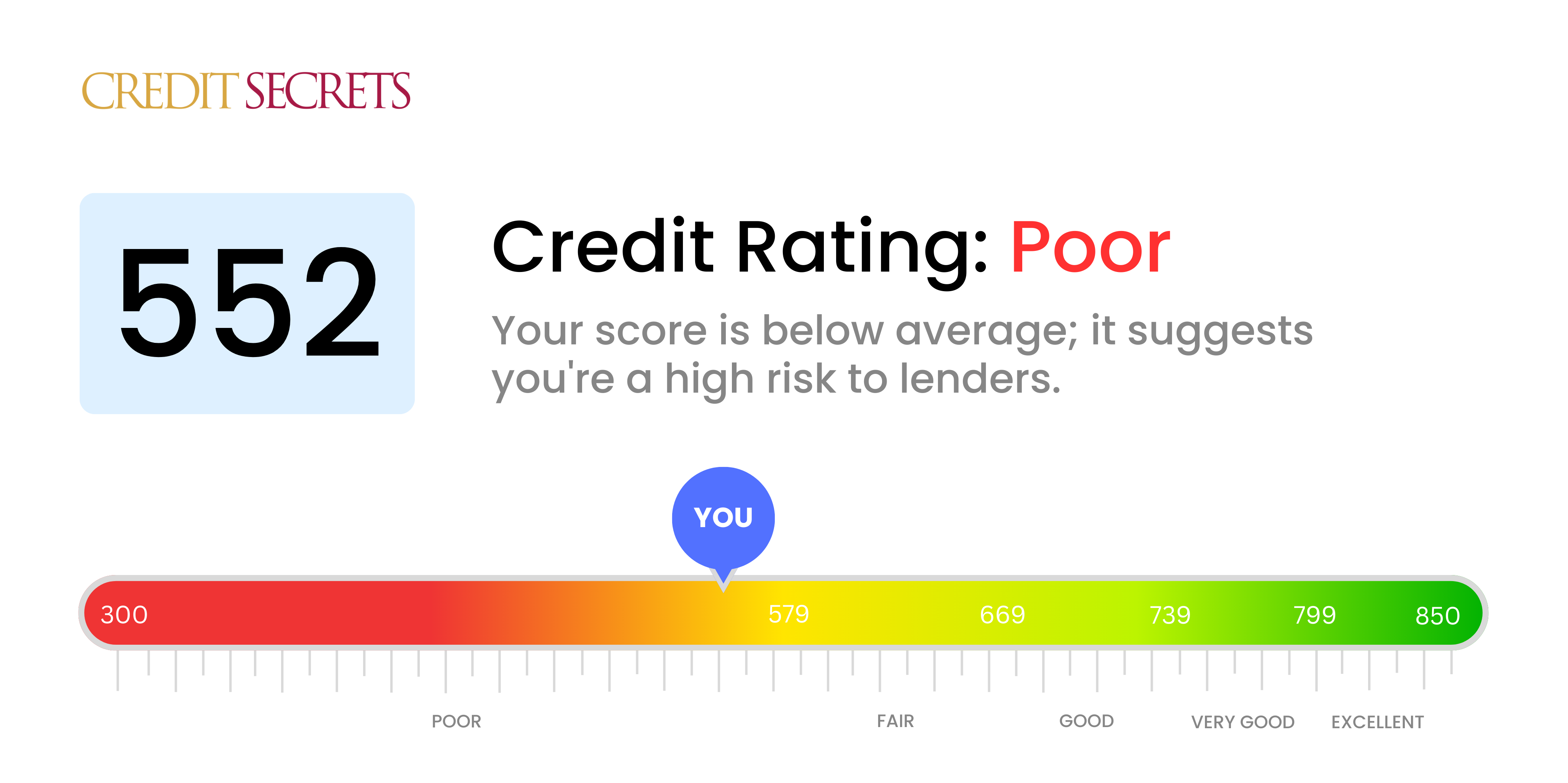

Is 552 a good credit score?

The credit score of 552 falls under the 'Poor' category. This means you may face difficulties when attempting to secure loans or credit, and you might find that lenders often charge higher interest rates due to the perceived risk they are taking.

However, a score isn't permanent, and just because it's 552 now, doesn't mean it'll stay that way. There are proven strategies you can employ to improve this score, such as timely payment of debts, maintaining low balance on your credit cards, and avoiding new debts. With consistent effort, you're capable of improving your credit health and moving towards a brighter financial future.

Can I Get a Mortgage with a 552 Credit Score?

Can I Get a Credit Card with a 552 Credit Score?

Can I Get a Car Loan with a 552 Credit Score?

What Factors Most Impact a 552 Credit Score?

Understanding a score of 552 is crucial for mapping out your journey toward financial improvement. Identifying and addressing the factors contributing to this score can pave the way for a healthier financial future. Remember, every financial journey is unique, filled with growth and learning opportunities.

Payment History

Your payment history has a significant impact on your credit score. Late payments or defaults may have played a key role in your score.

How to Check: Review your credit report for any instances of late payments or defaults. Reflect on any delayed payments and take steps to avoid them in the future.

Credit Utilization

High credit card balances that are close to the limits can negatively affect your score.

How to Check: Examine your credit card statements. Are the balances near their limits? Aim to keep your balances low compared to your credit limits.

Length of Credit History

A shorter credit history can have a negative impact on your score.

How to Check: Review your credit report to assess the age of your oldest and newest accounts, as well as the average age of all your accounts. Consider whether you have recently opened new accounts.

Credit Mix and New Credit

Having a variety of credit types and managing new credit responsibly are essential for a good score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Additionally, consider whether you have been applying for new credit sparingly.

Public Records

Public records like bankruptcies or tax liens can significantly impact your score.

How to Check: Examine your credit report for any public records. Address any listed items that may require resolution.

How Do I Improve my 552 Credit Score?

A credit score of 552 is considered poor, but with targeted steps, improvement is achievable. Here are the most impactful and accessible strategies for this score level:

1. Address Past-Due Accounts

If you have any accounts that are past due, bringing them current should be your first priority. Work on paying off the most overdue accounts first, as they have the most significant negative impact on your credit score. Reach out to your creditors to negotiate a payment plan if necessary.

2. Reduce Credit Card Balances

High credit card balances relative to your credit limit can significantly affect your credit score. Aim to reduce your credit card balances to below 30% of your credit limit, with a longer-term goal of keeping them below 10%. Prioritize paying down the cards with the highest utilization rates first.

3. Secured Credit Card

Given your current score, qualifying for a regular credit card might be challenging. Consider applying for a secured credit card, which requires a cash collateral deposit that serves as the credit line for that account. Use it responsibly, making small purchases and paying off the balance in full each month to build a positive payment history.

4. Become an Authorized User

Ask a family member or a friend with good credit if you can be added as an authorized user on their credit card. This can help improve your credit score by incorporating their positive payment history into your credit report. Ensure that the card issuer reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Mix

A diverse mix of credit accounts can contribute to improving your credit score. Once you have established a good payment history with a secured card, explore other types of credit, such as a credit builder loan or a retail credit card, and manage them responsibly.