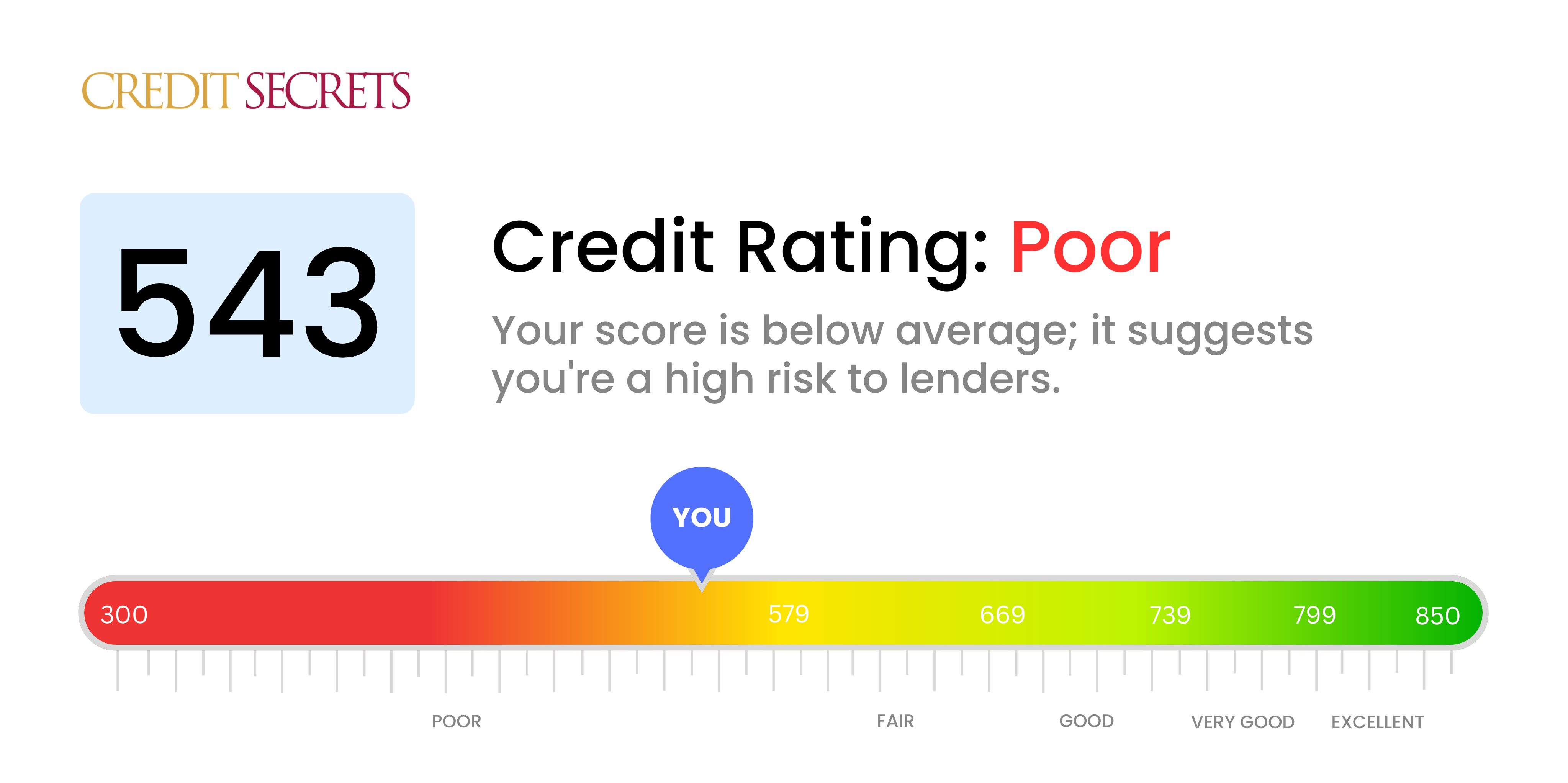

Is 543 a good credit score?

A credit score of 543 is considered poor according to standard credit scoring systems. This means you may face difficulties getting approved for new credit cards or loans, or you might get approved but with higher interest rates. However, remember that you have the power to improve your credit score with consistent effort and dedication.

Being in the 'Poor' category, potential lenders may view you as a risk, which could make borrowing money more challenging. Your focus should be on proactive strategies for credit improvement—timely bill payments, debt reduction, maintaining a low credit usage ratio, and routinely checking your credit reports for errors are a few steps in the right direction. As tough as it may seem right now, don't lose hope. With dedication and time, you can work towards improving your credit score.

Can I Get a Mortgage with a 543 Credit Score?

A credit score of 543 is typically considered to be quite low, and as a result, obtaining approval for a mortgage could be rather challenging. Most lenders are looking for a credit score in the mid-to-upper 600s at the very minimum. As such, a 543 score suggests that there have been a few bumps along your financial journey, such as late payments or possibly even defaulting on previous loans.

