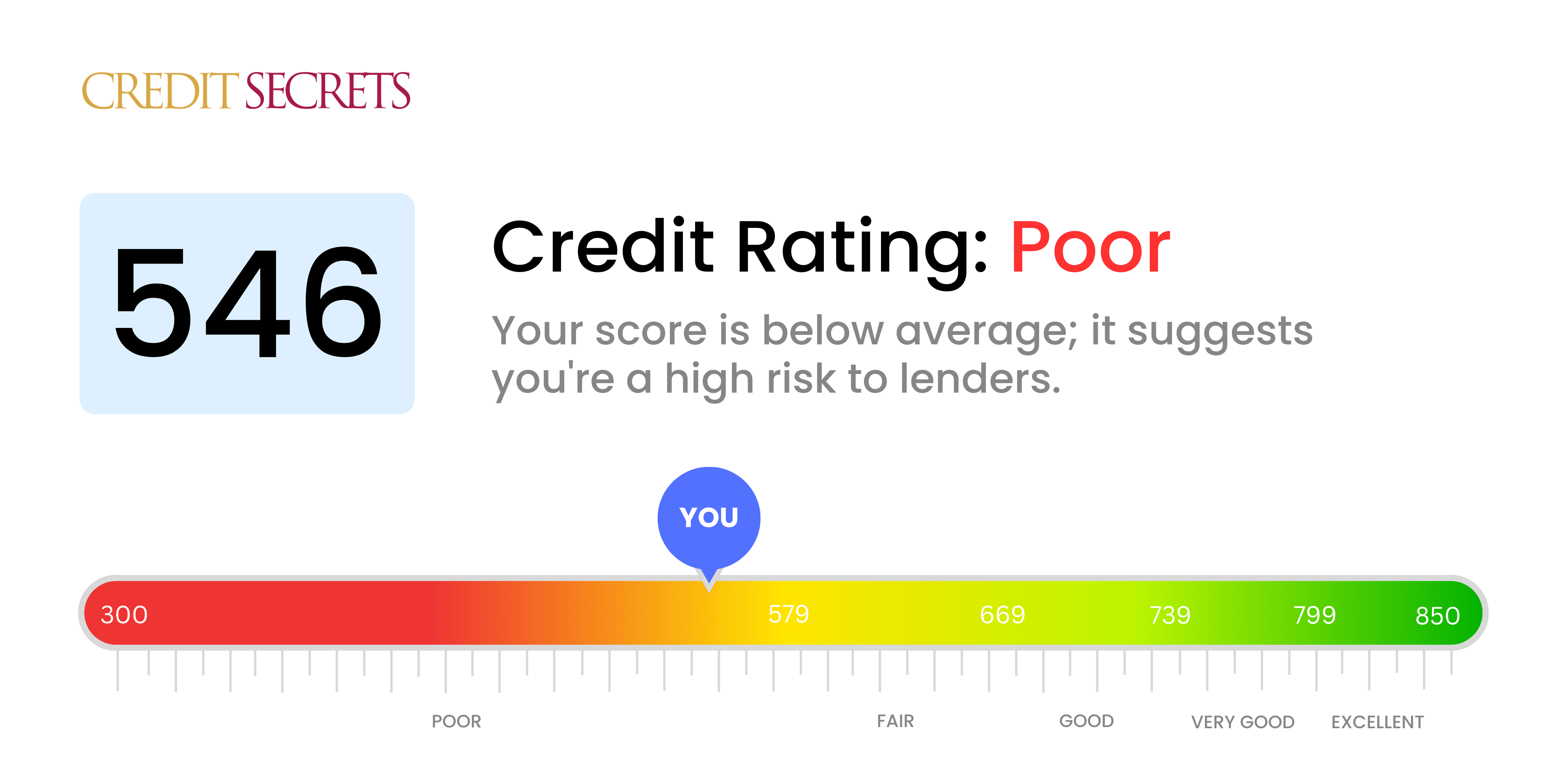

Is 546 a good credit score?

Having a credit score of 546 isn't optimal, meaning it falls in the 'poor' category on the standard FICO credit score ratings. Nevertheless, understanding this is the first steps towards improvement.

When your credit score is at 546, you could face difficulty when it comes to securing loans or quality interest rates. It's likely that carrying out some applications for credit may also end in rejection. This is simply because lenders often consider individuals with 'poor' credit scores as high risk. But remember, your credit score isn't set in stone and there are ways to boost it toward better financial possibilities in the future.

Can I Get a Mortgage with a 546 Credit Score?

With a credit score of 546, attaining approval for a mortgage might prove challenging. Such a score is typically viewed by lenders as a reflection of high financial risk, suggesting a past marked with credit struggles such as late payments or defaults. This score falls below the preferred benchmark for most mortgage lenders, potentially complicating your home buying journey significantly.

However, don't let this deter you. There are still options worth investigating. Certain mortgage products are designed to support those with lower credit scores. For example, FHA loans are government-backed mortgages that often have lower credit score requirements. Remember, though, that these alternatives may come with higher interest rates due to the perceived risk associated with lower credit scores. Begin your path to homeownership today by exploring the various mortgage options available and find one that aligns with your unique financial situation. It may be a more complex journey, but with determination and strategic planning, achieving your goal is still possible.

