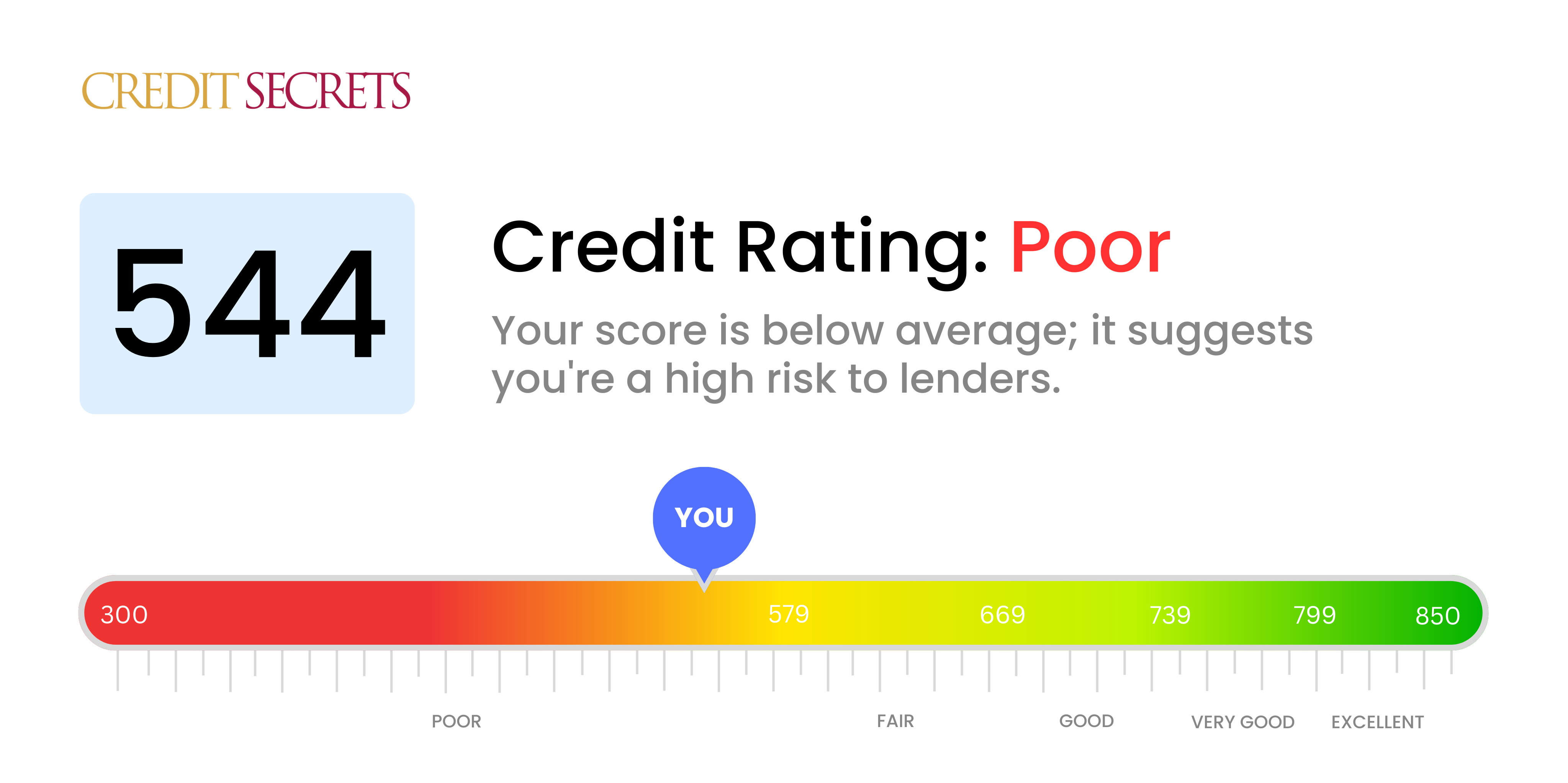

Is 544 a good credit score?

Having a credit score of 544 puts you in the 'poor' category, and it might not be considered as a good credit score. However, don't be disheartened, opportunities to improve your credit health are always within reach.

Being in this score range may pose challenges when it comes to getting credit or loans, as lenders often see a 'poor' score as a sign of high risk. However, remember, your present score is not your forever score. By following a disciplined approach to credit usage, you can move your score up the scale and open more financial opportunities for yourself.

Can I Get a Mortgage with a 544 Credit Score?

If you have a credit score of 544, obtaining approval for a mortgage could be challenging. Lenders typically prefer scores to be at least within the 620-660 range to consider a mortgage application. A score of 544 suggests that there may have been some financial mishaps in the past, such as late payments or defaulted loans.

Given these circumstances, alternatives such as a Federal Housing Administration (FHA) loan might be worthwhile considering. These types of loans are designed to assist those with lower credit scores and demand a lower minimum score than traditional mortgages. However, all lenders and loans are different, and it's important to research and understand the terms thoroughly. Keep in mind, even if approval is obtained, interest rates may be higher with a lower score. The long-term target should be to steadily work towards improving your credit score for more favorable loan possibilities in the future.