However, it's essential not to lose heart. Even if a traditional mortgage isn't an option right now, there are alternatives you may consider. FHA loans, for instance, are a federal assistance program that may approve borrowers with lower scores. However, remember that these alternatives often come with higher interest rates and insurance premiums; it's important to consider whether this option works for you in the long run. Your primary goal should always be to improve your credit score with a solid history of on-time payments and responsibly used credit. Progress might be slower than you'd like, but every small step counts.

Can I Get a Credit Card with a 543 Credit Score?

With a credit score of 543, getting approved for a typical credit card might be challenging as this score indicates certain financial instability attributes to potential lenders. It might be tough to hear, but accepting this reality is instrumental because understanding one's financial state is a crucial initial step towards reforming your credit.

Despite these barriers, there are viable alternatives available to address this setback, such as opt for a secured credit card. These particular cards demand a deposit that becomes your credit limit. In comparison to traditional cards, these are generally more accessible and can assist in slowly but steadily improving your credit. Other potential solutions could be finding a co-signer or exploring pre-paid debit cards. While the journey to a better credit score might appear uphill, remember that these options are practical steps towards attaining credit stability. Bear in mind that any accessible credit form for a credit score like 543 would likely bring notably higher interest rates, mirroring the augmented risk to lenders.

With a credit score of 543, obtaining a personal loan from a conventional lender might be an uphill challenge. A score in this range is often viewed as a high-risk proposition to lenders, significantly reducing the likelihood of loan approval. It's vital to understand what your credit score means to your borrowing prospects. Despite the difficulty, know that you're not completely without options.

If traditional lenders are reluctant to grant a personal loan, consider other avenues. Secured loans, where you provide an asset as collateral, or co-signed loans, backed by someone with a higher credit rating, might be possibilities. Peer-to-peer lending platforms sometimes have more flexible credit score requirements. However, you must remember that these alternatives may come with less favorable terms, including higher interest rates, due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 543 Credit Score?

With a credit score of 543, securing a car loan may pose some difficulties. Usually, lenders seek scores over 660 to offer favorable loan terms. Anything below 600 is often viewed as subprime, and unfortunately, your score of 543 falls in this area. This might result in higher interest rates or an outright denial of the loan. The reason is simple: to lenders, a lower credit score reflects a higher risk, based on past experiences that suggest possible issues with repaying loans.

But don't lose hope just yet. Your dream of owning a car isn’t entirely out of reach. There are lenders who specifically cater to folks with lower credit scores. However, you should exercise caution as these loans typically have much higher interest rates. Such rates are set this way because lenders are assuming a higher risk, and they're looking for ways to secure their investment. While it might be an uphill journey, with careful planning and thorough understanding of the terms, you can still get a car loan approved.

What Factors Most Impact a 543 Credit Score?

Grasping a score of 543 is an important step to redefining your financial journey. There are vital factors influencing this score that, when identified and addressed, can open the doors to a stronger financial future. Your journey is special - it's an experience to grow from and learn about.

Credit Payments

Your payment history is a definitive factor for your credit score. Consistent overdue payments can be a major reason for your current score.

How to Check: Thoroughly go through your credit report for any identified late payments. Contemplate on any instances where your payments might have been late, as these can result in a lower score.

Credit Card Usage

A high credit utilization can pull down your score. If your credit cards are continuously maxed out, it could be a noteworthy factor behind your score.

How to Check: Scrutinise your credit card statements. If your balances hover near the limit, seeking to maintain lower balances can be a good idea.

Duration of Credit History

A brief credit history can negatively impact your credit score.

How to Check: Examine your credit report to gauge the length of your oldest and newest credit accounts. Reflect if you've opened several new accounts recently.

Diversity in Credit and New Credit

Maintaining a variety of credit types and responsibly managing new credit plays a crucial role in a good credit score.

How to Check: Assess your collection of credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans. Evaluate if you've been prudent while applying for new credit.

Public Records

Public records such as tax liens or bankruptcies can heavily impact your credit score.

How to Check: Look over your credit report for any public records. Strive to resolve any detected items in these records.

How Do I Improve my 543 Credit Score?

At 543, your credit score is below average but there’s no need to stress. Starting now, strategic actions tailored to your particular situation can significantly lift your score. Let’s delve into the most impactful tactics for you:

1. Tidy Up Your Credit History

With a score of 543, missed payments or defaults could be dragging you down. Try rectifying the situation by contacting your creditors to set up a manageable repayment plan. Focus on addressing the oldest overdue amounts initially as these cause more harm to your score.

2. Credit Cards: Balance & Utilization

Routinely carrying high balances on your credit cards relative to the card limit harms your score. Aim to keep balances under 30% of the limit, and over time, work towards a less than 10% utilization ratio.

3. Take Advantage of a Secured Credit Card

Secured credit cards, which use a cash deposit as a credit line, can help growth your score. Practice responsible use by making minor charges and paying them off monthly to establish positive credit actions.

4. Authorized User Status

If you know someone with strong credit, consider asking them to add you as an authorized user to their card. Their good credit habits can reflect positively on your report, as long as the card issuer reports this to the credit bureaus.

5. Experiment with a Variety of Credit

After successful use of a secured credit card, think about diversification. Manage a mix, like credit builder loans or retail credit cards, with the same care. This breadth of credit types can boost your score over time.