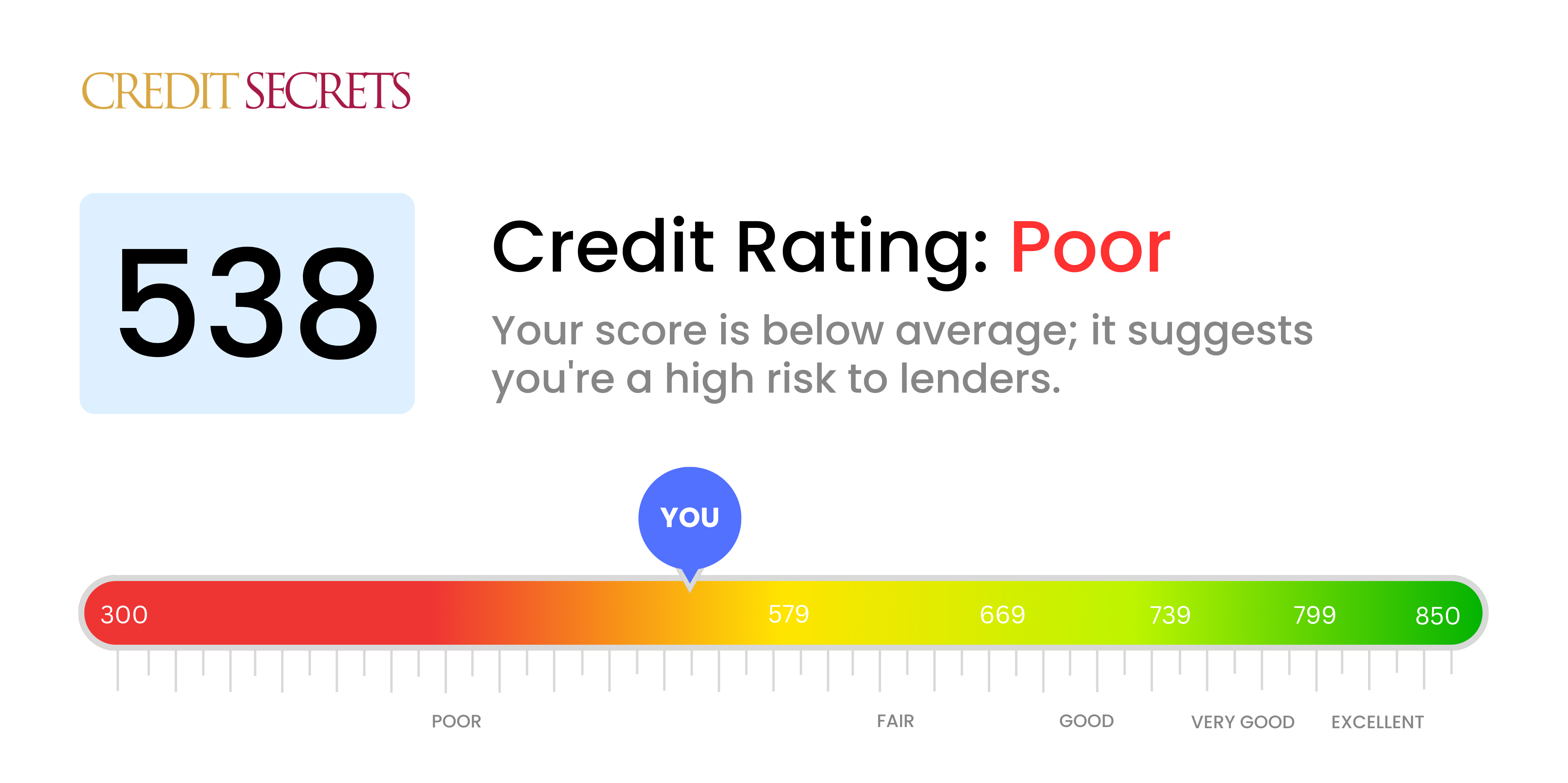

Is 538 a good credit score?

Having a credit score of 538 means your score falls into the 'Poor' category. It's not the best place to be, but don't lose hope; with the right plan, it is definitely possible to improve your score. With such a score, you may experience some difficulties when applying for new credit as it might be viewed as a high risk by lenders, but it isn't a resolveless situation. As you begin to take essential steps towards improving your credit health, that number will start to rise, and so will your opportunities for better credit offers.

Keep in mind that everyone's situation is different, but generally, a score of 538 might mean you're bearing higher interest rates, are being required to put down deposits for utilities, or you're having a hard time getting approved for new lines of credit. If you're interested in improving this scenario, it all starts with knowledge and action, such as understanding what's in your credit report and making timely payments. It may take time, but rest assured, improvement is absolutely possible. Remember, your financial journey is a marathon, not a sprint.

Can I Get a Mortgage with a 538 Credit Score?

With a credit score of 538, it is very unlikely you'll be approved for a mortgage. Most lenders require a higher score, and a score of 538 typically reflects past financial hardships like late payments or defaults. However, it's important to know that this is not the end of the road for you. It's a hurdle, to be sure, but not an insurmountable one.

It might be helpful to consider alternative options while you work on rebuilding your credit score. One such option could be saving up for a substantial down payment. Lenders may consider a mortgage application more favorably if you're able to bring a large down payment to the table. Additionally, you might want to explore other types of loans, such as FHA loans which are often easier to qualify for.

