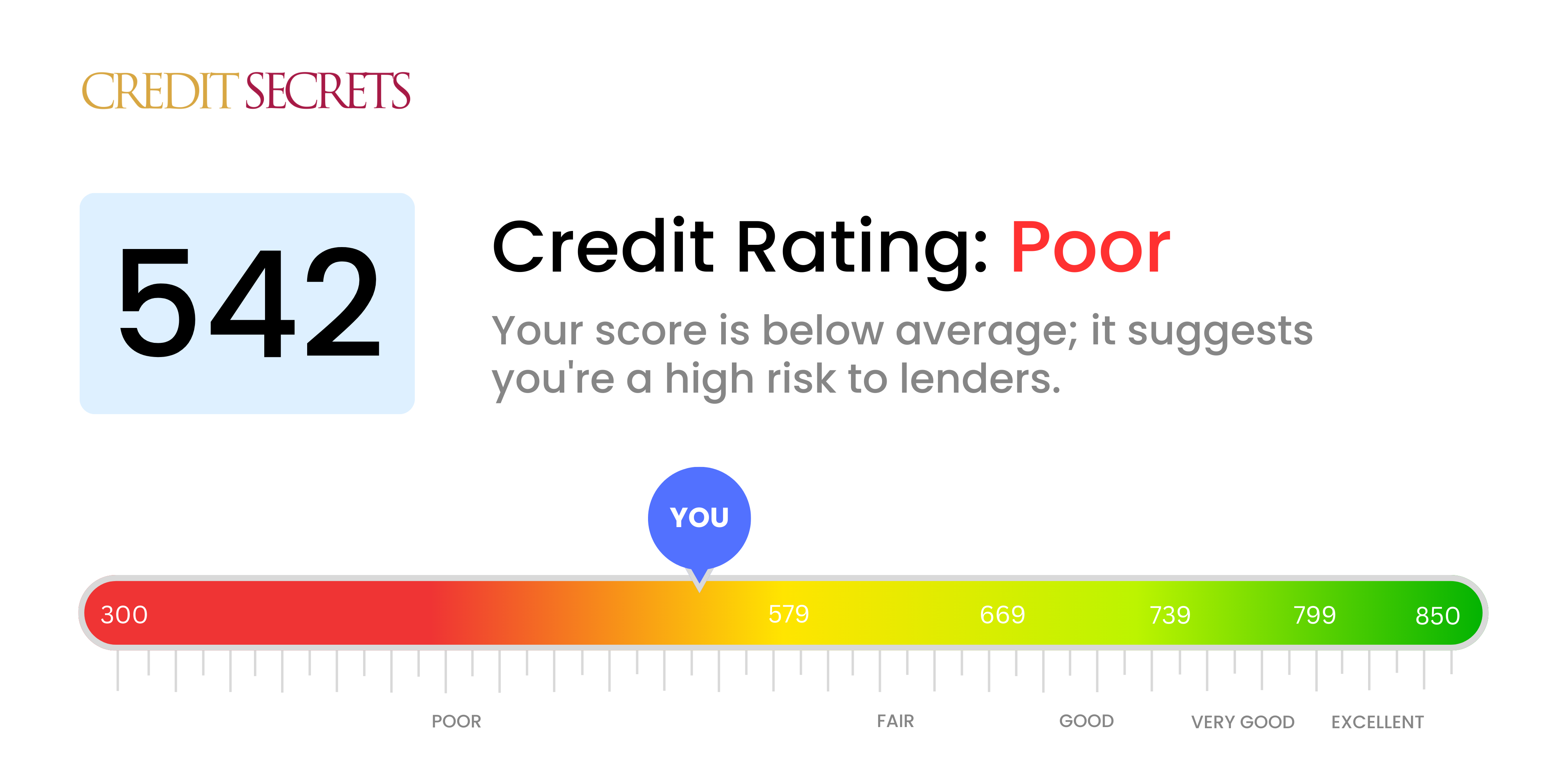

Is 542 a good credit score?

If your credit score is 542, unfortunately, this falls into the poor category. While this score may limit some of your financial options, it's never too late to improve your standing. Working on perfecting your payment habits, reducing your debt, and regularly checking your credit report for errors can help remedy the situation and boost your score over time.

Expect to experience a bit more difficulty in obtaining loans or lines of credit as lenders prefer candidates with higher scores. However, don't lose heart, as this isn't the end-all-be-all. By focusing on improving your score, you're taking control of your financial future and opening up more opportunities for yourself down the line.

Can I Get a Mortgage with a 542 Credit Score?

With a credit score of 542, unfortunately, it might be challenging for you to be approved for a mortgage. This score falls below the range most lenders generally consider acceptable, meaning they view it as a sign of significant financial stress--perhaps due to missed payments or overextended credit.

However, please don't lose hope. This isn't the end of your journey towards homeownership. There are lenders who cater to borrowers with lower credit scores, but be warned, they may charge higher interest rates due to the perceived risk. Alternatively, government-backed home loans such as FHA loans, which are more forgiving on credit scores, might be a feasible option for you. Importantly, this is a good time to focus on taking steps to improve your score, like reducing your debt and ensuring future payments are made on time. Keep in mind that boosting credit is a long-term task, but your efforts today can pave the way for a brighter financial future.

