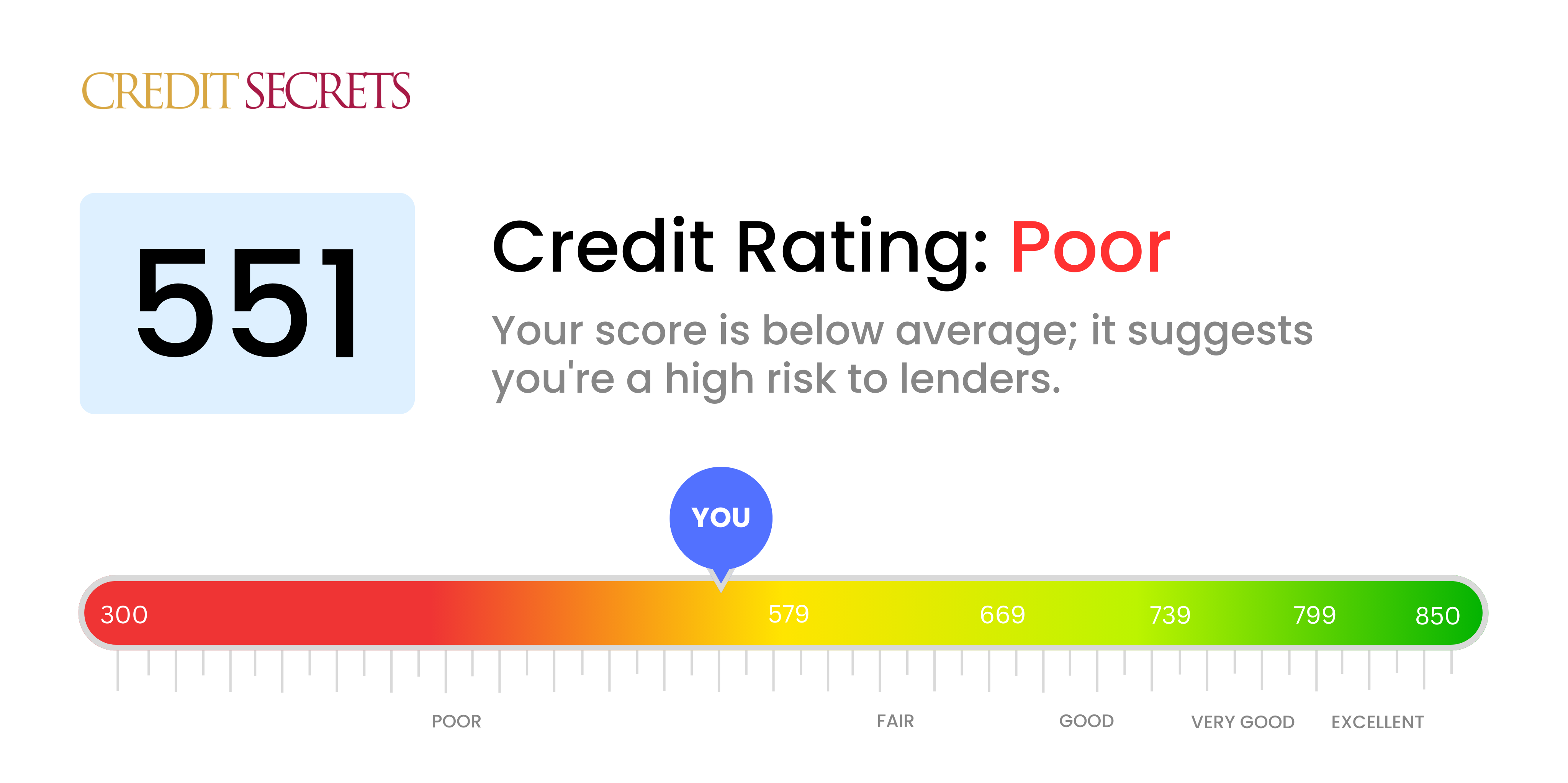

Is 551 a good credit score?

Unfortunately, a score of 551 would be considered a poor credit score. However, don't lose hope, it's possible to turn this situation around.

With a score of 551, you might find securing credit or loans to be a bit more challenging. Lenders may see you as a higher risk, leading to higher interest rates and stricter loan terms. But this is just a snapshot of your financial health and not a final verdict. There are many strategies for improving your credit score, and with hard work and consistency, it's entirely feasible to change this scenario for the better.

Can I Get a Mortgage with a 551 Credit Score?

With a credit score of 551, it is unlikely that you will be approved for a mortgage. While this score is not as low as some, it still falls below the minimum requirements of many lenders. A credit score in this range suggests that you may have had some financial difficulties or missed payments in the past.

We understand that this may be disappointing news, but it's important to remember that there are alternatives to a traditional mortgage. You may want to consider exploring other options such as rent-to-own agreements or working with a reputable housing agency that specializes in assisting individuals with lower credit scores.