Rest assured, your credit score doesn't define your financial future. It is just one part of your financial picture and with dedication and consistency, there's potential to increase it over time. It won't happen overnight, but every small improvement brings you a step closer to your goal.

Can I Get a Credit Card with a 538 Credit Score?

Unfortunately, with a credit score of 538, it may be difficult to get approved for a traditional credit card. From a lender's perspective, this kind of score could suggest a history of financial strain or irregular payment patterns. It might be tough to hear, but being candid about your situation is vital in moving forward and achieving financial stability. Recognizing the reality of your credit situation is a crucial first step on the pathway to credit rejuvenation.

Given these challenges, exploring alternatives like secured credit cards could be helpful. Secured credit cards require a deposit which acts as your credit limit, making them easier to obtain. With diligent use and timely repayments, these cards can assist in rebuilding your credit score gradually. In addition, you could consider finding a trusted co-signer, or looking into a pre-paid debit card. Please bear in mind, these methods don't provide an immediate fix but could be instrumental in your journey towards financial recovery. Do note, however, interest rates on credit options available to those with lower scores usually tend to be relatively high, factoring in the higher risks perceived by lenders.

Having a credit score of 538 is viewed in a less favorable light by most lenders. This score is considered below average and represents you as a considerable risk to lenders. Approval for a personal loan with this credit score is typically hard to achieve with conventional lenders. It might feel like a tough situation, but recognizing what this score means for your loan prospect is necessary.

While conventional loans may not be within reach, consider exploring other possibilities. Secured loans, which require you to provide a collateral, or co-signed loans, where another individual with a better credit score guarantees your loan, are potential options. You can also look into peer-to-peer lending networks. They can offer loans even with lower credit scores. Keep in mind, these alternatives might come with higher interest rates and terms that are less favorable due to the increased risk to the lender.

Can I Get a Car Loan with a 538 Credit Score?

With a credit score of 538, it can be quite challenging to secure approval for a car loan. Most car loan lenders look for credit scores above 660, and anything below 600 is commonly categorized as subprime. Your credit score of 538 falls into this less desirable range. Due to the lower score, lenders may see you as a higher risk, as this score suggests there may have been troubles in the past with managing and repaying borrowed money.

Despite the potential hurdles, there's no need to abandon your goal of purchasing a car. There are lenders out there who cater to those with lower credit scores, but it's vital to approach with caution. These car loans could come with noticeably higher interest rates due to the increased risk taken on by the lenders. It's an imperfect road, but securing a car loan is definitely not out of reach. Research, patience and careful planning can help navigate this challenging situation.

What Factors Most Impact a 538 Credit Score?

Knowing what a credit score of 538 implies is a key stepping stone towards a brighter financial future. Understanding and addressing the influences behind this score can lay the foundation for healthier financial endeavors. It's imperative to remember that everyone's financial path is distinct, filled with chances to grow and learn along the way.

Payment History

Your score is highly influenced by your payment history. A history of late payments or defaults can significantly lower your score.

How to Check: Inspect your credit report for any instances of late payment or defaulting. Consider past circumstances where you may have delayed payments as these can impact your score.

Credit Utilisation

Maintaining high credit utilization can detrimentally affect your score. If your credit utilization ratio is high, it could be a major reason for your score.

How to Check: Look at your credit card statements. Are you consistently reaching your limit? It's beneficial to your credit score to maintain a lower balance relative to your limit.

Length of Credit History

A shorter credit history may impact your score negatively.

How to Check: Check the age of your oldest and newest accounts on your credit report, and the average age of all your accounts. Also, think about if you've opened new credit accounts recently.

Credit Mix and New Credit

Having a diverse range of credit types and responsibly handling new credit is crucial for a good score.

How to Check: Take a look at your mix of credit accounts. This may include credit cards, retail accounts, mortgages. Be mindful of how frequently you've been applying for new credit.

Public Records

Public records, such as bankruptcies or tax liens, can have a substantial impact on your score.

How to Check: Review your credit report for any public records. Any records found should be addressed promptly to avoid damaging your credit score further.

How Do I Improve my 538 Credit Score?

With a credit score of 538, you might feel disheartened. However, rest assured, there are doable steps you can take today that will begin moving your score in the right direction.

1. Clear Overdue Accounts

Accounts in arrears hurt your score more than anything. Try to remove any overdue payments. Reach out to those businesses where payment is pending, perhaps they can offer a doable repayment plan.

2. Lower Credit Card Debt

Mounting credit card balances can slash your score. Try your best to take your card balances to lower than 30% of your credit limit. Looking more long-term, aim for less than 10%. Begin by targeting cards with the highest utilization rates.

3. Apply for a Guaranteed Credit Card

With the present score, obtaining a typical credit card could be tricky. A secured one could be an option, where the cash collateral deposit works as your credit line. Use it wisely, making minor purchases and repaying the complete balance each month, creating a track record of on-time payments.

4. Authorized User Status

Consider asking someone with a strong credit background to add you as an endorsed user on their card. This approach can help better your score by adding their healthy payment history to your credit report. Make sure the provider reports such user activities to credit bureaus.

5. Broaden Your Credit Portfolio

Having varied types of credit enhances your credit score. After building a good payment record with a secured card, look at other credit types such as a credit builder loan or a department store credit card. Remember to manage them sensibly.