Can I Get a Credit Card with a 542 Credit Score?

A credit score of 542 does fall into the “poor” range on the credit spectrum. This means that getting approval for a traditional credit card could be a challenge. It's crucial to approach this ceiling with a sense of understanding and pragmatism. It's a tough spot to be in, but acknowledging your credit standing is a significant stepping-stone on your financial recovery path.

With a score like this, it might be worth exploring alternative credit options instead. Secured credit cards, for example, ask for a deposit which becomes your credit limit. They usually have higher acceptance rates and can aid in credit repair over time. Another option could be asking a trusted individual to co-sign a credit card with you, or considering prepaid debit cards. Be aware, though, that interest rates for these options are typically higher as lenders see scores in this range as higher risk. These aren't instant solutions, but they're valuable tools in your journey towards improved financial health.

With a credit score of 542, securing a personal loan from traditional lenders can be challenging. This score sits below what is considered an acceptable range, suggesting a high risk to lenders. This unfortunately means that you may find difficulty in obtaining approval for a loan on standard terms. Although this is a tough situation to be in, it's important to understand what your credit score means for your borrowing options.

Fear not, however. There are alternative routes to take. Consider secured loans, where you offer a form of collateral, or co-signed loans, where another individual with a stronger credit score backs you up. Peer-to-peer lending platforms are also worth checking out, as they sometimes have more relaxed credit score requirements. Do bear in mind, though, these alternatives could come with higher interest rates and possibly less preferable terms due to elevated risk seen by the lender.

Can I Get a Car Loan with a 542 Credit Score?

With a score of 542, your credit falls into the category that lenders may deem as risky. This specific score is below the preferred threshold of 660 that most lenders look for when approving car loans, making the approval process more challenging. Typically, a credit score below 600 is branded as subprime, and your score of 542 fits into this bracket. This means that the likelihood of securing a car loan could be less than ideal. Lenders see lower credit scores as indicative of potentially higher risks when it comes to repayment of loans.

Yet, this doesn't mean you've reached a dead end in your pursuit of a car loan. There are lenders out there who cater specifically to those with lower credit scores. However, be prepared that these loans may come with higher interest rates as a measure the lenders take to mitigate their risk. It will require thorough examination of loan terms and wise decision making. Remember, even with a lower credit score, acquiring a car loan is still a possibility. Stay positive and comprehensive in your pursuit.

What Factors Most Impact a 542 Credit Score?

Analyzing a credit score of 542 is an essential first step towards financial betterment. Comprehensive understanding and subsequent improvement of certain factors can help enrich this credit score. Always remember, each financial journey is distinctive and filled with learning curves.

Track Record of Payments

A significant part of your credit score is influenced by your payment history. Outstanding payments and defaults are likely reasons for your current score.

How to Check: Delve deep into your credit report to spot late payments and defaults. Any lapse or delay in payments could have hampered your score.

Credit Utilization Ratio

Maxing out credit cards can be a reason behind a lower score. High credit utilization implies that you are heavily dependent on credit, a factor that can negatively impact your score.

How to Check: Carefully examine each credit card statement. Are the outstanding dues close to your credit limits? Lowering the balance compared to your credit limit will prove helpful.

Length of Credit History

A comparatively shorter credit history could be another reason for a 542 score.

How to Check: Review your credit report to assess the age of your oldest and newest credit accounts, as well as the average age of all your credit accounts. You also need to check if new accounts were opened recently.

Variety of Credit and New Credit

Maintaining a diverse mix of credits, like credit cards, retail accounts, installment loans, and mortgage loans, as well as properly managing new credits, is a necessity for a healthy credit score.

How to Check: Check your credit report for the variety of credit accounts. Also, consider if you've been refraining from applying for new credit frequently.

Public Records

Public records like bankruptcy proceedings and tax liens can be potent contributors to a lower credit score.

How to Check: Go through your credit report for any such public records. Ensure every such item is addressed and resolved promptly.

How Do I Improve my 542 Credit Score?

A credit score of 542 may be seen as subpar, but there’s no need to lose hope. Implementing dedicated strategies customized for this score range can surely show positive results. Here are essential steps that you should consider:

1. Catching up on Late Payments

Being late or defaulting on payments hurts your credit score the most. If you have any late payments, addressing them should be your immediate focus. Prioritize paying off the most overdue amounts. Discuss flexible repayment plans with your creditors if needed.

2. Prioritize High Utilization Credit Cards

High-utilization credit cards can weigh down your credit score. Aim to reduce the balance of these cards to less than 30% of your credit limit. Gradually, strive to maintain them below 10%, focusing first on those with the highest utilization.

3. Secured Credit Card as an Option

Your present score might make regular credit card approval harder. Consider a secured credit card, which demands a cash deposit equivalent to your credit limit. Keep usage minimal and clear balances monthly to build a stronger repayment history.

4. Responsible Authorized User Strategy

Request a loved one with high credit to put your name as an authorized user on their card. By doing so, you could benefit from their solid repayment record, provided their card issuer reports authorized user activities to credit bureaus.

5. Advance with a Diverse Credit Portfolio

Having various types of credit accounts shows you can manage different financial responsibilities. Once you have a secured card and maintain a good payment record, look into other types of credit like low-interest personal loans or retail cards, while keeping them in check.