Improving your credit score should also be a priority. Start by addressing any outstanding debts or delinquencies that are negatively affecting your score. Take steps to establish a history of on-time payments and responsible credit use. With consistent effort, you can improve your credit score and increase your chances of being approved for a mortgage in the future.

Can I Get a Credit Card with a 551 Credit Score?

With a credit score of 551, it may be challenging to be approved for a traditional credit card. Lenders often perceive this as a moderately high-risk score, indicating a history of financial difficulties or mismanagement. While this news can be disheartening, it is crucial to approach the situation with understanding and a realistic mindset. Taking stock of your credit status is the first step towards overcoming any setbacks and achieving financial well-being.

Considering the difficulties posed by this score, it might be worth exploring alternative options like secured credit cards. These cards typically require a deposit that acts as your credit limit and can be easier to obtain, helping you rebuild your credit over time. Another option worth looking into is finding a co-signer or exploring the use of prepaid debit cards. While these alternatives may not provide an instantaneous fix, they can serve as essential tools to guide you on your path towards financial stability. It's important to note that interest rates on credit available to individuals with such scores tend to be higher, reflecting the perceived risk for lenders.

Can I Get a Car Loan with a 551 Credit Score?

With a credit score of 551, obtaining approval for a car loan can be quite challenging. Lenders usually prefer scores above 660 for favorable terms, and a score below 600 is typically considered subprime. Your credit score falls into this subprime category, which may lead to higher interest rates or even loan denial. This is because a lower credit score suggests a higher risk to lenders, as it indicates potential difficulties in repaying borrowed money.

However, don't lose hope. While it may be more difficult, it's not impossible to secure a car loan with a credit score of 551. Some lenders specialize in working with individuals who have lower credit scores. Nevertheless, it's important to exercise caution, as these loans often come with significantly higher interest rates. These increased rates are a way for lenders to protect their investment and account for the perceived risk. Although the journey may be challenging, by carefully considering and exploring the terms, you can still make your car purchasing dreams a reality.

What Factors Most Impact a 551 Credit Score?

Understanding a credit score of 551 is crucial for taking control of your financial future. By identifying the factors influencing your score, you can make informed decisions to improve it and achieve your goals. Remember, everyone's financial journey is unique, filled with opportunities for growth and progress.

Payment History

Your payment history has a significant impact on your credit score. Late payments or defaults may be contributing factors affecting your score.

How to Check: Review your credit report for any instances of late payments or defaults. Reflect on your payment habits to see if there have been any delays that might have influenced your score.

Credit Utilization

High credit utilization can have a negative effect on your score. If your credit card balances are close to their limits, this could be a contributing factor to your current score.

How to Check: Examine your credit card statements to determine if your balances are nearing their limits. Maintaining lower balances compared to the limit can have a positive impact.

Length of Credit History

A shorter credit history can negatively influence your score. Consider the age of your oldest and newest accounts, as well as the average age of all your accounts. Opening new accounts recently may also impact your score.

How to Check: Review your credit report to assess the age of your accounts and consider any recent account openings.

Credit Mix and New Credit

Having a diverse mix of credit types and responsibly managing new credit are essential for a good score.

How to Check: Evaluate your credit mix, including credit cards, retail accounts, installment loans, and mortgage loans. Also, reflect on whether you have been applying for new credit sparingly.

Public Records

Public records such as bankruptcies or tax liens can significantly impact your credit score.

How to Check: Examine your credit report for any public records and take necessary action to resolve any items listed.

How Do I Improve my 551 Credit Score?

Your credit score of 551 falls into the poor range, but don’t worry – there are targeted steps you can take to improve it. Here are the most impactful and accessible strategies for your current score:

1. Address Past-Due Accounts

First and foremost, tackle any accounts that are past due. These accounts have a significant negative impact on your credit score. Start by paying off the most overdue ones as soon as possible. You can even try negotiating a payment plan with your creditors if needed.

2. Reduce Credit Card Balances

High credit card balances relative to your credit limit can greatly affect your score. Aim to lower your credit card balances to below 30% of your credit limit, with a goal of eventually keeping them under 10%. Begin by paying down the cards with the highest utilization rates to make a noticeable improvement.

3. Apply for a Secured Credit Card

Considering your current score, qualifying for a regular credit card might be challenging. Instead, apply for a secured credit card. This type of card requires a cash collateral deposit that serves as your credit line. Use it responsibly by making small purchases and paying off the balance in full each month to build a positive payment history.

4. Seek Authorization as an Authorized User

Reach out to a family member or friend with good credit and ask them to add you as an authorized user on their credit card. This can help boost your score by incorporating their positive payment history into your credit report. Just ensure that the card issuer reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Mix

Having a diverse mix of credit accounts can contribute to improving your score. Once you have established a good payment history with a secured card, consider exploring other types of credit, such as a credit builder loan or a retail credit card. Manage these new accounts responsibly to demonstrate your creditworthiness.

By following these steps, you can begin the journey to improving your credit score and achieving your financial goals. Remember, with determination and a solid plan, progress is within reach.