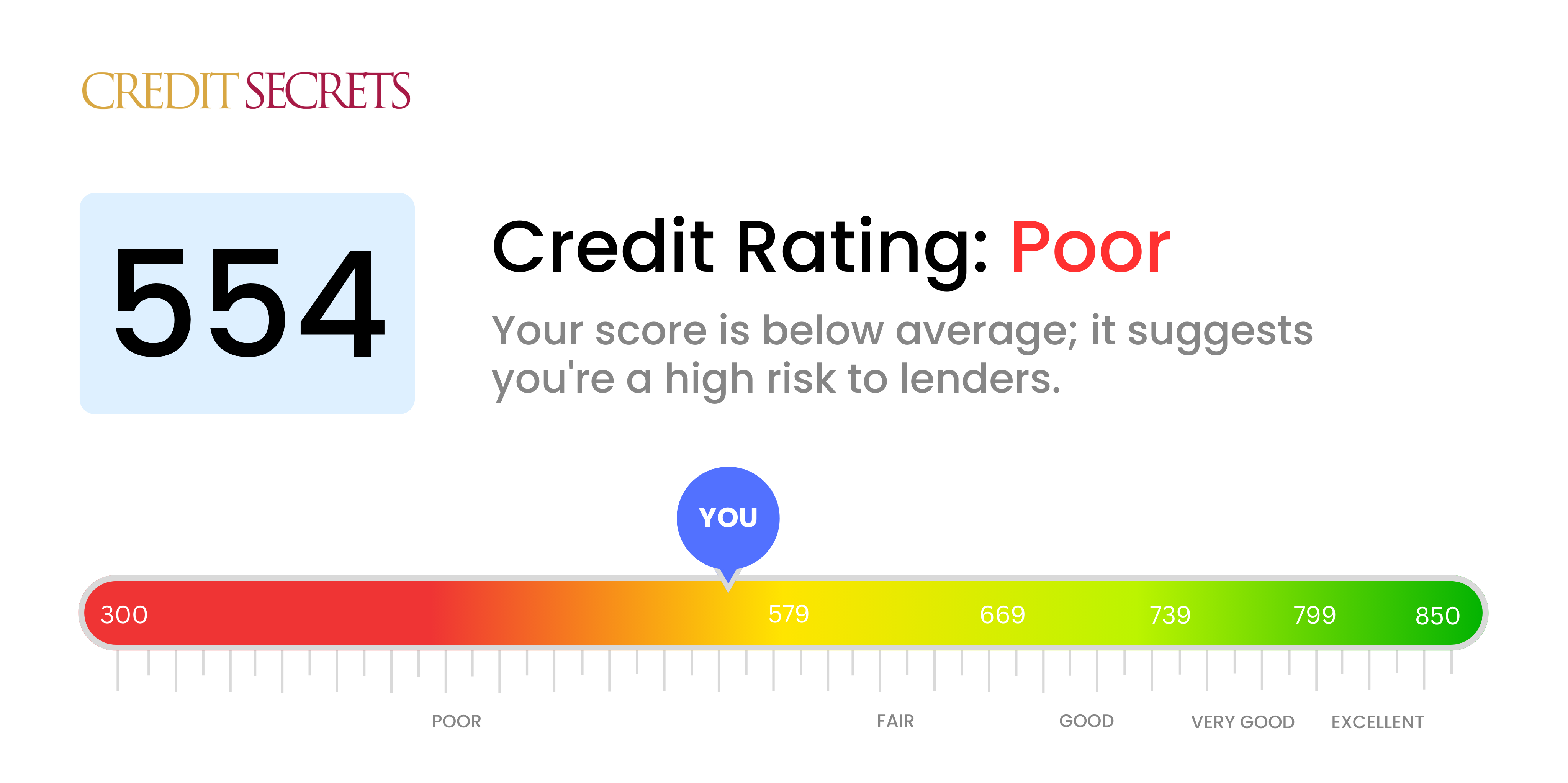

Is 554 a good credit score?

A credit score of 554 falls within the 'poor' range. This score is not ideal and might come with challenges including potential difficulty in acquiring loans, higher interest rates, and possible security deposits requirements for utilities or rentals.

However, you should not be discouraged. Specific actions like timely bill payment, decreasing debt, and refraining from creating new debt can significantly contribute to improving this score. In the Credit Secrets program, you can find more simple and effective strategies for credit enhancement. Remember, a financial setback is not a life sentence, and with focus and diligence progress can be made to improve your credit score.

