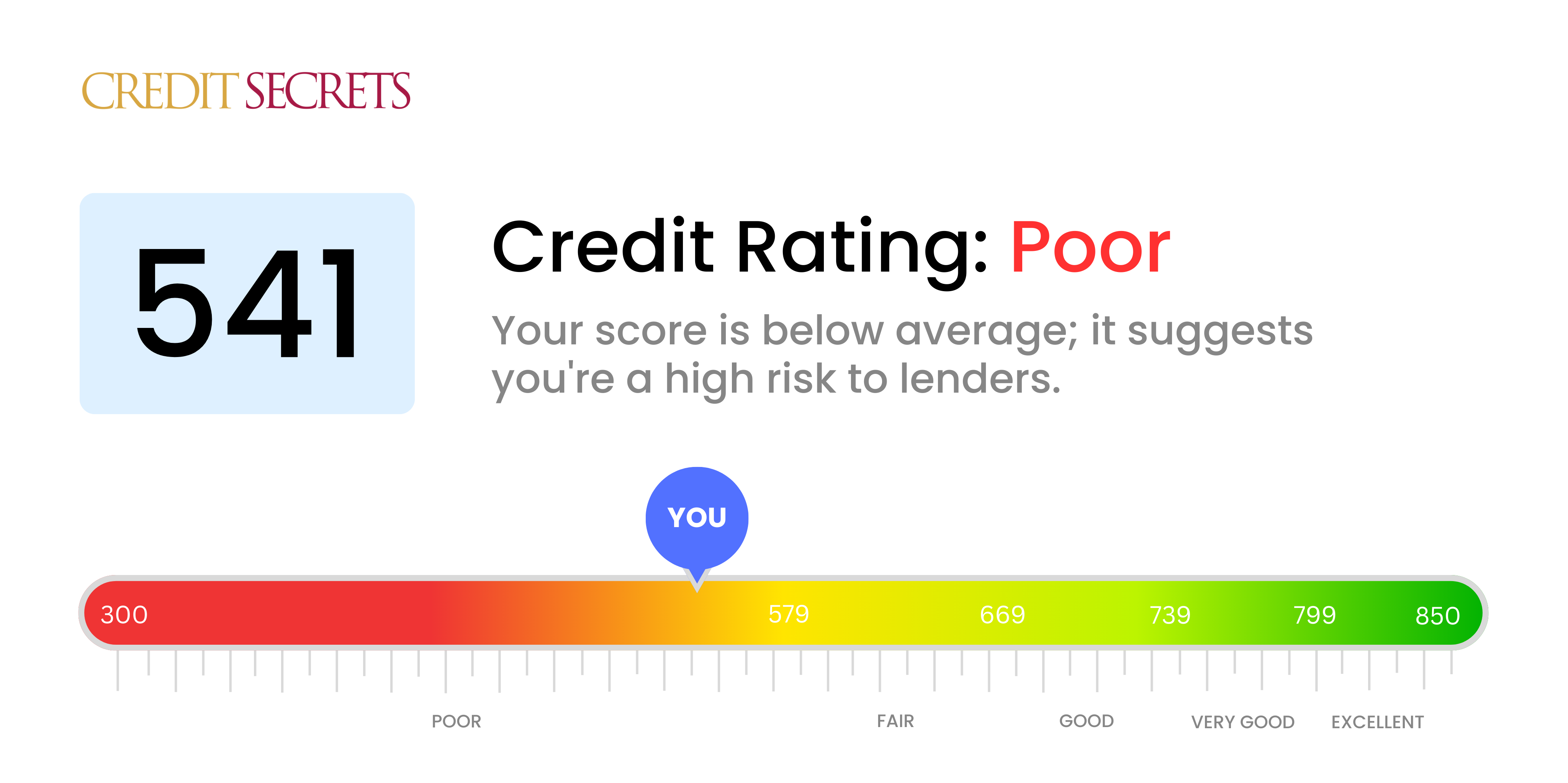

Is 541 a good credit score?

Having a credit score of 541 is viewed as 'poor' within the standard credit score range. Although this score isn't ideal, you should understand that it's not a life sentence - it's just a stepping stone on your financial pathway. There might be some challenges to securing loans or attractive interest rates, but there's always room for improvement.

You can expect some lenders to be cautious about approving credit card applications or loans. There may be hurdles such as higher interest rates or securing them might require a deposit or collateral. However, don't lose heart. Your financial habits can significantly improve your credit score over time. By ensuring regular timely repayments and keeping your credit utilization low, you can potentially improve this score and move closer towards your financial objectives.

Can I Get a Mortgage with a 541 Credit Score?

Having a credit score of 541, unfortunately, does not put you in an advantageous position for securing a mortgage. Most lenders are hesitant to approve mortgage loans for such scores, as it signifies a pattern of financial struggles such as missed or late payments. You're likely to face difficulties in getting mortgage approval from most lenders.

