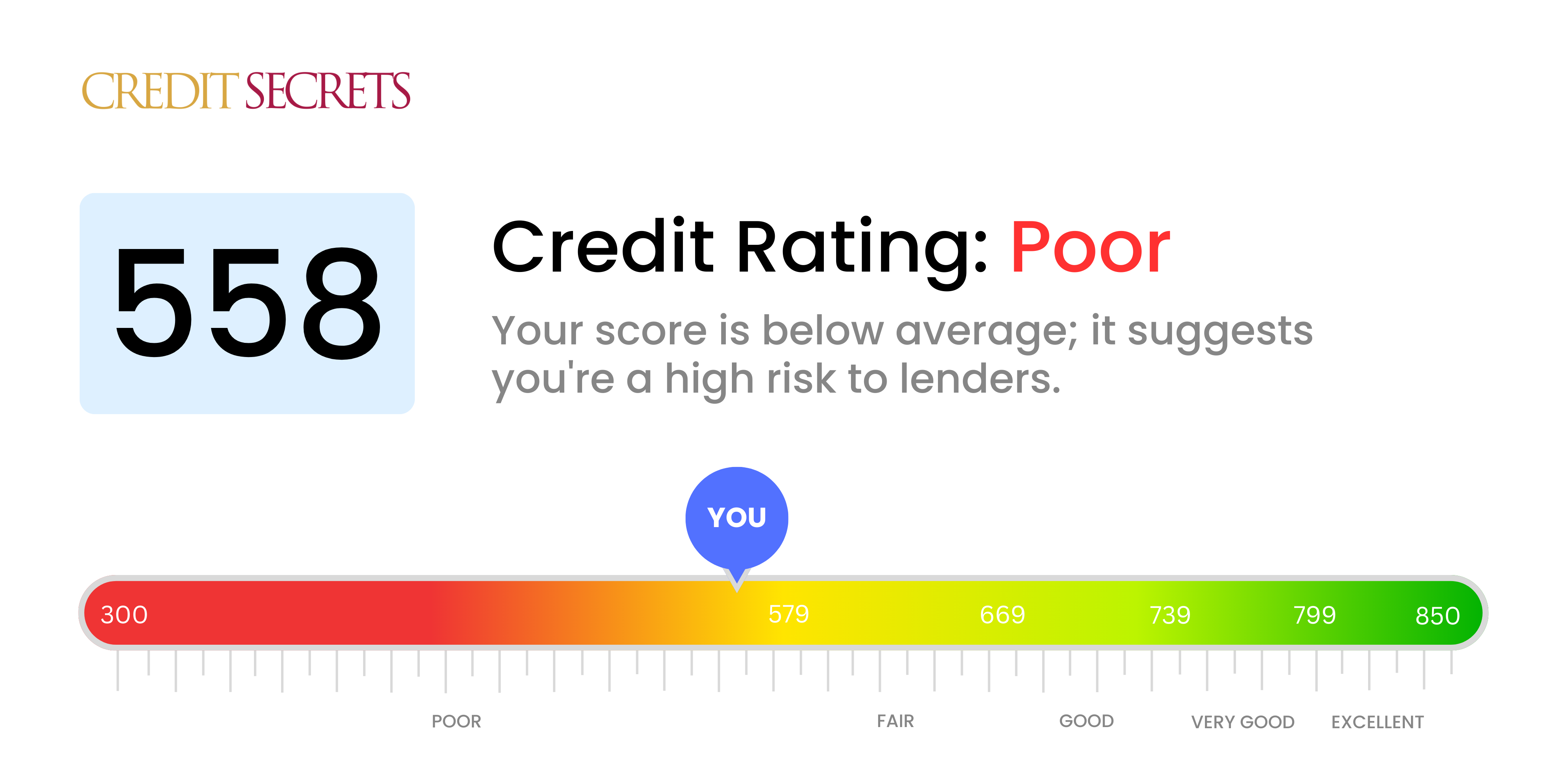

Is 558 a good credit score?

With a credit score of 558, you unfortunately fall into the 'Poor' category according to common credit score ranges. However, it's important not to lose hope. While this means you might find it quite challenging to get new credit and may face higher interest rates when you do, it is by no means a permanent situation. Improving your score is very possible and can open the door to better financial opportunities.

You can expect some roadblocks if you're seeking a loan or credit card with a 558 score; it indicates to lenders you've had significant credit issues in the past or potentially ongoing. But with patience, good financial habits, and a commitment to understanding your credit, you can change this. Remember, a low score doesn't define you or your worth - it's just an opportunity for improvement.

Can I Get a Mortgage with a 558 Credit Score?

A credit score of 558, while not the lowest, falls into the category of 'poor.' It may prove challenging to secure a mortgage loan approval with this score, as it suggests potential financial struggles from the past. Lenders often consider it as a sign of risk when deciding whether to loan funds.

Don't get discouraged, though. It's essential to keep in mind that each lender has different standards, and there is no definitive 'yes' or 'no' credit score for mortgage approval. While your chances might be slim with traditional lenders, other institutions might consider factors beyond your credit score, like employment history or down payment size. Also, certain types of government-backed loans, like FHA loans, are designed for individuals with lower credit scores.