Can I Get a Mortgage with a 554 Credit Score?

Can I Get a Credit Card with a 554 Credit Score?

With a credit score of 554, it can be challenging to get approved for a traditional credit card. Lenders perceive this score as moderate risk, indicating a history of financial issues or troubles. Even though this news might be disappointing, it's crucial to approach it with a realistic perspective. Understanding your credit status is the initial step towards financial improvement, even if it means confronting some inconvenient facts.

Due to the difficulties associated with a score like this, you might want to consider alternative options such as secured credit cards. These cards require a deposit as collateral, making them easier to obtain and helping you rebuild credit over time. Exploring the possibility of a co-signer or looking into pre-paid debit cards could also be viable alternatives. Remember, though these options won't provide an instant fix, they serve as valuable tools on your journey towards financial stability. Lastly, keep in mind that interest rates on any form of credit available to individuals with similar scores tend to be significantly higher, reflecting the perceived risk for lenders.

A credit score of 554 is significantly below the standard range that most traditional lenders consider acceptable for approving a personal loan. In the eyes of a lender, a score this low represents a high level of risk, making it unlikely that you would be approved for a loan under conventional terms. The situation is undoubtedly challenging, but it's important to face the reality of what this credit score implies for your borrowing options.

If traditional loans are off the table, you might consider alternatives like secured loans, where you provide collateral, or co-signed loans, where someone with better credit vouches for you. Peer-to-peer lending platforms are another option, as they sometimes offer more lenient credit requirements. However, it's crucial to understand that these alternatives often come with higher interest rates and less favorable terms, reflecting the higher risk to the lender.

Can I Get a Car Loan with a 554 Credit Score?

What Factors Most Impact a 554 Credit Score?

Payment History

Your payment history has a significant impact on your credit score. Late payments or defaults may be the key contributors to your score.

How to Check: Review your credit report for any instances of late payments or default. Take note of any delayed payments, as they could have affected your score.

Credit Utilization

High credit utilization can negatively affect your score. If your credit cards are approaching their limits, this could be a contributing factor to your score.

How to Check: Examine your credit card statements and observe if the balances are close to the limits. Aim to keep your balances low compared to the credit limits for a positive impact on your score.

Length of Credit History

A shorter credit history can have a negative influence on your score.

How to Check: Assess the age of your oldest and newest accounts, as well as the average age of all your accounts, by reviewing your credit report. Consider if you have recently opened new accounts, as this can impact your score negatively.

Credit Mix and New Credit

Holding a variety of credit types and managing new credit responsibly is vital for a good score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Also, consider if you have been applying for new credit sparingly, as excessive applications can negatively impact your score.

Public Records

Public records, such as bankruptcies or tax liens, can significantly affect your score.

How to Check: Examine your credit report for any public records. If any items require resolution, take the necessary steps to address them accordingly.

Understand that improving your credit score takes time and effort. By being proactive and addressing the factors contributing to your current score, you can start the journey towards better financial health.How Do I Improve my 554 Credit Score?

A credit score of 554 is considered poor, but there are actionable steps you can take to see improvement. Here are the most impactful and accessible strategies for your current situation:

1. Address Past-Due Accounts

If you have any accounts that are past due, it’s crucial to make them current. Start by prioritizing the most overdue accounts as they have the biggest negative impact on your credit score. Consider negotiating a payment plan with your creditors if necessary.

2. Reduce Credit Card Balances

High credit card balances relative to your credit limit can significantly affect your score. Aim to lower your credit card balances to below 30% of the credit limit, with a long-term goal of keeping them under 10%. Begin by paying down the cards with the highest utilization rates first.

3. Consider a Secured Credit Card

Given your current score, qualifying for a regular credit card may be challenging. Explore applying for a secured credit card, which requires a cash collateral deposit that serves as your credit line. Use it responsibly, making small purchases and paying off the balance in full each month to build a positive payment history.

4. Seek to Become an Authorized User

Ask a family member or friend with good credit if they would add you as an authorized user on their credit card. This can help improve your credit score by incorporating their positive payment history into your credit report. Ensure that the card issuer reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Mix

A diverse mix of credit accounts can contribute to improving your score. Once you’ve built a good payment history with a secured card, explore other types of credit such as a credit builder loan or a retail credit card. Remember, responsible management is key.

By following these steps, you can begin your journey towards a better credit score and achieve your financial goals. Take control of your credit today with Credit Secrets.