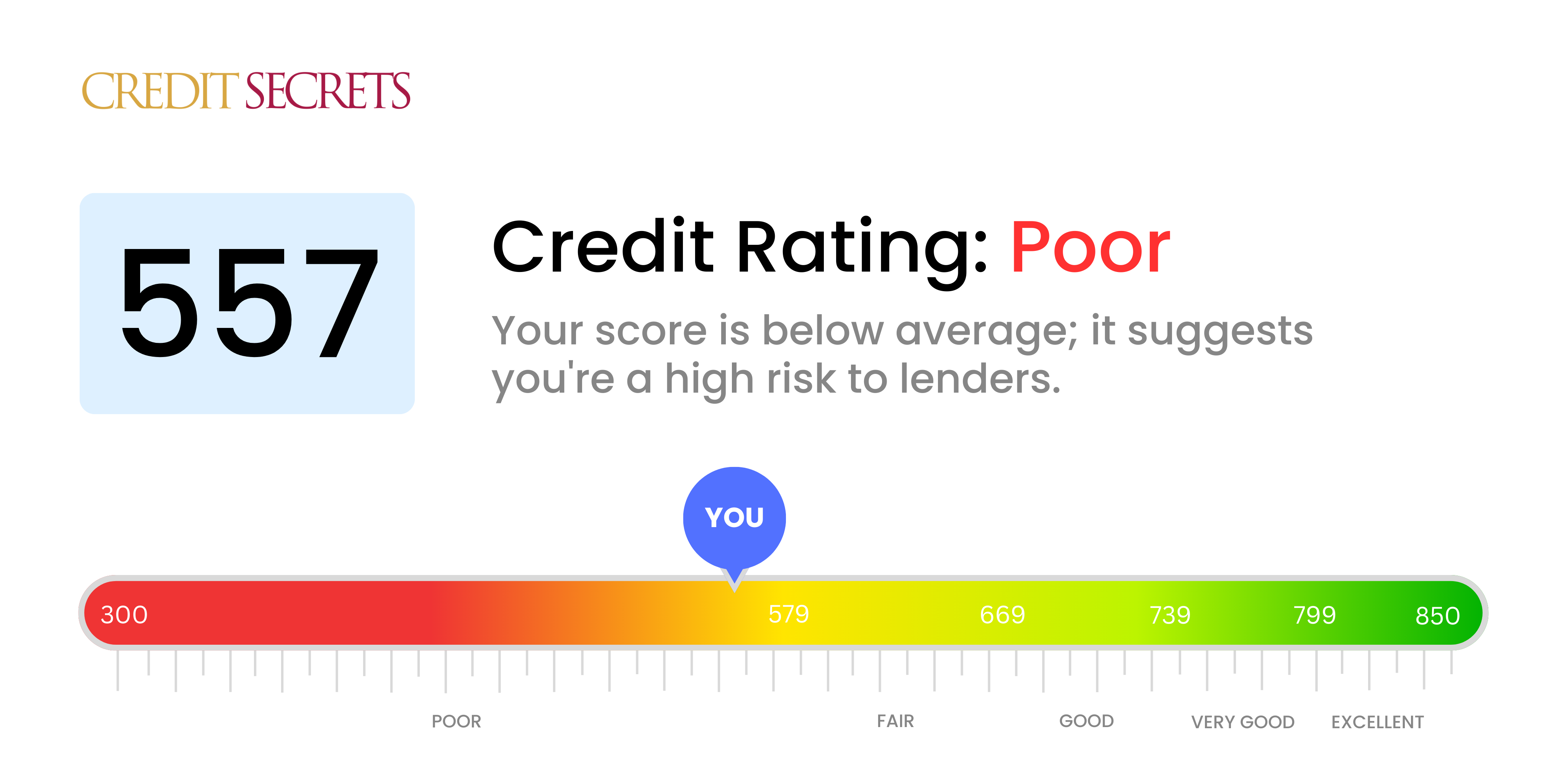

Is 557 a good credit score?

With a score of 557, your credit score is deemed poor. This might present challenges such as getting credit card approvals or securing loans from desired lenders.