However, this doesn't mean all hope is lost. Some lenders may still be willing to offer a loan, but probably at higher interest rates due to the risk they are taking on. Such rates could create substantial financial burden over time, meaning it might be more advantageous to work on improving your credit score first. This might involve addressing any existing debts, ensuring your future payments are made promptly, and maintaining responsible use of credit. While this road may seem tough, the financial freedom that comes from a healthier credit score is worth the journey.

Can I Get a Credit Card with a 541 Credit Score?

If you're carrying a credit score of 541, it may be tough to secure approval for a conventional credit card. Such a score often communicates to lenders that there may have been some financial setbacks or complications in your past. It's essential to face this reality with both understanding and seriousness, as understanding your credit status is a crucial first step towards achieving financial well-being.

Given the hurdles associated with a lower credit score like 541, seeking other routes like getting a secured credit card may prove beneficial. A secured credit card asks for a deposit that mirrors your credit limit, making it potentially easier to achieve. Other options could include finding a co-signer or investigating pre-paid debit cards. Though these choices won't instantaneously improve your situation, they can play a meaningful role in your path to financial health. In any case, bear in mind that interest rates are often steeper for those with lower credit scores, as lenders view them as a higher risk.

Having a credit score of 541 implies that obtaining a traditional personal loan may be quite a challenge. Most lenders regard this score as a strong sign of risk, lowering your chances of getting a conventional personal loan. This situation might seem tough, but it's key to grasp what your score means when it comes to your borrowing capacity.

Although standard loans might seem unreachable, don't lose hope. Options like secured loans or co-signed loans might be viable alternates for you. In a secured loan, you put up a collateral, while in a co-signed loan, another individual with a higher credit score backs you up. Peer-to-peer lending platforms are additional alternatives, often having more flexible credit requirements. However, you must remember that these alternates typically have higher interest rates and less desirable terms, due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 541 Credit Score?

With a credit score of 541, you may find it difficult to get approved for a car loan. Most lenders prefer borrowers to have credit scores above 660, and they generally consider a score under 600 to be subprime. Your score falls into this subprime category, which could translate into higher interest rates or even loan refusal. This stems from the belief that a lower credit score comes with a higher risk assuring lenders that repayment may become an issue.

Despite this, a low credit score isn't a finalized "no" for your car loan aspirations. There are lenders specialized in assisting those with lower credit scores, although it's crucial to be aware of the typically higher interest rates associated with these loans. These rates are a lender's safeguard against the increased risk they are taking on. You'll need to tread carefully and understand the terms in detail, but know that a car loan can still be a reality, even if the journey may appear difficult.

What Factors Most Impact a 541 Credit Score?

Achieving a better understanding of your credit score, specifically a score of 541, is pivotal in developing a plan of action that will promote financial growth. Your score isn't just a number. It's an indicator of certain financial behaviors that you can address to progressively improve your financial status.

Payment Practices

Your score might be indicative of some inconsistencies in making payments on time. Late or missed payments could be contributing significantly to your score.

How to Check: Make time to go through your credit report, taking note of any payments that were made late or missed entirely.

Credit Usage

How you utilize your credit can greatly influence your score. High usage could be a red flag.

How to Check: Take a look at your credit card balances. If they are close to or at their limit, you know where to start improving.

Duration of Credit History

A relatively short credit history might be affecting your score.

How to Check: Review your credit report. Look into the age of your oldest and most recent accounts and the average age of all your accounts.

Variety of Credit and Recent Credit Applications

It's vital to maintain a balanced mix of various credit types and to handle new credit responsibly.

How to Check: Assess your range of credit accounts. Consider if you've recently been applying for new credit.

Official Records

Public records such as bankruptcies or tax liens can negatively impact your score.

How to Check: Check your credit report for any recorded public records. Make sure to resolve any items listed that could potentially be harmful.

Keep in mind: Your journey to better credit is personal, unique, and full of opportunities for growth and learning.

How Do I Improve my 541 Credit Score?

With a credit score of 541, you might be feeling overwhelmed. However, keep in mind that better scores are within your grasp. Focus on these concrete steps designed just for your current situation to see improvements:

1. Rectify Late Payments

Initiate by settling any previous late payments. Fixing these overdue accounts will prove to be a significant step in enhancing your score. If payment in full isn’t possible, get in touch with your creditors and explore options for a manageable payment plan.

2. Minimize Credit Utilization

Strive to minimize your credit card balances to less than 30% of your available credit. In the long run, aim for a level below 10%. Prioritize paying those cards with the highest degree of utilization.

3. Opt for Secured Credit Card

Given your current score, a regular credit card might be out of reach. A secured credit card might be an alternative path forward. Your credit line on such a card will equal a cash deposit you make. Utilize it judiciously, making small charges and pay it off each month.

4. Become a Credit Card User

If you have a trusted relation with a robust credit history, you might ask to be added as an authorized user on their credit card. This helps improve your score by leveraging their good credit habits. Please verify that the card provider reports authorized user activity to the credit bureaus.

5. Broaden Credit Portfolio

An assortment of credit account types can contribute to a credit score improvement. After establishing regular payment with a secured card, you could consider adding other types of credit, like a store credit card or a credit builder loan.