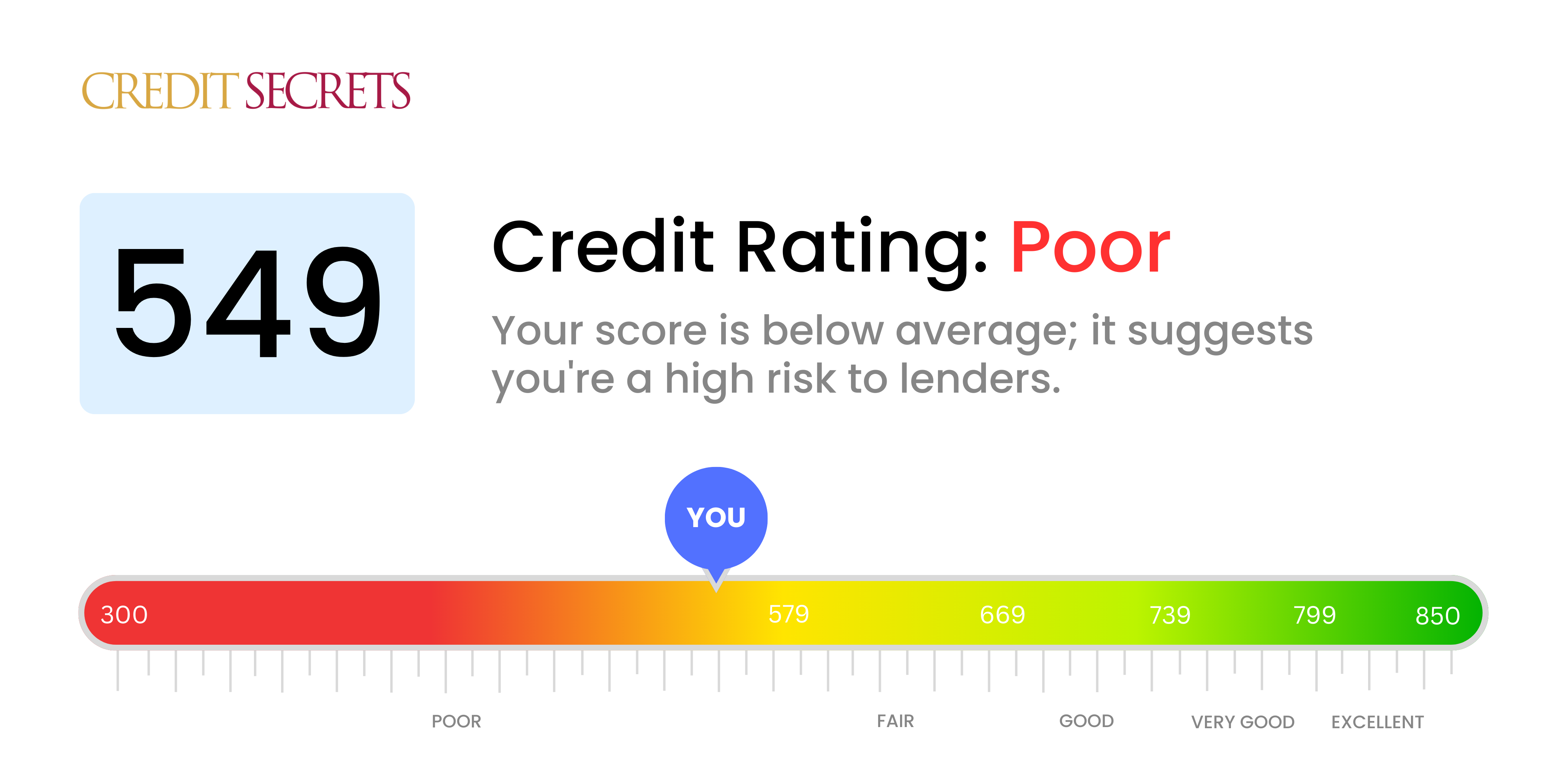

Is 549 a good credit score?

Having a credit score of 549 means your credit health falls into the 'poor' category. This isn't an ideal situation, but don't lose hope, there are steps you can take to improve your score.

Expect that borrowing money might be challenging with a 549 credit score. This can potentially result in higher interest rates and stricter terms on loans or credit cards. You might also encounter difficulties while trying to rent a house or get utilities without a deposit. But remember, your credit score isn't fixed, each step you take towards financial responsibility can help raise it over time.

Can I Get a Mortgage with a 549 Credit Score?

A credit score of 549 puts you in a difficult position when seeking approval for a mortgage. This score is considered low, and lenders might be wary of offering a loan due to the perceived high risk. This credit score could signify a pattern of missed or late payments, which cause lenders to doubt your ability to meet future mortgage repayments on time.

