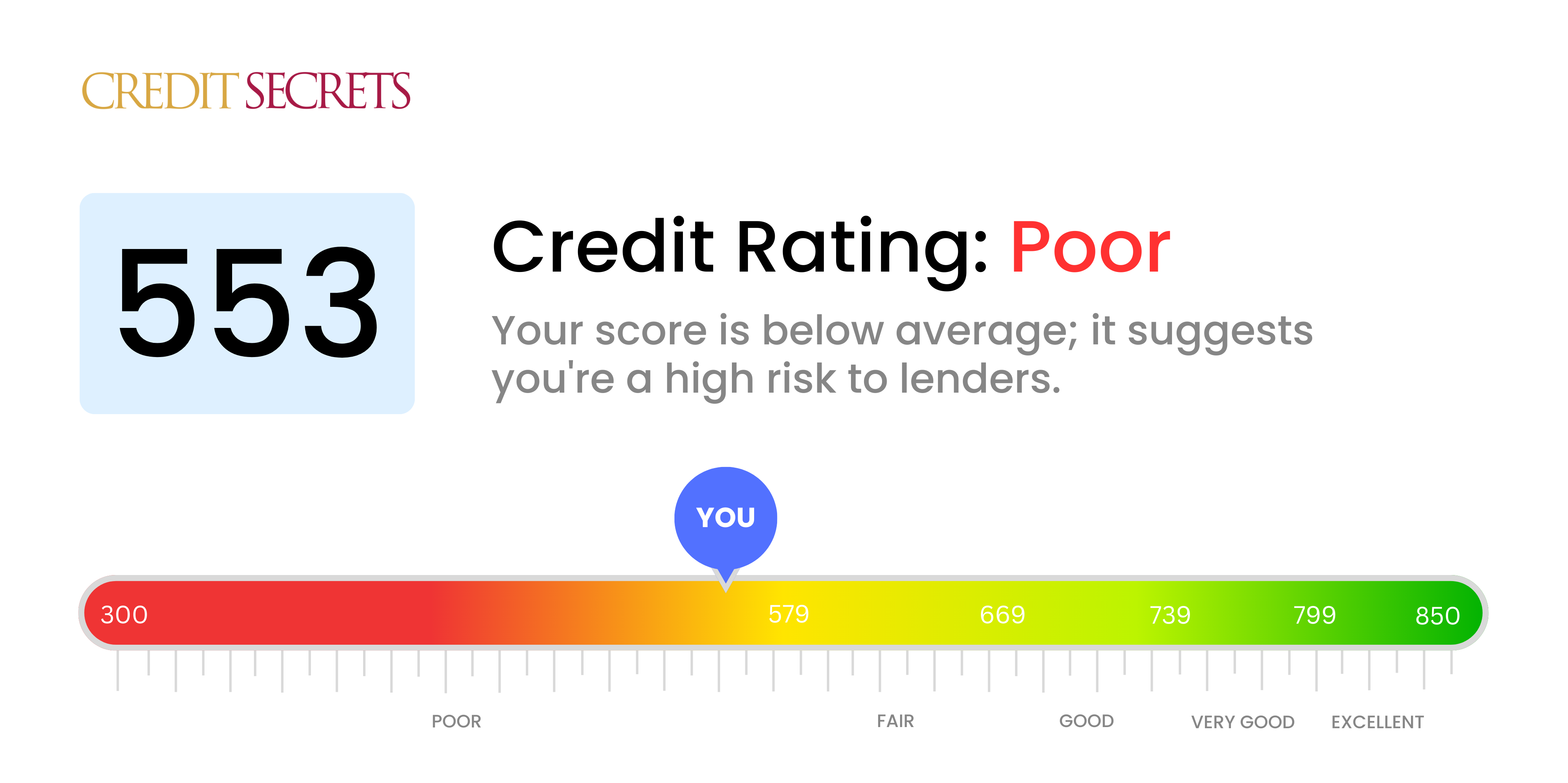

Is 553 a good credit score?

With a credit score of 553, it's clear that your financial situation is currently in the 'poor' range. It's a tough position to be in, but remember this is only a temporary state and with some diligent effort, your score can be improved.

A 'poor' credit score can make it more challenging to secure loans, credit cards, or even housing, as lenders view you as higher risk. However, there are still opportunities and strategies to rebuild your credit, such as consistently paying all bills on time and reducing your debts. It's a journey to increase your credit score, but remember, step by step, you can turn this situation around.

Can I Get a Mortgage with a 553 Credit Score?

With a credit score of 553, it is unlikely that you will be approved for a mortgage. While this score is not as severely low as some, it still falls below the minimum score required by most lenders. A credit score in this range suggests a history of financial challenges such as late payments or high credit card balances.

As disappointing as this news might be, it's important to remember that you have the power to improve your credit score. Begin by addressing any outstanding debts or delinquencies that are negatively impacting your score. Take steps towards establishing a record of timely payments and responsible credit utilization. Although the road to improvement may be gradual, with determination and consistency, you can enhance your prospects for the future.

