take appropriate actions to enhance your financial standing. Remember, everyone's financial journey is unique, offering opportunities for growth and learning.

Payment History

Payment history plays a significant role in determining your credit score. Late payments or defaults may have adversely impacted your score.

How to Check: Take a close look at your credit report to identify any instances of late payments or defaults. Reflect on any delayed payments that could have contributed to your score.

Credit Utilization

A high credit utilization ratio can negatively impact your score. If your credit cards are near their limits, it may be a contributing factor.

How to Check: Review your credit card statements to assess if your balances are close to the credit limits. Keeping your balances low compared to the limit is beneficial for your credit score.

Length of Credit History

A shorter credit history can have a negative influence on your score.

How to Check: Examine your credit report to determine the age of your oldest and newest accounts, as well as the average age of all your accounts. Consider if you have recently opened new accounts that might have impacted your credit history.

Credit Mix and New Credit

Holding a diverse mix of credit types and responsibly managing new credit is crucial for a good score.

How to Check: Evaluate your mix of credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans. Reflect on whether you have been applying for new credit sparingly.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score.

How to Check: Thoroughly review your credit report for any public records. Address any listed items that require resolution to improve your overall credit health.

How Do I Improve my 550 Credit Score?

A credit score of 550 is considered poor, but don’t lose hope! There are effective steps you can take to improve your credit score. Here are the most impactful strategies for your current situation:

1. Get Current on Past-Due Accounts

If you have any accounts that are past due, it’s crucial to bring them current. Start by tackling the most overdue accounts first, as they have the strongest negative impact on your credit score. Reach out to your creditors and try to negotiate a payment plan if needed.

2. Reduce Credit Card Balances

High credit card balances compared to your credit limit can significantly harm your credit score. Aim to lower your credit card balances to below 30% of your credit limit, with a long-term goal of keeping them under 10%. Prioritize paying down the cards with the highest utilization rates first.

3. Consider a Secured Credit Card

Given your current score, qualifying for a regular credit card might be challenging. However, you can explore applying for a secured credit card. This type of card requires a cash collateral deposit that serves as your credit line. Use the card responsibly by making small purchases and paying off the balance in full each month to build a positive payment history.

4. Seek to Become an Authorized User

Reach out to a family member or trusted friend who has good credit and ask if they would add you as an authorized user on their credit card. Being an authorized user can improve your credit score by incorporating their positive payment history into your credit report. Just ensure that the card issuer reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Mix

Having a diverse mix of credit accounts can have a positive impact on your credit score. Once you’ve established a good payment history with a secured card, consider exploring other types of credit, such as a credit builder loan or a retail credit card, and manage them responsibly.

By taking these steps, you’re on your way to improving your credit score. Keep a positive mindset and stay committed to your financial goals. You’ve got this!