Despite the sobering news, it's essential to remain hopeful. There are alternatives to consider. For instance, the Federal Housing Administration (FHA) is known to approve applicants with less favorable credit scores, but it comes with terms such as higher interest rates and a substantial down payment. Another possibility could be working with a local credit union; they often offer flexibility for those with less-than-perfect scores. Still, it is essential to take time to rebuild your credit by paying bills on time and managing debts responsibly for a better financial future. Remember, improving your credit score is a journey that takes time but will eventually pay off.

Can I Get a Credit Card with a 549 Credit Score?

With a credit score of 549, it's going to be tough to be approved for a conventional credit card. This score may signal to lenders that you're a high-risk candidate, perhaps due to past financial struggles or lack of credit history management. It might be hard to hear, but understanding your situation is key. Acknowledging your credit status is a crucial first step towards financial recovery, even though it might bring up some uncomfortable facts.

Considering your low score, you could look into options like a secured credit card, where a deposit becomes your credit limit. This kind of card may be less difficult to get and can help you rebuild your credit gradually. A co-signer or even prepaid debit cards might also be useful alternatives. Although these choices won't instantaneously improve your situation, they can support your journey to financial health. It's also important to bear in mind that interest rates are likely to be quite high with a score like 549, reflecting the increased risk lenders attribute to lending to you.

With a credit score of 549, obtaining a traditional personal loan may be a difficult task. Lenders typically consider this score as high risk, limiting the probability of your loan approval. It's a tough situation, but it's crucial to understand the implications of your credit score on your borrowing capacity.

You might still have options, though. Consider alternatives like secured loans where collateral is needed, or loans co-signed by someone with a higher credit score. You can also explore peer-to-peer lending, which may have softer credit requirements. Remember, such alternatives usually bear higher interest rates and less favorable terms due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 549 Credit Score?

Having a credit score of 549 certainly makes securing a car loan more difficult. Most lenders prefer to work with borrowers who have credit scores above 660. Unfortunately, your score is below 600, placing it in what's known as the subprime range. Lenders often view this as a signal of higher risk, which could lead to a denial of the loan application or, at best, an offer with higher interest rates.

But this score is not the end of your car financing journey. There are lenders who specialize in helping those with lower credit scores. While these loans are often accompanied by higher interest rates to counterbalance the increased risk, they can provide a viable path to car ownership. It's crucial to carefully consider all options and thoroughly understand the terms before moving forward. Securing a car loan with a score of 549 may be challenging, yet it's not out of reach.

What Factors Most Impact a 549 Credit Score?

Understanding your credit score of 549 is the first step on your path to financial improvement. Let's focus on a few aspects that could be impacting your score. Each financial journey is unique, but being proactive can lead to financial progress.

Payment History

Consistent, on-time payments significantly affect your score. If you've had delinquent payments or defaults, this might be impacting your 549 credit score.

How to Check: Scrutinize your credit report for any signs of delinquent payments or defaults. Delays or missed payments could have contributed to your current score.

Credit Utilization

Carrying high balances on your credit cards can negatively affect your score. If your balances are close to the limits, this could be a factor behind your 549 score.

How to Check: Look over your credit card statements. Aim for low balances relative to your credit limit to help boost your score.

Length of Credit History

Limited credit history can sometimes result in less-than-stellar scores. If you have only recently started building credit, this may explain your 549 score.

How to Check: Review your credit report to understand the age of your accounts. Recent new accounts might have lowered your score.

Credit Mix

Maintaining a variety of credit types responsibly can improve your score. Lack of diversity in your credit portfolio could be influencing your 549 score.

How to Check: Examine your credit report for the types of credit you have, such as credit cards, personal loans, and mortgages. Strategically diversify your credit mix where possible.

Public Records and Collection

Public records like bankruptcies, collection, or liens can severely lower your score. If you have any such records, these would be critical in understanding your 549 score.

How to Check: Scrutinize your credit report for any public records. Work towards resolving any outstanding items.

How Do I Improve my 549 Credit Score?

Your credit score of 549 will require attention, but don’t fret! Here are some helpful steps specifically designed for your situation to boost your score:

1. Pay Off Past Dues

It’s essential to clear any overdue balances you have. Those contribute significantly to a poor score. Prioritize those that are significantly late and contact your creditors to establish a payment schedule that suits your budget.

2. Minimize Credit Card Balances

High credit card balances can detrimentally affect your score. Always aim for less than 30% of your limit, but an ideal goal would be 10%. Start with the cards that are closest to their limit.

3. Try a Secured Credit Card

With your current score, a conventional credit card might seem a tall order. However, a secured credit card – backed by a cash deposit, which equals your credit line – could be a realistic alternative. Be sure to use this card responsibly to build good credit habits.

4. Become an Authorized User

If you know someone with a solid credit history, request to become an authorized user on their card. This strategy can augment your credit report with their good habits. Remember, the card issuer needs to report authorized user activity to credit bureaus.

5. Expand Your Credit Mix

Try different types of credit once you’re practiced good habits with your secured card. Consider options like a credit-builder loan or a store credit card. Couple this with responsible management to boost your score.