If you are currently unable to secure a mortgage due to your credit score, consider alternative options such as working on strengthening your credit before reapplying. Building a deposit fund and saving for a larger down payment may also help increase your approval chances. It could be beneficial to have a conversation with a mortgage professional who can guide you through the mortgage application process and provide personalized advice based on your unique circumstances.

Can I Get a Credit Card with a 553 Credit Score?

With a credit score of 553, it can be quite challenging to be approved for a traditional credit card. Lenders may view this score as indicating some past financial difficulties or mismanagement, making them hesitant to extend credit. While this news might be disheartening, it's important to face it head-on with understanding and realism. Recognizing your credit situation is the first step towards taking control and making positive changes.

Given the difficulties associated with a score like yours, it's worth exploring alternatives like secured credit cards. These types of cards require a deposit that acts as your credit limit, making them easier to obtain and helping you rebuild your credit over time. Additionally, considering a co-signer or researching pre-paid debit cards could be viable options. Remember, while these alternatives may not provide an immediate fix, they can serve as useful tools on your journey toward financial stability. Lastly, it's worth noting that interest rates on any credit available to individuals with lower scores tend to be higher to reflect the perceived risk to lenders.

Can I Get a Car Loan with a 553 Credit Score?

With a credit score of 553, it can be challenging to obtain approval for a car loan. Lenders typically prefer borrowers with scores above 660, which are considered more favorable. Unfortunately, a score below 600 is often categorized as subprime, indicating a higher level of risk for lenders. As a result, you may face higher interest rates or even the possibility of loan denial.

However, don't lose hope. Even with a lower credit score, it's still possible to fulfill your car purchasing dreams. Some lenders specialize in working with individuals in your situation. Keep in mind that these loans might come with higher interest rates due to the perceived risk lenders take. While it might require careful consideration and a thorough exploration of the terms, securing a car loan is within the realm of possibility.

If you face difficulties obtaining a car loan, consider other alternatives such as saving up for a down payment, using a cosigner, or exploring buy here pay here dealerships. These options can help you overcome the challenges posed by your credit score and move closer to your goal of purchasing a car.

What Factors Most Impact a 553 Credit Score?

Understanding a credit score of 553 is crucial for your financial journey towards improvement. Identifying the factors that contribute to this score will help you pave the way for a healthier financial future. Remember, every financial journey is unique, filled with growth and learning opportunities.

Payment History

Your payment history has a substantial impact on your credit score. Late payments or defaults may be key contributing factors to your current score.

How to Check: Review your credit report for any instances of late payments or defaults. Reflect on any delayed payments, as they could have affected your score.

Credit Utilization

A high credit utilization can negatively affect your score. If the balances on your credit cards are close to their limits, this might be a contributing factor.

How to Check: Examine your credit card statements. Are the balances close to the limits? Aim to keep balances low compared to the credit limits to improve your score.

Length of Credit History

A shorter credit history can influence your score negatively. Assess the age of your oldest and newest accounts, as well as the average age of all your accounts. Consider whether you have recently opened new accounts.

How to Check: Review your credit report to understand the age of your accounts. Opening new accounts may impact your credit score, so it's important to consider this when assessing your score.

Credit Mix and New Credit

To have a good score, it's essential to have a variety of credit types and manage new credit responsibly.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Consider whether you have been applying for new credit sparingly, as multiple new credit applications can negatively impact your score.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score.

How to Check: Examine your credit report for any public records. If there are any listed items that require resolution, address them as soon as possible.

How Do I Improve my 553 Credit Score?

A credit score of 553 is considered poor, but don’t worry, there are steps you can take to improve it. Here are the most impactful and accessible strategies for your current score:

1. Address Past-Due Accounts

If you have any past-due accounts, it’s essential to bring them current. Start by focusing on paying off the most overdue accounts first, as they have the most significant negative impact on your credit score. Negotiating a payment plan with your creditors can also help.

2. Reduce Credit Card Balances

High credit card balances compared to your credit limit can significantly impact your score. Aim to lower your balances to below 30% of your credit limit, with a long-term goal of keeping them below 10%. Prioritize paying down the cards with the highest utilization rates first.

3. Consider a Secured Credit Card

Given your current score, qualifying for a regular credit card may be challenging. You could explore applying for a secured credit card, where you provide a cash collateral deposit that becomes your credit line. Use this card responsibly, making small purchases and paying off the balance in full each month to build a positive payment history.

4. Become an Authorized User

Ask a family member or friend with good credit if they can add you as an authorized user on their credit card. This can boost your score by incorporating their positive payment history into your credit report. Ensure that the card issuer reports authorized user activity to the credit bureaus for maximum impact.

5. Diversify Your Credit Mix

Having a diverse mix of credit accounts can contribute to improving your credit score. Once you have established a good payment history with a secured card, consider exploring other types of credit, such as a credit builder loan or a retail credit card. Remember to manage them responsibly and make timely payments.

By taking these steps, you can start working towards rebuilding your credit. Stay committed and focused on your financial goals, and you’ll be on your way to achieving the credit score you desire.