Can I Get a Credit Card with a 546 Credit Score?

Having a credit score of 546 can make it difficult to be approved for a traditional credit card. With this score, lenders might consider the risk of lending too high, due to past financial mistakes or difficulties. It's not the most comfortable situation to find yourself in, but understanding your credit status is a critical first step towards financial recovery. It requires an objective and realistic approach.

Options such as secured credit cards might be worth considering as an alternative. These require a deposit that serves as your credit limit, making them easier to obtain while also helping to improve your credit over time. You might also think about having a co-signer, or perhaps using prepaid debit cards. Though these options won't rectify the situation immediately, they're powerful tools on your journey towards financial stability. However, it's worth remembering that any credit available to you is likely to come with higher interest rates, reflecting the heightened risk perceived by lenders.

With a credit score of 546, acquiring a personal loan can be a steep mountain to climb. This score is considered subpar in the lending industry and poses a significant risk to creditors. In most cases, traditional lenders may hesitate to approve your personal loan application due to this low score. It isn't the most encouraging situation, but understanding the impression your credit score gives is a step in the right direction.

While obtaining a personal loan from standard lenders might be challenging, explore other borrowing avenues like secured loans, where you would have to provide collateral, or peer-to-peer lending platforms. These organizations might be more flexible with their credit score requirements. Another option could be co-signer loans, where someone with a higher credit score vouches for you. However, be mindful that these alternatives may come with higher interest rates and less agreeable terms, due to the larger risk taken on by these lenders.

Can I Get a Car Loan with a 546 Credit Score?

Having a credit score of 546 might make securing a car loan somewhat tricky. Lenders typically prefer a score of 660 or higher for favorable loan terms. When your score dips below 600, you fall into the subprime category. With a score of 546, that's where you are. This could mean encountering higher interest rates or possibly even being denied for a loan entirely. The reason is simple: lenders see a lower score as a sign of increased risk, suggesting that there might be issues when it comes to paying back the money.

Yet, don't let a lower score dampen your car ownership goals. There are lenders who specialize in working with consumers who have lower scores. Just bear in mind, these kinds of loans can come with significantly higher interest rates. That is because lenders want to offset the risk they perceive in lending to those with lower scores. Even with a bit of a rocky credit score, getting a car loan isn't an impossible dream. Just remember to scrutinize the terms carefully and consider your options thoroughly.

What Factors Most Impact a 546 Credit Score?

Unraveling the factors contributing to your 546 credit score is the first step toward enhancing your financial prospects. This journey is individual to each person, so understanding the specific reasons behind your score is key to set a path toward credit improvement.

Poor Payment History

At a score of 546, one of the primary culprits could be an unfavorable payment history. Missed or late payments can weigh heavily on your score.

How to Check: Scrutinize your credit report for any missed or late payments. Be introspective about past payment habits.

Excessive Credit Utilization

A high credit utilization ratio, i.e., using most of your available credit, can negatively affect your score.

How to Check: Check your credit card statements. If your credit balances are nearly maxed out, this could be a significant factor.

Short Credit History

If your credit history is relatively new, it's likely influencing your score negatively.

How to Check: Analyze your credit report for the age of your accounts. Recently opened accounts could be affecting your score.

Limited Credit Mix

Lack of diversity in your credit types–credit cards, retail accounts, car loans, and home loans–can reflect poorly on your score.

How to Check: Review your credit profile for diversity. Reflect on frequency and nature of new credit applications.

Damaging Public Records

Public records such as bankruptcies and tax liens can have a severe negative impact on your score.

How to Check: Investigate your credit report for any public records. Endeavor to resolve any listed issues, if needed.

How Do I Improve my 546 Credit Score?

With a credit score of 546, you’re in a categorization often regarded as weak. However, don’t fret. There are specific measures you can take to escalate your score:

1. Regularize Overdue Bills

Addressing any delinquent accounts is critical. Accounts in arrears can drastically erode your credit score. Initiate by clearing any overdue bills, prioritizing those most delinquent. Negotiate with your creditors for feasible payment plans if required.

2. Lower Outstanding Credit Card Debt

Your credit card balances are a key factor that impacts your credit score. Aim to bring your credit card balance below 30% of your available credit limit, and eventually below 10%. Start by paying down cards with the highest usage rates.

3. Opt for a Secured Credit Card

With a 546 score, unsecured credit cards might be a stretch. Apply for a secured credit card instead, one that requires a cash collateral deposit acting as your credit line. Use it sensibly, making modest purchases and settling the balance monthly to establish a favorable payment record.

4. Seek Addition as an Authorized User

You may request a close associate or relative with substantial credit to add you as an authorized user to their card. This strategy can help boost your credit score, allowing their stellar payment history to reflect on your credit report. Be certain that the card provider documents authorized user activity to the credit bureaus.

5. Broaden Your Credit Palette

Once you’ve fostered a solid payment reputation with your secured card, delve into different credit types such as retail credit cards or credit-builder loans to add variety to your credit portfolio. Remember, responsible management of these accounts is key.