However, securing a loan with such a credit score might result in higher interest rates. This is because lenders often offset the risk of loaning money to individuals with lower scores by charging them more in interest. Therefore, improving your credit score remains crucial to increase your chances of securing more favorable loan terms.

Can I Get a Credit Card with a 558 Credit Score?

Having a credit score of 558 may pose certain difficulties when trying to secure a traditional credit card. This score signals to lenders a potential risk and might indicate past credit mismanagement. It is not the most favorable news to bear, but understanding and accepting your current credit standing is key to improving your financial health.

With a credit score in this range, it may be wise to consider alternative methods of building credit, such as opting for a secured credit card. These types of cards ask for an upfront deposit, which serves as your credit limit. They are often easier to qualify for and can steadily help improve your credit score. Other alternatives could include seeking a co-signer or using prepaid debit cards. Do keep in mind, the interest rates for any credit options that might be available with a 558 score are likely to be high, due to the heightened risk perceived by moneylenders. While these may not be instantaneous solutions, they form essential building blocks in your path to better financial stability.

With a credit score of 558, it is often seen as a high-risk range by most mainstream lenders when considering personal loan approval. This score can make it difficult for you to secure a loan in a conventional manner. We understand that this may feel overwhelming, but it's crucial to recognize what a score like this means for your borrowing abilities.

Given this scenario, exploring alternatives such as secured loans might be beneficial. These loans require collateral as a form of security. Another possibility might be a co-signed loan where a person with a stronger credit standing backs your loan. Peer-to-peer lenders can sometimes provide a little more flexibility with credit score requirements. However, it's essential to be aware that while these options are available, they typically come with higher interest rates and tougher conditions to mirror the elevated lending risk. Remember, it's crucial to thoroughly understand the terms of these alternatives before proceeding.

Can I Get a Car Loan with a 558 Credit Score?

With a credit score of 558, the path to getting approved for a car loan can be quite tough. This is due to the fact that lenders usually favor credit scores above 660, and a score falling under 600 is frequently thought of as subprime. Your credit score of 558 puts you in this subprime category, which can result in higher interest rates or even being declined a loan. The reason behind this is simple: a lower credit score portrays a higher risk to lenders, as it suggests potential issues with repaying the loan.

However, do not lose hope - a lower credit score doesn't mean you can never own a car. There are some lenders that specifically cater to those with lower scores, but it's important to note that their loans often come with considerably higher interest rates. This is their way of protecting their investment against the increased risk. It's definitely tougher to secure a car loan with a less-than-ideal credit score, but with careful thought and understanding of the loan terms, it's still achievable.

What Factors Most Impact a 558 Credit Score?

Grasping the implications of a 558 credit score is an essential part of your financial revitalization journey. Delving into the key factors that could have contributed to this score will grant you the knowledge to shift towards a stronger credit position. Each credit enhancement journey is unique, with opportunities for growth and education.

Punctuality of Payments

Your payment history carries a significant weight in shaping your credit score. Hence, delayed payments or non-payment might have contributed to your current score.

To Check: Thoroughly scrutinize your credit report for late payments, or any other irregularities that have not been settled.

Level of Credit Utilization

An elevated rate of credit utilization can negatively impact your score. If you are carrying high balances on your cards, this is likely to be a factor.

To Check: Refer to your credit card statements. If your balances are alarmingly close to their limits, this calls for corrective measures.

Credit History Span

A brief credit history could impose a negative effect on your score.

To Check: Take a look at your credit report to evaluate the duration of your oldest and newest accounts along with the mean age of all your accounts. Consider if you have recently inaugurated new accounts.

Diversity of Credit and New Credit Management

Handling various types of credit and responsibly managing new credit crucially influences your score.

To Check: Study your mix of credit accounts, which would include credit cards, store accounts, installment loans, and house loans. Consider if you have kept a check on the frequency of new credit applications.

Public Records

Public records such as bankruptcy filings or tax liens can severely impact your score.

To Check: Rummage through your credit report for any public records. Make it a point to tackle any listed items that require resolution.

How Do I Improve my 558 Credit Score?

Carrying a credit score of 558 suggests that there’s room for improvement on your credit health journey. Remember, credit rebuilding is an achievable goal that can be reached with the right steps. Here are some strategic actions you could consider:

1. Review Your Credit Report

Begin by ordering a free copy of your credit report. Look for any errors, such as incorrect late payments or outstanding debts. If you find any inaccuracies, dispute them directly with the credit bureau to have them corrected.

2. Settle Overdue Payments

Overdue payments have the most significant adverse impact on your credit score. Seek to clear these first. If you’re unable to pay the total amount, consider contacting your creditors to discuss renegotiating your payment terms.

3. Add To Your Credit Types

Taking on different types of credit can boost your score, if managed wisely. Once you have a history of timely payments on a secured credit card, consider applying for a retail credit card or a credit builder loan, depending on your financial comfort level.

4. Consider A Secured Credit Card

Applying for a secured credit card could help your score. These cards demand a refundable cash deposit, which sets your credit limit for that account. Use your card wisely, clearing your balance each month to demonstrate positive financial behavior.

5. Explore Becoming an Authorized User

Being added as an authorized user on a credit card owned by a trusted person with a healthy credit history could benefit your credit score. Make sure the credit card provider reports authorized user activity to credit reporting agencies.

Stay disciplined, stay focused. Note progress may be gradual, but each positive step brings you closer to your credit score goals.