Can I Get a Credit Card with a 544 Credit Score?

When it comes to a credit score of 544, the likelihood of being approved for a typical credit card isn't promising. This score reflects some financial stumbling blocks in the past, and lenders may see this as too risky. This reality may be hard to accept, but confronting it head-on is an essential part of gaining control of your financial future.

However, there are other options out there for you. One possibility is a secured credit card, which requires a deposit that establishes your credit limit. They are generally more accessible to individuals with lower credit scores and can be an effective tool in gradually enhancing your credit over time. Another alternative is to contemplate getting a co-signer or perhaps using pre-paid debit cards. While these solutions won't drastically change the situation overnight, they can be a positive start on the road towards financial stability. Lastly, keep in mind that any credit options available at this credit score will likely come with higher interest rates due to the increased risk to the lenders.

If your credit score is 544, securing a traditional personal loan approval may pose a challenge. Most lenders view a score in this range as a considerable risk, which could make them unlikely to approve your loan. However, it's important to understand your score, what it signifies when it comes to borrowing, and that there are other paths to explore.

Consider alternative loan options such as secured or co-signed loans. A secured loan would require collateral, while a co-signed loan involves having someone with a more favorable credit history guarantee your repayment. Another viable route could be peer-to-peer lending platforms, which can sometimes offer loans despite lower credit scores. However, remember that these alternative options often come with higher interest rates and less ideal terms due to the additional risk these lenders undertake.

Can I Get a Car Loan with a 544 Credit Score?

With a credit score of 544, the journey towards getting approved for a car loan may seem a little rugged. To put it plainly, lenders generally look for credit scores above 660 - a score under 600 is often viewed as subprime. Your score, standing at 544, does fall into this subprime bracket. This may lead to challenges such as higher interest rates or even a refusal of loan approval, as your score may suggest to lenders that there is a risk in lending money due to possible repayment difficulties.

While this might seem disheartening, remember that the road to a car loan isn't completely closed. There are lenders who specialize in working with folks that have lower credit scores. Be aware though - they are likely to charge higher interest rates to offset the risk they perceive in such loans. It's crucial to study your loan terms carefully and consider all your options. Even with a few hurdles, obtaining a car loan with a credit score of 544 may still be achievable. Keep going, the journey isn't over!

What Factors Most Impact a 544 Credit Score?

Grasping what a score of 544 entails is crucial for your credit improvement journey. Addressing these factors can truly assist you in the pursuit of stronger financial health. Though challenges emerge, remember, each is also an opportunity for personal growth and monetary wisdom.

Payment Record

Your payment record profoundly affects your credit score. Delinquent payments or defaults are often key culprits behind a score of 544.

How to Verify: Scan your credit report for any signs of late payments or defaults. Consider times when you might've postponed payments; these instances could hold the answer to your current score.

Credit Utilization Ratio

A high credit utilization ratio can hinder your score. If you're maxing out your credit cards, this may explain your score.

How to Verify: Look through your credit card statements. Are you consistently reaching your credit limits? Strive to maintain lower balances for a healthy score.

Credit History Duration

A limited credit history can negatively sway your score.

How to Verify: Revisit your credit report, checking both the ages of your oldest and newest accounts, as well as the average age across all accounts. Reflect on whether you've opened any new accounts recently.

Variety of Credit and New Credit Requests

Maintaining a diverse range of credit types and responsibly handling new credit is paramount for a healthy credit score.

How to Verify: Scrutinize your blend of credit accounts. Do you have a good mix of retail accounts, installment loans, and credit cards? Reconsider if you've been excessively applying for new credit.

Public Record

Public records such as bankruptcies or tax liens can take a severe toll on your score.

How to Verify: Inspect your credit report for any public records. Attend to any items that may need settling.

How Do I Improve my 544 Credit Score?

With a credit score of 544, you’re currently in the ‘poor’ credit range. However, by taking targeted actions, it’s entirely possible to improve your score. Here are several highly effective strategies for someone in your situation:

1. Correct any errors on your credit report

It’s essential to ensure the information on your credit report is accurate. If you find errors, dispute them immediately with the credit bureau. A single error could be significantly affecting your credit score.

2. Manage your credit utilization

Try to keep your credit utilization ratio—the percentage of your available credit that you’re using—under 30%. Work on paying down credit card balances to reach this threshold, which can significantly boost your score.

3. Look into a credit-builder loan

With a lower credit score, consider a credit-builder loan. These loans, offered by many credit unions and banks, are designed to help individuals build or repair their credit history.

4. Implement automatic bill payments

Missed or late payments can have a harsh impact on your credit score. Setting up automatic bill payments can prevent accidental delinquencies and help to build a good payment history.

5. Explore a secured credit card

If regular credit cards are out of reach due to your current score, a secured credit card could be an option. It requires a deposit but can aid in rebuilding your credit when used wisely.

6. Limit new credit applications

Each time you apply for credit, a hard inquiry is made on your report, which can decrease your score. Try to limit new credit applications while you’re working on improving your credit.