Although it might seem daunting, don't despair—we've seen many others turn ratings like this around. You may find higher interest rates on loans and credit cards until your score improves, but there's always opportunity for growth. Let's think of this as your starting-point for developing better credit habits and laying the groundwork for a more secure financial future.

Can I Get a Mortgage with a 557 Credit Score?

Can I Get a Credit Card with a 557 Credit Score?

Can I Get a Car Loan with a 557 Credit Score?

With a credit score of 557, obtaining approval for a car loan can be quite challenging. Lenders typically prefer borrowers with scores above 660 for more favorable terms, and a score below 600 is often considered subprime. Unfortunately, your credit score falls within this subprime range, which may lead to higher interest rates or even loan denial. It's essential to understand that a lower credit score represents a higher risk to lenders, as it indicates possible difficulties in repaying borrowed money.

However, don't lose hope just yet. While it may be more difficult, securing a car loan with a credit score of 557 is not impossible. Some lenders specialize in working with individuals who have lower credit scores. It's crucial to approach these lenders with caution, as they often offer loans with significantly higher interest rates. This increase in rates is a way for lenders to protect their investment due to the perceived risk involved. Despite the potential bumpy road, with careful consideration and thorough examination of the loan terms, you can still make your car purchasing dreams a reality.

What Factors Most Impact a 557 Credit Score?

Understanding a score of 557 is crucial for mapping out your journey toward financial improvement. Identifying and addressing the factors contributing to this score can pave the way for a healthier financial future. Remember, every financial journey is unique, filled with growth and learning opportunities.

Payment History

Payment history has a significant impact on your credit score. Late payments or defaults could be key contributing factors.

How to Check: Review your credit report for any instances of late payments or defaults. Reflect on any delayed payments that may have affected your score.

Credit Utilization

High credit utilization can negatively affect your score. If your credit cards are close to their limits, this might be a contributing factor.

How to Check: Examine your credit card statements. Are your balances near the credit limits? Aim to keep your balances low compared to the limit for a positive impact on your score.

Length of Credit History

A shorter credit history can have a negative influence on your score.

How to Check: Review your credit report to assess the age of your oldest and newest accounts, as well as the average age of all your accounts. Consider whether you have recently opened new accounts.

Credit Mix and New Credit

Having a variety of credit types and managing new credit responsibly are essential for a good score.

How to Check: Evaluate your mix of credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Consider whether you have been applying for new credit sparingly.

Public Records

Public records like bankruptcies or tax liens can significantly affect your score.

How to Check: Examine your credit report for any public records. If there are any items listed that need resolution, address them accordingly.

How Do I Improve my 557 Credit Score?

A credit score of 557 indicates a poor credit standing, but don’t lose hope. With focused efforts, you can definitely improve your score. Take these accessible and impactful steps to start your credit journey:

1. Tackle Past-Due Accounts

Prioritize resolving any past-due accounts as a first step. Start by bringing the most overdue accounts up to date, as they have the most detrimental impact on your score. Consider negotiating a payment plan with your creditors if needed.

2. Trim Credit Card Balances

High credit card balances compared to your limit can strongly impact your credit score. Aim to reduce your credit card balances to below 30% of your limit, with a long-term goal of keeping them below 10%. Begin by paying down the cards with the highest utilization rates.

3. Explore Secured Credit Cards

Since qualifying for a regular credit card may be challenging at your current score, consider applying for a secured credit card. This type of card requires a cash collateral deposit, which serves as your credit line. Use it responsibly by making small purchases and paying the balance in full each month to establish a positive payment history.

4. Seek Authorization as a User

Reach out to a trusted family member or friend with good credit and ask if they can add you as an authorized user on one of their credit cards. This can improve your credit score by incorporating their positive payment history into your own credit report. Ensure that the card issuer reports authorized user activity to the credit bureaus.

5. Diversify Your Credit Mix

A diverse mix of credit accounts can contribute to improving your credit score over time. Once you have established a good payment history with a secured card, consider exploring other types of credit, such as a credit builder loan or a retail credit card, and manage them responsibly.

Fear not, with determination and these actionable steps, you can make strides towards a better credit future. Let Credit Secrets be your guide on this empowering journey.